Inherited IRA: Definition and Tax Rules for Spouses and Non-Spouses

An inherited IRA is an individual retirement account that is passed down to a beneficiary after the death of the original account holder. This type of IRA allows the beneficiary to continue to grow the funds in a tax-advantaged manner. However, it is important to understand the tax rules associated with inheriting an IRA, whether you are a spouse or a non-spouse beneficiary.

Another option for spouses is to treat the inherited IRA as a beneficiary IRA. This allows the spouse to take distributions from the account based on their own life expectancy. They can also name their own beneficiaries for the account, who will then be subject to the same distribution rules.

It is important to note that both spouses and non-spouse beneficiaries may be subject to taxes when taking distributions from an inherited IRA. Traditional IRA distributions are generally taxable as ordinary income, while distributions from a Roth IRA are tax-free as long as certain conditions are met.

What is an Inherited IRA?

An Inherited IRA is created when an individual designates a beneficiary to receive their IRA assets upon their death. The beneficiary can be a spouse, child, sibling, or any other person or entity. The purpose of an Inherited IRA is to allow the beneficiary to continue to grow the assets tax-deferred or tax-free, depending on the type of IRA.

Tax Rules for Inherited IRA

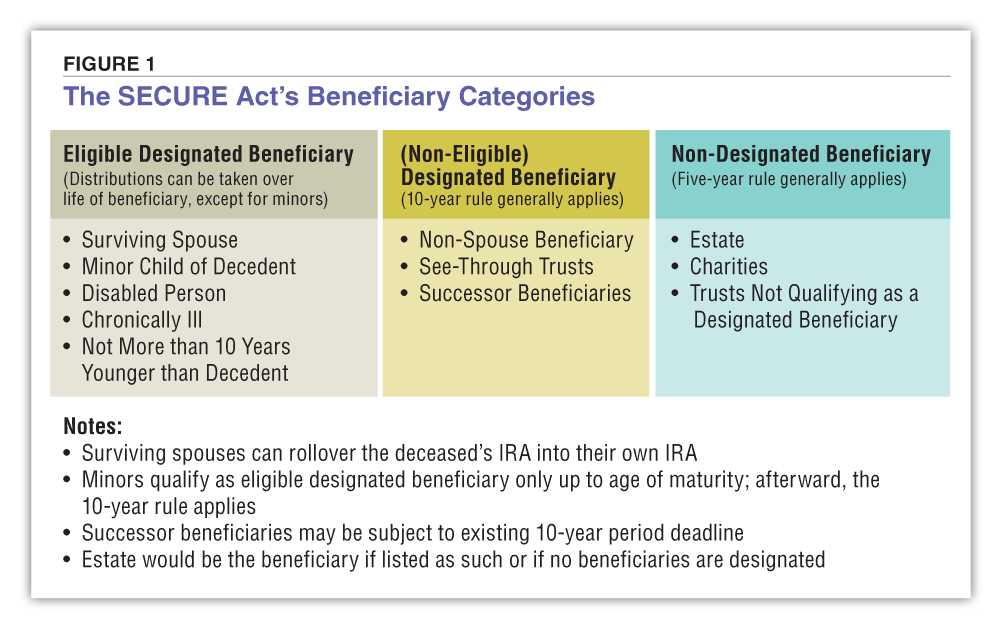

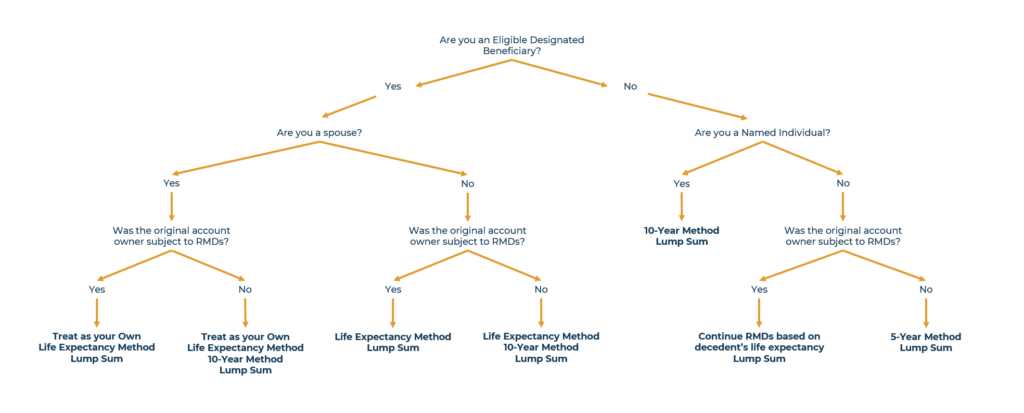

The tax rules for Inherited IRA depend on whether the beneficiary is a spouse or a non-spouse.

Tax Rules for Spouses

Tax Rules for Non-Spouses

Benefits of Inherited IRA

Tax Rules for Spouses

1. Spousal Rollover: One of the key benefits for spouses inheriting an IRA is the option to perform a spousal rollover. This means that the spouse can transfer the inherited IRA into their own IRA account. By doing so, the spouse can delay required minimum distributions (RMDs) until they reach the age of 72, allowing the funds to continue growing tax-deferred.

