What is an Irrevocable Beneficiary?

An irrevocable beneficiary is a designation made in a legal document, such as a trust or life insurance policy, that cannot be changed or revoked without the consent of the beneficiary. This means that once an individual is named as an irrevocable beneficiary, they have a legal right to receive the benefits or assets specified in the document.

Irrevocable beneficiaries are typically chosen for their long-term financial security and protection. By designating someone as an irrevocable beneficiary, the individual making the designation ensures that the beneficiary will receive the intended benefits, even if their circumstances change or if the individual making the designation passes away.

Unlike revocable beneficiaries, who can be changed or removed at any time, irrevocable beneficiaries have a higher level of protection and security. This is because the designation of an irrevocable beneficiary requires the consent of the beneficiary themselves, as well as any other parties involved, such as a trustee or insurance company.

Why Choose an Irrevocable Beneficiary?

There are several reasons why someone may choose to designate an irrevocable beneficiary. One common reason is to provide financial support and security for a loved one, such as a spouse or child, in the event of their own death. By designating an irrevocable beneficiary, the individual can ensure that their loved one will receive the intended benefits, even if they are no longer around to provide for them.

Another reason to choose an irrevocable beneficiary is to protect assets from creditors or legal claims. By designating assets as irrevocable, they are no longer considered part of the individual’s estate and are therefore protected from being seized or claimed by creditors or legal judgments.

Additionally, designating an irrevocable beneficiary can help to avoid probate, which is the legal process of distributing assets after death. By bypassing probate, the assets can be transferred directly to the irrevocable beneficiary, saving time and potentially reducing estate taxes.

Conclusion

Key Characteristics of Irrevocable Beneficiaries

An irrevocable beneficiary is a designation made in a legal document, such as a life insurance policy or a trust, that cannot be changed or revoked without the consent of the beneficiary. This means that once someone is named as an irrevocable beneficiary, they have certain rights and protections that cannot be taken away.

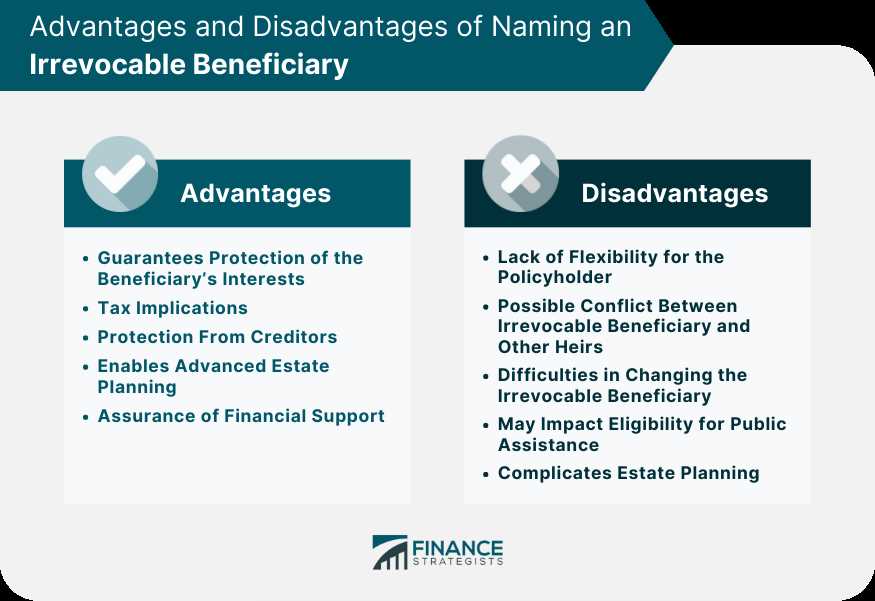

1. Protection from Creditors

One of the key characteristics of an irrevocable beneficiary is that their rights to the assets or benefits cannot be seized by creditors. This means that if the policyholder or trust creator were to face financial difficulties or bankruptcy, the assets designated for the irrevocable beneficiary would be protected.

2. Control over Distribution

Irrevocable beneficiaries also have control over the distribution of the assets or benefits. This means that they can decide how and when they receive the assets, within the terms and conditions set forth in the legal document. They may choose to receive a lump sum payment, regular installments, or even delay the distribution until a certain age or event.

3. Tax Benefits

Irrevocable beneficiaries may also be entitled to certain tax benefits. For example, life insurance proceeds paid to an irrevocable beneficiary are typically not subject to income tax. This can be a significant advantage, especially for larger policies or estates.

4. Protection from Changes in Circumstances

Another important characteristic of irrevocable beneficiaries is that they are protected from changes in circumstances. This means that even if the policyholder or trust creator were to change their mind or face new circumstances, they cannot remove or alter the rights of the irrevocable beneficiary without their consent.

