What is a Level 1 Trading Screen?

Definition and Overview

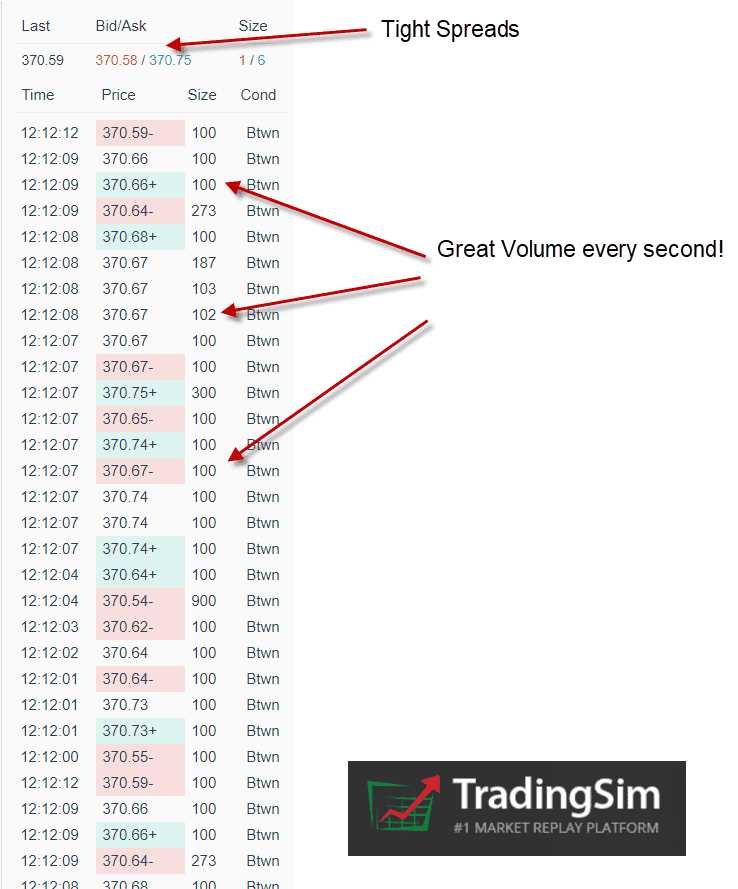

In addition to the bid and ask prices, a Level 1 Trading Screen also shows the last trade price, which is the price at which the most recent transaction for the security occurred. This information is crucial for traders as it helps them gauge the current market sentiment and make informed decisions about buying or selling a security.

How Does a Level 1 Trading Screen Work?

A Level 1 Trading Screen works by aggregating real-time market data from various sources and displaying it in a user-friendly format. Traders can access this information through a trading platform provided by their broker or financial institution.

Traders can use the information displayed on the Level 1 Trading Screen to make trading decisions. For example, if the bid price is higher than the ask price, it may indicate a bullish market sentiment, suggesting that the security’s price may increase. Conversely, if the ask price is higher than the bid price, it may indicate a bearish market sentiment, suggesting that the security’s price may decrease.

Accessibility of Level 1 Trading Screens

Level 1 Trading Screens are widely accessible to traders and investors. Most brokerage firms and financial institutions provide their clients with access to a Level 1 Trading Screen as part of their trading platform.

Traders can access Level 1 Trading Screens through desktop applications, web-based platforms, or mobile apps, allowing them to monitor the market and make trading decisions from anywhere at any time.

Overall, Level 1 Trading Screens are essential tools for traders and investors, providing them with real-time market data and insights to make informed trading decisions.

Definition and Overview

A Level 1 Trading Screen is a real-time data display that provides traders with essential information about a particular security or financial instrument. It is the most basic level of market data and is widely used by individual investors, day traders, and small-scale traders.

The Level 1 Trading Screen is typically accessed through trading platforms or online brokerage accounts. It is available to both professional traders and retail investors, making it accessible to a wide range of market participants.

Key Features of a Level 1 Trading Screen

1. Real-time Data: The Level 1 Trading Screen provides real-time data, allowing traders to see the most up-to-date information about a security. This is essential for making timely trading decisions.

2. Bid and Ask Prices: The bid price represents the highest price a buyer is willing to pay for a security, while the ask price represents the lowest price a seller is willing to accept. Traders can use this information to determine the potential profit or loss of a trade.

3. Last Traded Price: The last traded price is the price at which the most recent trade for a security occurred. It helps traders gauge the current market sentiment and identify trends.

4. Trading Volume: The trading volume indicates the number of shares or contracts traded for a security during a given period. High trading volume can indicate increased market activity and liquidity.

5. High and Low Prices: The Level 1 Trading Screen displays the highest and lowest prices at which a security has traded during the current trading session. This information helps traders understand the price range and potential volatility of a security.

Overall, the Level 1 Trading Screen provides traders with essential market data that is necessary for making informed trading decisions. It is a valuable tool for both experienced traders and beginners in the financial markets.

How Does a Level 1 Trading Screen Work?

A Level 1 Trading Screen is a tool used by traders to access real-time market data and make informed trading decisions. It provides a snapshot of the current market conditions, including the bid and ask prices, volume, and the latest trades.

When a trader logs into a Level 1 Trading Screen, they are presented with a list of securities or instruments they are interested in trading. Each security is listed with its ticker symbol, which is a unique identifier for that particular security.

In addition to the bid and ask prices, the Level 1 Trading Screen also shows the volume of shares or contracts traded for each security. This information is important because it indicates the level of liquidity in the market for that security. Higher volume generally means there is more interest and activity in trading that security.

The Level 1 Trading Screen also provides information on the latest trades for each security. This includes the price at which the trade was executed, the volume of shares or contracts traded, and the time of the trade. By monitoring the latest trades, traders can get a sense of the current market sentiment and make more informed trading decisions.

Traders can customize their Level 1 Trading Screen to display the specific securities and information they are interested in. They can also set up alerts and notifications to be notified of any significant changes in the market, such as when a security reaches a certain price level or when the volume exceeds a certain threshold.

Accessibility of Level 1 Trading Screens

Level 1 trading screens are widely accessible to individuals interested in trading stocks and other financial instruments. They can be accessed through various platforms, including online trading platforms, mobile applications, and desktop software provided by brokerage firms.

One of the key advantages of level 1 trading screens is their accessibility to retail investors. In the past, access to real-time market data was limited to professional traders who could afford expensive data feeds. However, with the advancement of technology and the rise of online trading, level 1 trading screens have become accessible to individual investors.

Most brokerage firms offer level 1 trading screens as part of their trading platforms. These platforms provide users with real-time quotes for stocks, as well as other relevant information such as bid and ask prices, volume, and the latest trades. Users can also customize their level 1 trading screens by adding or removing specific stocks or other financial instruments.

Level 1 trading screens are typically user-friendly and intuitive, making them accessible to both experienced traders and beginners. They often provide charts and graphs to help users analyze market trends and make informed trading decisions. Some platforms also offer additional features, such as news feeds and research tools, to further enhance the accessibility and usability of level 1 trading screens.

Furthermore, level 1 trading screens can be accessed from anywhere with an internet connection, allowing traders to monitor the markets and execute trades on the go. This accessibility is particularly beneficial for individuals who prefer to trade on their mobile devices or need to stay updated with market movements while traveling.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.