What is a Qualified Small Employer Health Reimbursement Arrangement (QSEHRA)?

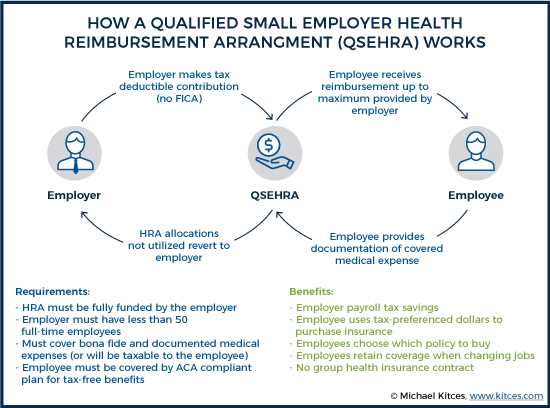

A Qualified Small Employer Health Reimbursement Arrangement (QSEHRA) is a type of health benefit plan that allows small businesses to reimburse their employees for qualified medical expenses. It was established as part of the 21st Century Cures Act in 2016 to provide small employers with an affordable alternative to traditional group health insurance.

With a QSEHRA, small businesses can set aside a certain amount of money each year to reimburse employees for eligible medical expenses, such as health insurance premiums, doctor visits, prescription medications, and more. The reimbursement amounts are tax-free for both the employer and the employee, making it a cost-effective option for small businesses.

In summary, a Qualified Small Employer Health Reimbursement Arrangement (QSEHRA) is a flexible and cost-effective health benefit plan for small businesses. It allows employers to reimburse employees for qualified medical expenses, providing them with more control and choice over their healthcare options.

Benefits of a QSEHRA for Small Businesses

A Qualified Small Employer Health Reimbursement Arrangement (QSEHRA) offers several benefits for small businesses. Here are some key advantages:

1. Cost Savings:

QSEHRA allows small businesses to provide health benefits to their employees without the high costs associated with traditional group health insurance plans. Instead of paying fixed premiums, employers can set a monthly allowance for employees to use towards their individual health insurance premiums and qualified medical expenses.

2. Customization:

With a QSEHRA, small businesses have the flexibility to design a plan that meets their specific needs and budget. Employers can set different reimbursement amounts for different employee classes or offer varying allowances based on factors like age or family size.

3. Attraction and Retention of Talent:

4. Tax Advantages:

QSEHRA offers tax advantages for both employers and employees. Employers can deduct their contributions to the plan as a business expense, reducing their taxable income. Employees can receive their QSEHRA allowances tax-free, saving on income and payroll taxes.

5. Employee Empowerment:

QSEHRA puts employees in control of their healthcare decisions. They can choose the health insurance plan that best suits their needs and preferences, and use their QSEHRA allowance to cover premiums and eligible medical expenses. This empowers employees to make personalized healthcare choices and take ownership of their health and well-being.

How to Set Up a QSEHRA for Your Small Business

Setting up a Qualified Small Employer Health Reimbursement Arrangement (QSEHRA) for your small business is a straightforward process that can provide significant benefits for both you and your employees. Here are the steps to follow:

1. Determine Eligibility

First, you need to determine if your small business is eligible to offer a QSEHRA. To qualify, your business must have fewer than 50 full-time employees and not offer a group health insurance plan to any employees.

2. Establish a Formal Plan

3. Communicate with Employees

Once your QSEHRA plan is established, you need to communicate the details to your employees. This includes explaining how the reimbursement process works, what expenses are eligible for reimbursement, and any other important information they need to know.

4. Set Up a Reimbursement Process

To streamline the reimbursement process, you can use a third-party administrator or software platform to manage the QSEHRA. These tools can help automate the reimbursement process, track employee expenses, and ensure compliance with IRS regulations.

When setting up the reimbursement process, you’ll need to decide how often reimbursements will be made (monthly, quarterly, etc.) and establish a system for employees to submit their expenses for reimbursement.

5. Maintain Compliance

Finally, it’s crucial to maintain compliance with IRS regulations regarding QSEHRAs. This includes keeping accurate records of reimbursements, ensuring that reimbursements are only made for eligible expenses, and providing annual reports to employees and the IRS.

Regularly review your QSEHRA plan to ensure it remains compliant with any changes in regulations or guidelines.

By following these steps, you can successfully set up a QSEHRA for your small business and provide valuable health benefits to your employees while also enjoying potential tax advantages. Consult with a qualified professional or benefits advisor to ensure you meet all requirements and understand the full implications of offering a QSEHRA.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.