What is a Junior Accountant?

A junior accountant is an entry-level position in the field of accounting. They work under the supervision of senior accountants or accounting managers and assist in the preparation and maintenance of financial records. Junior accountants play a crucial role in ensuring the accuracy and integrity of financial data for organizations.

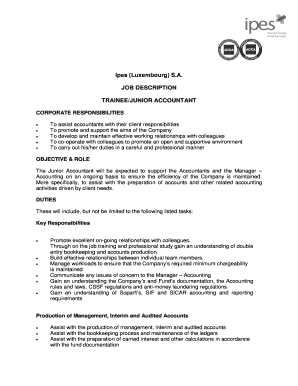

The responsibilities of a junior accountant may vary depending on the size and nature of the organization. However, some common tasks include recording financial transactions, reconciling bank statements, preparing financial reports, and assisting in the preparation of budgets and forecasts.

Junior accountants are also responsible for ensuring compliance with applicable laws and regulations, such as tax laws and financial reporting standards. They may assist in the preparation of tax returns and financial statements, as well as participate in audits and other financial reviews.

Overall, a junior accountant is an important member of an accounting team, contributing to the financial stability and success of an organization. It is a stepping stone towards more advanced roles in the field of accounting and finance.

Definition and Role

A junior accountant is an entry-level position in the field of accounting. They work under the supervision of senior accountants or accounting managers and assist with various financial tasks within an organization. The role of a junior accountant involves handling financial data, preparing financial reports, and ensuring compliance with accounting principles and regulations.

Junior accountants are responsible for maintaining accurate and up-to-date financial records. They may be involved in tasks such as recording transactions, reconciling bank statements, and processing invoices. They also assist in the preparation of financial statements, including balance sheets, income statements, and cash flow statements.

In addition to their day-to-day accounting responsibilities, junior accountants may also assist in financial analysis and budgeting. They may help analyze financial data to identify trends and patterns, and provide recommendations for improving financial performance. They may also assist in the preparation of budgets and forecasts, and monitor actual performance against budgeted targets.

Junior accountants play a crucial role in ensuring the accuracy and integrity of an organization’s financial information. They must have a strong attention to detail and be able to work with numbers and data accurately. They should also have good analytical and problem-solving skills to identify and resolve any discrepancies or issues in financial records.

Overall, the role of a junior accountant is essential in supporting the financial operations of an organization. They provide valuable assistance to senior accountants and contribute to the overall financial health and success of the organization.

Requirements for Junior Accountants

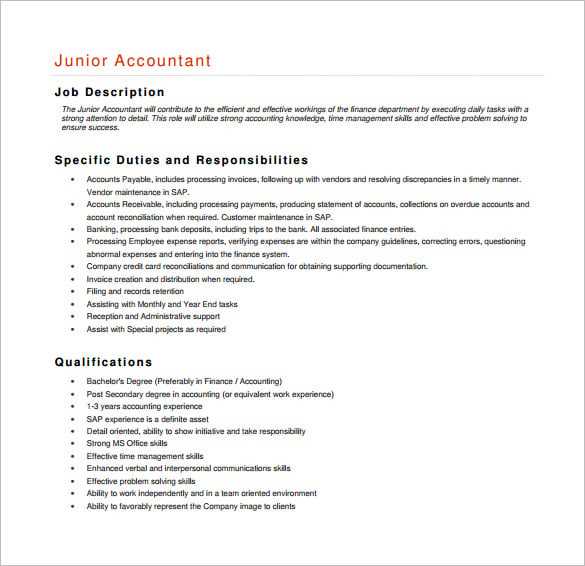

Educational Requirements

Most employers require junior accountants to have at least a bachelor’s degree in accounting or a related field. A solid foundation in accounting principles, financial analysis, and taxation is essential. Some employers may also prefer candidates with a master’s degree in accounting or a CPA (Certified Public Accountant) certification.

Technical Skills

Analytical Skills

Communication and Teamwork

Junior accountants often work as part of a team, collaborating with other accountants, auditors, and finance professionals. Therefore, strong communication and teamwork skills are essential. They should be able to effectively communicate financial information to non-financial stakeholders and work well in a collaborative environment.

