Investor Relations: Definition and Importance

Investor Relations is a crucial function within a company that focuses on managing relationships and communications between the company and its investors. It plays a vital role in ensuring transparency, trust, and effective communication between the company and its shareholders, potential investors, financial analysts, and other stakeholders.

Importance of Investor Relations:

1. Building Trust: Investor Relations helps build trust and credibility by providing accurate and timely information to investors. This transparency fosters confidence in the company and its management.

2. Effective Communication: Investor Relations professionals act as a bridge between the company and the investment community. They ensure that relevant information is effectively communicated to investors, helping them make informed decisions.

3. Investor Engagement: Investor Relations teams engage with investors through various channels, such as investor conferences, earnings calls, and meetings. These interactions help build relationships and provide a platform for investors to voice their concerns and ask questions.

4. Managing Expectations: Investor Relations professionals play a crucial role in managing investor expectations. They provide guidance and insights into the company’s performance, strategy, and future prospects, helping investors understand the company’s potential and risks.

5. Attracting and Retaining Investors: Investor Relations activities, such as roadshows and investor presentations, aim to attract new investors and retain existing ones. By showcasing the company’s strengths and growth potential, Investor Relations helps create a positive perception among investors.

6. Crisis Management: During times of crisis or negative events, Investor Relations professionals play a critical role in managing communications and mitigating potential damage to the company’s reputation. They provide accurate information and address investor concerns promptly.

7. Market Intelligence: Investor Relations teams closely monitor market trends, competitor activities, and investor sentiment. This market intelligence helps the company stay informed about industry developments and investor expectations.

What is Investor Relations?

Investor Relations (IR) is a strategic management function that involves communicating with and managing relationships with investors, shareholders, and financial analysts. It is a crucial aspect of a company’s overall communication strategy and plays a significant role in shaping the perception of the company in the investment community.

The main goal of investor relations is to provide accurate and timely information to investors and potential investors, enabling them to make informed decisions about investing in the company’s stock or bonds. This includes providing financial reports, hosting investor conferences and presentations, and responding to inquiries from investors and analysts.

Investor relations also involve monitoring and analyzing market trends, competitor activities, and regulatory changes that may impact the company’s performance or investor sentiment. This information is used to develop strategies and tactics to enhance the company’s investor relations efforts and ensure that the company is well-positioned in the market.

In summary, investor relations is a critical function within a company that focuses on building and maintaining relationships with investors and financial analysts. It involves effectively communicating the company’s financial performance, strategic initiatives, and market positioning to the investment community. By doing so, investor relations professionals help to shape investor perception and support the company’s overall growth and success.

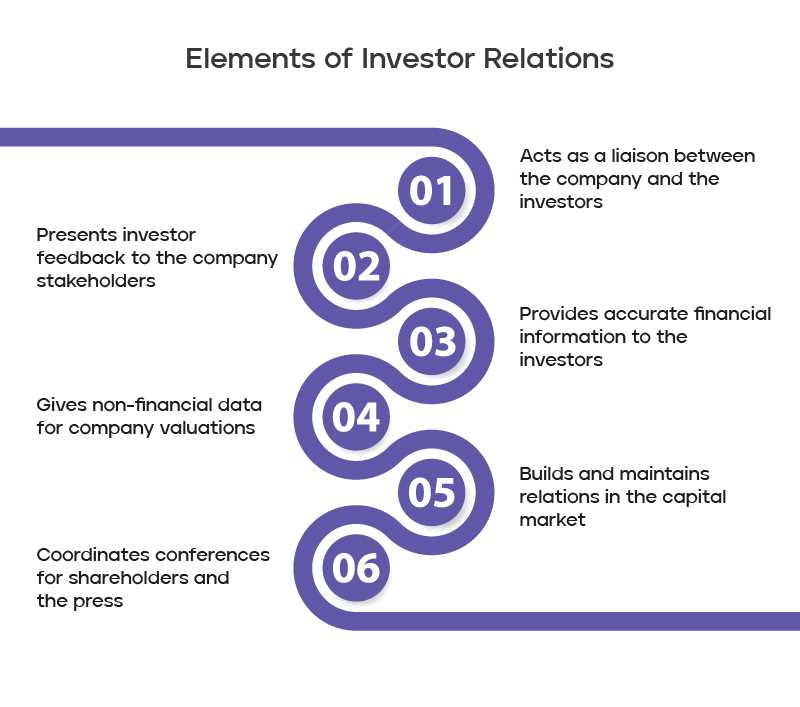

Role and Responsibilities of an Investor Relations Professional

An investor relations professional plays a crucial role in bridging the gap between a company and its investors. They are responsible for managing and maintaining relationships with current and potential investors, as well as financial analysts and other stakeholders. Their main objective is to ensure that the company’s financial performance and prospects are effectively communicated to the investment community.

One of the key responsibilities of an investor relations professional is to provide accurate and timely information to investors. This includes preparing and distributing financial reports, earnings releases, and other relevant information that may impact the company’s stock price. They also organize and participate in investor conferences, roadshows, and other events to present the company’s financial performance and strategy to investors.