3. Stretch IRA: Another option available to spouses is the “stretch IRA” strategy. This allows the spouse to take distributions over their own life expectancy, potentially extending the tax advantages of the inherited IRA. By stretching the distributions, the spouse can minimize the tax impact and maximize the growth potential of the funds.

Tax Rules for Non-Spouses

Required Minimum Distributions (RMDs)

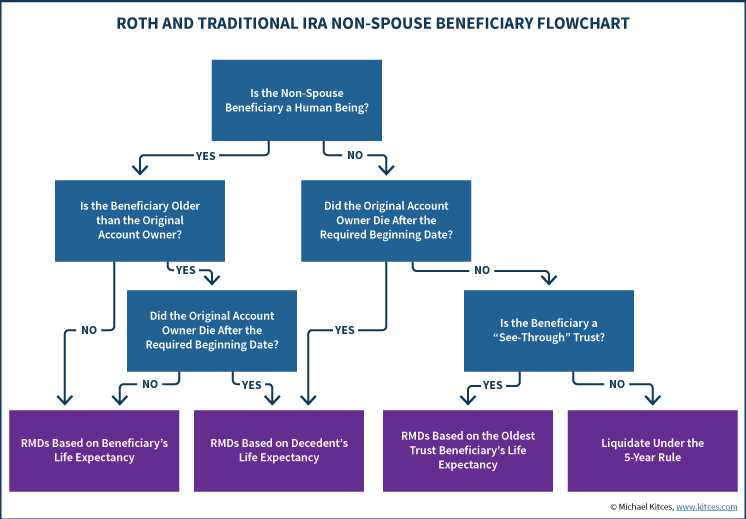

One of the key tax rules for non-spouse beneficiaries is the requirement to take required minimum distributions (RMDs) from the inherited IRA. The RMDs must begin by December 31 of the year following the original owner’s death. The amount of the RMD is based on the beneficiary’s life expectancy and is calculated using the IRS Single Life Expectancy Table.

If the original owner had already started taking RMDs before their death, the non-spouse beneficiary must continue taking the RMDs based on the original owner’s life expectancy. However, if the original owner had not started taking RMDs, the non-spouse beneficiary can choose to take distributions over their own life expectancy or distribute the entire balance within five years.

Taxation of Distributions

When a non-spouse beneficiary takes distributions from an inherited IRA, those distributions are generally subject to income tax. The amount of tax owed depends on whether the IRA is a traditional IRA or a Roth IRA.

If the inherited IRA is a traditional IRA, the distributions are taxed as ordinary income. The beneficiary must include the distributions in their taxable income for the year in which they are received.

If the inherited IRA is a Roth IRA and the original owner had met the five-year holding period, the distributions are generally tax-free. However, if the five-year holding period has not been met, the earnings portion of the distributions may be subject to income tax.

Stretch IRA Strategy

A popular tax planning strategy for non-spouse beneficiaries is the stretch IRA strategy. This strategy allows the beneficiary to take distributions over their own life expectancy, potentially stretching out the tax advantages of the inherited IRA over a longer period of time.

By taking only the required minimum distributions each year, the beneficiary can minimize the amount of taxable income and potentially keep the inherited IRA growing tax-deferred for a longer period of time.

Table of Tax Rules for Non-Spouses

| Tax Rule | Traditional IRA | Roth IRA |

|---|---|---|

| Required Minimum Distributions | Start by December 31 of the year following the original owner’s death | Start by December 31 of the year following the original owner’s death |

| Taxation of Distributions | Taxed as ordinary income | Generally tax-free if the five-year holding period has been met |

| Stretch IRA Strategy | Potential to stretch distributions over the beneficiary’s life expectancy | Potential to stretch distributions over the beneficiary’s life expectancy |

Benefits of Inherited IRA

An Inherited IRA can provide several benefits for beneficiaries, whether they are spouses or non-spouses. Here are some key advantages:

- Flexibility: Inherited IRAs provide beneficiaries with flexibility in managing their inherited assets. Spouses who inherit an IRA have the option to roll it over into their own IRA, giving them control over the investments and distribution strategies. Non-spouse beneficiaries, although they cannot roll over the inherited IRA, can still choose between taking a lump sum distribution or stretching the distributions over their life expectancy.

- Continued Growth: Inherited IRAs allow the assets to continue growing tax-deferred or tax-free, depending on the type of IRA. This can be especially advantageous for younger beneficiaries who have a longer time horizon for investment growth. By stretching the distributions over their life expectancy, non-spouse beneficiaries can potentially maximize the growth potential of the inherited assets.

- Protection from Creditors: Inherited IRAs may offer some protection from creditors. While the level of protection can vary depending on state laws, in general, inherited IRAs are shielded from creditors’ claims. This can provide beneficiaries with added peace of mind knowing that their inherited assets are protected.

- Legacy Planning: Inherited IRAs can be an effective tool for legacy planning. By carefully considering the distribution strategies, beneficiaries can pass on the remaining assets to future generations. This can help create a lasting financial legacy and provide for the financial well-being of loved ones.

Overall, an Inherited IRA can provide significant benefits for both spouses and non-spouses. From potential tax advantages to flexibility in managing the inherited assets, it offers a range of advantages that can help beneficiaries make the most of their inherited wealth.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.