Gross Domestic Income (GDI) Formula and Calculations

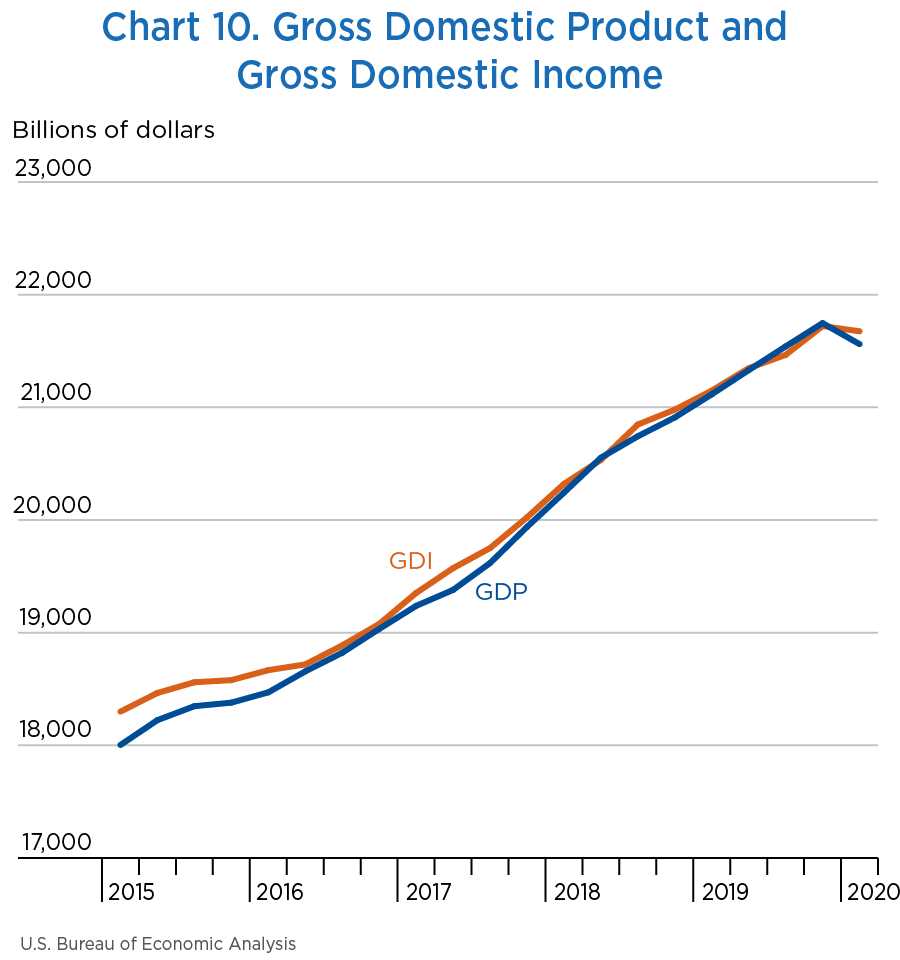

Gross Domestic Income (GDI) is a measure used in economics to calculate the total income generated within a country’s borders during a specific period. It is an alternative approach to measuring a country’s economic output, alongside Gross Domestic Product (GDP).

The formula for calculating GDI is as follows:

- Wages and salaries

- Corporate profits

- Interest income

- Rental income

- Proprietors’ income

- Taxes on production and imports

- Statistical discrepancy

Once these components are determined, they are added together to obtain the Gross Domestic Income for the given period.

GDI provides a different perspective on a country’s economic performance compared to GDP. While GDP focuses on the value of goods and services produced, GDI focuses on the income generated by individuals and businesses.

Calculating GDI is important as it helps economists and policymakers understand the distribution of income within a country. It provides insights into the different sources of income and how they contribute to overall economic growth.

