Cash Ratio Definition, Formula, and Example

The cash ratio is calculated by dividing the company’s cash and cash equivalents by its current liabilities. The formula for cash ratio is:

Cash Ratio = (Cash + Cash Equivalents) / Current Liabilities

The cash and cash equivalents include cash on hand, demand deposits, and short-term investments that can be easily converted into cash. Current liabilities are the company’s obligations that are due within one year.

For example, let’s say Company ABC has $100,000 in cash and cash equivalents and $50,000 in current liabilities. The cash ratio would be calculated as:

Cash Ratio = ($100,000) / ($50,000) = 2

This means that Company ABC has a cash ratio of 2, indicating that it has twice the amount of cash needed to cover its current liabilities.

What is Cash Ratio?

Cash ratio is a financial ratio that measures a company’s ability to pay off its current liabilities using only its cash and cash equivalents. It is a measure of a company’s liquidity and indicates how easily it can cover its short-term obligations without relying on other sources of funds.

The cash ratio is calculated by dividing a company’s cash and cash equivalents by its current liabilities. Cash and cash equivalents include cash on hand, demand deposits, and short-term investments that can be easily converted into cash.

A high cash ratio indicates that a company has a strong ability to meet its short-term obligations, while a low cash ratio suggests that a company may struggle to pay off its debts in the near future.

Overall, the cash ratio provides insight into a company’s liquidity position and its ability to handle short-term financial obligations. It is a useful tool for investors and analysts to evaluate a company’s financial health and make informed investment decisions.

How to Calculate Cash Ratio?

The cash ratio is a financial ratio that measures a company’s ability to pay off its short-term liabilities with its cash and cash equivalents. It is an important indicator of a company’s liquidity and financial health. The cash ratio is calculated by dividing a company’s cash and cash equivalents by its current liabilities.

Formula:

The formula for calculating the cash ratio is as follows:

Cash Ratio = (Cash and Cash Equivalents) / Current Liabilities

Where:

- Cash and Cash Equivalents refers to the total amount of cash on hand and cash equivalents that a company has.

- Current Liabilities refers to the total amount of short-term liabilities that a company owes and is expected to pay within one year.

The cash ratio is expressed as a decimal or a percentage. A higher cash ratio indicates that a company has a greater ability to cover its short-term liabilities with its cash reserves, which is generally seen as a positive sign of financial health.

Example:

Let’s say Company XYZ has $100,000 in cash and cash equivalents and $50,000 in current liabilities. To calculate the cash ratio, we can use the formula:

Cash Ratio = $100,000 / $50,000 = 2

This means that Company XYZ has a cash ratio of 2, indicating that it has twice the amount of cash and cash equivalents compared to its current liabilities. This suggests that the company is in a strong financial position and has sufficient liquidity to meet its short-term obligations.

It is important to note that the cash ratio should be interpreted in the context of the industry and company’s specific circumstances. A high cash ratio may not always be desirable, as it could indicate that the company is not effectively utilizing its cash resources.

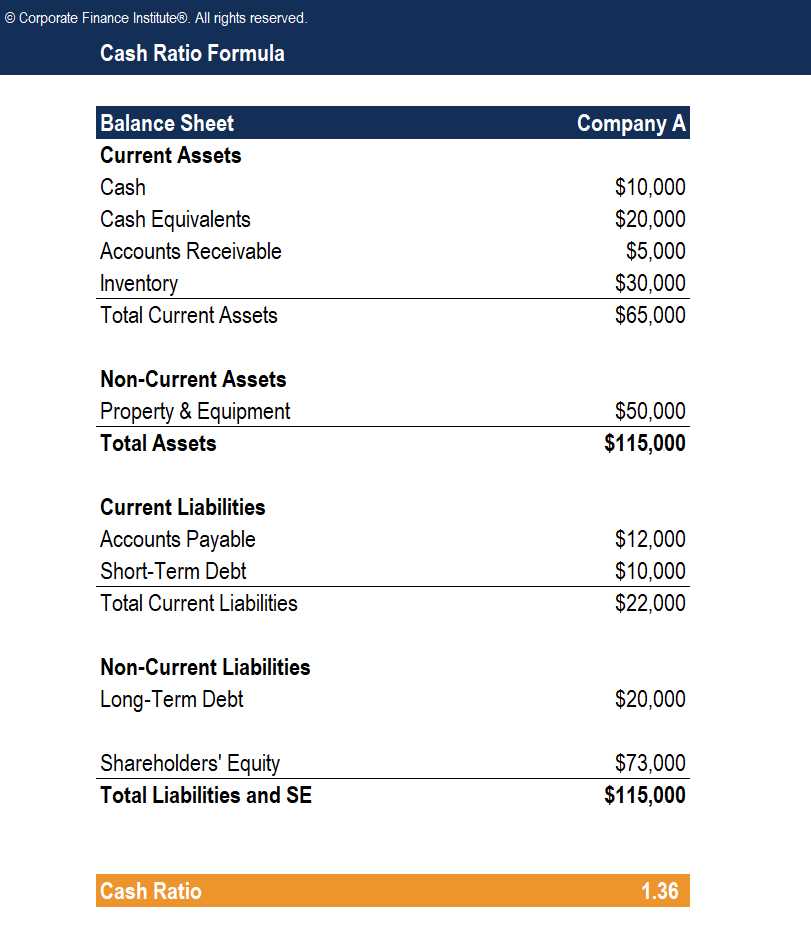

Example of Cash Ratio Calculation

| Assets | Amount |

|---|---|

| Cash | $50,000 |

| Accounts Receivable | $20,000 |

| Inventory | $30,000 |

| Current Liabilities | $40,000 |

Using the formula:

Cash Ratio = Total Cash / Current Liabilities

Substituting the values:

Cash Ratio = $50,000 / $40,000

Cash Ratio = 1.25

The cash ratio for Company XYZ is 1.25. This means that for every dollar of current liabilities, the company has $1.25 of cash available to cover those liabilities.

The cash ratio is an important financial ratio as it indicates the company’s ability to meet its short-term obligations using its available cash. A higher cash ratio is generally considered favorable as it shows a stronger liquidity position.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.