Pump Priming: Definition and Examples of Use in the U.S. and Japan

Pump priming is an economic strategy used by governments to stimulate economic growth and increase consumer spending. It involves injecting funds into the economy through various means, such as government spending, tax cuts, or monetary policies, with the aim of boosting economic activity.

In the United States, pump priming has been used as a tool to combat economic downturns and stimulate economic recovery. One example of pump priming in the U.S. is the American Recovery and Reinvestment Act of 2009, which aimed to create jobs and stimulate economic growth through infrastructure projects, tax cuts, and increased government spending.

In Japan, pump priming has also been utilized to stimulate economic growth and combat deflation. The Japanese government has implemented various measures, such as increased public spending, tax cuts, and monetary easing, to encourage consumer spending and investment. One example of pump priming in Japan is the Abenomics policy, which was introduced by Prime Minister Shinzo Abe in 2012 to revive the Japanese economy through a combination of fiscal stimulus, monetary easing, and structural reforms.

| Examples of Pump Priming in the U.S. | Examples of Pump Priming in Japan |

|---|---|

| The American Recovery and Reinvestment Act of 2009 | Abenomics policy |

| Infrastructure projects | Increased public spending |

| Tax cuts | Tax cuts |

| Increased government spending | Monetary easing |

Pump priming can have both positive and negative effects on the economy. On one hand, it can stimulate economic growth, create jobs, and increase consumer spending. On the other hand, it can lead to increased government debt and inflation if not managed properly.

