Gross Profit Margin Formula

Gross profit margin is a financial ratio that measures a company’s profitability by assessing how efficiently it generates profit from its revenue. It is an important metric for businesses as it provides insights into the company’s pricing strategy, cost structure, and overall financial health.

To calculate the gross profit margin, you need to know two key figures: the revenue and the cost of goods sold (COGS). Revenue represents the total amount of money generated from sales, while COGS includes all the direct costs associated with producing or delivering the goods or services sold.

Calculating Gross Profit Margin

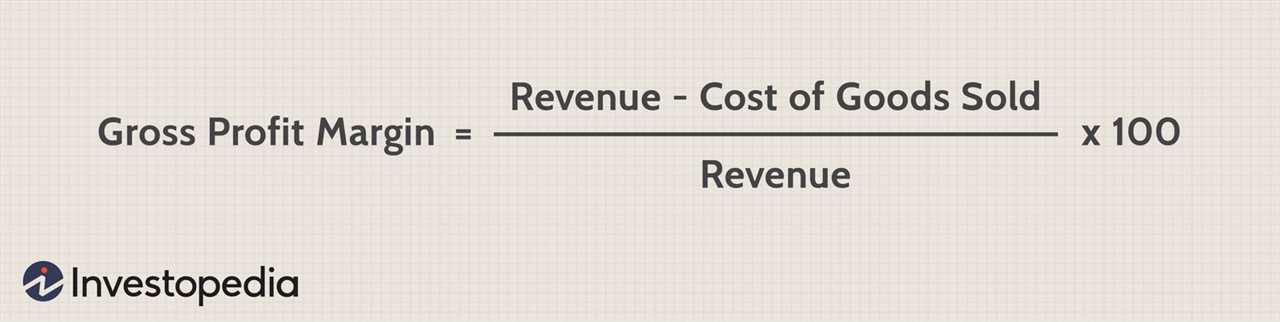

The formula to calculate the gross profit margin is:

By dividing the difference between revenue and COGS by the revenue, you get a percentage that represents the gross profit margin. This percentage indicates how much profit the company is generating from each dollar of revenue.

What It Tells You

The gross profit margin provides insights into the company’s pricing strategy and cost management. A higher gross profit margin indicates that the company is effectively controlling its costs and generating more profit from its revenue. On the other hand, a lower gross profit margin may suggest that the company is facing challenges in managing its costs or pricing its products competitively.

Assessing Profitability

The gross profit margin is an essential metric for assessing a company’s profitability. It helps investors and stakeholders evaluate the company’s ability to generate profit and its overall financial performance. Comparing the gross profit margin of a company to its competitors or industry benchmarks can provide valuable insights into its competitive position and efficiency.

Evaluating Efficiency

In addition to assessing profitability, the gross profit margin also reflects the efficiency of a company’s operations. A higher gross profit margin indicates that the company is effectively utilizing its resources and generating more profit per unit of revenue. This efficiency can be attributed to factors such as effective cost management, economies of scale, or superior pricing strategies.

COGS includes the direct costs associated with producing or delivering a company’s products or services. This can include the cost of raw materials, labor, and manufacturing overhead. By subtracting COGS from revenue, the gross profit margin reveals how much profit a company is generating from its primary business activities.

The gross profit margin is expressed as a percentage, which allows for easy comparison between different companies or industries. A higher gross profit margin indicates that a company is able to generate more profit from each dollar of revenue, which is generally seen as a positive sign of efficiency and profitability.

On the other hand, a lower gross profit margin may indicate that a company is facing challenges in controlling its production costs or pricing its products competitively. It can also suggest that a company is heavily reliant on volume sales rather than generating higher margins on each sale.

| Pros | Cons |

|---|---|

| Easy to calculate and understand | Does not consider other expenses such as overhead |

| Provides a snapshot of profitability | Can vary significantly between industries |

| Allows for easy comparison between companies | Does not account for differences in business models |

Calculating Gross Profit Margin

Calculating the gross profit margin is an essential step in evaluating the financial health and profitability of a business. It provides valuable insights into how efficiently a company is generating profits from its core operations.

The formula for calculating the gross profit margin is:

