Growth Rates Formula

The growth rates formula is a financial analysis tool used to calculate and assess the rate at which a specific variable or metric is growing over a given period of time. It is commonly used in various fields such as finance, economics, and business to evaluate the performance and potential of a company or investment.

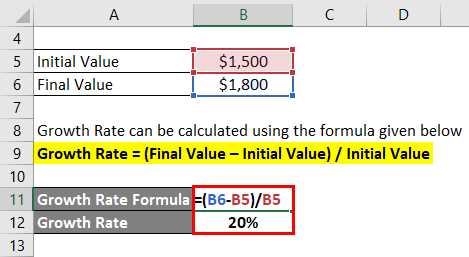

To calculate the growth rate, you need to know the initial value and the final value of the variable you are analyzing. The formula for calculating the growth rate is:

This formula calculates the percentage change in the variable over time. By expressing the growth rate as a percentage, it allows for easier comparison and interpretation of the results.

The growth rate formula can be applied to various metrics, such as revenue, profit, market share, or customer base. It provides valuable insights into the performance and trajectory of a company or investment.

For example, if a company’s revenue increased from $1 million to $1.5 million over a year, the growth rate would be:

This indicates that the company’s revenue grew by 50% over the specified period.

The growth rate formula is a powerful tool for financial analysis and decision-making. It helps investors, analysts, and managers assess the growth potential and performance of a company, identify trends, and make informed decisions.

| Advantages | Disadvantages |

|---|---|

| Provides a standardized measure of growth | Does not account for external factors |

| Allows for easy comparison between different variables or periods | May not accurately reflect the underlying dynamics of the variable |

| Helps identify trends and patterns | Relies on accurate and reliable data |

How to Calculate Growth Rates

To calculate growth rates, follow these steps:

- Select the variable: Determine the specific variable you want to analyze. This could be revenue, profit, market share, or any other relevant metric.

- Choose the time period: Decide on the time frame for which you want to calculate the growth rate. This could be a year, a quarter, or any other period that is relevant to your analysis.

- Obtain the initial value: Find the initial value of the variable at the beginning of the chosen time period. This could be the revenue at the start of the year, for example.

- Obtain the final value: Find the final value of the variable at the end of the chosen time period. This could be the revenue at the end of the year.

For example, let’s say you want to calculate the revenue growth rate of a company for the year 2020. The initial revenue at the beginning of the year was $1 million, and the final revenue at the end of the year was $1.5 million. Using the formula, the growth rate would be:

This means that the company’s revenue grew by 50% during the year 2020.

Definition of Growth Rates

In financial analysis, growth rates refer to the percentage change in a specific financial metric over a certain period of time. It is used to measure the rate at which a particular variable, such as revenue, profit, or market share, is increasing or decreasing.

The formula to calculate growth rates is:

Where:

- Growth Rate is the percentage change in the variable being analyzed.

- Ending Value is the value of the variable at the end of the period.

- Beginning Value is the value of the variable at the beginning of the period.

For example, if a company’s revenue was $1 million at the beginning of the year and increased to $1.5 million at the end of the year, the growth rate would be calculated as follows:

A positive growth rate indicates an increase in the variable being analyzed, while a negative growth rate indicates a decrease. The magnitude of the growth rate reflects the extent of the change.

It is important to note that growth rates should be interpreted in the context of the industry and market conditions. A high growth rate may be impressive for a company, but if the industry is experiencing even higher growth, it may indicate that the company is underperforming relative to its competitors.

Financial Analysis of Growth Rates

In financial analysis, growth rates are an important metric used to evaluate the performance and potential of a company. By calculating and analyzing growth rates, investors and analysts can gain insights into the company’s ability to generate revenue and increase profitability over time.

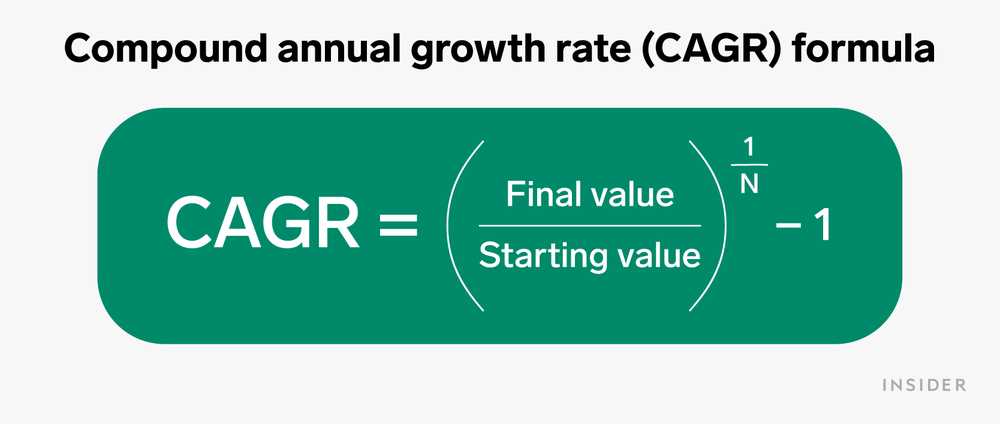

There are several key growth rates that are commonly used in financial analysis. These include revenue growth rate, earnings growth rate, and return on investment (ROI) growth rate. Each of these growth rates provides a different perspective on the company’s financial health and growth potential.

The revenue growth rate measures the percentage increase in a company’s revenue over a specific period of time. It is calculated by taking the difference between the current period’s revenue and the previous period’s revenue, dividing it by the previous period’s revenue, and multiplying by 100. A high revenue growth rate indicates that the company is experiencing strong sales growth, while a low or negative growth rate may indicate a decline in sales.

The earnings growth rate measures the percentage increase in a company’s earnings over a specific period of time. It is calculated in a similar manner to the revenue growth rate, by taking the difference between the current period’s earnings and the previous period’s earnings, dividing it by the previous period’s earnings, and multiplying by 100. A high earnings growth rate indicates that the company is increasing its profitability, while a low or negative growth rate may indicate declining profitability.

The return on investment (ROI) growth rate measures the percentage increase in a company’s ROI over a specific period of time. ROI is a measure of the profitability of an investment and is calculated by dividing the net profit from the investment by the cost of the investment, and multiplying by 100. A high ROI growth rate indicates that the company is generating increasing returns on its investments, while a low or negative growth rate may indicate a decline in investment performance.

Financial analysts use these growth rates to assess the overall financial performance and growth potential of a company. By comparing a company’s growth rates to industry benchmarks and historical performance, analysts can identify trends and make informed investment decisions. Additionally, growth rates can be used to forecast future performance and estimate the value of a company’s stock or assets.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.