What is a Regressive Tax?

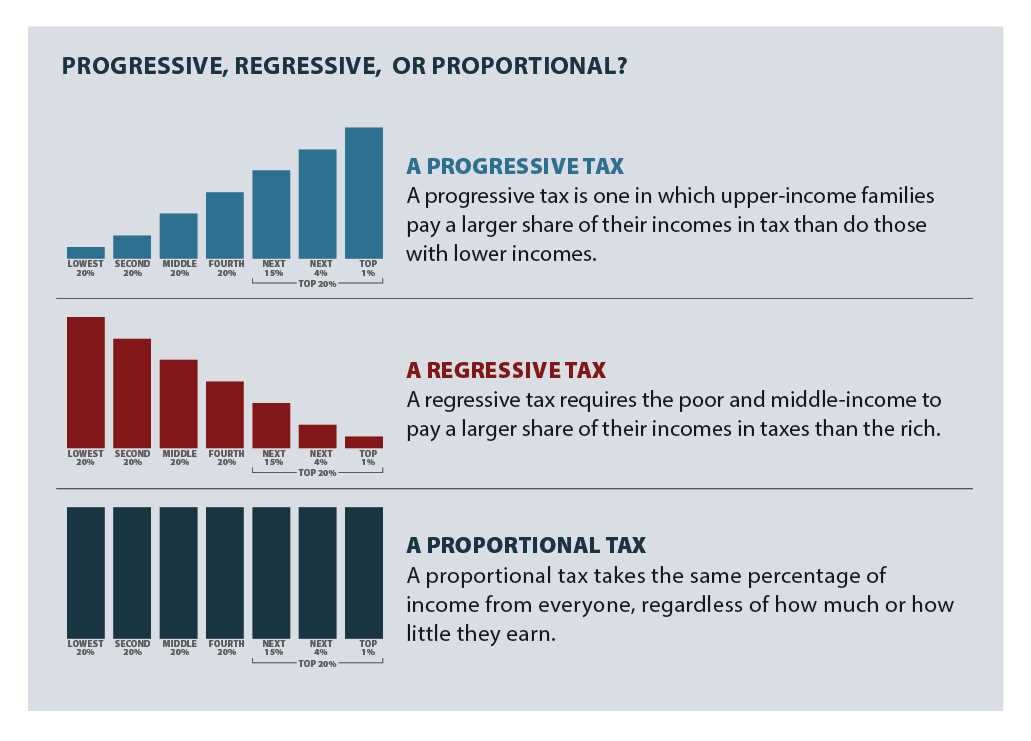

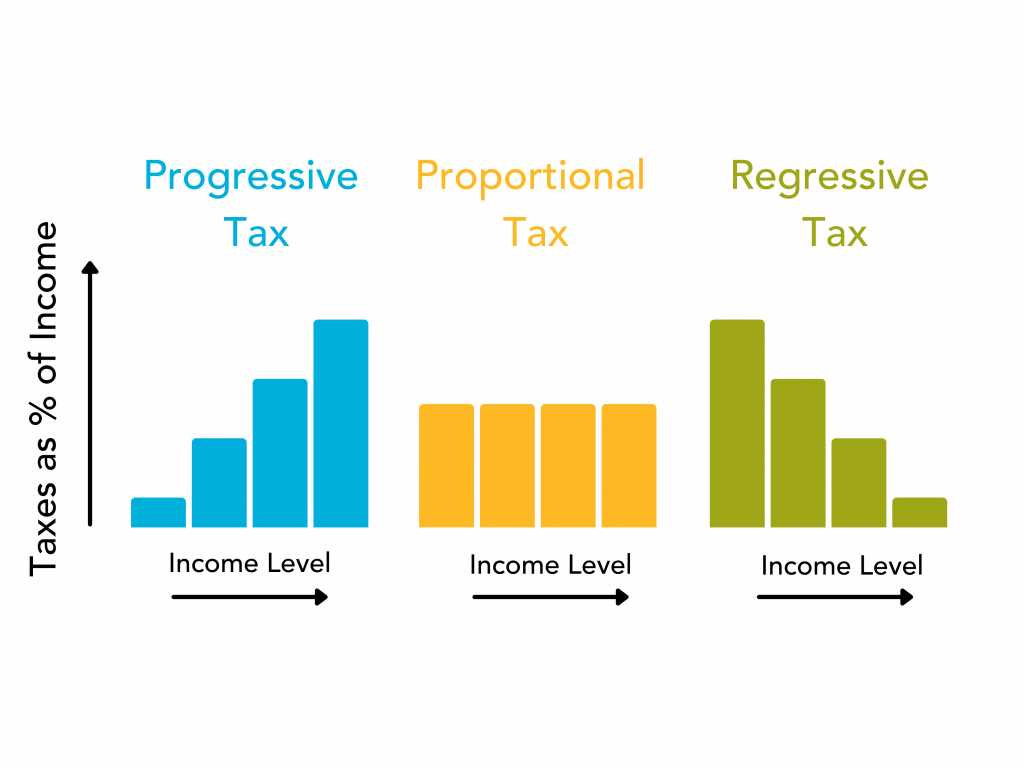

A regressive tax is a type of tax that takes a larger percentage of income from low-income individuals compared to high-income individuals. In other words, as income decreases, the tax burden increases. This is in contrast to a progressive tax, where the tax burden increases as income increases.

Examples of Regressive Taxes

There are several types of regressive taxes that exist. One example is sales tax, which is a tax on goods and services. Sales tax is regressive because it takes a larger percentage of income from low-income individuals, who tend to spend a larger proportion of their income on taxable goods and services.

Another example is payroll tax, which is a tax on wages and salaries. Payroll tax is regressive because it is typically a flat rate, meaning that everyone pays the same percentage regardless of income. This means that low-income individuals pay a larger percentage of their income in payroll taxes compared to high-income individuals.

Impact of Regressive Taxes

The impact of regressive taxes can be significant, particularly for low-income individuals and families. These taxes can place a greater financial burden on those who are already struggling to make ends meet, making it more difficult for them to afford basic necessities and improve their financial situation.

Regressive taxes are a type of taxation system where the tax burden falls disproportionately on lower-income individuals or households. Unlike progressive taxes, which increase as income rises, regressive taxes have a greater impact on those with lower incomes.

Regressive taxes are often criticized for their potential to exacerbate income inequality. Since lower-income individuals typically spend a larger portion of their income on essential goods and services, such as food and housing, regressive taxes can place a heavier burden on them compared to higher-income individuals who can afford to allocate a smaller percentage of their income towards these necessities.

One example of a regressive tax is sales tax. Sales tax is a percentage added to the price of goods and services at the point of sale. Since lower-income individuals tend to spend a higher proportion of their income on taxable items, they end up paying a larger portion of their income in sales tax compared to higher-income individuals.

