What is Adjusted EBITDA?

Adjusted EBITDA stands for Adjusted Earnings Before Interest, Taxes, Depreciation, and Amortization. It is a financial metric used by companies to evaluate their operational performance and profitability. Adjusted EBITDA provides a clearer picture of a company’s financial health by excluding certain expenses that may not be directly related to its core operations.

Adjusted EBITDA is often used by investors, analysts, and lenders to assess a company’s ability to generate cash flow and its overall financial stability.

By excluding non-operating expenses such as interest, taxes, depreciation, and amortization, Adjusted EBITDA allows for a more accurate comparison of companies operating in different industries or with varying capital structures.

It is important to note that Adjusted EBITDA is not a measure recognized by Generally Accepted Accounting Principles (GAAP) and may not be directly comparable between companies. Each company may have its own unique adjustments to arrive at its Adjusted EBITDA figure.

Adjusted EBITDA is a useful tool for investors and analysts as it provides a clearer view of a company’s operating performance and profitability, allowing for better decision-making and comparisons within the industry.

Definition and Explanation

Adjusted EBITDA, or Adjusted Earnings Before Interest, Taxes, Depreciation, and Amortization, is a financial metric used to evaluate a company’s profitability and cash flow. It provides a clearer picture of a company’s operating performance by excluding certain non-operating expenses and one-time items.

Adjusted EBITDA is particularly useful for companies that have significant non-operating expenses, such as restructuring costs, one-time legal settlements, or non-recurring expenses related to acquisitions. By excluding these expenses, Adjusted EBITDA provides a more accurate measure of a company’s ongoing profitability.

Adjusted EBITDA is also commonly used by investors and analysts to assess a company’s ability to generate cash flow and its potential for growth. It can help identify trends in a company’s financial performance and provide insights into its operational efficiency.

To calculate Adjusted EBITDA, start with the company’s EBITDA figure and then make adjustments to exclude non-operating expenses and one-time items. These adjustments can vary depending on the company and industry, but common adjustments include adding back non-recurring expenses, such as restructuring charges, and excluding non-operating income, such as gains from the sale of assets.

Overall, Adjusted EBITDA is a valuable financial metric that provides a more accurate and comprehensive measure of a company’s operating performance and cash flow. It allows investors, analysts, and stakeholders to make informed decisions and assess the true financial health of a company.

Importance and Benefits of Adjusted EBITDA

Adjusted EBITDA, or Earnings Before Interest, Taxes, Depreciation, and Amortization, is a financial metric that is widely used by investors, analysts, and companies to evaluate the financial performance of a business. It provides a clearer picture of a company’s profitability by excluding certain expenses that may not be directly related to its core operations.

Importance of Adjusted EBITDA

Adjusted EBITDA is important for several reasons:

- Comparability: By excluding non-operating expenses such as interest, taxes, depreciation, and amortization, Adjusted EBITDA allows for better comparability between companies in the same industry. It provides a standardized measure of profitability that can be used to evaluate and compare different businesses.

- Focus on Core Operations: Adjusted EBITDA focuses on a company’s core operations by excluding expenses that are not directly related to generating revenue. This allows investors and analysts to assess the underlying profitability of the business without the impact of non-operating factors.

- Flexibility: Adjusted EBITDA can be used by companies of all sizes and in different industries. It provides a flexible metric that can be tailored to the specific needs of a business, allowing for a more accurate assessment of its financial performance.

- Investment Decision-Making: Adjusted EBITDA is often used by investors to make informed investment decisions. It provides a comprehensive view of a company’s profitability and can help investors assess its ability to generate cash flow and repay debt.

Benefits of Adjusted EBITDA

There are several benefits of using Adjusted EBITDA:

- Clearer Financial Picture: Adjusted EBITDA provides a clearer financial picture of a company’s performance by excluding non-operating expenses. This allows stakeholders to focus on the core profitability of the business.

