Gross Income Multiplier (GMI) Definition

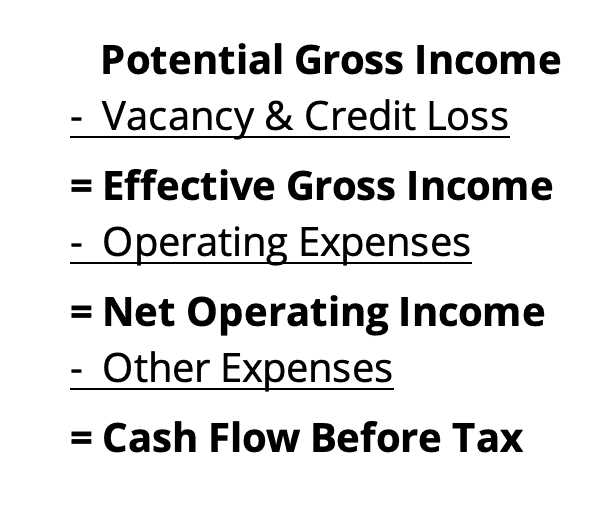

The Gross Income Multiplier (GMI) is a financial metric used in real estate investing to determine the value of a property based on its income potential. It is calculated by dividing the property’s sale price by its annual gross income. The GMI provides investors with a quick and easy way to assess the income-generating potential of a property and compare it to similar properties in the market.

By using the GMI, investors can quickly analyze the profitability of a property and make informed decisions about whether to invest in it or not. A higher GMI indicates a higher income potential, while a lower GMI suggests a lower income potential. However, it is important to note that the GMI should not be the sole factor in determining the value of a property, as other factors such as location, condition, and market trends also play a significant role.

The GMI is particularly useful in real estate investing because it allows investors to compare properties in different locations and with different income levels. For example, if an investor is considering two properties with similar sale prices but different annual gross incomes, the GMI can help determine which property offers a better return on investment.

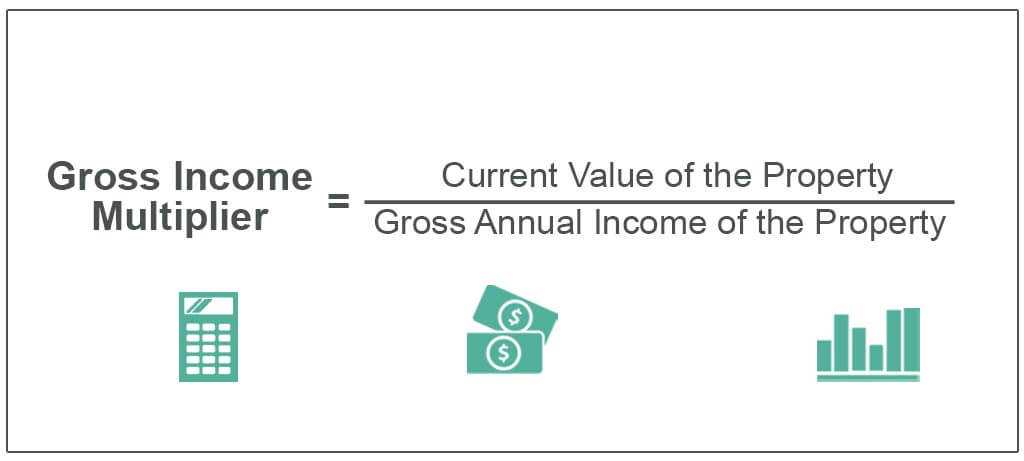

To calculate the GMI, simply divide the property’s sale price by its annual gross income. For example, if a property is sold for $500,000 and generates an annual gross income of $50,000, the GMI would be 10 ($500,000 / $50,000). This means that it would take 10 years of gross income to recoup the initial investment in the property.

The Gross Income Multiplier (GMI) is a financial metric used in real estate investing to evaluate the value of a property based on its income potential. It is calculated by dividing the property’s sale price by its gross annual income. The GMI provides investors with a quick and simple way to compare the income-generating potential of different properties.

How is GMI calculated?

To calculate the GMI, you need to determine the property’s gross annual income, which includes all the income generated by the property, such as rental income, parking fees, and any other sources of revenue. Once you have the gross annual income, divide it by the property’s sale price to get the GMI.

For example, if a property has a sale price of $500,000 and generates a gross annual income of $50,000, the GMI would be 10 ($500,000 / $50,000). This means that it would take 10 years of gross income to recoup the investment in the property.

What does GMI tell us?

The GMI provides investors with a rough estimate of how long it would take to recoup their investment in a property based on its income potential. A lower GMI indicates a higher income potential and a faster return on investment. Conversely, a higher GMI suggests a lower income potential and a longer payback period.

Limitations of GMI

While the GMI can be a useful tool for initial property evaluation, it has its limitations. It does not consider the property’s operating expenses, such as maintenance costs, property taxes, insurance, and property management fees. These expenses can significantly impact the property’s profitability and should be taken into account when making investment decisions.

In addition, the GMI does not account for potential future income growth or market fluctuations. It provides a snapshot of the property’s income potential at a specific point in time. Therefore, investors should consider the long-term prospects of the property and the surrounding market before making any investment decisions.

Uses of Gross Income Multiplier (GMI) in Real Estate Investing

1. Property Valuation

One of the primary uses of GMI is property valuation. By calculating the GMI, investors can determine the fair market value of a property based on its income potential. This allows them to compare different properties and identify those that offer the best return on investment.

For example, if two properties have similar gross incomes but different purchase prices, the one with a lower GMI would be considered more valuable as it offers a higher return on investment.

2. Investment Analysis

GMI is also used in investment analysis to assess the financial viability of a property. By comparing the GMI of a property to industry benchmarks or similar properties in the area, investors can determine if the property is generating sufficient income to cover expenses and generate a profit.

If the GMI is below average or declining over time, it may indicate that the property is not performing well financially. On the other hand, a high GMI suggests that the property is generating strong income relative to its purchase price, making it an attractive investment opportunity.

3. Risk Assessment

On the other hand, a high GMI suggests that the property is generating strong income relative to its purchase price, which can lower the risk for investors. This is because the property’s income potential provides a cushion to cover expenses and potential vacancies.

By considering the GMI, investors can evaluate the risk-reward profile of a property and make informed decisions based on their investment goals and risk tolerance.

Calculation of Gross Income Multiplier (GMI)

The Gross Income Multiplier (GMI) is a ratio used in real estate investing to determine the value of a property based on its income potential. It is calculated by dividing the property’s sale price by its gross annual income.

Step 1: Gather the necessary information

Before calculating the GMI, you need to gather the following information:

- The sale price of the property

- The gross annual income generated by the property

Step 2: Calculate the GMI

Once you have the necessary information, you can calculate the GMI by dividing the sale price of the property by its gross annual income.

GMI = Sale Price / Gross Annual Income

Step 3: Interpret the GMI

The resulting GMI value can be used to assess the value of the property in relation to its income potential. A higher GMI indicates a higher value relative to the income it generates, while a lower GMI suggests a lower value relative to the income.

By calculating the Gross Income Multiplier (GMI), real estate investors can gain insights into the income potential and value of a property. This information can help them make informed decisions when buying or selling real estate.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.