Overview of the Hong Kong Stock Exchange

The Hong Kong Stock Exchange (HKEX) is one of the world’s leading stock exchanges, providing a platform for companies to raise capital and for investors to trade securities. It is located in Hong Kong, a global financial hub known for its strong regulatory framework and business-friendly environment.

The HKEX operates as a marketplace for a wide range of financial instruments, including equities, bonds, and derivatives. It offers a diverse range of investment opportunities, catering to both domestic and international investors. With its deep liquidity and transparent trading system, the HKEX attracts investors from around the world.

The HKEX is known for its high regulatory standards, ensuring the integrity and stability of the market. It has implemented robust measures to protect investors’ interests and maintain market fairness. The exchange also provides comprehensive market data and information, enabling investors to make informed decisions.

One of the key features of the HKEX is its dual-listing system, which allows companies to list their shares both in Hong Kong and on other major stock exchanges. This provides companies with access to a global pool of investors and enhances their visibility in the international market.

In recent years, the HKEX has seen significant growth in its market capitalization and trading volume, reflecting the increasing interest in the Hong Kong market. It has become a preferred destination for companies looking to raise capital and investors seeking attractive investment opportunities.

Overall, the Hong Kong Stock Exchange offers a vibrant and dynamic marketplace for investors, with its strong regulatory framework, diverse range of investment opportunities, and global connectivity. Whether you are a seasoned investor or just starting out, the HKEX provides a platform to participate in the exciting world of stock market investing.

Benefits of Investing in the Hong Kong Stock Exchange

Investing in the Hong Kong Stock Exchange offers a range of benefits for both individual and institutional investors. Here are some key advantages:

