Fair Value Definition, Formula, and Example

Fair value is a term used in finance to determine the worth of an asset or liability. It is the price that would be agreed upon by willing and knowledgeable parties in an open and unrestricted market.

The formula for calculating fair value depends on the type of asset or liability being valued. For financial instruments such as stocks and bonds, fair value is often determined using market prices. For other assets, such as real estate or machinery, fair value may be estimated based on comparable sales or replacement cost.

To calculate fair value, various factors are taken into consideration, such as market conditions, supply and demand, and the specific characteristics of the asset or liability. This can involve complex mathematical models and analysis.

Here is an example to illustrate the concept of fair value:

Let’s say Company A owns a piece of land that it purchased 10 years ago for $500,000. Since then, the real estate market in the area has boomed, and similar properties are now selling for $1 million. Based on this information, the fair value of Company A’s land would be $1 million.

It is important to note that fair value is not always equal to the book value or the historical cost of an asset. It reflects the current market conditions and the perceived value by market participants.

Fair value is a financial concept that is used to determine the worth or value of an asset or liability. It is an important concept in the field of accounting and finance, as it helps in making informed decisions about investments, acquisitions, and financial reporting.

When we talk about fair value, we are referring to the price at which an asset or liability would be exchanged between knowledgeable and willing parties in an arm’s length transaction. In other words, it is the price that would be agreed upon by buyers and sellers in a fair and open market.

Importance of Fair Value

The concept of fair value is important because it provides a more accurate representation of an asset or liability’s true value. It takes into account various factors such as market conditions, supply and demand, and the specific characteristics of the asset or liability.

By using fair value, companies can provide more transparent and reliable financial statements, which are essential for investors, creditors, and other stakeholders. It helps in assessing the financial health and performance of a company, as well as making informed decisions about buying or selling assets.

Methods of Determining Fair Value

There are several methods that can be used to determine the fair value of an asset or liability. Some common methods include:

- Market Approach: This method uses market prices of similar assets or liabilities to determine fair value. It relies on the principle of supply and demand, and assumes that the market is efficient and competitive.

- Income Approach: This method uses the present value of expected future cash flows to determine fair value. It takes into account factors such as interest rates, risk, and the time value of money.

- Cost Approach: This method uses the cost to replace or reproduce the asset or liability to determine fair value. It is commonly used for assets that do not have an active market.

It is important to note that the method used to determine fair value may vary depending on the nature of the asset or liability and the specific circumstances.

Conclusion

Calculating Fair Value

Calculating fair value is an important process in finance and investing. It helps determine the true worth of an asset or liability, taking into account various factors such as market conditions, risk, and future cash flows. There are different methods and formulas used to calculate fair value, depending on the type of asset or liability being evaluated.

Methods for Calculating Fair Value

There are several methods commonly used to calculate fair value:

- Market Approach: This method determines fair value by comparing the asset or liability to similar assets or liabilities that have recently been sold in the market. It relies on the principle of supply and demand, considering the price at which similar assets or liabilities are currently being traded.

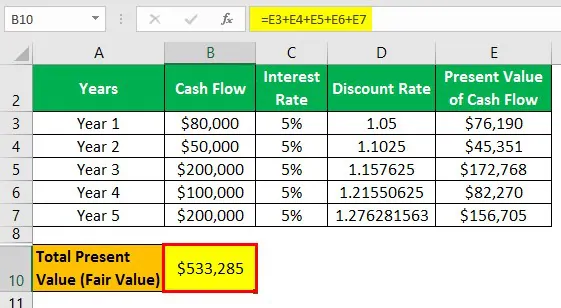

- Income Approach: This method calculates fair value based on the present value of the future cash flows generated by the asset or liability. It takes into account factors such as expected returns, risk, and the time value of money. This approach is commonly used for valuing income-generating assets such as stocks, bonds, and real estate.

- Cost Approach: This method determines fair value by considering the cost to replace the asset or liability with a similar one. It takes into account factors such as depreciation, obsolescence, and the cost of production. This approach is commonly used for valuing tangible assets such as buildings, machinery, and equipment.

Formulas for Calculating Fair Value

Depending on the method used, there are different formulas available to calculate fair value:

- Market Approach: Fair value = Market price of comparable assets/liabilities

- Income Approach: Fair value = Present value of expected future cash flows

It is important to note that calculating fair value is not an exact science and involves some degree of estimation and judgment. Different analysts may use different methods and assumptions, leading to variations in the calculated fair value. It is also important to consider the limitations and potential biases of each method when interpreting the results.

Example of Fair Value Calculation

Calculating the fair value of an asset or liability is an important process in finance and accounting. It helps determine the true worth of an investment or financial instrument, taking into consideration various factors such as market conditions, risk, and future cash flows.

Step 1: Gather Relevant Information

The first step in calculating fair value is to gather all the relevant information about the asset or liability. This includes data such as historical prices, market trends, interest rates, and any other factors that may impact the value of the investment.

Step 2: Determine the Valuation Method

Next, you need to determine the appropriate valuation method to use. There are several methods available, including market approach, income approach, and cost approach. The choice of method depends on the nature of the asset or liability and the availability of data.

Step 3: Apply the Valuation Method

Once you have chosen the valuation method, you can apply it to calculate the fair value. For example, if you are using the market approach, you would compare the asset or liability to similar assets or liabilities that have recently been sold or traded in the market.

Step 4: Consider Adjustments

In some cases, adjustments may need to be made to the calculated fair value. These adjustments can account for factors such as liquidity, market conditions, or any other unique characteristics of the asset or liability.

Step 5: Review and Document the Calculation

Finally, it is important to review and document the fair value calculation. This helps ensure transparency and provides a clear record of how the fair value was determined. It is also important for compliance purposes and for future reference.

By following these steps, you can calculate the fair value of an asset or liability accurately and effectively. This information is crucial for making informed investment decisions, financial reporting, and complying with accounting standards.

All You Need to Know About Fair Value

Fair value is a term used in finance and accounting to determine the worth of an asset or liability. It is an estimate of the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date.

There are several methods to calculate fair value, including market approach, income approach, and cost approach. The market approach uses the prices of similar assets or liabilities in active markets as a benchmark. The income approach considers the present value of future cash flows generated by the asset or liability. The cost approach calculates the cost to replace the asset or liability.

Fair value is important in financial reporting as it provides a more accurate representation of an entity’s financial position. It is used in the valuation of financial instruments, such as stocks, bonds, and derivatives, as well as non-financial assets, such as real estate and machinery.

When calculating fair value, it is essential to consider relevant factors, such as market conditions, the nature of the asset or liability, and any restrictions on its sale or transfer. Professional judgment and expertise are often required to determine the most appropriate method and inputs to use in the valuation process.

Example:

- Company ABC owns a piece of land that it purchased five years ago for $500,000.

- The real estate market has been booming, and similar properties in the area are now selling for $1,000,000.

- Using the market approach, Company ABC determines that the fair value of its land is $1,000,000.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.