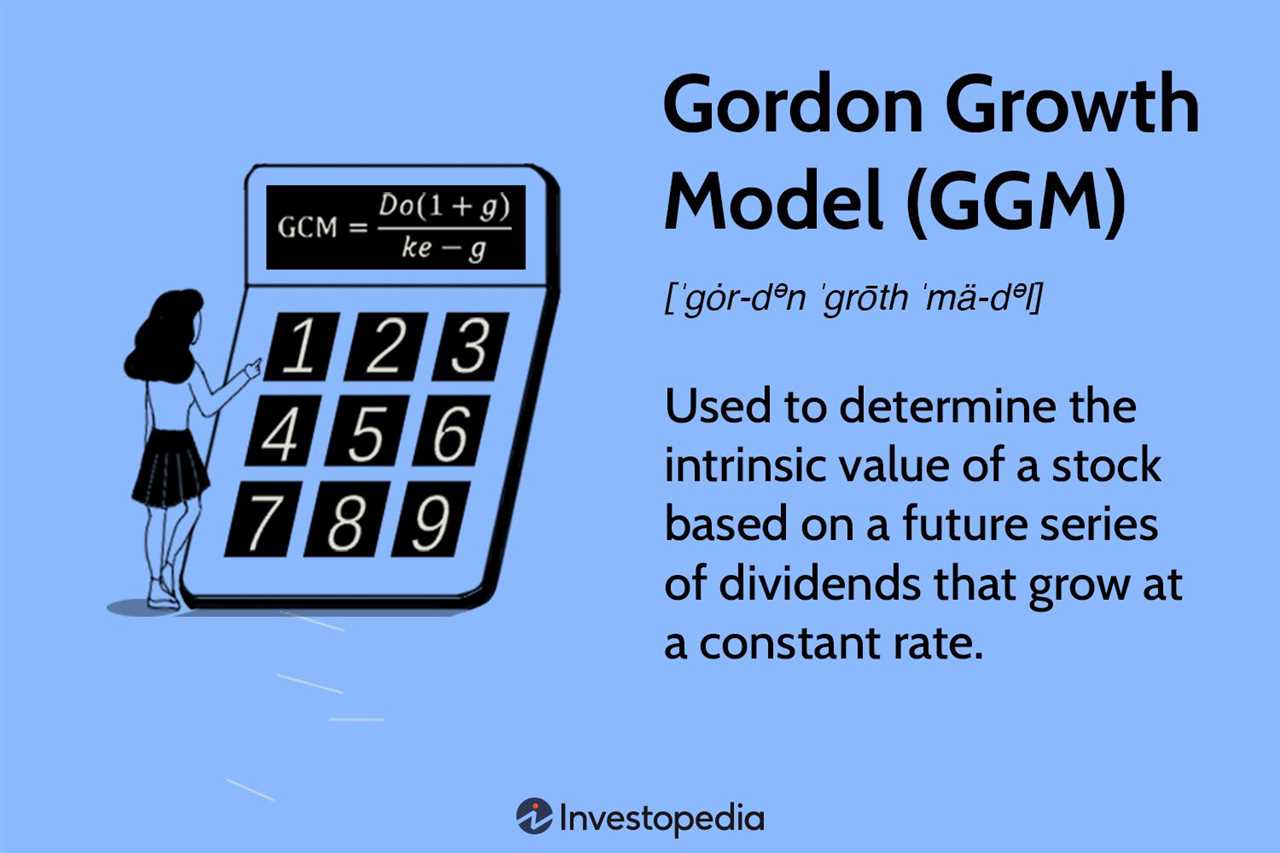

Gordon Growth Model: Example and Formula

The formula for the Gordon Growth Model is:

Where:

- V is the intrinsic value of the stock

- D is the expected dividend per share

- r is the required rate of return

- g is the expected growth rate of dividends

The formula suggests that the intrinsic value of a stock is directly proportional to its expected dividends and inversely proportional to the difference between the required rate of return and the expected growth rate of dividends.

For example, let’s say a stock is expected to pay a dividend of $2 per share, the required rate of return is 10%, and the expected growth rate of dividends is 5%. Using the Gordon Growth Model, we can calculate the intrinsic value of the stock:

Therefore, the intrinsic value of the stock is $40 per share.

The Gordon Growth Model is a method used to estimate the intrinsic value of a stock based on its expected future dividends. It is based on the assumption that the value of a stock is equal to the present value of all its future dividends.

The formula for the Gordon Growth Model is as follows:

Where:

- V is the intrinsic value of the stock

- D is the expected future dividend

- r is the required rate of return

- g is the expected growth rate of dividends

This simplified formula is commonly used in practice.

The required rate of return, r, represents the minimum return an investor expects to earn from the stock. It takes into account the risk-free rate of return and the risk associated with the stock.

By plugging in the expected future dividend, required rate of return, and expected growth rate of dividends into the formula, investors can estimate the intrinsic value of a stock.

It is important to note that the Gordon Growth Model has its limitations. It assumes a constant growth rate of dividends, which may not be realistic for all companies. Additionally, it relies on accurate predictions of future dividends and growth rates, which can be challenging to make.

Despite these limitations, the Gordon Growth Model can still be a useful tool for investors to estimate the intrinsic value of a stock and make informed investment decisions.

Example Calculation

Now let’s walk through an example to illustrate how the Gordon Growth Model is used to calculate the intrinsic value of a stock.

Suppose we are analyzing a company called XYZ Inc. and we want to determine its intrinsic value. XYZ Inc. is expected to pay a dividend of $2 per share next year and has a required rate of return of 10%. The growth rate of XYZ Inc.’s dividends is estimated to be 5%.

To calculate the intrinsic value of XYZ Inc., we can use the Gordon Growth Model formula:

Plugging in the values from our example:

Intrinsic Value = $2 / 0.05

Intrinsic Value = $40

Therefore, according to the Gordon Growth Model, the intrinsic value of XYZ Inc. is $40 per share.

Limitations of the Gordon Growth Model

1. Assumptions

The Gordon Growth Model is based on several assumptions that may not always hold true in the real world. For example, the model assumes that the dividend growth rate is constant and sustainable indefinitely. However, in reality, companies may experience fluctuations in their dividend growth rates due to various factors such as changes in market conditions or business cycles.

2. Accuracy

3. Non-Dividend Paying Companies

4. Market Efficiency

The Gordon Growth Model assumes that the market is efficient and that stock prices reflect all available information. However, in reality, markets may not always be perfectly efficient, and stock prices may deviate from their intrinsic values. This can lead to discrepancies between the model’s estimated value and the actual market price.

5. Sensitivity to Inputs

The Gordon Growth Model is highly sensitive to changes in its inputs. Small changes in the dividend growth rate or the required rate of return can have a significant impact on the estimated value of a stock. Therefore, the model’s results should be interpreted with caution and used as a starting point for further analysis rather than as a definitive valuation.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.