Rights of Irrevocable Beneficiaries

Irrevocable beneficiaries have certain rights that are protected by law. These rights ensure that the beneficiary’s interests are safeguarded and cannot be easily revoked or changed without their consent. Here are some key rights of irrevocable beneficiaries:

1. Right to Receive Benefits:

2. Right to Contest Changes:

Irrevocable beneficiaries have the right to contest any changes made to the policy or trust agreement that may affect their rights or benefits. This includes changes to the designated beneficiary or alterations to the distribution of assets.

3. Right to Information:

Irrevocable beneficiaries have the right to access information about the policy or trust agreement, including details about the assets, investments, and any changes made to the plan. This information allows beneficiaries to monitor their interests and ensure that their rights are being upheld.

4. Right to Sue:

If the rights of an irrevocable beneficiary are violated or if they believe they have been treated unfairly, they have the right to take legal action. This may involve filing a lawsuit against the policyholder, trustee, or any other party involved in the management of the policy or trust.

5. Right to Assign or Transfer:

In some cases, irrevocable beneficiaries may have the right to assign or transfer their rights to another individual or entity. This can be done through a legal process and may require the consent of the policyholder or trustee.

It is important for irrevocable beneficiaries to understand their rights and to seek legal advice if they believe their rights are being violated. By knowing and asserting their rights, beneficiaries can ensure that their interests are protected and that they receive the benefits they are entitled to.

How to Designate an Irrevocable Beneficiary

Designating an irrevocable beneficiary is an important step in estate planning and ensuring that your assets are distributed according to your wishes. Here are the steps to designate an irrevocable beneficiary:

- Review your estate planning documents: Start by reviewing your will, trust, or any other relevant documents that outline the distribution of your assets upon your death. These documents may already include provisions for designating irrevocable beneficiaries.

- Consult with an attorney: If you are unsure about the process or need assistance, it is recommended to consult with an experienced estate planning attorney. They can provide guidance and ensure that your wishes are properly documented.

- Choose the right beneficiary: Consider who you want to designate as an irrevocable beneficiary. This could be a family member, friend, or even a charitable organization. Make sure to discuss your decision with the intended beneficiary to ensure they are willing to take on the responsibility.

- Complete the necessary forms: Depending on the type of asset or account, you may need to complete specific forms provided by the financial institution or insurance company. These forms typically require the beneficiary’s name, contact information, and relationship to you.

- Provide supporting documentation: In some cases, you may need to provide additional documentation to prove the beneficiary’s identity, such as a copy of their identification or a marriage certificate.

- Update your estate planning documents: Once you have designated an irrevocable beneficiary, it is important to update your estate planning documents to reflect this change. This ensures that your wishes are accurately reflected and avoids any potential conflicts or confusion.

- Keep copies of all documents: Make sure to keep copies of all the documents related to designating an irrevocable beneficiary, including the completed forms and any supporting documentation. Store them in a safe place and inform your executor or trusted family member of their location.

By following these steps, you can designate an irrevocable beneficiary and have peace of mind knowing that your assets will be distributed according to your wishes. Remember to regularly review and update your estate planning documents as needed to ensure they remain current and reflect any changes in your circumstances or preferences.

Considerations for Choosing Irrevocable Beneficiaries

Choosing irrevocable beneficiaries is an important decision that should be made carefully and thoughtfully. Here are some key considerations to keep in mind:

1. Trustworthiness: When designating an irrevocable beneficiary, it is crucial to choose someone who is trustworthy and responsible. This person will have control over the assets or benefits and should be someone who will act in the best interest of the intended beneficiaries.

2. Financial Stability: Consider the financial stability of the irrevocable beneficiary. It is important to choose someone who is financially responsible and capable of managing the assets or benefits they will receive. This will help ensure that the intended beneficiaries are properly cared for.

4. Age and Health: Consider the age and health of the potential irrevocable beneficiary. If you are designating a person as an irrevocable beneficiary, it is important to consider their age and health to ensure that they will be able to manage the assets or benefits they will receive.

5. Legal and Tax Implications: Consult with a legal and/or tax professional to understand the legal and tax implications of designating irrevocable beneficiaries. They can provide guidance and help you make informed decisions based on your specific situation.

6. Contingency Plans: Consider creating contingency plans in case the designated irrevocable beneficiary is unable or unwilling to fulfill their role. This can help ensure that your assets or benefits are still distributed according to your wishes.

7. Regular Review: Regularly review and update your irrevocable beneficiary designations. Life circumstances can change, and it is important to ensure that your designations reflect your current wishes and intentions.

By considering these factors and seeking professional advice when necessary, you can make informed decisions when choosing irrevocable beneficiaries. This will help ensure that your assets or benefits are distributed according to your wishes and that the intended beneficiaries are properly cared for.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.