China A-Shares: Definition, History, and Comparison with B-Shares

China A-Shares are a class of shares that are traded on the Shanghai and Shenzhen stock exchanges in mainland China. They are denominated in Chinese yuan (CNY) and are only available for purchase by mainland Chinese citizens and certain qualified institutional investors. A-Shares represent ownership in companies that are incorporated in mainland China and are traded in the local currency.

History of China A-Shares

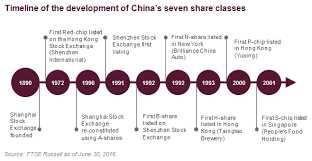

The concept of A-Shares was introduced in 1990 when the Chinese government decided to establish stock exchanges in Shanghai and Shenzhen. Initially, only domestic investors were allowed to trade A-Shares, and foreign investors had limited access through the Qualified Foreign Institutional Investor (QFII) program. However, in recent years, China has taken steps to open up its stock markets to foreign investors, allowing them to invest in A-Shares through the Stock Connect program.

Comparison with B-Shares

While A-Shares are traded in the local currency and are primarily available to mainland Chinese investors, B-Shares are traded in foreign currencies, such as US dollars or Hong Kong dollars, and are open to both domestic and foreign investors. B-Shares were introduced in the early 1990s as a way to attract foreign investment into Chinese companies. However, due to the limited liquidity and higher trading costs associated with B-Shares, they have become less popular compared to A-Shares.

One of the key differences between A-Shares and B-Shares is the investor base. A-Shares are primarily owned by mainland Chinese investors, while B-Shares are more commonly held by foreign investors. Additionally, A-Shares are generally considered to be more representative of the Chinese economy and provide investors with exposure to the domestic market, while B-Shares offer exposure to the international market.

Another difference is the regulatory framework. A-Shares are subject to stricter regulations and are governed by the China Securities Regulatory Commission (CSRC), while B-Shares are regulated by the China Securities Regulatory Commission (CSRC) and the local stock exchange where they are listed.

In terms of market performance, A-Shares have historically outperformed B-Shares. This can be attributed to the fact that A-Shares are more liquid and have a larger investor base, which leads to higher trading volumes and greater price efficiency.

China A-Shares refer to shares of mainland Chinese companies that are listed on the Shanghai Stock Exchange and the Shenzhen Stock Exchange. These shares are denominated in Chinese yuan and are only available for trading by mainland Chinese investors and qualified foreign institutional investors (QFIIs).

China A-Shares are considered to be the primary shares of Chinese companies and are mainly targeted at domestic investors. They represent the majority of the Chinese stock market and are subject to the regulations and restrictions imposed by the Chinese government.

Investing in China A-Shares can provide investors with exposure to the Chinese economy, which is one of the fastest-growing economies in the world. It allows investors to participate in the growth potential of Chinese companies and industries, such as technology, consumer goods, and financial services.

However, investing in China A-Shares also comes with certain risks and challenges. The Chinese stock market is known for its volatility and can be influenced by factors such as government policies, economic indicators, and global market trends. Additionally, there are restrictions on foreign ownership and repatriation of profits, which can limit the liquidity and accessibility of China A-Shares for international investors.

Despite these challenges, China A-Shares have become increasingly popular among international investors due to the potential for high returns and diversification benefits. Many global index providers, such as MSCI and FTSE Russell, have included China A-Shares in their benchmark indices, which has further increased the visibility and attractiveness of these shares.

Historical Background of China A-Shares

The history of China A-Shares dates back to the late 1980s when the Chinese government introduced a dual-share structure in its stock market. At that time, China was in the early stages of economic reform and opening up to the world. The government wanted to attract foreign investment and promote the development of its domestic capital market.

China A-Shares were initially created as a way for Chinese companies to raise capital from domestic investors. These shares were denominated in the local currency, the Renminbi (RMB), and were only available for purchase by Chinese citizens and qualified institutional investors.

Over the years, China A-Shares have undergone several reforms and liberalizations to attract more foreign investment. In 2002, the Chinese government launched the B-Share market, which allowed foreign investors to trade in US dollars on the Shanghai and Shenzhen exchanges. This provided a way for foreign investors to indirectly access the A-Share market.

In 2014, China launched the Shanghai-Hong Kong Stock Connect program, followed by the Shenzhen-Hong Kong Stock Connect in 2016. These programs allowed investors from Hong Kong and other international markets to trade directly in China A-Shares through their local brokerage accounts. This marked a significant milestone in the opening up of China’s capital market.

Today, China A-Shares are an integral part of the global investment landscape. They represent the largest and most liquid segment of the Chinese stock market, with a wide range of companies across various sectors. Foreign investors can now invest in China A-Shares through various channels, including the Stock Connect programs, QFII, and the recently launched Shanghai-London Stock Connect.