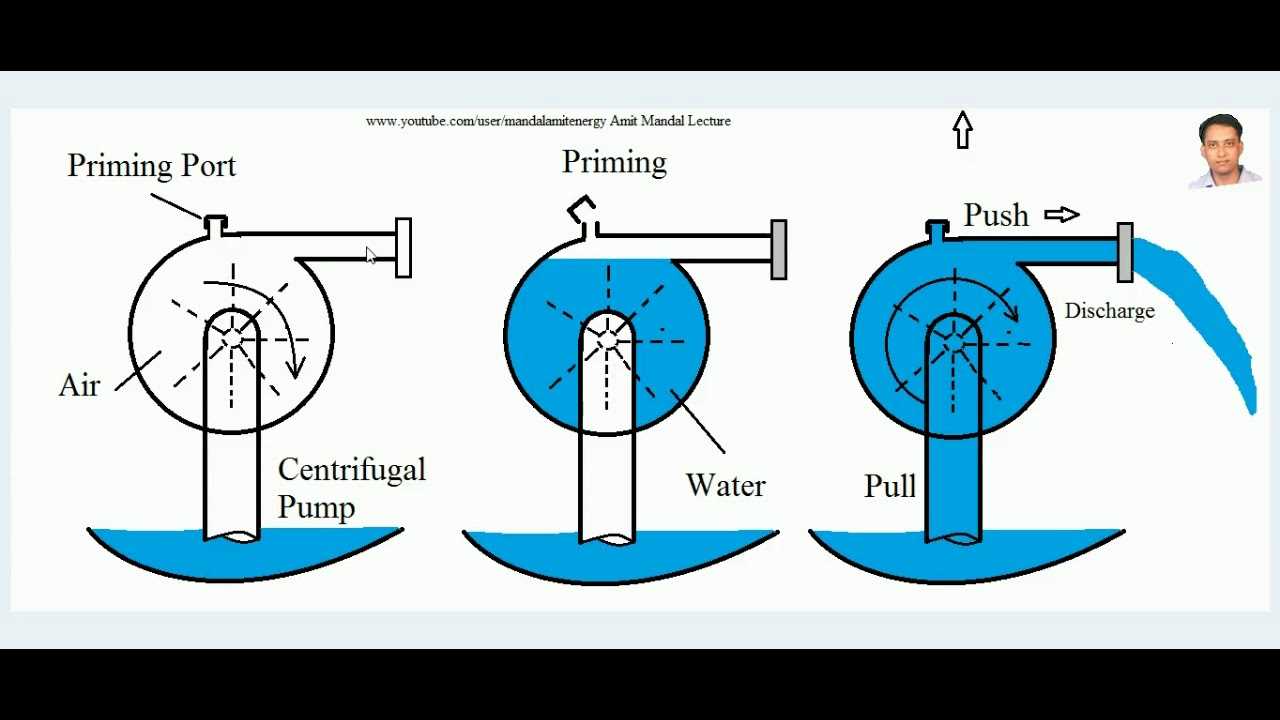

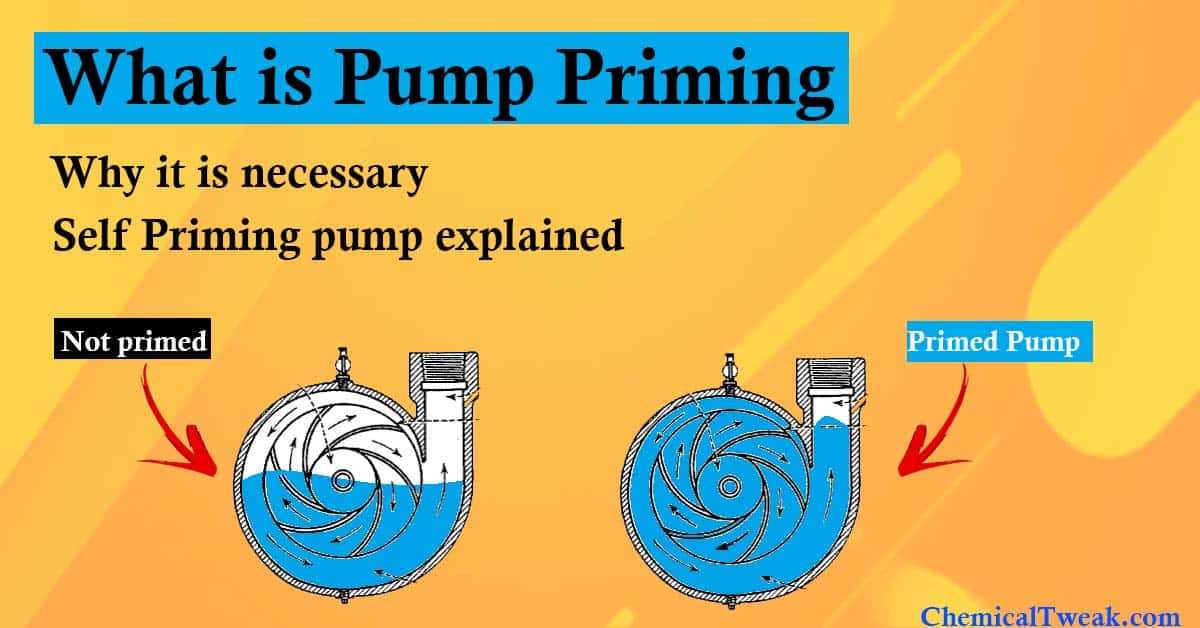

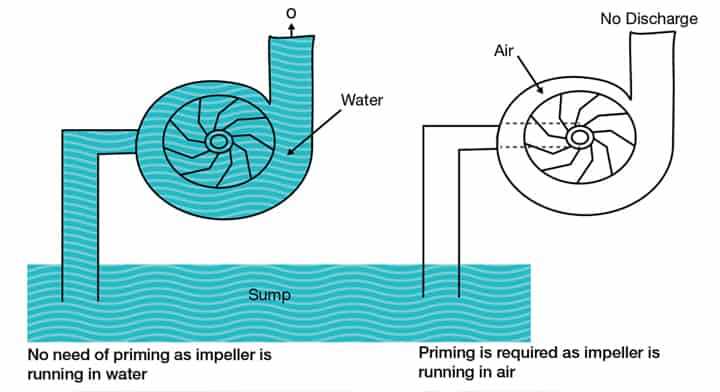

Pump priming is an economic concept that refers to the use of government spending or monetary policies to stimulate economic growth during a recession or downturn. The term “pump priming” originates from the idea of priming a pump, where an initial input of water is required to start the flow.

In the context of economics, pump priming involves injecting money into the economy to stimulate consumer spending and business investment. This injection of funds is intended to create a multiplier effect, where each dollar spent generates additional economic activity.

There are various methods of pump priming, including fiscal policies and monetary policies. Fiscal policies involve government spending on infrastructure projects, such as building roads, bridges, and schools. This increased government spending creates jobs and increases demand for goods and services, which in turn stimulates economic growth.

Monetary policies, on the other hand, involve actions taken by central banks to influence the money supply and interest rates. Central banks can lower interest rates to encourage borrowing and investment, thereby stimulating economic activity. They can also engage in quantitative easing, which involves purchasing government bonds to inject money into the economy.