- Standardized Measure: Adjusted EBITDA provides a standardized measure of profitability that can be used to compare companies within the same industry. It allows for better benchmarking and evaluation of financial performance.

- Identifying Trends: By analyzing Adjusted EBITDA over time, stakeholders can identify trends in a company’s profitability. This can help in making strategic decisions and assessing the effectiveness of business strategies.

- Valuation: Adjusted EBITDA is often used in valuation models to determine the value of a company. By providing a measure of profitability that is not influenced by non-operating factors, it can help in estimating the fair value of a business.

Formula for Calculating Adjusted EBITDA

Adjusted EBITDA is a financial metric used to assess the profitability and operating performance of a company. It provides a clearer picture of a company’s earnings by excluding certain non-operating expenses and non-cash items. The formula for calculating Adjusted EBITDA is as follows:

Adjusted EBITDA = EBITDA + Non-recurring or one-time expenses + Non-cash expenses

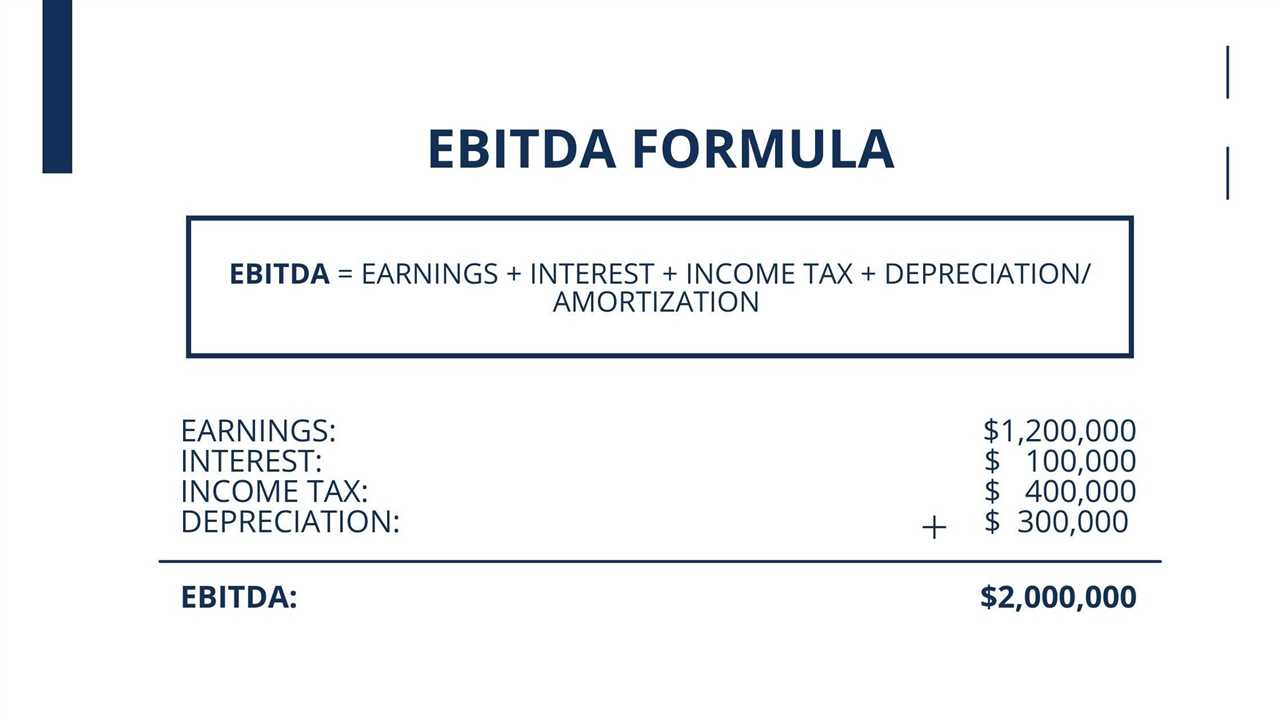

EBITDA stands for Earnings Before Interest, Taxes, Depreciation, and Amortization. It is a measure of a company’s operating performance and profitability before accounting for interest, taxes, and non-cash expenses.

