Average Daily Balance Method Definition

The average daily balance method is a financial calculation used by lenders and credit card companies to determine the interest charges on a loan or credit card balance. This method takes into account the daily balance of the account over a specific period of time, usually a month, and calculates the average of those daily balances.

How Does the Average Daily Balance Method Work?

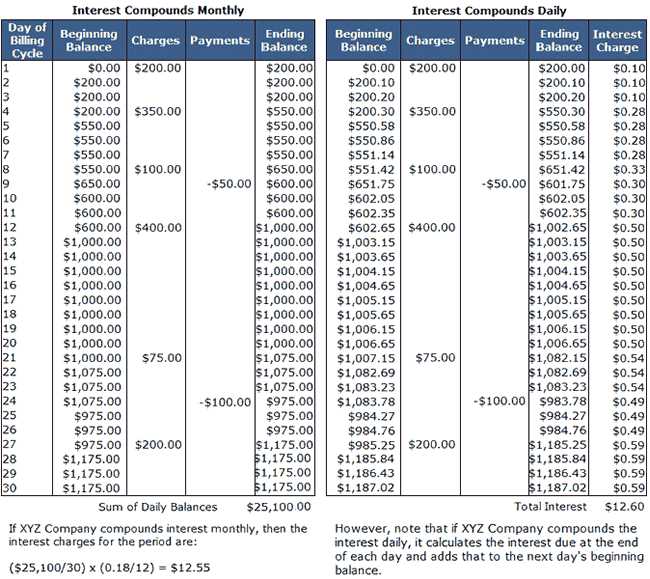

To calculate the average daily balance, the lender or credit card company adds up the daily balances of the account for each day in the billing cycle and then divides that total by the number of days in the cycle. The resulting average balance is then multiplied by the applicable interest rate to determine the interest charges for that billing period.

For example, let’s say you have a credit card with a $1,000 balance and an interest rate of 18%. Over a billing cycle of 30 days, the credit card company would calculate the average daily balance by adding up the balances for each day and dividing by 30. If the balances for each day were as follows:

| Day | Balance |

|---|---|

| 1 | $1,000 |

| 2 | $950 |

| 3 | $900 |

| … | … |

| 30 | $500 |

The credit card company would add up all the balances ($1,000 + $950 + $900 + … + $500) and divide by 30 to get the average daily balance. They would then multiply this average balance by the interest rate (18%) to calculate the interest charges for that billing period.

What is the Average Daily Balance Method?

The Average Daily Balance Method is a way of calculating interest charges on a credit card or loan. It is a common method used by financial institutions to determine the interest that a borrower owes for a specific period of time.

With the Average Daily Balance Method, the interest is calculated based on the average balance of the account over a certain period, usually a month. This method takes into account the daily balance of the account, including any purchases, payments, and other transactions that occur during the billing cycle.

To calculate the average daily balance, the financial institution adds up the daily balances of the account for each day of the billing cycle and then divides that total by the number of days in the cycle. This gives the average daily balance for that period.

Once the average daily balance is determined, the financial institution applies the interest rate to calculate the interest charge for that billing cycle. The interest charge is then added to the outstanding balance of the account.

Overall, the Average Daily Balance Method provides a fair and accurate way of calculating interest charges, ensuring that borrowers are charged based on their actual usage of the credit card or loan.

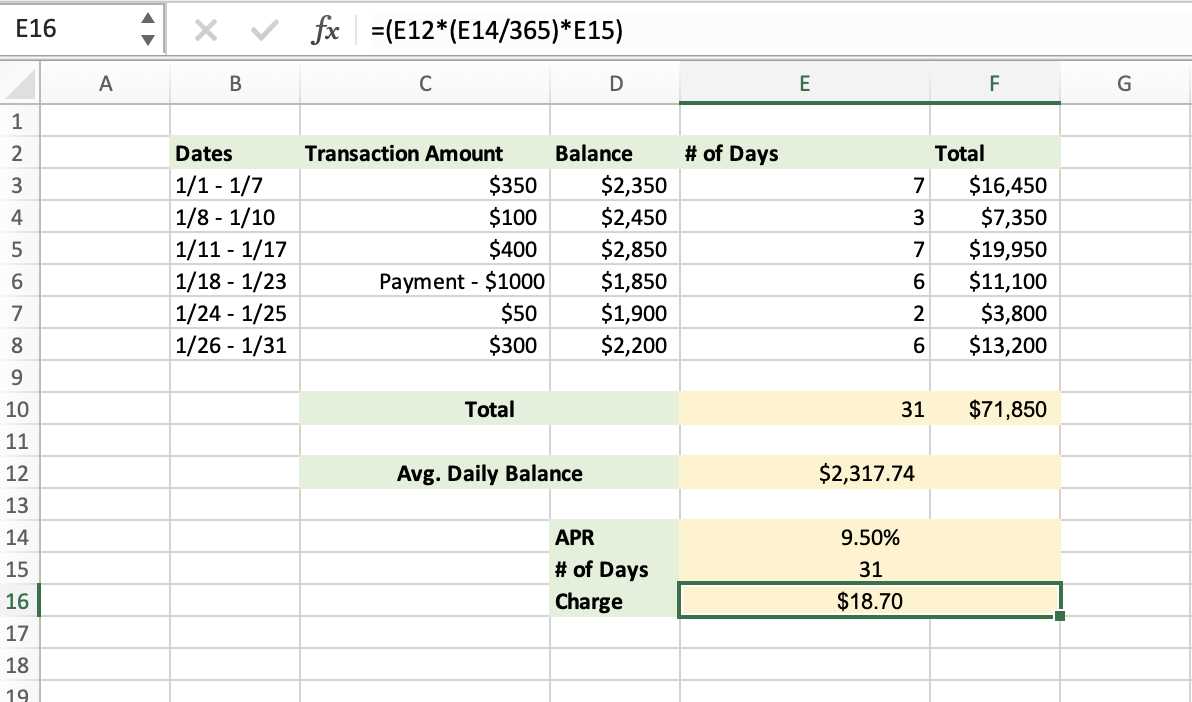

How to Calculate Average Daily Balance?