Effects on Consumer Behavior

The regressive nature of these taxes can also influence consumer behavior. Lower-income individuals may be more likely to reduce their spending on non-essential items or seek lower-cost alternatives to avoid paying higher taxes. This can have a negative impact on businesses that rely on consumer spending, particularly those that cater to lower-income individuals.

Additionally, regressive taxes can discourage savings and investment among lower-income individuals. Since they have less disposable income after paying taxes, it becomes more challenging for them to save for the future or invest in education or business opportunities. This can further perpetuate income inequality and hinder social mobility.

Policy Considerations

When implementing regressive taxes, policymakers must carefully consider the potential consequences on income distribution and economic growth. While regressive taxes may generate revenue for the government, they can also have unintended negative effects on lower-income individuals and the overall economy.

Some policymakers argue for the implementation of progressive tax systems, where higher-income individuals pay a higher percentage of their income in taxes. This approach aims to distribute the tax burden more equitably and reduce income inequality. However, implementing progressive tax systems requires careful consideration of economic factors and potential impacts on investment and economic growth.

Types of Regressive Taxes

Regressive taxes are a form of taxation where the tax burden falls more heavily on low-income individuals compared to high-income individuals. There are several types of regressive taxes that governments may implement:

Sales Tax

A sales tax is a tax imposed on the sale of goods and services. It is typically a percentage of the purchase price and is added to the total cost of the item or service. Sales taxes are considered regressive because low-income individuals tend to spend a higher proportion of their income on goods and services compared to high-income individuals. Therefore, a sales tax takes a larger percentage of their income, resulting in a greater burden.