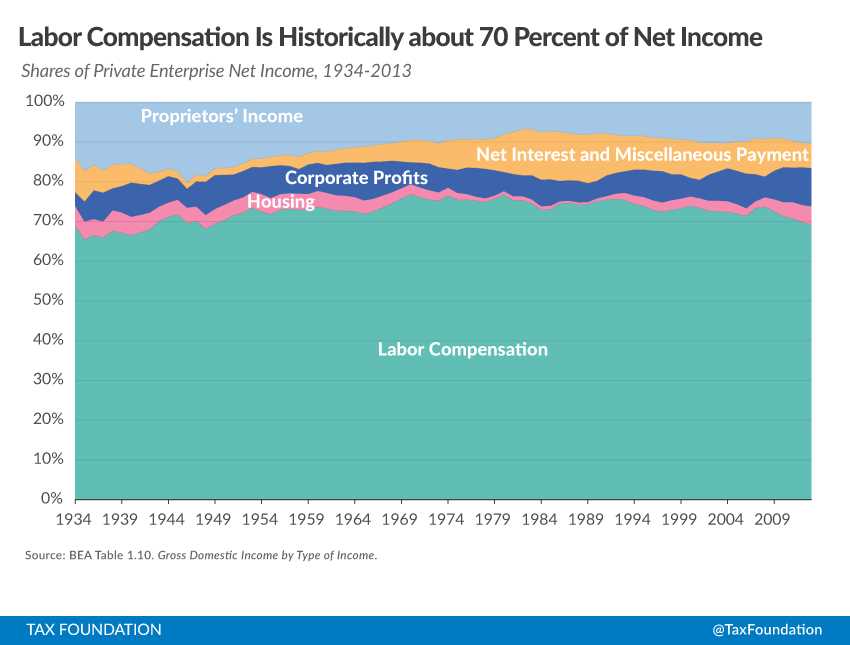

By analyzing GDI, economists can assess the health of various sectors of the economy. For example, if wages and salaries are increasing, it indicates a strong labor market and potential consumer spending power. On the other hand, if corporate profits are declining, it may suggest a slowdown in business activity.

Gross Domestic Income (GDI) is a crucial economic indicator that measures the total income generated within a country’s borders over a specific period. It provides valuable insights into the overall economic health and performance of a nation.

GDI is calculated by summing up all the income earned by individuals, businesses, and the government within a country. This includes wages, salaries, profits, rents, and other forms of income. GDI is an alternative measure to Gross Domestic Product (GDP) and provides a different perspective on the economy.

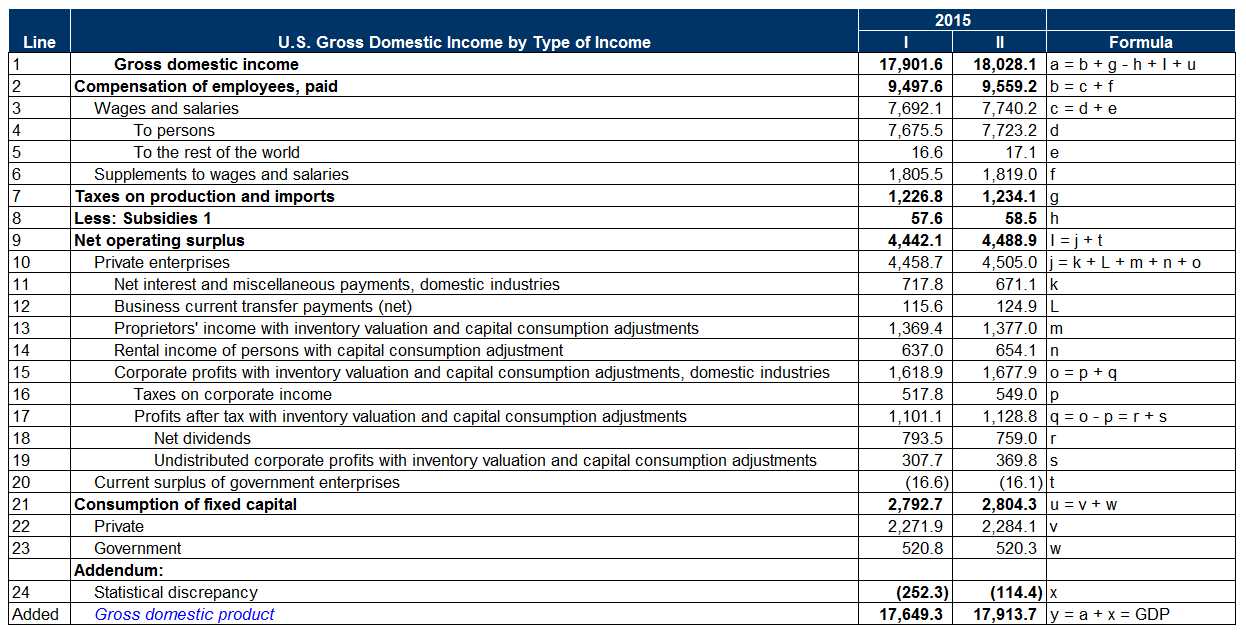

Components of Gross Domestic Income

GDI consists of several components, each representing a different source of income:

| Component | Description |

|---|---|

| Wages and Salaries | Income earned by individuals through employment. |

| Profits | Income earned by businesses after deducting expenses. |

| Rents | Income earned from the use of property or assets. |

| Interest | Income earned from lending money or owning financial assets. |

| Dividends | Income earned from owning shares of a company. |

| Government Transfers | Income received from the government, such as social security benefits or welfare payments. |

Importance of Gross Domestic Income

By analyzing GDI, economists can assess the overall economic performance, identify trends, and compare it with other countries. It also helps in evaluating the effectiveness of government policies and their impact on income distribution.