Another important aspect of the role is to act as a liaison between the company’s management team and the investment community. Investor relations professionals often work closely with the CEO, CFO, and other executives to ensure that investor concerns and questions are addressed effectively. They serve as a point of contact for investors, providing them with the necessary information and guidance to make informed investment decisions.

In addition, investor relations professionals monitor and analyze market trends, competitor activities, and regulatory developments that may impact the company’s financial performance. They provide insights and recommendations to the management team on how to effectively communicate and respond to these external factors.

Furthermore, investor relations professionals play a crucial role in crisis management. In times of financial or reputational crises, they are responsible for communicating with investors and other stakeholders, providing accurate and transparent information to mitigate any potential negative impact on the company’s stock price and reputation.

Overall, the role of an investor relations professional is crucial in building and maintaining trust and confidence in a company among its investors. By effectively communicating the company’s financial performance and prospects, they contribute to the company’s overall success in the capital markets.

Skills and Qualifications for a Career in Investor Relations

1. Financial Knowledge:

2. Communication Skills:

Effective communication is crucial in investor relations. You should be able to communicate complex financial information in a clear and concise manner to both internal and external stakeholders. Strong written and verbal communication skills are a must.

3. Relationship Building:

4. Strategic Thinking:

Being able to think strategically and understand the long-term goals and objectives of the company is important in investor relations. You should be able to align investor relations strategies with the overall corporate strategy and communicate the company’s vision effectively.

5. Analytical Skills:

Analytical skills are essential in investor relations, as you will be analyzing financial data, market trends, and investor sentiment. Being able to interpret data and draw meaningful insights is crucial for making informed decisions.

6. Industry Knowledge:

7. Adaptability:

The investor relations landscape is constantly evolving, so being adaptable and open to change is important. You should be able to quickly adapt to new technologies, industry trends, and regulatory requirements.

8. Ethics and Integrity:

By developing and honing these skills and qualifications, you can build a successful career in investor relations and contribute to the success of your company.

Investor Relations Career Path

Investor relations is a dynamic field that offers a variety of career paths for professionals interested in finance and communications. Whether you are just starting out or looking to advance in your career, there are several steps you can take to build a successful career in investor relations.

2. Entry-level positions: Many professionals start their career in investor relations by working in entry-level positions, such as investor relations assistant or analyst. These roles provide valuable experience and allow individuals to learn the basics of investor relations.

3. Professional development: To advance in the field of investor relations, it is important to continuously develop your skills and knowledge. This can be done through professional development programs, certifications, and attending industry conferences and events.

4. Networking: Building a strong network is crucial for success in investor relations. Connecting with professionals in the industry can provide valuable insights, job opportunities, and mentorship. Attend industry events, join professional organizations, and engage with peers on social media platforms.

5. Specialization: As you gain experience in investor relations, consider specializing in a specific area, such as investor communications, financial analysis, or corporate governance. This can help you stand out in the field and open up new career opportunities.

6. Leadership roles: As you progress in your career, aim for leadership roles such as Investor Relations Manager or Director of Investor Relations. These positions involve managing a team, developing investor relations strategies, and representing the company to investors and analysts.

7. Continuous learning: Investor relations is a constantly evolving field, so it is important to stay up-to-date with industry trends and developments. Continuously learning and adapting to changes will help you stay competitive and advance in your career.

Example of Investor Relations in Action

Investor relations is a crucial function for any company that wants to maintain a positive relationship with its shareholders and the investment community. It involves effectively communicating with investors, analysts, and other stakeholders to provide them with accurate and timely information about the company’s financial performance, business strategy, and future prospects.

Let’s consider an example of how investor relations can be put into action. Imagine a publicly traded technology company that recently released its quarterly earnings report. The investor relations team would play a key role in disseminating this information to the investment community.

Preparing the Earnings Release

The investor relations team would work closely with the company’s finance and accounting departments to prepare the earnings release. This document would include financial statements, key performance metrics, and management commentary on the company’s results. The team would ensure that the information is accurate, consistent, and compliant with regulatory requirements.

Organizing an Earnings Conference Call

Once the earnings release is finalized, the investor relations team would organize an earnings conference call. This call allows the company’s management to discuss the financial results in more detail and answer questions from analysts and investors. The team would coordinate the logistics of the call, including setting the date and time, sending out invitations, and managing the Q&A session.

Engaging with Investors and Analysts

Throughout the quarter, the investor relations team would proactively engage with investors and analysts to build relationships and provide updates on the company’s progress. This could involve attending investor conferences, hosting one-on-one meetings, and participating in industry events. The team would also respond to inquiries from shareholders and analysts, addressing any concerns or questions they may have.

Monitoring and Reporting on Shareholder Activity

The investor relations team would closely monitor shareholder activity, including changes in ownership and voting patterns. They would analyze this data and provide regular reports to senior management and the board of directors. This information helps the company understand the composition of its shareholder base and identify any potential risks or opportunities.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.