What are Fully Diluted Shares?

Fully diluted shares refer to the total number of shares that would be outstanding if all possible sources of conversion, such as stock options, convertible bonds, and warrants, were exercised or converted into common shares. These potential sources of conversion represent the maximum number of shares that could be issued by a company.

When a company issues stock options, convertible bonds, or warrants, it grants the holder the right to convert or exercise these instruments into common shares at a predetermined price and within a specific time frame. If these instruments are exercised or converted, they add to the total number of outstanding shares, diluting the ownership stake of existing shareholders.

Why are Fully Diluted Shares Important?

Fully diluted shares are an important concept in the world of finance and investing. They provide a more accurate representation of a company’s ownership structure and potential dilution of existing shareholders.

When a company issues stock options, convertible securities, or other forms of equity compensation, it can potentially increase the number of shares outstanding. This increase in shares can dilute the ownership percentage of existing shareholders.

Calculating Dilution

To calculate dilution, you need to know the total number of shares outstanding and the number of new shares being issued. The formula for calculating dilution is as follows:

- Step 1: Determine the total number of shares outstanding before the new issuance.

- Step 2: Determine the number of new shares being issued.

- Step 3: Add the number of new shares being issued to the total number of shares outstanding before the new issuance.

- Step 4: Divide the number of new shares being issued by the total number of shares outstanding after the new issuance.

- Step 5: Multiply the result by 100 to get the dilution percentage.

For example, let’s say a company has 1,000,000 shares outstanding before a new issuance of 100,000 shares. To calculate the dilution percentage, you would follow these steps:

- Step 1: 1,000,000 shares outstanding

- Step 2: 100,000 new shares being issued

- Step 3: 1,000,000 + 100,000 = 1,100,000 total shares outstanding after the new issuance

- Step 4: 100,000 / 1,100,000 = 0.0909

- Step 5: 0.0909 * 100 = 9.09% dilution

Calculating dilution is crucial for investors to understand the potential impact on their ownership and the overall value of their investment. It allows them to make informed decisions based on the potential dilution of their shares.

What is Dilution?

Dilution refers to the decrease in the ownership percentage of existing shareholders in a company when new shares are issued. It occurs when a company issues additional shares, either through a secondary offering, private placement, or stock options exercise. The new shares dilute the ownership stake of existing shareholders, reducing their proportional ownership and control over the company.

Dilution can have a significant impact on the value of existing shares. When new shares are issued, the ownership pie gets divided into smaller pieces, resulting in a decrease in the value of each individual share. This is because the company’s total value remains the same, but the number of shares increases.

Types of Dilution

There are two main types of dilution: dilution of ownership and dilution of earnings.

Dilution of ownership occurs when the company issues new shares, reducing the percentage ownership of existing shareholders. For example, if an investor owns 10% of a company before a dilution event and the company issues new shares, the investor’s ownership percentage will decrease.

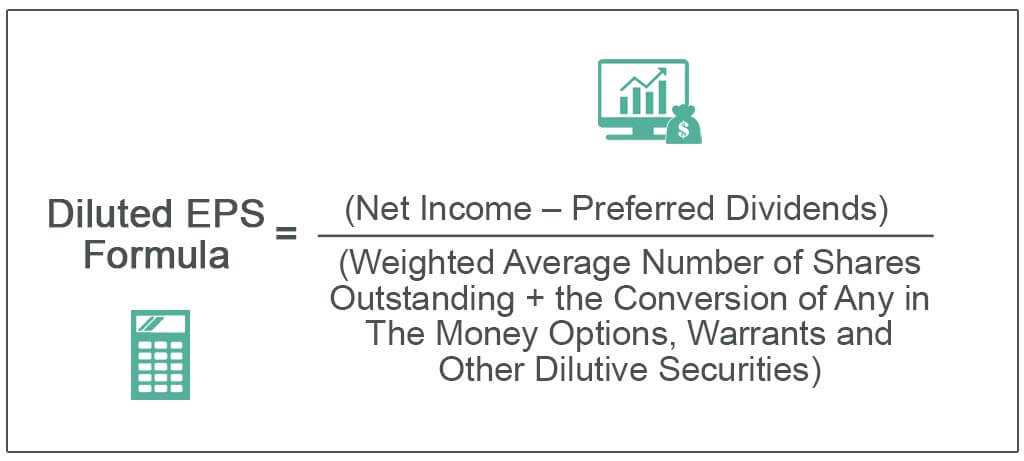

Dilution of earnings occurs when the company’s earnings per share (EPS) decrease due to the issuance of new shares. This happens because the company’s total earnings are divided among a larger number of shares, resulting in a lower EPS for each individual share.

Impact of Dilution

Dilution can have both positive and negative impacts on a company and its shareholders.

Positive impact: Dilution can provide a company with additional capital to fund growth initiatives, such as expanding operations, investing in research and development, or acquiring other companies. This can potentially increase the company’s value in the long run.

Calculating Dilution

To calculate dilution, you need to know the number of new shares issued and the total number of shares outstanding before the dilution event. The formula for calculating dilution is as follows:

Dilution = (Number of new shares issued / (Number of existing shares + Number of new shares issued)) * 100%

For example, if a company has 1,000,000 existing shares and issues 100,000 new shares, the dilution would be calculated as:

Dilution = (100,000 / (1,000,000 + 100,000)) * 100% = 9.09%

This means that the ownership percentage of existing shareholders would be diluted by 9.09% due to the issuance of new shares.

It is important for investors to understand the concept of dilution and its potential impact on their investment. Dilution can significantly affect the value and ownership structure of a company, so it is crucial to consider it when evaluating investment opportunities.

How to Calculate Dilution?

Dilution is a crucial concept in finance and investing. It refers to the reduction in the ownership percentage of existing shareholders when new shares are issued. Dilution can occur through various means, such as stock options, convertible bonds, or secondary offerings. Calculating dilution is essential for investors to understand the potential impact on their ownership and the overall value of their investment.

Step 1: Determine the Number of Existing Shares

The first step in calculating dilution is to determine the number of existing shares. This includes all shares that are currently outstanding and held by shareholders.

Step 2: Identify the Number of New Shares

The next step is to identify the number of new shares that will be issued. This can be done by reviewing the company’s announcements, such as an upcoming stock offering or the exercise of stock options.

Step 3: Calculate the Dilution Ratio

The dilution ratio is calculated by dividing the number of new shares by the sum of the existing shares and the new shares. This ratio represents the proportion of ownership that will be diluted.

Dilution Ratio = Number of New Shares / (Existing Shares + New Shares)

Step 4: Calculate the Diluted Ownership Percentage

To calculate the diluted ownership percentage, subtract the dilution ratio from 1 and multiply by 100. This will give you the percentage of ownership that remains after dilution.

Step 5: Assess the Impact on Ownership and Value

Once you have calculated the diluted ownership percentage, you can assess the impact on your ownership and the overall value of your investment. A higher dilution ratio indicates a greater reduction in ownership, which can potentially decrease the value of your shares.

It is important to note that dilution is not always negative. In some cases, companies issue new shares to raise capital for growth opportunities, which can benefit existing shareholders in the long run.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.