Proxy Fight: Definition, Causes, What Happens, and Example

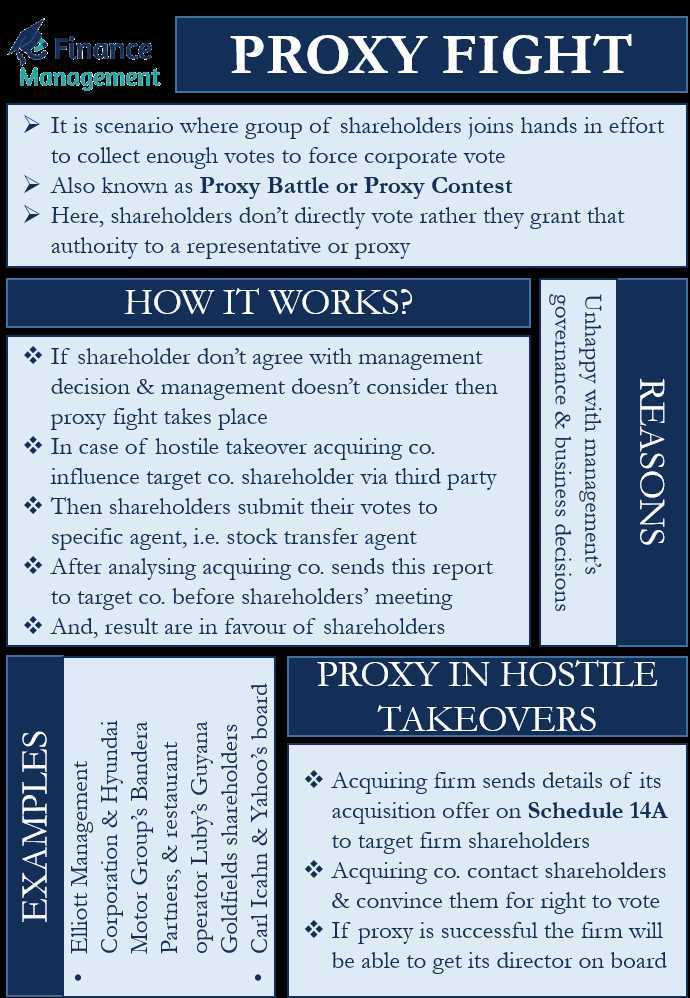

A proxy fight is a corporate battle for control between a company’s management and its shareholders. It occurs when shareholders, dissatisfied with the current management, attempt to gain control of the company by soliciting proxies from other shareholders to vote in favor of their proposed changes.

Causes of Proxy Fights

Proxy fights can arise due to various reasons, including:

- Disagreements with Management: Shareholders may be dissatisfied with the company’s performance, strategic decisions, or executive compensation, leading to a proxy fight.

- Corporate Governance Issues: Proxy fights can occur when shareholders believe that the board of directors is not acting in the best interest of the company or its shareholders.

- Control and Ownership: Proxy fights may arise when shareholders want to gain control of the company or increase their ownership stake.

What Happens During a Proxy Fight?

A proxy fight typically involves several steps:

- Proxy Contest: Shareholders who want to initiate a proxy fight must file a proxy statement with the Securities and Exchange Commission (SEC) and send it to other shareholders. The statement outlines the proposed changes and urges shareholders to vote in favor of them.

- Proxy Solicitation: Shareholders seeking control of the company will actively solicit proxies from other shareholders, trying to convince them to vote in favor of their proposals.

- Shareholder Voting: Shareholders cast their votes either by proxy or in person at the annual general meeting. The outcome of the vote determines whether the proposed changes are approved or rejected.

- Impact on Management: If the dissident shareholders win the proxy fight, they may gain control of the company’s board of directors and have the power to make significant changes, such as replacing the CEO or altering the company’s strategic direction.

Example of a Proxy Fight

A notable example of a proxy fight is the battle between activist investor Carl Icahn and the board of directors of Apple Inc. In 2013, Icahn publicly criticized Apple’s management and called for the company to increase its share buyback program. He launched a proxy fight, urging shareholders to vote in favor of his proposal. Although Icahn ultimately withdrew his proxy fight, Apple agreed to increase its share buyback program, partially addressing his concerns.

What is a Proxy Fight?

In a proxy fight, shareholders who are unhappy with the company’s performance or strategic decisions may form a group or join forces with other dissatisfied shareholders to challenge the current management. They typically seek to replace some or all of the board members with individuals who they believe will better serve their interests.

Proxy Fight Process

The process of a proxy fight involves several steps:

- Proxy Solicitation: The dissident shareholders actively seek support from other shareholders by sending out proxy materials, such as proxy cards or voting instruction forms, to encourage them to vote in favor of their proposed changes.

- Shareholder Voting: The shareholders receive the proxy materials and vote either by mail, phone, or online. The votes are then collected and counted.

- Annual Meeting: The company holds its annual meeting, where shareholders gather to vote on various matters, including the election of directors. The dissident shareholders may present their case and argue why their proposed changes are in the best interest of the company and its shareholders.

- Outcome: The results of the shareholder vote are announced, and if the dissident shareholders are successful in gaining enough support, their proposed changes may be implemented.