As China continues to open up its capital market and attract more foreign investment, the significance of China A-Shares is expected to grow. They offer investors the opportunity to participate in the growth of China’s economy and tap into the potential of its domestic market.

Key Differences between China A-Shares and B-Shares

China A-Shares and B-Shares are two different types of shares that are traded on the Chinese stock market. While they both represent ownership in Chinese companies, there are several key differences between the two:

1. Eligibility: China A-Shares are denominated in Chinese yuan and are only available for purchase by domestic investors and qualified foreign institutional investors (QFIIs). On the other hand, B-Shares are denominated in foreign currencies (usually US dollars or Hong Kong dollars) and can be purchased by both domestic and foreign investors.

2. Listing: A-Shares are listed on the Shanghai Stock Exchange (SSE) and the Shenzhen Stock Exchange (SZSE), which are the two main stock exchanges in China. B-Shares, on the other hand, are listed on the Shanghai Stock Exchange International Board (SSX) and the Shenzhen Stock Exchange International Board (SZSX), which are designed specifically for foreign investors.

5. Price Differences: A-Shares and B-Shares can have different prices for the same company. This is because A-Shares are mainly traded by domestic investors, while B-Shares are mainly traded by foreign investors. The different investor base and market conditions can lead to price discrepancies between the two types of shares.

6. Investment Restrictions: There are certain investment restrictions for A-Shares that do not apply to B-Shares. For example, foreign investors need to obtain a Qualified Foreign Institutional Investor (QFII) license to invest in A-Shares, and there are limits on the amount of A-Shares that foreign investors can own.

Overall, while both A-Shares and B-Shares provide access to the Chinese stock market, they have different characteristics and considerations for investors. It is important for investors to understand these key differences before deciding to invest in either type of share.

Benefits of Investing in China A-Shares

Investing in China A-Shares can offer several benefits to investors. Here are some key advantages:

1. Access to the World’s Second-Largest Stock Market

China A-Shares provide investors with the opportunity to participate in the world’s second-largest stock market by market capitalization. With a rapidly growing economy and a large population, China offers significant investment potential.

2. Diversification

Investing in China A-Shares allows investors to diversify their portfolios geographically. By including Chinese stocks in their investment mix, investors can reduce the risk associated with being overly concentrated in a single market or region.

3. Exposure to High-Growth Sectors

4. Potential for Higher Returns

China A-Shares have historically offered higher returns compared to other international markets. The Chinese stock market has experienced significant growth in recent years, driven by factors such as economic reforms, increased consumer spending, and technological advancements.

5. Greater Influence on Corporate Governance

Investing in China A-Shares gives investors the opportunity to have a greater say in the corporate governance of Chinese companies. Shareholders can participate in voting on important company decisions, which can help improve transparency and accountability.

6. Currency Appreciation

7. Potential for Long-Term Growth

China’s economy is expected to continue growing at a robust pace in the coming years. Investing in China A-Shares allows investors to capitalize on this long-term growth potential and potentially generate significant wealth over time.

| Benefits | Description |

|---|---|

| Access to the World’s Second-Largest Stock Market | China A-Shares provide investors with the opportunity to participate in the world’s second-largest stock market by market capitalization. |

| Diversification | Investing in China A-Shares allows investors to diversify their portfolios geographically. |

| Exposure to High-Growth Sectors | China is known for its thriving technology, consumer, and healthcare sectors. |

| Potential for Higher Returns | China A-Shares have historically offered higher returns compared to other international markets. |

| Greater Influence on Corporate Governance | Investing in China A-Shares gives investors the opportunity to have a greater say in the corporate governance of Chinese companies. |

| Currency Appreciation | |

| Potential for Long-Term Growth | China’s economy is expected to continue growing at a robust pace in the coming years. |

Comparison of China A-Shares with Other International Markets

When considering investing in China A-Shares, it is important to understand how they compare to other international markets. Here, we will explore the key differences between China A-Shares and other major global markets.

1. Market Size

China A-Shares represent the largest equity market in the world by market capitalization. With a vast number of listed companies, the Chinese market offers significant opportunities for investors.

2. Accessibility

While China A-Shares were historically only accessible to domestic investors, the market has gradually opened up to international investors in recent years. However, there are still certain restrictions and regulatory requirements that investors must navigate.

3. Volatility

China A-Shares have a reputation for being more volatile compared to other international markets. This can be attributed to various factors, including the influence of retail investors and the impact of government policies.

4. Government Intervention

The Chinese government plays a significant role in the country’s stock market. Government policies and interventions can have a substantial impact on China A-Shares, which is a key consideration for investors.

5. Corporate Governance

Corporate governance practices in China may differ from those in other international markets. Investors should carefully evaluate the governance structures and practices of Chinese companies before investing in China A-Shares.

6. Currency Risk

7. Growth Potential

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.