What is the Long Run?

In the field of economics, the long run refers to a period of time in which all factors of production are variable. This means that in the long run, a firm can adjust its input levels, such as labor and capital, to optimize its production process and maximize its profits.

The concept of the long run is important because it allows economists to analyze how firms make decisions in the face of changing market conditions. By studying the long run, economists can understand how firms respond to changes in input prices, technology, and market demand.

In the long run, firms have the flexibility to adjust their production processes and make strategic decisions. This is in contrast to the short run, where some factors of production, such as capital, are fixed and cannot be easily changed.

Mechanics of the Long Run

In the long run, firms can make changes to their production processes in several ways. They can invest in new technology or machinery to increase productivity, they can expand or reduce their workforce, and they can even enter or exit the market entirely.

For example, a firm may decide to invest in new machinery that allows it to produce goods more efficiently. This investment may initially be costly, but over time, it can lead to lower production costs and increased profits.

Real-Life Examples of the Long Run

Another example is the automobile industry, where firms are constantly updating their production processes and investing in new technology to improve fuel efficiency and reduce emissions. This long-term focus on innovation has led to the development of electric and hybrid vehicles, which are becoming increasingly popular as consumers demand more environmentally-friendly options.

In microeconomics, the concept of the long run refers to a period of time in which all factors of production can be adjusted. Unlike the short run, where at least one factor of production is fixed, the long run allows for flexibility in adjusting all inputs.

During the long run, firms have the ability to change the size of their production facilities, hire or fire workers, and adopt new technologies. This flexibility enables firms to optimize their production processes and make adjustments based on changing market conditions.

Factors of Production

The factors of production are the inputs used in the production process to create goods and services. These factors include land, labor, capital, and entrepreneurship. In the long run, firms have the ability to adjust all of these factors to achieve their desired level of output.

Land refers to the natural resources used in production, such as land itself, minerals, and water. Labor represents the human effort involved in production, including both physical and mental work. Capital refers to the physical assets used in production, such as machinery, equipment, and buildings. Entrepreneurship refers to the ability to take risks and organize the other factors of production to create a business.

Optimization and Efficiency

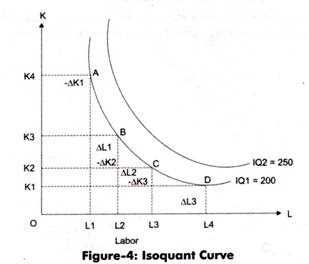

In the long run, firms aim to optimize their production processes and achieve maximum efficiency. By adjusting their factors of production, firms can find the optimal combination that minimizes costs and maximizes output.

For example, a firm may decide to expand its production facilities in order to take advantage of economies of scale. By increasing the scale of production, the firm can spread its fixed costs over a larger output, resulting in lower average costs. This can lead to increased profitability and competitiveness in the market.

Market Conditions

The long run is also influenced by market conditions. Firms need to consider factors such as demand, competition, and technological advancements when making adjustments in the long run.

For instance, if a firm operates in a highly competitive market, it may need to invest in new technologies or improve its production processes to stay competitive. On the other hand, if demand for a firm’s product decreases, it may need to downsize its production facilities or find alternative markets.

| Advantages of the Long Run | Disadvantages of the Long Run |

|---|---|

| – Flexibility in adjusting factors of production | – Time and cost required for adjustments |

| – Ability to optimize production processes | – Uncertainty in market conditions |

| – Potential for increased profitability | – Need for continuous monitoring and adaptation |

Mechanics of the Long Run

One of the key concepts in the mechanics of the long run is the idea of economies of scale. Economies of scale occur when a firm’s average cost of production decreases as it increases its level of output. This can be due to various factors, such as increased specialization, better utilization of resources, or improved technology. As a result, firms in the long run can take advantage of economies of scale to lower their costs and increase their profitability.

Another important aspect of the mechanics of the long run is the concept of entry and exit. In the long run, firms have the ability to enter or exit a market based on their profitability. If a firm is earning above-normal profits, new firms may enter the market to take advantage of the opportunity. On the other hand, if a firm is experiencing losses, it may choose to exit the market to avoid further financial decline. This process of entry and exit helps to ensure that markets remain competitive and efficient in the long run.

Additionally, the long run is also characterized by the ability of firms to make capital investments. Capital investments refer to the purchase of long-lasting assets, such as machinery or equipment, that can improve a firm’s production process. By making capital investments, firms can increase their productivity and efficiency, leading to higher levels of output and potentially greater profits in the long run.

Real-Life Examples of the Long Run

The concept of the long run is a fundamental concept in microeconomics that helps us understand how markets and firms behave over time. To illustrate this concept, let’s look at some real-life examples.

| Example | Description |

|---|---|

| Investment in Research and Development | Companies that invest in research and development are looking to improve their products or develop new ones. These investments often have long-term implications and can take years to yield results. In the long run, companies that consistently invest in research and development are more likely to stay competitive and adapt to changing market conditions. |

| Entry and Exit of Firms | In a competitive market, firms can enter or exit the industry in the long run. For example, if a particular industry becomes profitable, new firms may enter, increasing competition. This can lead to lower prices and better products for consumers. On the other hand, if a firm is not able to compete effectively, it may exit the industry in the long run. |

| Technological Advancements | Technological advancements can have a significant impact on markets and firms in the long run. For example, the rise of e-commerce has transformed the retail industry, leading to the closure of many traditional brick-and-mortar stores. Similarly, advancements in renewable energy technologies have disrupted the energy sector and led to the decline of fossil fuel-based industries. |

| Changes in Consumer Preferences | Consumer preferences can change over time, and firms need to adapt to these changes in the long run. For example, the growing demand for healthier food options has led to the rise of organic and plant-based food companies. Firms that fail to anticipate and respond to these changes may lose market share in the long run. |

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.