Importance of Proxy Fights

Proxy fights can also serve as a catalyst for change within a company. The threat of a proxy fight may prompt the current management to address shareholder concerns and make strategic changes to avoid losing control.

Conclusion

A proxy fight is a powerful tool that shareholders can use to challenge the current management and advocate for changes in a company. It allows shareholders to have a say in the decision-making process and influence the future direction of the company. Proxy fights are an important aspect of corporate governance and can lead to significant changes in the management and governance structure of a company.

Causes of Proxy Fights

1. Disagreements over Corporate Strategy

One of the main causes of proxy fights is disagreements between shareholders and management regarding the company’s strategic direction. Shareholders may believe that the current management is not effectively executing the company’s strategy or that the strategy itself is flawed. They may seek to gain control of the board of directors in order to implement their own strategic vision.

2. Poor Financial Performance

Another common cause of proxy fights is poor financial performance. Shareholders may become dissatisfied with the company’s financial results, such as declining profits or a stagnant stock price. They may blame the current management for these poor results and seek to replace them with individuals they believe can improve the company’s financial performance.

3. Governance Issues

Governance issues can also trigger proxy fights. Shareholders may be concerned about the composition of the board of directors, the independence of the directors, or the effectiveness of the company’s internal controls and risk management. They may launch a proxy fight to bring about changes in corporate governance practices and improve transparency and accountability.

4. Executive Compensation

Executive compensation is another factor that can lead to proxy fights. Shareholders may feel that the current management is being excessively compensated, especially if the company’s financial performance does not justify such high pay. They may seek to elect directors who will be more aligned with shareholder interests and advocate for more reasonable executive compensation packages.

5. Mergers and Acquisitions

Mergers and acquisitions can also be a catalyst for proxy fights. Shareholders may disagree with the terms of a proposed merger or acquisition and believe that it is not in their best interest. They may launch a proxy fight to block the transaction or to ensure that the transaction is renegotiated to better benefit shareholders.

What Happens During a Proxy Fight?

During a proxy fight, several key events and actions take place. These include:

1. Proxy Contest Announcement

The proxy fight begins with an announcement by an activist shareholder or group of shareholders that they intend to challenge the current management and board of directors. This announcement is usually made through a public filing with the Securities and Exchange Commission (SEC) or a press release.

2. Proxy Statement Preparation

3. Proxy Statement Distribution

The activist shareholder(s) distribute the proxy statement to all shareholders of the company. This is usually done through mail or electronic means. The proxy statement includes instructions on how shareholders can vote their shares and support the activist’s nominees.

4. Shareholder Voting

Shareholders have the opportunity to vote on the activist’s nominees and other proposals put forth by the activist shareholder(s). They can vote by proxy, which means they authorize someone else to vote on their behalf, or they can vote in person at the company’s annual general meeting or a special meeting.

5. Proxy Solicitation

The activist shareholder(s) engage in proxy solicitation efforts to encourage shareholders to vote in favor of their nominees and proposals. This can include contacting shareholders directly, holding meetings or conference calls with shareholders, and issuing additional communications to persuade shareholders to support their cause.

6. Proxy Voting Results

After the voting deadline, the proxy votes are counted and the results are announced. If the activist shareholder(s) are successful in gaining enough support from shareholders, their nominees may be elected to the board of directors, and changes to the company’s management and strategic direction may occur.

7. Post-Proxy Fight Actions

After a proxy fight, the company may undergo significant changes in its leadership and governance. The newly elected directors may implement new policies and strategies, and the company’s management team may be reshuffled. The outcome of a proxy fight can have a lasting impact on the company’s future.

Example of a Proxy Fight

A proxy fight is a common occurrence in the corporate world, where shareholders attempt to gain control of a company by soliciting votes from other shareholders. One notable example of a proxy fight is the battle between activist investor Carl Icahn and the board of directors at Apple Inc. in 2014.

Background

In 2013, Carl Icahn announced that he had acquired a significant stake in Apple Inc. and believed that the company was undervalued. He argued that Apple should increase its share buyback program to boost shareholder value. However, Apple’s board of directors disagreed with Icahn’s proposal and believed that the company was already returning a substantial amount of capital to shareholders.

The Proxy Fight

Unable to reach an agreement, Icahn decided to launch a proxy fight to gain support from other shareholders. He sent a letter to Apple’s shareholders, urging them to vote in favor of his proposal and replace some of the board members with his own nominees. Icahn also used his influential position and media presence to publicly criticize Apple’s management and advocate for his agenda.

Apple, on the other hand, actively campaigned against Icahn’s proposal and defended its existing strategy. The company argued that it had a solid track record of creating shareholder value and that Icahn’s demands were not in the best interest of the company or its long-term shareholders.

The Outcome

The proxy fight gained significant attention from both the media and the investment community. Ultimately, Icahn withdrew his proposal before the shareholder vote, stating that he was pleased with Apple’s commitment to increasing its share buyback program. Although Icahn did not achieve all of his objectives, his activism brought attention to Apple’s capital allocation strategy and put pressure on the company to address shareholders’ concerns.

This example highlights the power of proxy fights in influencing corporate decision-making and the dynamics between shareholders and management. Proxy fights can be a valuable tool for activist investors to challenge the status quo and advocate for changes they believe will enhance shareholder value.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.