Furthermore, GDI is an essential input for calculating other economic indicators, such as per capita income, savings rate, and disposable income. It serves as a vital tool for economic forecasting and planning.

Gross Domestic Income Formula

Gross Domestic Income (GDI) is a measure used in economics to calculate the total income generated within a country’s borders during a specific period. It is an alternative approach to measuring a country’s economic activity compared to Gross Domestic Product (GDP). The GDI formula takes into account all the income earned by individuals, businesses, and the government within the country.

The formula for calculating Gross Domestic Income is:

- Personal Income (PI): This includes all income earned by individuals, such as wages, salaries, rental income, and dividends.

- Corporate Profits (CP): This includes the profits earned by businesses, including both domestic and foreign-owned companies operating within the country.

- Net Interest (NI): This refers to the interest earned by individuals and businesses, minus the interest paid on loans and other debts.

- Rental Income (RI): This includes income earned from renting out properties, such as houses, apartments, and commercial spaces.

- Government Revenue (GR): This includes all income earned by the government, including taxes, fees, and other sources of revenue.

The Gross Domestic Income formula can be written as:

GDI = PI + CP + NI + RI + GR

By calculating GDI, economists can gain insights into the overall income distribution within a country and assess the health of its economy. It provides a comprehensive view of the income generated by various sectors and entities, allowing for a more accurate analysis of economic performance.

It is important to note that GDI and GDP are two different measures of economic activity. While GDP focuses on the total value of goods and services produced within a country, GDI focuses on the total income generated. Both measures are used to assess the overall economic health of a country and are often analyzed together to provide a more complete picture.

Calculating Gross Domestic Income

Gross Domestic Income (GDI) is a measure of the total income generated within a country’s borders in a specific period of time. It is an important indicator of the economic health and productivity of a nation. Calculating GDI involves several steps and formulas.

Step 1: Determine the Components of GDI

GDI is comprised of several components, including:

- Wages and salaries

- Profits of corporations

- Interest income

- Rental income

- Government transfer payments

Each of these components represents a different source of income within the economy.

Step 2: Collect Data

To calculate GDI, data needs to be collected for each component. This data can be obtained from various sources, such as government reports, financial statements, and surveys.

Step 3: Calculate the Sum of the Components

Once the data for each component is collected, the next step is to calculate the sum of all the components. This can be done by adding up the values for each component.

Step 4: Adjust for Depreciation

Depreciation refers to the decrease in value of capital goods over time. To account for depreciation, it is necessary to subtract the depreciation value from the sum of the components calculated in the previous step.

Step 5: Calculate Net Foreign Income

Net foreign income is the difference between income earned from foreign sources and income paid to foreign entities. To calculate net foreign income, subtract the income paid to foreign entities from the income earned from foreign sources.

Step 6: Calculate Gross Domestic Income

Finally, to calculate GDI, add the sum of the components (after adjusting for depreciation) to the net foreign income.

By following these steps and formulas, it is possible to calculate the Gross Domestic Income of a country. This information is valuable for policymakers, economists, and investors as it provides insights into the overall economic performance and productivity of a nation.

The Importance of Gross Domestic Income

1. Economic Performance

GDI serves as a measure of economic performance as it reflects the total income earned by individuals, businesses, and the government. A higher GDI indicates a robust and growing economy, while a lower GDI suggests economic contraction or stagnation. By analyzing GDI trends over time, economists can assess the overall health of an economy and identify potential areas of concern.

2. Income Distribution

For example, if GDI shows that a significant portion of income is concentrated in a few wealthy individuals or corporations, policymakers may introduce policies to redistribute wealth and reduce income inequality.

3. Investment Opportunities

GDI data is crucial for investors as it helps in identifying potential investment opportunities. A higher GDI indicates a growing economy with increased consumer spending power, which can attract domestic and foreign investments. Investors can use GDI data to assess the profitability and growth potential of different sectors and make informed investment decisions.

4. Economic Policies

GDI plays a vital role in the formulation of economic policies. Policymakers rely on GDI data to assess the effectiveness of existing policies and develop new strategies to stimulate economic growth. By analyzing GDI trends, policymakers can identify sectors that contribute significantly to the country’s income and prioritize policies that support their growth.

For instance, if GDI shows that the manufacturing sector is a major contributor to the country’s income, policymakers may introduce policies to attract investments, promote innovation, and enhance the competitiveness of the manufacturing industry.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.