What is a Green Fund and How Does it Work?

A green fund is an investment vehicle that focuses on companies and projects that are environmentally friendly and socially responsible. These funds aim to generate financial returns while also promoting sustainability and positive environmental impact.

Green funds typically invest in companies that are involved in renewable energy, clean technology, sustainable agriculture, waste management, and other environmentally friendly sectors. They may also invest in government bonds and other fixed-income securities that support green initiatives.

One of the key principles of a green fund is the consideration of environmental, social, and governance (ESG) factors in the investment decision-making process. This means that the fund managers assess the environmental impact, social responsibility, and corporate governance practices of the companies they invest in.

Green funds can be structured as mutual funds, exchange-traded funds (ETFs), or private equity funds. Mutual funds and ETFs are open to individual investors and can be bought and sold on stock exchanges. Private equity funds, on the other hand, are typically available only to institutional investors and have longer investment horizons.

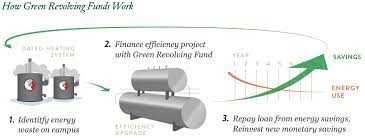

How do Green Funds work?

Green funds work by investing in companies that meet certain environmental, social, and governance (ESG) criteria. These criteria can vary depending on the fund, but typically include factors such as carbon emissions, waste management, renewable energy usage, labor practices, and community engagement.

Investors can choose to invest in green funds directly or through a financial advisor. The funds pool together money from multiple investors and use it to buy shares or bonds of companies that align with their ESG criteria. The fund managers conduct thorough research and analysis to identify suitable investment opportunities.

By investing in green funds, individuals and institutions can support companies that are actively working towards a more sustainable future. These funds provide a way for investors to align their financial goals with their values and contribute to positive change.

Benefits of Investing in Green Funds

Investing in green funds offers several benefits:

- Environmental Impact: By investing in companies that prioritize sustainability, investors can contribute to the reduction of carbon emissions, conservation of natural resources, and the development of clean technologies.

- Financial Returns: Green funds have the potential to generate competitive financial returns, as companies focused on sustainability often have long-term growth prospects.

- Risk Mitigation: Companies that prioritize ESG factors tend to have better risk management practices, which can help reduce the risk of investment losses.

- Alignment with Values: Green funds allow investors to align their investments with their personal values and support causes they care about.

Risks of Investing in Green Funds

- Market Volatility: Like any investment, green funds are subject to market fluctuations and can experience periods of volatility.

- Performance Variability: The performance of green funds can vary depending on the fund’s investment strategy and the performance of the companies it invests in.

- Greenwashing: Some companies may falsely claim to be environmentally friendly or socially responsible, which can lead to investments in companies that do not meet the intended ESG criteria.

- Limited Investment Options: The universe of companies that meet strict ESG criteria may be limited, which can result in a narrower range of investment opportunities.

Investing in a Green Fund: Benefits and Risks

Investing in a green fund can offer a range of benefits for both investors and the environment. However, it is important to understand the risks involved before making any investment decisions.

However, it is important to note that investing in green funds also comes with certain risks. One of the main risks is the volatility of the green market. The performance of green companies and projects can be influenced by factors such as government regulations, technological advancements, and market trends. As a result, the value of investments in green funds can fluctuate and may be subject to periods of underperformance.

Another risk to consider is the potential for greenwashing. Greenwashing refers to the practice of companies misleading consumers and investors about their environmental impact. Some companies may claim to be environmentally friendly without actually implementing sustainable practices. This can make it difficult for investors to accurately assess the environmental credentials of companies within a green fund.

Furthermore, green funds may also have higher fees compared to traditional investment funds. This is because the process of identifying and evaluating sustainable companies requires additional research and analysis. Investors should carefully consider the fees associated with green funds and assess whether the potential benefits outweigh the costs.

FAQs about Green Funds: Answers to Your Questions

Green funds have gained popularity in recent years as more investors seek to align their investments with their values and contribute to a more sustainable future. If you are considering investing in a green fund, you may have some questions. Here are answers to some frequently asked questions:

1. What is a green fund?

2. How does a green fund work?

3. What are the benefits of investing in a green fund?

4. What are the risks of investing in a green fund?

5. How can I find a suitable green fund?

There are several ways to find a suitable green fund. You can start by researching different fund options online and comparing their investment strategies, performance, and fees. It’s also a good idea to consult with a financial advisor who specializes in sustainable investing. They can help you identify funds that align with your investment goals and provide personalized advice based on your financial situation.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.