What Are Crypto Tokens?

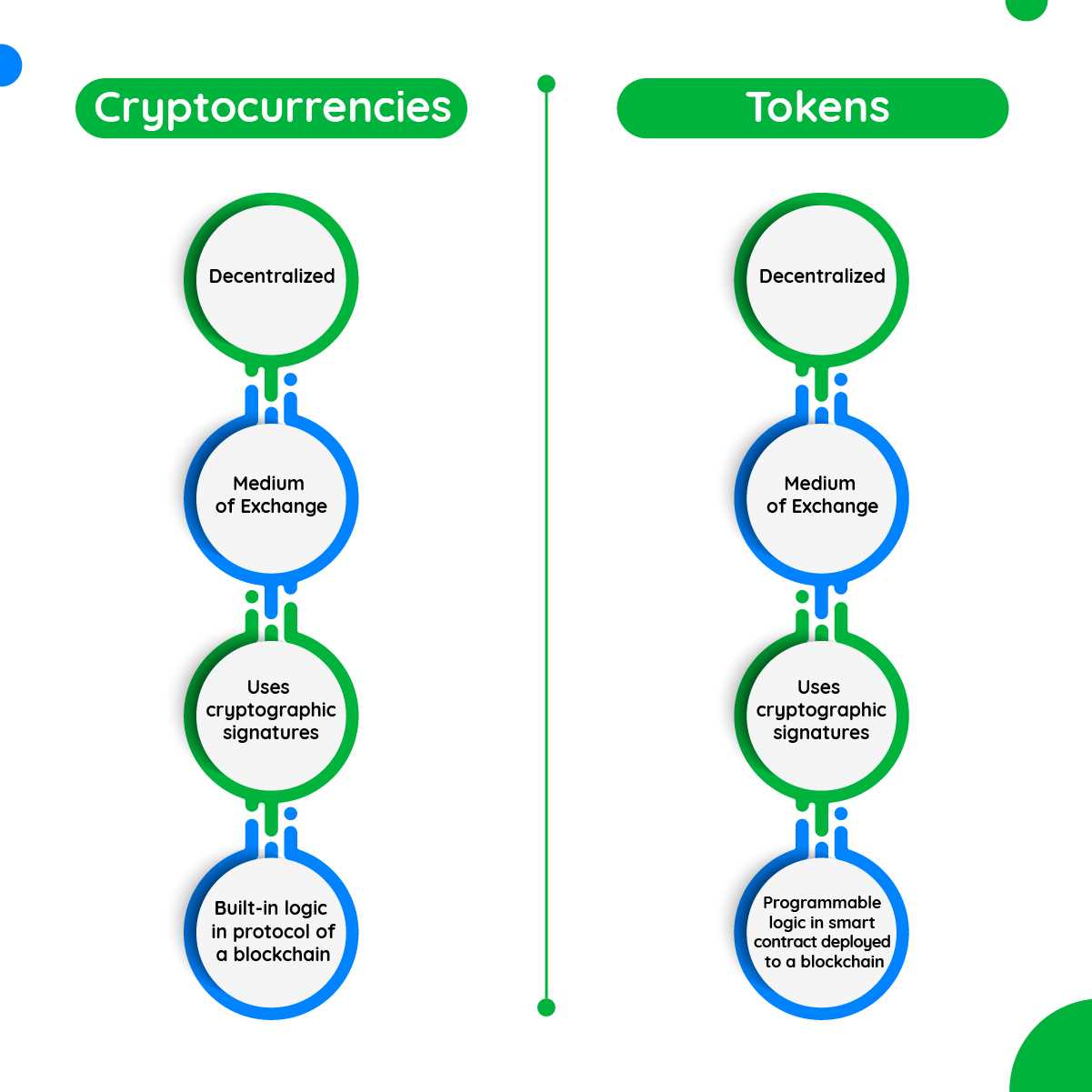

Crypto tokens are digital assets that are created and managed using blockchain technology. They are a type of cryptocurrency that represent a specific asset or utility within a blockchain network. Unlike traditional cryptocurrencies like Bitcoin or Ethereum, which serve as a medium of exchange or store of value, crypto tokens have additional functionality and purpose.

These tokens can represent ownership of a physical or digital asset, such as real estate or intellectual property. They can also be used to access certain services or products within a blockchain ecosystem. Crypto tokens can be created and distributed through initial coin offerings (ICOs) or token sales, where investors can purchase these tokens in exchange for other cryptocurrencies or fiat currencies.

There are different types of crypto tokens, including utility tokens, security tokens, and asset-backed tokens. Utility tokens are used to access a specific service or product within a blockchain network, while security tokens represent ownership in a company or project and may provide dividends or voting rights. Asset-backed tokens are backed by physical assets, such as gold or real estate, and their value is tied to the value of the underlying asset.

Overall, crypto tokens have gained popularity due to their potential for creating new business models and disrupting traditional industries. They offer a way to tokenize real-world assets and enable peer-to-peer transactions without the need for intermediaries. As blockchain technology continues to evolve, the use cases and benefits of crypto tokens are expected to expand, revolutionizing various sectors such as finance, supply chain management, and healthcare.

Definition and Types

In the world of cryptocurrency, a crypto token is a digital asset that represents a certain value or utility within a specific blockchain ecosystem. These tokens are created and managed using blockchain technology, which ensures their security, transparency, and immutability.

There are several types of crypto tokens, each serving a different purpose and function:

1. Utility Tokens:

Utility tokens are designed to provide access to a specific product or service within a blockchain platform. They are often used as a form of payment or to access certain features or functionalities. Utility tokens are not intended to be investments and do not represent ownership in the company or project.