The first step in calculating Adjusted EBITDA is to determine the EBITDA of the company. This can be done by subtracting the operating expenses, such as cost of goods sold, salaries, and rent, from the company’s total revenue. The resulting figure represents the earnings generated by the company’s core operations.

Next, non-recurring or one-time expenses are added to the EBITDA. These expenses are typically unusual or infrequent in nature and are not expected to occur regularly. Examples of non-recurring expenses include restructuring costs, legal settlements, or expenses related to a one-time event.

Finally, non-cash expenses are added to the adjusted EBITDA calculation. Non-cash expenses are expenses that do not involve an actual outflow of cash but are recorded as expenses in the financial statements. Examples of non-cash expenses include depreciation and amortization of assets, stock-based compensation, and impairment charges.

By adding these adjustments to the EBITDA, the adjusted EBITDA provides a more accurate representation of a company’s profitability and operating performance. It allows investors and analysts to compare the financial performance of different companies, as it eliminates the impact of non-operating and non-cash items.

It is important to note that the formula for calculating Adjusted EBITDA may vary slightly depending on the company and industry. Some companies may have additional adjustments or exclusions specific to their operations. Therefore, it is essential to understand the specific adjustments made by a company when analyzing its adjusted EBITDA.

Step-by-Step Guide to Calculating Adjusted EBITDA

Calculating Adjusted EBITDA involves a series of steps to ensure accurate and reliable results. Here is a step-by-step guide to help you calculate Adjusted EBITDA:

Step 1: Gather the necessary financial statements

Collect the relevant financial statements, including the income statement, balance sheet, and statement of cash flows. These statements provide the required information to calculate Adjusted EBITDA.

Step 2: Identify the key components

Identify the key components that need to be adjusted in the EBITDA calculation. These adjustments are made to exclude certain expenses or income that may not accurately reflect the company’s operational performance.

Step 3: Calculate EBITDA

Calculate EBITDA by adding back the non-operating expenses, such as interest, taxes, depreciation, and amortization, to the net income. This provides a measure of the company’s operating performance before these non-operating expenses are taken into account.

Step 4: Adjust for non-recurring items

Adjust the EBITDA figure for any non-recurring or one-time items that may have affected the company’s financial performance. These items could include restructuring costs, legal settlements, or gains/losses from the sale of assets.

Step 5: Adjust for non-cash expenses

Adjust the EBITDA figure for any non-cash expenses, such as stock-based compensation or impairment charges. These expenses do not involve an actual cash outflow and can distort the true operational performance of the company.

Step 6: Calculate Adjusted EBITDA

Calculate Adjusted EBITDA by subtracting the adjusted non-recurring items and non-cash expenses from the EBITDA figure. This provides a more accurate representation of the company’s operational performance.

Step 7: Analyze and interpret the results

Once you have calculated the Adjusted EBITDA, analyze and interpret the results to gain insights into the company’s financial performance. Compare the Adjusted EBITDA figures over time and against industry benchmarks to assess the company’s profitability and efficiency.

By following these steps, you can calculate Adjusted EBITDA accurately and use it as a valuable financial metric to evaluate a company’s operational performance. It provides a clearer picture of the company’s profitability by excluding certain expenses that may not be directly related to its core business operations.

Tools for Calculating Adjusted EBITDA

Calculating Adjusted EBITDA can be a complex process, but there are several tools available that can simplify the task. These tools can help businesses accurately calculate Adjusted EBITDA and make informed financial decisions. Here are some recommended tools:

1. Excel Spreadsheets

Excel spreadsheets are a popular choice for calculating Adjusted EBITDA. They provide a user-friendly interface and allow for easy manipulation of financial data. With Excel, you can create formulas and perform calculations to determine Adjusted EBITDA. Additionally, Excel offers various functions and features that can enhance the accuracy and efficiency of the calculation process.