Calculating the average daily balance is a straightforward process that requires a few simple steps. By following these steps, you can determine the average daily balance for a specific period.

Step 1: Gather the Daily Balances

First, you need to gather the daily balances for the period you want to calculate the average for. These daily balances can be obtained from your bank statements or online banking records. Make sure to include all deposits and withdrawals made during the period.

Step 2: Determine the Number of Days

Next, determine the number of days included in the period you are calculating the average for. This can be done by counting the number of days between the start and end dates of the period.

Step 3: Add Up the Daily Balances

Add up all the daily balances you gathered in step 1. This will give you the total balance for the period.

Step 4: Divide by the Number of Days

Divide the total balance by the number of days determined in step 2. This will give you the average daily balance for the period.

For example, let’s say you want to calculate the average daily balance for the month of January. You gather the daily balances for each day of the month and find that the total balance is $5,000. January has 31 days, so you divide $5,000 by 31 to get an average daily balance of approximately $161.29.

Calculating the average daily balance can be useful for various financial purposes, such as determining interest charges on credit cards or calculating average balances for investment accounts. By following these steps, you can easily calculate the average daily balance for any given period.

Calculation Example of Average Daily Balance Method

Let’s understand the Average Daily Balance Method with the help of an example:

Suppose you have a credit card with a balance of $1,000. The following transactions occurred during a billing cycle:

- Day 1: $500 purchase

- Day 5: $200 payment

- Day 10: $300 purchase

- Day 15: $100 payment

- Day 20: $400 purchase

- Day 25: $200 payment

To calculate the average daily balance, you need to determine the balance at the end of each day and then calculate the average of those balances.

Here’s how you can calculate the average daily balance:

Step 1: Determine the Daily Balances

Day 1: Balance = $1,000 + $500 = $1,500

Day 2: Balance = $1,500

Day 3: Balance = $1,500

Day 4: Balance = $1,500

Day 6: Balance = $1,300

Day 7: Balance = $1,300

Day 8: Balance = $1,300

Day 9: Balance = $1,300

Day 10: Balance = $1,300 + $300 = $1,600

Day 11: Balance = $1,600

Day 12: Balance = $1,600

Day 13: Balance = $1,600

Day 14: Balance = $1,600

Day 16: Balance = $1,500

Day 17: Balance = $1,500

Day 18: Balance = $1,500

Day 19: Balance = $1,500

Day 20: Balance = $1,500 + $400 = $1,900

Day 21: Balance = $1,900

Day 22: Balance = $1,900

Day 23: Balance = $1,900

Day 24: Balance = $1,900

Day 26: Balance = $1,700

Day 27: Balance = $1,700

Day 28: Balance = $1,700

Day 29: Balance = $1,700

Day 30: Balance = $1,700

Day 31: Balance = $1,700

Step 2: Calculate the Average Daily Balance

Sum of Daily Balances = ($1,500 + $1,300 + $1,600 + $1,500 + $1,900 + $1,700) = $9,500

Number of Days = 31

Average Daily Balance = Sum of Daily Balances / Number of Days

Average Daily Balance = $9,500 / 31 = $306.45

Therefore, the average daily balance for this billing cycle is $306.45.

By using the average daily balance method, the credit card company can calculate the interest charges based on the average balance throughout the billing cycle, rather than just the balance at the end of the cycle.

Example of Average Daily Balance Calculation

Let’s consider an example to understand how the average daily balance method is calculated.

Step 1: Gather the necessary information

First, you need to gather all the necessary information related to your account. This includes the starting balance, ending balance, and the number of days in the billing cycle.

For example, let’s say your starting balance for the billing cycle is $1,000, and your ending balance is $2,000. The billing cycle is 30 days.

Step 2: Calculate the daily balances

Next, you need to calculate the daily balances for each day of the billing cycle. To do this, divide the total balance by the number of days in the billing cycle.

In our example, the daily balance would be calculated as follows:

Day 1: $1,000 / 30 = $33.33

Day 2: $1,000 / 30 = $33.33

…

Day 30: $2,000 / 30 = $66.67

Step 3: Calculate the average daily balance

Once you have the daily balances for each day of the billing cycle, you need to calculate the average daily balance. To do this, add up all the daily balances and divide by the number of days in the billing cycle.

In our example, the average daily balance would be calculated as follows:

Average Daily Balance = ($33.33 + $33.33 + … + $66.67) / 30 = $1,433.33 / 30 = $47.78

Step 4: Use the average daily balance for interest calculations

Finally, the average daily balance is used to calculate the interest charges for the billing cycle. The credit card issuer will typically apply an interest rate to the average daily balance to determine the amount of interest owed.

By using the average daily balance method, you can get a more accurate representation of your account balance and the interest charges associated with it.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.