| Gross Profit Margin | = | / | Revenue |

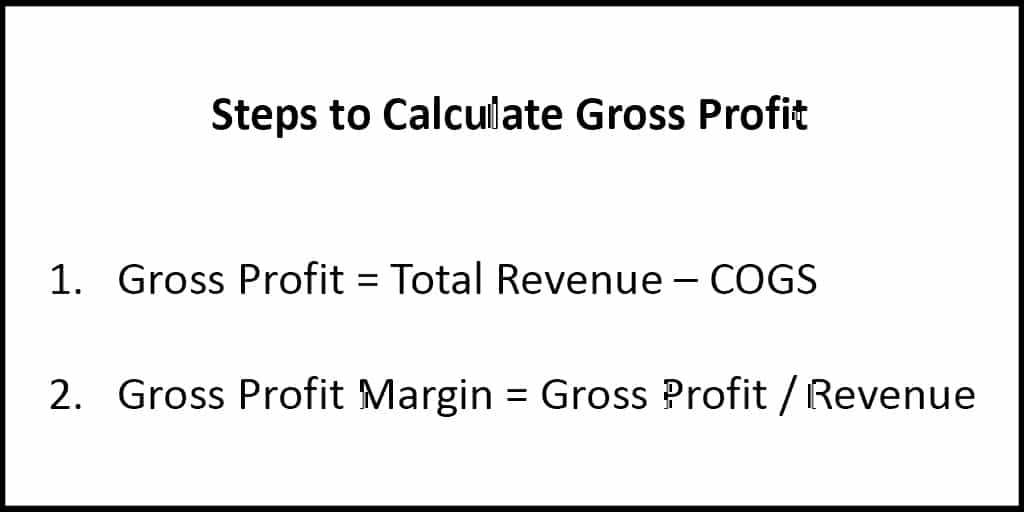

Let’s break down the formula:

- Revenue: This refers to the total amount of money generated from sales or services provided by the company.

- Cost of Goods Sold (COGS): This includes all the direct costs associated with producing or delivering the goods or services sold by the company. It typically includes expenses such as raw materials, labor, and manufacturing overhead.

By subtracting the COGS from the revenue and dividing the result by the revenue, we can determine the gross profit margin as a percentage. The higher the percentage, the better, as it indicates that the company is generating more profit from its core operations.

For example, if a company has $1,000,000 in revenue and $600,000 in COGS, the gross profit margin would be calculated as follows:

| Gross Profit Margin | = | / | $1,000,000 | |

| = | $400,000 | / | $1,000,000 | |

| = | 0.4 | or | 40% |

Calculating the gross profit margin allows businesses to assess their profitability and make informed decisions regarding pricing, cost control, and overall financial performance. It is an important metric for investors, lenders, and stakeholders to evaluate the financial health of a company.

What It Tells You

Calculating the gross profit margin allows you to understand how efficiently your business is generating profit from its core operations. It provides valuable insights into the financial health and performance of your company.

The gross profit margin is expressed as a percentage and indicates the amount of profit generated for each dollar of revenue. A higher gross profit margin indicates that your business is effectively managing its costs and pricing its products or services competitively.

By analyzing the gross profit margin over time, you can identify trends and make informed decisions to improve profitability. For example, if your gross profit margin is declining, it may indicate that your costs are increasing or your pricing strategy needs adjustment.

Comparing the gross profit margin with industry benchmarks can also help you assess your business’s performance relative to competitors. If your gross profit margin is significantly lower than the industry average, it may indicate inefficiencies that need to be addressed.

Additionally, the gross profit margin can be used to evaluate the profitability of different product lines or business segments. By calculating the gross profit margin for each, you can identify which areas are generating the most profit and allocate resources accordingly.

In summary, the gross profit margin is a key financial ratio that provides insights into the efficiency and profitability of your business. By monitoring and analyzing this metric, you can make informed decisions to improve your company’s financial performance and stay competitive in the market.

Assessing Profitability

Assessing profitability is a crucial aspect of running a successful business. One key metric to consider is the gross profit margin. This metric helps you understand how efficiently your company is generating profit from its revenue.

The gross profit margin is calculated by subtracting the cost of goods sold (COGS) from the total revenue and then dividing the result by the total revenue. This percentage represents the portion of each dollar of revenue that is left after accounting for the direct costs associated with producing the goods or services.

A high gross profit margin indicates that your business is effectively managing its production costs and generating a healthy profit. On the other hand, a low gross profit margin may indicate that your business is facing challenges in controlling its costs or pricing its products competitively.

By regularly monitoring and analyzing your gross profit margin, you can gain valuable insights into the financial health of your business. It allows you to identify trends, make informed decisions, and take necessary actions to improve profitability.

Furthermore, comparing your gross profit margin to industry benchmarks or competitors can provide additional context and help you assess your company’s performance relative to others in the market. This analysis can highlight areas where you may need to make adjustments or improvements to stay competitive.

Overall, assessing profitability through the gross profit margin is essential for making informed business decisions and ensuring the long-term success of your company. It provides a clear picture of how effectively your business is generating profit and helps you identify areas for improvement. By focusing on profitability, you can drive sustainable growth and achieve your business goals.

Evaluating Efficiency

By calculating the gross profit margin, you can determine the percentage of revenue that is left after deducting the cost of goods sold. This information is essential for assessing the efficiency of a company’s operations and its ability to generate profits.

Why is efficiency important?

Efficiency is a key factor in determining the overall success of a business. A high gross profit margin indicates that a company is effectively managing its resources and generating substantial profits. On the other hand, a low gross profit margin may indicate inefficiencies in the production process or pricing strategies.

By evaluating the efficiency of a business, you can identify areas for improvement and make informed decisions to optimize operations. This can lead to increased profitability and a competitive advantage in the market.

How to evaluate efficiency using the gross profit margin formula?

To evaluate efficiency using the gross profit margin formula, you need to compare the gross profit margin of a company with industry benchmarks or competitors. This allows you to assess how well the company is performing relative to its peers.

If the company’s gross profit margin is higher than industry averages, it indicates that the company is more efficient in generating profits. Conversely, if the gross profit margin is lower than industry averages, it may indicate inefficiencies that need to be addressed.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.