Balanced Fund Investment: Definition

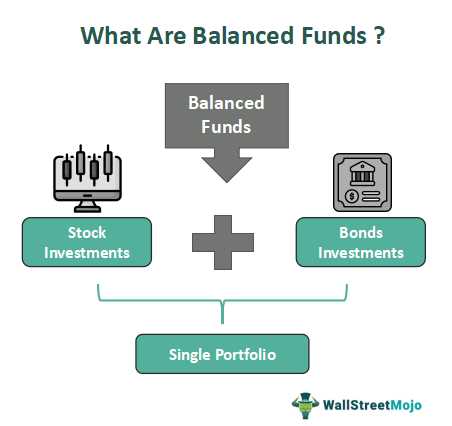

A balanced fund investment is a type of mutual fund that aims to provide investors with a balanced portfolio of both stocks and bonds. It is designed to offer a mix of growth and income by investing in a diversified range of assets. The fund manager allocates the assets based on the fund’s investment objective and strategy.

What is a balanced fund?

How does a balanced fund work?

A balanced fund works by investing in a mix of stocks and bonds. The fund manager allocates the assets based on the fund’s investment objective and strategy. The stocks in the portfolio provide potential for growth, while the bonds provide income and stability. This combination helps to reduce the overall risk of the fund and provide a more balanced return for investors.

Benefits of investing in a balanced fund

Investing in a balanced fund offers several benefits. First, it provides diversification by investing in a mix of stocks and bonds. This helps to reduce the overall risk of the portfolio. Second, it offers potential for both growth and income. The stocks in the portfolio provide the potential for capital appreciation, while the bonds provide regular income through interest payments. Finally, a balanced fund is managed by a professional fund manager who has expertise in selecting and managing the portfolio, which can help to optimize returns.

Conclusion

In summary, a balanced fund investment is a type of mutual fund that aims to provide investors with a balanced portfolio of both stocks and bonds. It offers diversification, potential for growth and income, and is managed by a professional fund manager. Consider investing in a balanced fund to achieve a balanced and diversified investment portfolio.

A balanced fund is a type of mutual fund that aims to provide investors with a balanced portfolio of assets. This means that the fund manager will invest in both stocks and bonds, with the goal of achieving a balance between growth and income.

One of the key benefits of balanced fund investment is diversification. By investing in a mix of stocks and bonds, investors can spread their risk across different asset classes. This can help to protect their investments from market volatility and reduce the overall risk of their portfolio.

Another advantage of balanced fund investment is the potential for steady returns. While stocks offer the potential for higher returns, they also come with a higher level of risk. Bonds, on the other hand, tend to be more stable but offer lower returns. By investing in a balanced fund, investors can benefit from the potential growth of stocks while also enjoying the stability of bonds.

Mix of Balanced Fund Investment

Stocks: A balanced fund may invest a portion of its assets in stocks or equity securities. These can include shares of individual companies or exchange-traded funds (ETFs) that track a specific stock market index. Investing in stocks can provide the potential for capital appreciation, but it also comes with a higher level of risk compared to other asset classes.

Bonds: Another component of a balanced fund’s portfolio is bonds or fixed-income securities. These can include government bonds, corporate bonds, or municipal bonds. Bonds are generally considered less risky than stocks and can provide a steady stream of income through interest payments. They are often used to diversify the portfolio and provide stability.

Cash Equivalents: The third element of a balanced fund’s mix is cash equivalents, which are short-term, highly liquid investments. These can include Treasury bills, certificates of deposit (CDs), or money market funds. Cash equivalents provide stability and liquidity to the portfolio, allowing the fund manager to take advantage of investment opportunities or meet redemption requests from investors.

By combining these different asset classes, a balanced fund aims to achieve a balance between growth and income. The mix of assets is carefully selected by the fund manager based on their assessment of market conditions, economic outlook, and the fund’s investment objectives. It is important for investors to review the fund’s prospectus and understand the specific mix of assets before making an investment decision.