2. Financial Software

Financial software, such as QuickBooks or Xero, can also be used to calculate Adjusted EBITDA. These software solutions often have built-in tools and features specifically designed for financial analysis. They allow users to input financial data and generate reports, including Adjusted EBITDA calculations. Financial software can streamline the process and provide a comprehensive overview of a company’s financial performance.

3. Online Calculators

There are numerous online calculators available that can calculate Adjusted EBITDA. These calculators typically require users to input specific financial data, such as revenue, expenses, and non-operating items. The calculator then performs the necessary calculations and provides the Adjusted EBITDA figure. Online calculators are convenient and can be accessed from anywhere with an internet connection.

4. Financial Modeling Tools

Financial modeling tools, such as Microsoft Power BI or Tableau, can also be utilized to calculate Adjusted EBITDA. These tools allow users to create interactive financial models and perform complex calculations. With financial modeling tools, businesses can analyze various scenarios and determine the impact on Adjusted EBITDA. These tools are particularly useful for businesses that require advanced financial analysis.

5. Custom-built Spreadsheets or Software

For businesses with unique financial requirements, custom-built spreadsheets or software can be developed to calculate Adjusted EBITDA. These customized solutions can be tailored to specific business needs and incorporate additional variables or calculations. Custom-built spreadsheets or software may require the assistance of a financial professional or software developer to ensure accuracy and functionality.

When selecting a tool for calculating Adjusted EBITDA, it is important to consider the specific needs and capabilities of your business. The chosen tool should be user-friendly, accurate, and provide the necessary features to perform the calculation effectively. By utilizing these tools, businesses can gain valuable insights into their financial performance and make informed decisions to drive growth and profitability.

List of Recommended Tools for Calculating Adjusted EBITDA

Calculating Adjusted EBITDA can be a complex task, especially for businesses with multiple revenue streams and expenses. Fortunately, there are several tools available that can help streamline the process and ensure accurate calculations. Here is a list of recommended tools:

1. Excel

Microsoft Excel is a versatile spreadsheet program that can be used for various financial calculations, including calculating Adjusted EBITDA. It provides a range of functions and formulas that can be customized to fit specific business needs. Excel also allows for easy data entry and manipulation, making it a popular choice for financial analysis.

2. Google Sheets

Google Sheets is a cloud-based spreadsheet program that offers similar functionality to Excel. It allows for collaboration and real-time updates, making it ideal for teams working on financial analysis together. Google Sheets also integrates with other Google products, such as Google Drive, making it easy to store and share financial data.

3. Financial Analysis Software

There are various financial analysis software available in the market that can assist in calculating Adjusted EBITDA. These software often have built-in templates and formulas specifically designed for financial analysis. Some popular options include QuickBooks, Xero, and Sage Intacct.

4. Online Calculators

There are several online calculators specifically designed for calculating Adjusted EBITDA. These calculators typically require inputting financial data such as revenue, expenses, and non-operating items, and provide instant results. Some popular online calculators include Investopedia’s Adjusted EBITDA Calculator and DCF-Model’s Adjusted EBITDA Calculator.

5. Custom-built Spreadsheets

For businesses with unique financial structures or specific requirements, custom-built spreadsheets can be a viable option. These spreadsheets can be tailored to fit the specific needs of the business, allowing for more accurate and detailed calculations. However, building custom spreadsheets may require advanced Excel skills or the assistance of a financial professional.

When selecting a tool for calculating Adjusted EBITDA, it is important to consider the specific needs of the business, the level of complexity involved, and the available resources. Whether using a spreadsheet program, financial analysis software, online calculators, or custom-built spreadsheets, the key is to choose a tool that provides accurate results and helps streamline the financial analysis process.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.