LIFO Reserve Meaning and How to Calculate It

The LIFO Reserve is an important accounting concept that measures the difference between the cost of inventory under the Last-In, First-Out (LIFO) method and the cost of inventory under the First-In, First-Out (FIFO) method. It represents the potential tax liability that a company would incur if it were to switch from using the LIFO method to the FIFO method.

Calculating the LIFO Reserve involves determining the difference in inventory costs between the LIFO and FIFO methods. This is done by subtracting the value of the inventory under the FIFO method from the value of the inventory under the LIFO method. The resulting amount is the LIFO Reserve.

The LIFO Reserve is a reflection of the effects of inflation on a company’s inventory. Under the LIFO method, the cost of the most recently purchased inventory is matched with the revenue from sales, resulting in a higher cost of goods sold and lower taxable income. This can provide a tax advantage for companies during periods of rising prices.

However, if a company were to switch to the FIFO method, which matches the cost of the oldest inventory with the revenue from sales, the cost of goods sold would be lower, resulting in higher taxable income and potentially higher tax liability. The LIFO Reserve represents the potential tax liability that would arise if the company were to switch to FIFO.

Importance of LIFO Reserve in Accounting

The LIFO Reserve is an important tool for financial analysts and investors as it provides insights into a company’s tax position and the potential impact of a change in accounting method. It allows for a more accurate assessment of a company’s profitability and financial health.

Calculating LIFO Reserve

To calculate the LIFO Reserve, follow these steps:

- Determine the value of the inventory under the LIFO method.

- Determine the value of the inventory under the FIFO method.

- Subtract the value of the inventory under the FIFO method from the value of the inventory under the LIFO method.

The resulting amount is the LIFO Reserve.

It is important to note that the LIFO Reserve is not a cash reserve or an actual amount of money set aside. It is simply an accounting measure that represents the potential tax liability.

Example of LIFO Reserve Calculation

Let’s consider an example to illustrate the calculation of the LIFO Reserve:

A company has inventory valued at $10,000 under the LIFO method and $8,000 under the FIFO method. To calculate the LIFO Reserve:

Overall, the LIFO Reserve is an important accounting concept that provides insights into a company’s tax position and the potential impact of a change in accounting method. It is crucial for financial analysis and decision-making.

Importance of LIFO Reserve in Accounting

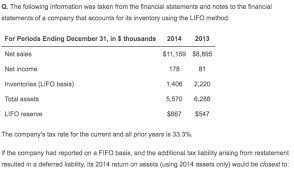

The LIFO reserve plays a crucial role in financial reporting and analysis. It provides insight into the impact of using the LIFO method on a company’s financial statements. By comparing the LIFO reserve to the company’s net income, investors and analysts can assess the effect of LIFO on profitability.

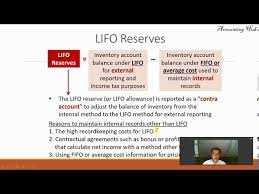

Additionally, the LIFO reserve can affect a company’s tax liability. In the United States, for example, companies that use the LIFO method for tax purposes must also maintain a LIFO reserve for financial reporting. The LIFO reserve allows companies to defer taxes by reducing their reported income and, consequently, their taxable income.

Calculating LIFO Reserve

The LIFO reserve can be calculated using the following formula:

To calculate the LIFO reserve, you need to determine the value of the ending inventory under both the LIFO method and an alternative method, such as FIFO. The difference between these two values represents the LIFO reserve.

Importance of LIFO Reserve in Accounting

The LIFO reserve is a crucial concept in accounting that helps businesses accurately value their inventory and calculate their cost of goods sold. LIFO, which stands for Last In, First Out, is a method of inventory valuation where the most recent purchases are assumed to be sold first. This means that the cost of goods sold is based on the cost of the most recent purchases, resulting in a higher cost of goods sold and lower net income compared to other inventory valuation methods like FIFO (First In, First Out).

The LIFO reserve is the difference between the inventory valuation using the LIFO method and the inventory valuation using another method, typically FIFO. It represents the amount by which the cost of goods sold and the value of the ending inventory would be different if the company had used a different inventory valuation method.

The LIFO reserve is important because it provides valuable information to investors, creditors, and other stakeholders about the impact of using the LIFO method on a company’s financial statements. By disclosing the LIFO reserve, a company can provide transparency and allow users of the financial statements to make more informed decisions.

Benefits of LIFO Reserve

There are several benefits of calculating and disclosing the LIFO reserve:

- Accurate inventory valuation: By calculating the LIFO reserve, a company can accurately value its inventory and reflect the current market prices. This helps in providing a more realistic picture of the company’s financial position.

- Comparability: The LIFO reserve allows for better comparability between companies that use different inventory valuation methods. It provides a common ground for evaluating and comparing financial statements.

- Tax advantages: The LIFO method often results in lower taxable income due to the higher cost of goods sold. By disclosing the LIFO reserve, a company can provide information about the potential tax advantages it enjoys.

Disclosure of LIFO Reserve

The LIFO reserve is typically disclosed in the footnotes to the financial statements. It is presented as a separate line item and is accompanied by a detailed explanation of the calculation method and the impact on the financial statements.

| Year | LIFO Reserve |

|---|---|

| 20XX | $X,XXX,XXX |

| 20XX-1 | $X,XXX,XXX |

| 20XX-2 | $X,XXX,XXX |

By disclosing the LIFO reserve, a company can provide transparency and allow users of the financial statements to understand the impact of the LIFO method on the company’s financial performance and position.

Calculating LIFO Reserve

To calculate the LIFO Reserve, you need to follow these steps:

- Determine the cost of inventory using the LIFO method. This involves valuing the inventory based on the most recent purchases, which are assumed to be the last ones sold.

- Determine the cost of inventory using the FIFO method. This involves valuing the inventory based on the oldest purchases, which are assumed to be the first ones sold.

- Subtract the cost of inventory calculated using the FIFO method from the cost of inventory calculated using the LIFO method. The result is the LIFO Reserve.

The LIFO Reserve is an important metric for financial analysis because it provides insights into the impact of using the LIFO method on a company’s financial statements. A positive LIFO Reserve indicates that the LIFO method is resulting in a lower cost of goods sold and higher inventory values compared to the FIFO method. This can have a significant impact on a company’s profitability and tax liabilities.

On the other hand, a negative LIFO Reserve indicates that the LIFO method is resulting in a higher cost of goods sold and lower inventory values compared to the FIFO method. This may be due to inflation or other factors that have increased the cost of inventory over time.

By calculating the LIFO Reserve, companies can better understand the effects of their inventory valuation method on their financial statements and make informed decisions regarding inventory management and tax planning.

Example of LIFO Reserve Calculation

Let’s consider an example to understand how to calculate the LIFO reserve. Suppose a company, ABC Corp, uses the LIFO method for inventory valuation. They have the following data:

Beginning Inventory

Quantity: 100 units

Cost per unit: $10

Purchases

Quantity: 200 units

Cost per unit: $12

Sales

Quantity: 150 units

Selling price per unit: $20

To calculate the LIFO reserve, we need to determine the difference between the ending inventory value under LIFO and the ending inventory value under FIFO. Here’s how we do it:

1. Calculate the ending inventory under LIFO:

2. Calculate the ending inventory under FIFO:

3. Calculate the LIFO reserve:

The LIFO reserve is an important concept in accounting as it helps companies determine the impact of using the LIFO method on their financial statements. It allows for better comparison of financial data between companies using different inventory valuation methods.

By calculating the LIFO reserve, companies can make informed decisions regarding their inventory management and financial reporting. It is essential for accurate financial analysis and decision-making.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.