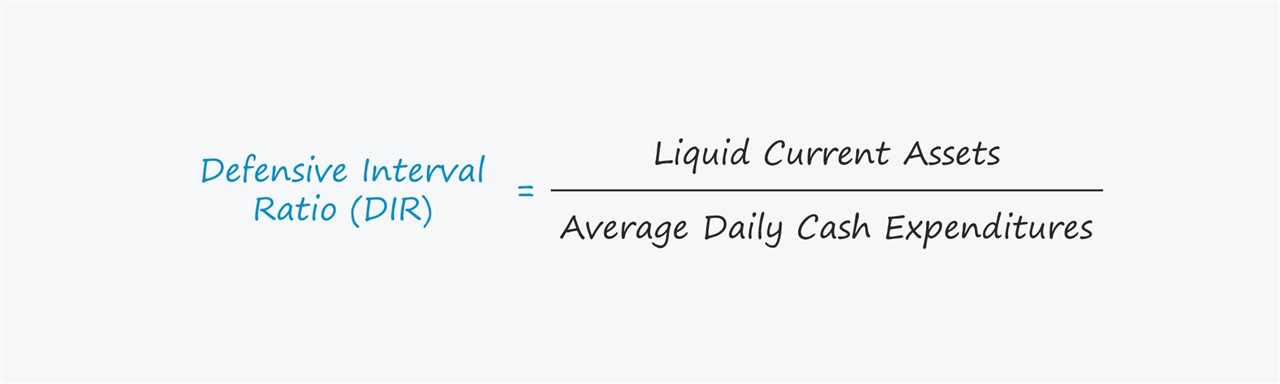

Defensive Interval Ratio (DIR) Formula

The Defensive Interval Ratio (DIR) is a financial ratio that measures a company’s ability to cover its short-term liabilities with its liquid assets. It is an important indicator of a company’s financial health and its ability to withstand economic downturns or unexpected expenses.

Formula

The formula for calculating the Defensive Interval Ratio is as follows:

DIR = (Cash + Marketable Securities + Accounts Receivable) / Average Daily Operating Expenses

Where:

- Cash represents the amount of cash the company has on hand.

- Marketable Securities refers to short-term investments that can be easily converted into cash.

- Accounts Receivable represents the amount of money owed to the company by its customers.

- Average Daily Operating Expenses is the average amount of money the company spends on its daily operations.

The result of the formula is a ratio that indicates the number of days a company can cover its short-term liabilities without relying on external sources of funding.

Interpretation

A higher Defensive Interval Ratio indicates that a company has a greater ability to cover its short-term liabilities. This is a positive sign as it means the company has a strong liquidity position and is less likely to face financial difficulties in the near future.

On the other hand, a lower Defensive Interval Ratio suggests that a company may struggle to meet its short-term obligations. This could be a cause for concern as it may indicate a potential liquidity problem or an inability to generate sufficient cash flow.

Limitations

Additionally, the DIR is based on historical data and may not accurately reflect a company’s future performance. It is important to regularly update and analyze the ratio to ensure its relevance and accuracy.

Advantages of DIR Formula

The Defensive Interval Ratio (DIR) formula is a financial ratio that provides valuable insights into a company’s ability to cover its short-term liabilities with its liquid assets. This ratio is widely used by investors and analysts to assess a company’s financial health and its ability to withstand economic downturns or unexpected financial challenges.

1. Easy Calculation

One of the main advantages of the DIR formula is its simplicity. The formula is straightforward and easy to calculate, making it accessible to both financial professionals and individual investors. By using basic financial data, such as current assets and average daily expenses, investors can quickly determine a company’s defensive interval ratio.

2. Focus on Liquidity

The DIR formula emphasizes the importance of liquidity in assessing a company’s financial position. It takes into account the company’s current assets, which are the most liquid assets that can be easily converted into cash. By focusing on liquidity, the DIR formula provides a more accurate picture of a company’s ability to meet its short-term obligations without relying on long-term assets or external financing.

3. Predictive Power

The DIR formula has proven to be a useful predictor of a company’s financial stability and future performance. A higher DIR indicates that a company has a larger cushion of liquid assets to cover its short-term liabilities, which suggests a lower risk of financial distress. On the other hand, a lower DIR may indicate a higher risk of default or liquidity problems. By analyzing a company’s DIR over time, investors can identify trends and potential risks before they become significant issues.

4. Industry Comparison

Another advantage of the DIR formula is its ability to facilitate industry comparisons. Since the formula focuses on a company’s ability to cover its short-term liabilities, it provides a standardized measure that can be used to compare companies within the same industry. This allows investors to assess a company’s financial health relative to its peers and make more informed investment decisions.

5. Supplemental Ratio

Financial Ratios

Financial ratios are quantitative tools used to analyze a company’s financial performance and assess its financial health. They provide valuable insights into various aspects of a company’s operations, profitability, liquidity, and solvency.

Profitability ratios measure a company’s ability to generate profits from its operations. They include ratios such as gross profit margin, operating profit margin, and net profit margin. These ratios help investors and analysts assess the company’s profitability and compare it to industry peers.

Overall, financial ratios play a crucial role in financial analysis and decision-making. They help investors, analysts, and stakeholders evaluate a company’s financial performance, identify strengths and weaknesses, and make informed investment or business decisions.

Catname of Financial Ratios

Financial ratios are essential tools for analyzing a company’s financial health and performance. They provide valuable insights into various aspects of a company’s operations, profitability, liquidity, and solvency. Catname is a term used to categorize different types of financial ratios based on their purpose and the information they provide.

There are several catnames of financial ratios, each serving a specific purpose and providing unique insights. Some common catnames include:

Liquidity Ratios:

Liquidity ratios measure a company’s ability to meet its short-term obligations and manage its cash flow. Examples of liquidity ratios include the current ratio, quick ratio, and cash ratio.

Profitability Ratios:

Profitability ratios assess a company’s ability to generate profits from its operations. These ratios help investors and analysts evaluate a company’s profitability and compare it to its competitors. Examples of profitability ratios include the gross profit margin, net profit margin, and return on equity.

Efficiency Ratios:

Efficiency ratios measure how effectively a company utilizes its assets and resources to generate sales and profits. These ratios provide insights into a company’s operational efficiency and productivity. Examples of efficiency ratios include the asset turnover ratio, inventory turnover ratio, and accounts receivable turnover ratio.

Solvency Ratios:

Solvency ratios evaluate a company’s long-term financial stability and its ability to meet its long-term obligations. These ratios assess a company’s leverage and its ability to generate sufficient cash flow to cover its debt payments. Examples of solvency ratios include the debt-to-equity ratio, interest coverage ratio, and debt ratio.

Market Ratios:

Market ratios are used to assess a company’s valuation and its attractiveness to investors. These ratios help investors evaluate the company’s stock price relative to its earnings, book value, or other financial metrics. Examples of market ratios include the price-to-earnings ratio, price-to-book ratio, and dividend yield.

By categorizing financial ratios into different catnames, investors and analysts can easily identify the specific information they need and compare companies within the same industry or sector. Each catname provides a different perspective on a company’s financial performance and helps stakeholders make informed decisions.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.