Terminal Capitalization Rate Definition

The terminal cap rate is expressed as a percentage and represents the expected rate of return on an investment property based on its net operating income (NOI) in the final year of ownership. It is used to calculate the future value of the property by dividing the NOI by the terminal cap rate.

The terminal cap rate is influenced by various factors, including the property’s location, market conditions, property type, and risk profile. It is typically lower than the initial cap rate, which is the rate used to value the property at the time of purchase.

Investors use the terminal cap rate to estimate the potential appreciation or depreciation of a property over time. A lower terminal cap rate indicates a higher property value, while a higher terminal cap rate suggests a lower value.

It is important to note that the terminal cap rate is just one of many factors considered when valuing an investment property. Other factors, such as cash flow projections, market trends, and potential risks, should also be taken into account to make a well-informed investment decision.

What is Terminal Capitalization Rate?

The terminal capitalization rate is an important factor in determining the overall return on investment for a real estate property. It is used in conjunction with the net operating income (NOI) to estimate the property’s value. The terminal cap rate takes into account the expected future income and the risk associated with the investment.

How is Terminal Capitalization Rate Calculated?

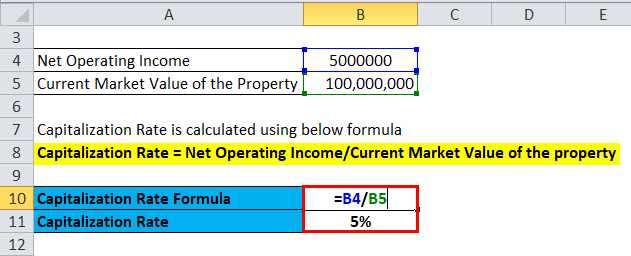

The terminal capitalization rate is calculated by dividing the expected net operating income (NOI) at the end of the holding period by the estimated terminal value of the property. The formula for calculating the terminal cap rate is as follows:

| Terminal Cap Rate | = | Expected NOI at the end of the holding period | / | Estimated terminal value of the property |

|---|

For example, if the expected NOI at the end of the holding period is $100,000 and the estimated terminal value of the property is $1,000,000, the terminal cap rate would be calculated as follows:

| Terminal Cap Rate | = | $100,000 | / | $1,000,000 |

|---|---|---|---|---|

| = | 0.1 |

It is important to note that the terminal cap rate is just one factor to consider when evaluating a real estate investment. Other factors, such as market conditions, location, and property-specific factors, should also be taken into account to make a well-informed investment decision.

How is Terminal Capitalization Rate Calculated?

The Terminal Capitalization Rate is a crucial metric used in real estate investing to estimate the value of a property at the end of its holding period. It is calculated by dividing the Net Operating Income (NOI) at the terminal year by the terminal value of the property.

Formula:

The formula for calculating the Terminal Capitalization Rate is as follows:

Terminal Capitalization Rate = Net Operating Income (NOI) at Terminal Year / Terminal Value

The Net Operating Income (NOI) at the terminal year is the projected income generated by the property in its final year of operation. It is calculated by subtracting the operating expenses from the potential rental income.

The terminal value is the estimated future sale price of the property at the end of the holding period. It is calculated using a capitalization rate and the projected Net Operating Income (NOI) for the terminal year.

Example:

Let’s consider an example to illustrate the calculation of the Terminal Capitalization Rate:

Suppose you are analyzing a commercial property that is expected to generate a Net Operating Income (NOI) of $100,000 in its terminal year. The estimated terminal value of the property is $1,500,000. To calculate the Terminal Capitalization Rate, divide the Net Operating Income (NOI) at the terminal year by the terminal value:

| Net Operating Income (NOI) at Terminal Year | Terminal Value | Terminal Capitalization Rate |

|---|---|---|

| $100,000 | $1,500,000 | $100,000 / $1,500,000 = 0.067 (or 6.7%) |

The Terminal Capitalization Rate is an essential tool for real estate investors as it helps them estimate the future value of a property and make informed investment decisions. It is important to consider various factors such as market conditions, property location, and rental income potential when calculating the Terminal Capitalization Rate.

Terminal Capitalization Rate Calculation Example

Calculating the terminal capitalization rate is an important step in real estate investing. It helps investors determine the value of a property at the end of its holding period. Let’s walk through an example to understand how to calculate the terminal capitalization rate.

Step 1: Determine the Net Operating Income (NOI)

The first step in calculating the terminal capitalization rate is to determine the property’s Net Operating Income (NOI). The NOI is the income generated by the property after deducting operating expenses but before deducting debt service and taxes.

Step 2: Determine the Terminal Value

The next step is to determine the terminal value of the property. The terminal value is the estimated value of the property at the end of its holding period. It is usually calculated using a capitalization rate and the projected Net Operating Income (NOI) at that time.

For example, let’s assume that the projected Net Operating Income (NOI) at the end of the holding period is $80,000. To determine the terminal value, divide the projected Net Operating Income (NOI) by the terminal capitalization rate.

Let’s say the terminal capitalization rate is 8%. The terminal value would be calculated as follows:

Terminal Value = Projected Net Operating Income (NOI) / Terminal Capitalization Rate

Terminal Value = $80,000 / 0.08

Terminal Value = $1,000,000

So, the terminal value of the property would be $1,000,000.

By calculating the terminal capitalization rate and determining the terminal value, real estate investors can estimate the potential future value of a property. This information can be used to make informed investment decisions and assess the profitability of a real estate investment.

Step 1: Determine the Net Operating Income (NOI)

Before calculating the Terminal Capitalization Rate, it is important to determine the Net Operating Income (NOI) of the property. The NOI represents the total income generated by the property after deducting all operating expenses.

To calculate the NOI, you need to consider the rental income, which includes the monthly or annual rent received from tenants. Additionally, you should include any other sources of income related to the property, such as parking fees or laundry facilities.

Next, you need to deduct the operating expenses, which include property taxes, insurance, maintenance costs, utilities, and any other expenses necessary to keep the property running smoothly.

Once you have gathered all the necessary information, you can calculate the Net Operating Income by subtracting the total operating expenses from the total income generated by the property.

It is important to note that the Net Operating Income should be calculated based on the current market conditions and the property’s potential for future income growth.

By accurately determining the Net Operating Income, you can move on to the next step of calculating the Terminal Capitalization Rate.

Step 2: Determine the Terminal Value

Once you have calculated the Net Operating Income (NOI) in Step 1, the next step in determining the Terminal Capitalization Rate is to determine the Terminal Value. The Terminal Value represents the estimated value of the property at the end of the holding period.

To calculate the Terminal Value, you need to consider the expected future growth rate of the property’s income and the appropriate capitalization rate. The future growth rate is typically based on market trends and projections for the specific property type and location.

Here is the formula to calculate the Terminal Value:

Where:

- NOI: Net Operating Income, which was calculated in Step 1.

- Growth Rate: The expected future growth rate of the property’s income.

- Capitalization Rate: The appropriate capitalization rate for the property.

By plugging in the values for NOI, Growth Rate, and Capitalization Rate into the formula, you can determine the Terminal Value.

Once you have determined the Terminal Value, you can proceed to the next steps in calculating the Terminal Capitalization Rate and making informed investment decisions.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.