Benefits of Pump Priming

Pump priming can have several benefits for an economy. Firstly, it can help to stimulate aggregate demand, which is the total demand for goods and services in an economy. By increasing consumer spending and business investment, pump priming can boost aggregate demand and drive economic growth.

Secondly, pump priming can help to reduce unemployment. By creating jobs through government spending on infrastructure projects, pump priming can provide employment opportunities for individuals who may have lost their jobs during a recession. This can help to alleviate the social and economic costs associated with high unemployment rates.

Furthermore, pump priming can have a positive impact on business confidence and investor sentiment. When the government demonstrates a commitment to stimulating economic growth through pump priming, it can instill confidence in businesses and investors, encouraging them to increase their spending and investment activities.

Drawbacks of Pump Priming

While pump priming can be an effective tool for stimulating economic growth, it is not without its drawbacks. One potential drawback is the risk of inflation. When there is an increase in government spending or monetary expansion, it can lead to an increase in the overall price level of goods and services. This can erode the purchasing power of consumers and reduce the effectiveness of pump priming.

Another drawback is the potential for a budget deficit. Pump priming often involves increased government spending, which can lead to a larger budget deficit if not accompanied by sufficient revenue generation. This can create long-term fiscal challenges for the government and may require additional measures, such as tax increases or spending cuts, to address the deficit.

Conclusion

Pump priming is a concept that involves using government spending or monetary policies to stimulate economic growth during a recession or downturn. It can be an effective tool for increasing aggregate demand, reducing unemployment, and boosting business confidence. However, it is important to consider the potential drawbacks, such as inflation and budget deficits, and carefully evaluate the effectiveness of pump priming in each specific economic context.

Examples of Pump Priming in the U.S.

One example of pump priming in the U.S. is the American Recovery and Reinvestment Act of 2009. In response to the global financial crisis, the U.S. government implemented a stimulus package worth $787 billion. This package included tax cuts, infrastructure spending, and increased funding for social programs. The goal was to create jobs and boost consumer spending, thereby stimulating economic growth.

Another example of pump priming in the U.S. is the Economic Stimulus Act of 2008. This act was passed in response to the economic downturn caused by the subprime mortgage crisis. The government implemented tax rebates for individuals and families, as well as tax incentives for businesses. The aim was to encourage spending and investment, and prevent further economic decline.

During the Great Depression, President Franklin D. Roosevelt introduced the New Deal, a series of economic programs aimed at providing relief, recovery, and reform. The New Deal included public works projects, financial reforms, and social welfare programs. These initiatives were intended to stimulate economic activity and alleviate the hardships faced by the American people during the Depression.

In more recent years, the U.S. government has used pump priming strategies to address specific economic challenges. For example, following the 2001 recession, President George W. Bush implemented tax cuts to stimulate consumer spending and business investment. Similarly, in response to the 2020 COVID-19 pandemic, the U.S. government implemented the CARES Act, which included direct payments to individuals, expanded unemployment benefits, and financial assistance for businesses.

Examples of Pump Priming in Japan

Japan has a long history of utilizing pump priming as an economic strategy to stimulate growth and combat recessions. Here are some notable examples of pump priming measures implemented in Japan:

1. Infrastructure Development

One of the key areas where pump priming has been employed in Japan is infrastructure development. The government has consistently invested in the construction of new roads, bridges, railways, and airports to create jobs and boost economic activity. For example, the construction of the Shinkansen high-speed rail network in the 1960s not only improved transportation efficiency but also generated employment opportunities and stimulated various industries.

2. Tax Incentives

The Japanese government has also used tax incentives as a form of pump priming. By offering tax breaks and incentives to businesses and individuals, the government aims to encourage spending and investment, thereby stimulating economic growth. For instance, during the global financial crisis in 2008, the Japanese government introduced tax incentives for homebuyers to revive the stagnant real estate market and stimulate construction activity.

3. Subsidies and Grants

Another approach to pump priming in Japan is the provision of subsidies and grants to specific industries or regions. These financial incentives aim to support struggling sectors and promote economic development. For example, the government has provided subsidies to renewable energy companies to encourage the adoption of clean energy technologies and reduce reliance on fossil fuels.

4. Monetary Policy

In addition to fiscal measures, the Bank of Japan has implemented various monetary policies to stimulate the economy. These policies include lowering interest rates, expanding the money supply, and implementing quantitative easing measures. By reducing borrowing costs and increasing liquidity in the financial system, the central bank aims to encourage borrowing, investment, and consumer spending.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.