Diversification

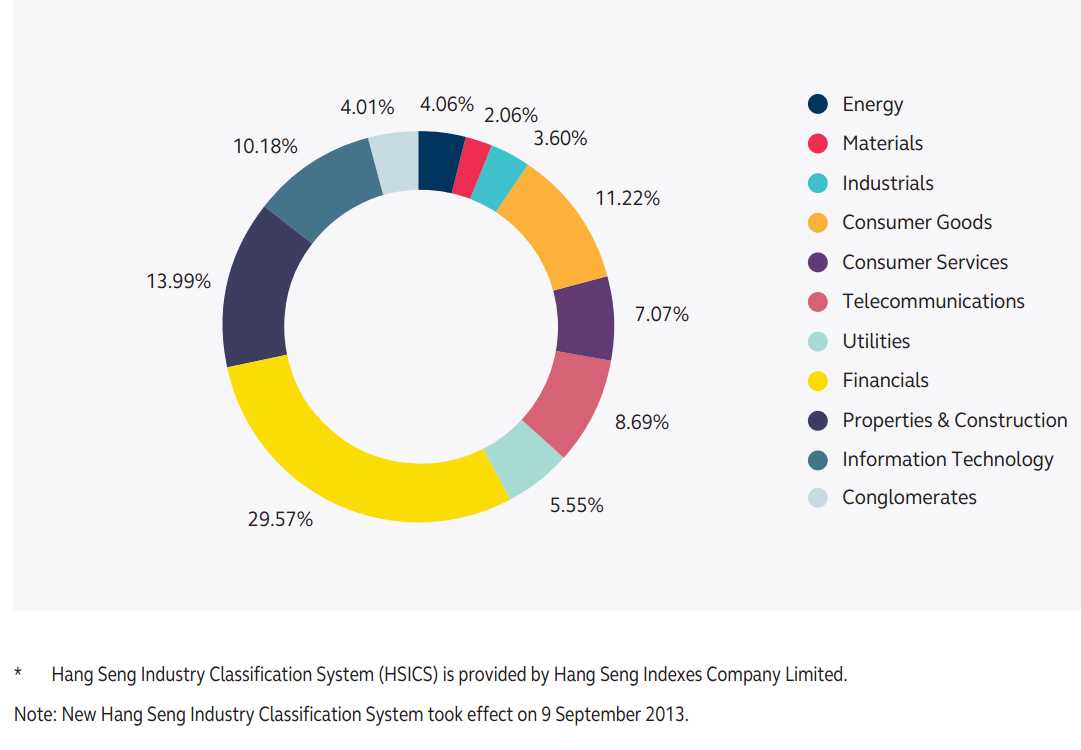

By investing in the Hong Kong Stock Exchange, you can diversify your investment portfolio and reduce risk. The exchange is home to a wide range of companies from various sectors, including finance, real estate, technology, and more. This diversification can help protect your investments from market volatility and economic downturns.

Access to Chinese Market

The Hong Kong Stock Exchange provides access to the Chinese market, which is one of the fastest-growing economies in the world. By investing in Hong Kong-listed companies, you can tap into the vast potential of the Chinese market and benefit from its rapid economic growth.

Furthermore, the Hong Kong Stock Exchange is an important gateway for foreign investors to access Chinese companies, as it allows for easier investment and trading compared to mainland China’s stock exchanges.

Regulatory Framework

The Hong Kong Stock Exchange operates under a robust regulatory framework, which ensures transparency, fairness, and investor protection. The exchange has stringent listing requirements and continuous disclosure obligations for listed companies, which helps maintain market integrity.

Liquidity

The Hong Kong Stock Exchange is one of the most liquid stock exchanges in the world, with high trading volumes and a deep pool of investors. This liquidity provides investors with the ability to buy and sell securities quickly and at competitive prices.

Additionally, the exchange offers a range of trading mechanisms, including regular trading hours, after-hours trading, and electronic trading, providing flexibility and convenience for investors.

International Recognition

The Hong Kong Stock Exchange is internationally recognized and respected, attracting both domestic and foreign investors. It is a major financial hub in Asia and has a strong reputation for its regulatory framework, market efficiency, and corporate governance standards.

Investing in the Hong Kong Stock Exchange can enhance your investment portfolio’s credibility and open doors to new opportunities in the global market.

How to Invest in the Hong Kong Stock Exchange

Investing in the Hong Kong Stock Exchange can be a great way to diversify your portfolio and potentially earn significant returns. Here are the steps to get started:

1. Choose a Stockbroker

The first step is to choose a reputable stockbroker that is licensed to trade on the Hong Kong Stock Exchange. Look for a broker that offers a user-friendly trading platform, competitive fees, and a wide range of investment options.

2. Open a Trading Account

Once you have selected a stockbroker, you will need to open a trading account. This involves providing your personal information, such as your name, address, and identification documents. The stockbroker will guide you through the account opening process.

3. Fund Your Account

After your trading account is open, you will need to fund it with money to start investing. You can transfer funds from your bank account to your trading account using various payment methods, such as bank transfer or credit/debit card.

4. Conduct Research

Before making any investment decisions, it is important to conduct thorough research on the companies listed on the Hong Kong Stock Exchange. Look for companies with strong financials, a solid track record, and positive growth prospects.

5. Place Your Trades

Once you have identified the stocks you want to invest in, you can place your trades through your stockbroker’s trading platform. You will need to specify the quantity of shares you want to buy or sell and the price at which you are willing to trade.

6. Monitor Your Investments

After placing your trades, it is important to monitor your investments regularly. Keep track of the performance of your stocks and stay updated on any news or events that may impact their value. Consider setting up price alerts or stop-loss orders to manage your risk.

7. Review and Adjust

Periodically review your investment portfolio and make adjustments as needed. Consider rebalancing your portfolio to maintain a diversified mix of investments and to take advantage of new opportunities that may arise.

Remember, investing in the stock market carries risks, and it is important to do your due diligence and seek professional advice if needed. The Hong Kong Stock Exchange offers a wide range of investment opportunities, and with careful planning and research, you can potentially achieve your financial goals.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.