Organizational Skills

Junior accountants are responsible for managing multiple tasks and deadlines simultaneously. Therefore, excellent organizational skills are necessary to prioritize work, meet deadlines, and maintain accuracy. They should be able to handle confidential information with integrity and maintain a high level of professionalism.

Outlook for Junior Accountants

Junior accountants play a crucial role in the financial management of organizations, and their outlook in the job market is promising. As businesses continue to grow and expand, the demand for skilled accounting professionals, including junior accountants, is expected to remain strong.

One of the main factors driving the positive outlook for junior accountants is the increasing complexity of financial regulations and reporting requirements. With the ever-changing landscape of accounting standards and tax laws, companies need professionals who can navigate these complexities and ensure compliance.

Additionally, the globalization of business has created new opportunities for junior accountants. As companies expand their operations internationally, they require individuals who can understand and apply international accounting standards and regulations.

Furthermore, the increasing focus on data analysis and technology in accounting has opened up new avenues for junior accountants. With the rise of automation and artificial intelligence, junior accountants need to adapt and develop skills in data analytics, financial software, and other technological tools to stay competitive in the job market.

Overall, the outlook for junior accountants is positive, with a steady demand for their skills and expertise. As businesses continue to evolve and adapt to changing financial landscapes, the need for junior accountants will remain strong. By staying up-to-date with the latest industry trends and continuously improving their skills, junior accountants can ensure long-term career growth and success.

SALARIES & COMPENSATION for Junior Accountants

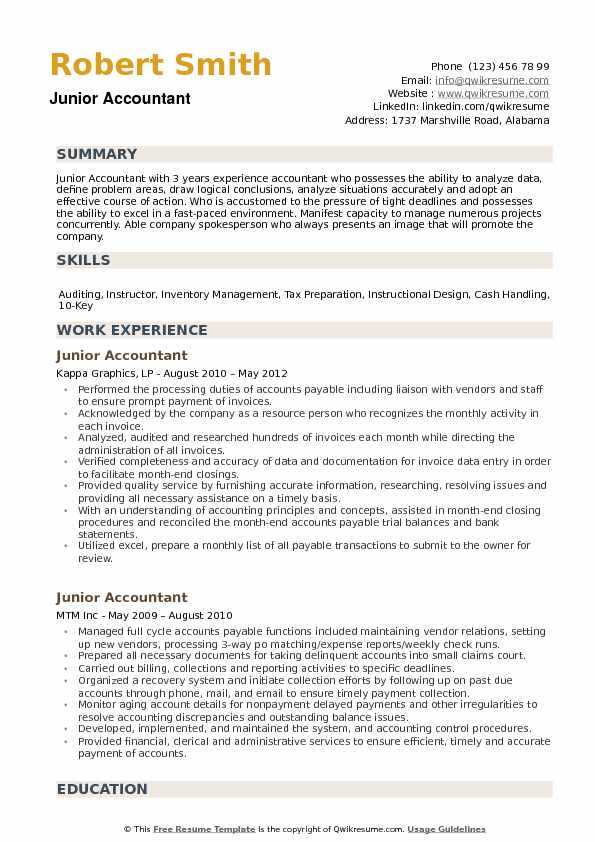

The average salary for a junior accountant in the United States is around $50,000 per year. However, this can vary depending on the factors mentioned above. For example, junior accountants working in major cities like New York or San Francisco may earn higher salaries due to the higher cost of living.

In addition to the base salary, junior accountants may also receive bonuses and other incentives based on their performance. These can be in the form of profit-sharing, commission, or annual bonuses. The exact amount of these incentives will depend on the company’s policies and the individual’s performance.

Furthermore, junior accountants may also receive benefits such as health insurance, retirement plans, paid time off, and professional development opportunities. These benefits can add significant value to the overall compensation package.

As junior accountants gain more experience and expertise, their salaries and compensation packages are likely to increase. They may also have opportunities for career advancement, such as promotions to senior accountant or managerial positions, which can come with higher salaries and additional benefits.

Overall, the salaries and compensation for junior accountants are competitive and offer room for growth and advancement. It is important for junior accountants to continuously improve their skills and knowledge to stay competitive in the field and increase their earning potential.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.