Excise Tax

An excise tax is a tax levied on specific goods or services, such as alcohol, tobacco, gasoline, or luxury items. Excise taxes are often regressive because they tend to be flat taxes, meaning that the tax rate is the same for everyone regardless of income. Since low-income individuals may spend a larger proportion of their income on these goods and services, they end up paying a higher percentage of their income in excise taxes compared to high-income individuals.

Property Tax

Property taxes are taxes imposed on the value of real estate or personal property. While property taxes are generally considered progressive because they are based on the value of the property, they can also be regressive in certain situations. For example, if property tax rates are not adjusted for income levels, low-income homeowners may end up paying a larger proportion of their income in property taxes compared to high-income homeowners.

Flat Income Tax

A flat income tax is a tax system where all individuals, regardless of their income level, are taxed at the same rate. While a flat income tax may seem fair on the surface, it can be regressive in practice. Since low-income individuals typically spend a larger proportion of their income on basic necessities, such as housing and food, a flat income tax takes a larger percentage of their income compared to high-income individuals.

It is important to note that regressive taxes can have a significant impact on low-income individuals and may contribute to income inequality. Governments often implement measures to mitigate the regressive nature of these taxes, such as providing tax credits or exemptions for low-income individuals. However, the overall impact of regressive taxes on income distribution remains a topic of debate and policy consideration.

Examining Different Forms of Regressive Taxation

Sales Tax

One common form of regressive taxation is sales tax. Sales tax is a consumption tax imposed on goods and services at the point of sale. It is typically a fixed percentage of the purchase price. Since lower-income individuals tend to spend a larger proportion of their income on goods and services, sales tax can have a disproportionate impact on them. This means that a higher percentage of their income goes towards paying sales tax compared to higher-income individuals.

Excise Tax

Another form of regressive taxation is excise tax. Excise tax is a tax levied on specific goods, such as alcohol, tobacco, gasoline, and luxury items. These taxes are often considered regressive because lower-income individuals tend to spend a larger proportion of their income on these goods. As a result, they end up paying a higher percentage of their income in excise taxes compared to higher-income individuals.

Flat Income Tax

A flat income tax is another example of regressive taxation. In a flat income tax system, all individuals, regardless of their income level, are taxed at the same rate. This means that lower-income individuals are burdened with a higher percentage of their income compared to higher-income individuals. While a flat income tax may seem fair on the surface, it can have a significant impact on lower-income individuals who rely on a larger proportion of their income for basic necessities.

Property Tax

Property tax is another form of regressive taxation. Property tax is levied on the value of real estate properties owned by individuals. Since the value of real estate properties tends to be higher in affluent areas, higher-income individuals often own more valuable properties and therefore pay higher property taxes. On the other hand, lower-income individuals who own less valuable properties still have to pay property taxes, but the tax burden is relatively higher for them compared to their income level.

Impact on Different Segments of the Population

The impact of regressive taxation on different segments of the population is significant. Lower-income individuals, who already have limited financial resources, bear a heavier burden in terms of their income compared to higher-income individuals. This can lead to increased income inequality and hinder economic mobility for those at the lower end of the income spectrum.

Furthermore, regressive taxation can have a disproportionate impact on vulnerable populations, such as low-income families, the elderly, and individuals with disabilities. These individuals may struggle to meet their basic needs when a larger portion of their income is allocated towards paying regressive taxes.

Impact of Regressive Taxes

One of the main consequences of regressive taxes is that they exacerbate income inequality. Since low-income earners have to allocate a larger portion of their income to pay these taxes, they have less disposable income available for basic necessities and improving their standard of living. On the other hand, high-income earners, who can afford to pay a larger amount of taxes, are not as affected by regressive taxes.

Regressive taxes also have a regressive effect on consumption patterns. When individuals have to spend a higher percentage of their income on taxes, they have less money available to spend on goods and services. This can lead to a decrease in consumer spending, which can have a negative impact on the economy as a whole.

Furthermore, regressive taxes can hinder economic mobility. Since low-income earners are burdened with a higher tax rate, it becomes more difficult for them to save money and invest in education or other opportunities that can help them improve their financial situation. This can perpetuate the cycle of poverty and limit upward mobility.

Another consequence of regressive taxes is the potential for social unrest. When a significant portion of the population feels unfairly burdened by taxes, it can lead to dissatisfaction and protests. This can create social and political instability, which can have long-term negative effects on a country’s economy and social fabric.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.