Allocation of Assets

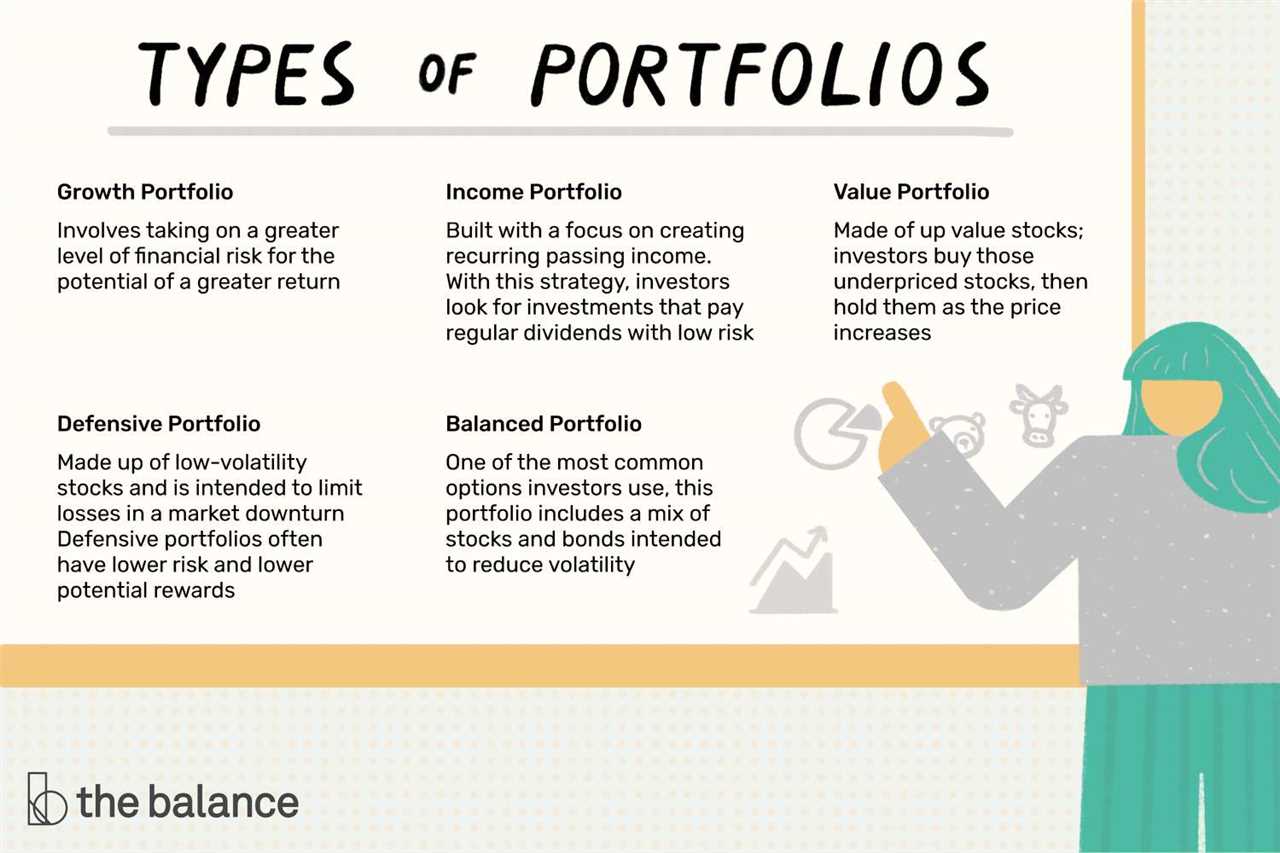

When investing in a balanced fund, it is important to understand how the assets are allocated. A balanced fund typically invests in a mix of stocks, bonds, and cash equivalents to achieve a balance between growth and income. The allocation of assets can vary depending on the fund’s investment objectives and the fund manager’s strategy.

The allocation of assets in a balanced fund is usually expressed as a percentage of the total portfolio. For example, a balanced fund may have an allocation of 60% stocks, 30% bonds, and 10% cash equivalents. This allocation is designed to provide investors with a diversified portfolio that can potentially generate both capital appreciation and income.

The allocation of assets in a balanced fund is based on several factors, including the fund’s investment goals, the risk tolerance of the investors, and the market conditions. The fund manager will carefully select the stocks, bonds, and cash equivalents that best align with the fund’s objectives and the current market environment.

By diversifying the allocation of assets, balanced funds aim to reduce the overall risk of the portfolio. Stocks provide the potential for capital appreciation, while bonds offer income and stability. Cash equivalents, such as money market funds, provide liquidity and act as a buffer against market volatility.

Examples of Balanced Fund Investment

When considering balanced fund investment options, it can be helpful to look at some examples to better understand how these funds work and what they can offer. Here are a few examples of balanced fund investments:

1. XYZ Balanced Fund: This fund aims to provide a mix of both growth and income by investing in a diversified portfolio of stocks, bonds, and other assets. It has a track record of consistent performance and offers a low expense ratio.

2. ABC Balanced Fund: With a focus on capital preservation and income generation, this fund invests in a combination of high-quality bonds and dividend-paying stocks. It is designed to provide stability and steady returns over the long term.

3. DEF Balanced Fund: This fund takes a more aggressive approach by investing in a mix of growth-oriented stocks and high-yield bonds. It aims to generate higher returns, but also carries a higher level of risk compared to more conservative balanced funds.

Case Studies

Case Study 1: John’s Retirement Portfolio

John, a 45-year-old investor, wanted to secure a comfortable retirement for himself. He decided to allocate a portion of his savings to a balanced fund. By investing in a balanced fund, John was able to benefit from the diversification of assets, including stocks and bonds. Over the course of 15 years, John’s balanced fund investment generated an average annual return of 8%, allowing him to accumulate a substantial retirement nest egg.

Case Study 2: Sarah’s Education Fund

Sarah, a young professional, wanted to save for her child’s future education expenses. She chose to invest in a balanced fund to take advantage of the growth potential of stocks while also maintaining a level of stability through bond investments. Sarah’s balanced fund investment performed exceptionally well, providing an average annual return of 10% over a 10-year period. As a result, Sarah was able to fund her child’s college education without any financial strain.

Case Study 3: Mark’s Wealth Preservation Strategy

Mark, a high-net-worth individual, wanted to preserve and grow his wealth while minimizing risk. He decided to allocate a portion of his assets to a balanced fund that focused on capital preservation. The balanced fund’s investment strategy, which included a mix of conservative stocks and high-quality bonds, helped Mark maintain a steady and reliable income stream while protecting his capital. Over a 20-year period, Mark’s balanced fund investment delivered consistent returns, allowing him to achieve his wealth preservation goals.

These case studies demonstrate the potential of balanced fund investments to generate attractive returns while managing risk effectively. Whether you are saving for retirement, funding education expenses, or preserving your wealth, a balanced fund can be a valuable addition to your investment portfolio.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.