2. Security Tokens:

3. Payment Tokens:

4. Asset Tokens:

Asset tokens represent real-world assets, such as real estate, commodities, or precious metals, on a blockchain. These tokens enable fractional ownership and provide liquidity to traditionally illiquid assets. Asset tokens can be traded and transferred easily, making them a convenient way to invest in and manage assets.

5. Governance Tokens:

Governance tokens are used to participate in the decision-making process within a blockchain ecosystem. Holders of these tokens have the right to vote on proposals and changes to the protocol. Governance tokens are often used in decentralized autonomous organizations (DAOs) to ensure community governance and decision-making.

These are just a few examples of the types of crypto tokens that exist. Each token type has its own unique characteristics and use cases, catering to different needs and purposes within the blockchain industry.

How Do Crypto Tokens Work?

Crypto tokens are digital assets that are created and managed using blockchain technology. They work by leveraging the underlying blockchain infrastructure to enable secure and transparent transactions.

When a crypto token is created, it is assigned a unique identifier and a set of rules that govern its behavior. These rules are defined by a smart contract, which is a self-executing contract with the terms of the agreement directly written into code.

Once the token is created, it can be transferred between parties using the blockchain network. Each transaction is recorded on the blockchain, providing a transparent and immutable record of ownership and transfer history.

Crypto tokens can have various functionalities depending on their purpose. Some tokens, such as utility tokens, are used to access a specific product or service within a blockchain ecosystem. Others, such as security tokens, represent ownership in a real-world asset, such as equity in a company or shares in a fund.

One of the key benefits of crypto tokens is their ability to enable programmable money. Smart contracts can be used to automate certain conditions and actions related to the token. For example, a token can be programmed to automatically distribute dividends to token holders based on predefined rules.

Additionally, crypto tokens can be used to create decentralized applications (DApps) that run on top of a blockchain network. These DApps can leverage the functionality of the underlying blockchain and tokens to create new and innovative applications.

Overall, crypto tokens work by leveraging blockchain technology to create and manage digital assets. They enable secure and transparent transactions, can have various functionalities, and can be used to create programmable money and decentralized applications.

Tokenization Process and Blockchain Technology

Tokenization is the process of converting real-world assets or rights into digital tokens on a blockchain. This process enables the representation and transfer of value in a secure and decentralized manner.

Blockchain technology plays a crucial role in the tokenization process. It provides a transparent and immutable ledger where token transactions can be recorded and verified by multiple participants in the network. This ensures the integrity and security of the tokenized assets.

There are several steps involved in the tokenization process:

1. Asset Identification: The first step is to identify the asset or right that will be tokenized. This can include physical assets like real estate or commodities, as well as intangible assets like intellectual property or financial instruments.

2. Legal Framework: Once the asset is identified, a legal framework is established to define the ownership rights and obligations associated with the tokenized asset. This framework ensures that the token holders have legal protection and rights.

3. Token Creation: The next step is to create the digital tokens that represent the asset. These tokens are typically created using smart contracts, which are self-executing contracts with the terms of the agreement directly written into code. Smart contracts ensure the automatic execution of transactions and the enforcement of the predefined rules.

4. Token Offering: After the tokens are created, they can be offered to investors or users through a token sale or initial coin offering (ICO). This allows individuals to purchase or acquire the tokens and participate in the ownership or use of the underlying asset.

5. Token Trading and Transfer: Once the tokens are in circulation, they can be traded and transferred between individuals on a secondary market. This provides liquidity and allows token holders to buy, sell, or exchange their tokens based on market demand.

6. Asset Management: Throughout the tokenization process, proper asset management is crucial. This includes maintaining accurate records of ownership, ensuring compliance with regulatory requirements, and managing any changes or updates to the tokenized asset.

The tokenization process offers numerous benefits, including increased liquidity, fractional ownership, enhanced transparency, and reduced transaction costs. It also opens up new opportunities for investment and access to previously illiquid assets.

Use Cases and Benefits of Crypto Tokens

Crypto tokens have gained popularity in various industries due to their unique features and benefits. Here are some of the use cases and advantages of using crypto tokens:

- Decentralized Finance (DeFi): Crypto tokens have revolutionized the financial industry by enabling decentralized finance applications. These tokens allow users to participate in lending, borrowing, and trading without the need for intermediaries like banks. DeFi platforms built on blockchain technology provide transparency, security, and efficiency.

- Reward Systems: Many companies and platforms are utilizing crypto tokens as a means of incentivizing their users. By rewarding users with tokens, they encourage active participation, loyalty, and engagement. These tokens can be redeemed for various goods, services, or even other cryptocurrencies.

- Supply Chain Management: Crypto tokens can be used to track and verify the authenticity of products throughout the supply chain. Each product can be assigned a unique token that contains information about its origin, manufacturing process, and distribution. This ensures transparency, reduces counterfeiting, and improves trust between consumers and producers.

- Tokenized Assets: Real-world assets like real estate, art, and commodities can be tokenized using crypto tokens. This allows for fractional ownership, increased liquidity, and easier transferability. Tokenized assets can be traded 24/7 on blockchain-based platforms, eliminating the need for intermediaries and reducing transaction costs.

- Identity Verification: Crypto tokens can be used for identity verification and authentication. By storing personal information on a blockchain in the form of tokens, individuals can have control over their data and share it securely with authorized parties. This can help prevent identity theft and streamline processes that require identity verification.

- Charitable Donations: Crypto tokens have made it easier to donate to charitable causes. By accepting donations in the form of tokens, charities can reduce transaction fees and increase transparency. Donors can also track how their contributions are being used, ensuring that their funds are being utilized for the intended purpose.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.