What is Market Value?

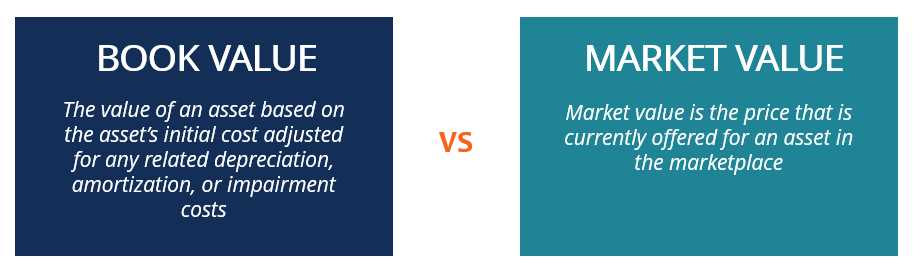

Market value refers to the current price at which an asset, security, or investment can be bought or sold in the open market. It is determined by the forces of supply and demand and represents the perceived worth of an asset based on the prevailing market conditions.

Market value is often used as a measure of the fair value of an asset and is an important concept in finance and investing. It provides investors with an indication of how much an asset is worth in the current market and can help them make informed decisions about buying, selling, or holding investments.

Factors Affecting Market Value

Several factors can influence the market value of an asset:

- Supply and demand: The basic principle of economics, supply and demand, plays a significant role in determining market value. When the demand for an asset exceeds its supply, the market value tends to increase. Conversely, when the supply exceeds the demand, the market value tends to decrease.

- Market sentiment: Investor sentiment and market psychology can also impact market value. Positive news and optimistic outlooks can drive up market value, while negative news and pessimistic views can lead to a decline in market value.

- Economic factors: Economic indicators such as interest rates, inflation, GDP growth, and unemployment rates can influence market value. A strong economy generally leads to higher market values, while a weak economy can result in lower market values.

- Company performance: The financial performance and prospects of a company can affect its market value. Positive earnings reports, revenue growth, and strong management can increase market value, while poor financial performance can decrease market value.

- Industry trends: Market value can also be influenced by trends and developments within a specific industry. Technological advancements, regulatory changes, and shifts in consumer preferences can impact the market value of companies operating in those industries.

It is important for investors to understand these factors and how they can affect market value. By analyzing these factors and conducting thorough research, investors can make more informed decisions and potentially identify undervalued or overvalued assets.

Why is Market Value Important for Investors?

Here are some key reasons why market value is important for investors:

| 1. Assessing Investment Performance | Market value allows investors to evaluate the performance of their investments. By comparing the market value of an asset to its purchase price, investors can determine whether their investment has appreciated or depreciated in value. This information is essential for assessing the success of an investment strategy and making necessary adjustments. |

| 2. Determining Fair Value | Market value helps investors determine the fair value of an asset. If the market value of an asset is higher than its fair value, it may be overvalued, indicating that it may not be a good investment. Conversely, if the market value is lower than the fair value, the asset may be undervalued, presenting a potential buying opportunity. |

| 3. Identifying Market Trends | Monitoring market values can provide insights into market trends. By analyzing the market values of different assets over time, investors can identify patterns and trends that may influence their investment decisions. For example, if the market values of stocks in a particular industry are consistently increasing, it may indicate a bullish trend, prompting investors to consider investing in that sector. |

| 4. Risk Management | |

| 5. Portfolio Diversification | Market value plays a crucial role in portfolio diversification. By considering the market values of different assets, investors can create a well-diversified portfolio that spreads risk across various investments. This strategy can help protect against the volatility of individual assets and improve overall portfolio performance. |

Factors Affecting Market Value

Economic Conditions

One of the primary factors affecting market value is the overall economic conditions. Factors such as GDP growth, inflation, interest rates, and unemployment rates can have a significant impact on the market value of investments. In a booming economy, market values tend to rise as investors have more confidence in the market and are willing to pay higher prices for assets. Conversely, during an economic downturn, market values may decline as investors become more risk-averse and demand for assets decreases.

Industry Performance

The performance of a specific industry can also influence market values. If an industry is experiencing growth and generating high profits, investors may perceive the assets within that industry as more valuable, leading to an increase in market value. On the other hand, if an industry is facing challenges or declining, market values may decrease as investors lose confidence in the industry’s future prospects.

Company Performance

The performance of an individual company can have a significant impact on its market value. Factors such as revenue growth, profitability, market share, and management effectiveness can all influence market values. Positive company performance indicators often lead to an increase in market value, while negative performance indicators can result in a decrease. Investors closely monitor company performance to assess the potential for future growth and determine the value of their investments.

Supply and Demand

The basic economic principle of supply and demand plays a crucial role in determining market value. If the demand for a particular asset exceeds the available supply, market values tend to increase. Conversely, if the supply of an asset outweighs the demand, market values may decline. Factors such as population growth, consumer preferences, and technological advancements can all impact supply and demand dynamics, thereby influencing market values.

Market Sentiment

How to Evaluate Market Value

Evaluating market value is an essential skill for investors as it helps them make informed decisions about buying or selling assets. Here are some steps to evaluate market value:

- Research and gather information: Start by researching the asset you want to evaluate. Look for relevant data such as historical prices, financial statements, industry trends, and news articles. This information will provide insights into the asset’s performance and its market value.

- Compare similar assets: To determine the market value of an asset, it is important to compare it with similar assets in the market. Look for assets that have similar characteristics, such as size, industry, and financials. This comparison will help you understand how the asset is priced relative to its peers.

- Analyze supply and demand: Market value is influenced by the forces of supply and demand. Assess the current supply and demand dynamics for the asset you are evaluating. If there is high demand and limited supply, the market value is likely to be higher. Conversely, if there is low demand and abundant supply, the market value may be lower.

- Consider market sentiment: Market sentiment plays a crucial role in determining market value. Analyze the overall sentiment towards the asset and the market it operates in. Positive sentiment can drive up market value, while negative sentiment can lead to a decrease in market value.

- Use valuation models: Valuation models, such as discounted cash flow (DCF) analysis, can provide a quantitative estimate of an asset’s market value. These models consider factors such as future cash flows, growth rates, and risk. By applying these models, investors can estimate the intrinsic value of the asset and compare it to the current market value.

- Monitor market trends: Market value is not static and can change over time. Stay updated with market trends and factors that can influence the asset’s value. Regularly monitor economic indicators, industry developments, and news that may impact the asset’s market value.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.