Net Present Value Rule: Definition

The Net Present Value (NPV) Rule is a financial concept used in business to evaluate the profitability of an investment or project. It is based on the principle that the value of money decreases over time, so future cash flows are worth less than the same amount of money today.

According to the NPV Rule, a project or investment is considered profitable if the net present value of its cash flows is positive. The net present value is calculated by discounting the future cash flows to their present value and subtracting the initial investment.

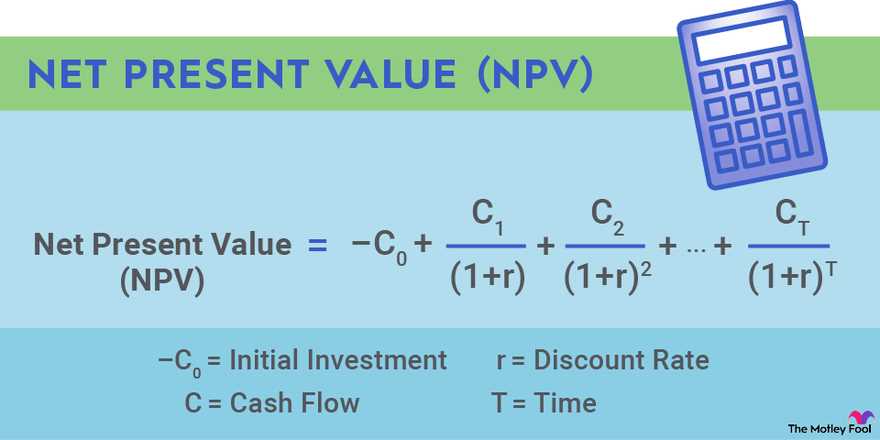

The formula for calculating the net present value is:

Where:

- CF0 is the initial investment

- CF1, CF2, …, CFn are the expected cash flows for each period

- r is the discount rate, which represents the cost of capital or the minimum required rate of return

If the net present value is positive, it indicates that the project or investment is expected to generate more cash flows than the initial investment, making it financially viable. On the other hand, if the net present value is negative, it suggests that the project is not expected to generate enough cash flows to cover the initial investment and may not be worth pursuing.

The NPV Rule is widely used in financial analysis and decision-making, as it helps businesses assess the profitability and feasibility of investment opportunities. By comparing the net present values of different projects or investments, companies can prioritize and allocate their resources effectively.

The Net Present Value (NPV) rule is a financial concept used to evaluate the profitability of an investment or project. It is based on the principle that the value of money decreases over time due to factors such as inflation and the opportunity cost of investing in alternative projects.

How does the NPV rule work?

The NPV rule calculates the present value of expected cash flows from an investment and compares it to the initial cost of the investment. If the NPV is positive, it indicates that the investment is expected to generate more cash inflows than the initial cost, making it a profitable venture. On the other hand, if the NPV is negative, it suggests that the investment is expected to generate less cash inflows than the initial cost, indicating a potential loss.

The NPV rule takes into account the time value of money by discounting future cash flows to their present value using a discount rate. The discount rate represents the minimum rate of return required by an investor to compensate for the risk and time value of money. The higher the discount rate, the lower the present value of future cash flows, and vice versa.

Why is the NPV rule important?

The NPV rule is an important tool for decision-making in business and finance. It helps managers and investors assess the profitability and feasibility of investment projects, acquisitions, and other financial decisions. By considering the time value of money, the NPV rule provides a more accurate measure of the potential return on investment and allows for better comparisons between different projects or investment opportunities.

Additionally, the NPV rule helps in determining the optimal allocation of resources by identifying projects that are expected to generate the highest returns. It enables companies to prioritize investments based on their potential profitability and align their capital allocation with their strategic goals.

Limitations of the NPV rule

While the NPV rule is a widely used financial tool, it has some limitations. One limitation is that it relies on accurate estimation of future cash flows, which can be challenging, especially for long-term projects. Changes in market conditions, competition, and other factors can significantly impact the expected cash flows and, consequently, the NPV calculation.

Another limitation is that the NPV rule assumes that cash flows are reinvested at the discount rate, which may not always be realistic. In practice, the actual reinvestment rate may be higher or lower, leading to deviations from the estimated NPV.

Despite these limitations, the NPV rule remains a valuable tool for evaluating investment opportunities and making informed financial decisions. It provides a systematic approach to assess the profitability and feasibility of projects, taking into account the time value of money and the expected cash flows.

Net Present Value Rule: Use and Example

The Net Present Value (NPV) rule is a financial concept used in business to determine the profitability of an investment or project. It takes into account the time value of money, which means that a dollar received in the future is worth less than a dollar received today. By using the NPV rule, businesses can evaluate whether an investment will generate positive or negative returns.

How to Use the Net Present Value Rule

To use the NPV rule, you need to follow these steps:

- Identify the initial investment: Determine the amount of money that will be invested in the project or investment.

- Estimate future cash flows: Forecast the expected cash flows that the investment will generate over its lifetime.

- Calculate the discount rate: Determine the appropriate discount rate to use, which reflects the risk and opportunity cost of the investment.

- Calculate the present value of each cash flow: Apply the discount rate to each future cash flow to calculate its present value.

- Sum up the present values: Add up all the present values of the cash flows to get the net present value.

- Evaluate the net present value: If the net present value is positive, the investment is considered profitable. If it is negative, the investment is not expected to generate a positive return.

Example of Net Present Value Rule

Let’s say a company is considering an investment in a new manufacturing facility. The initial investment is $1,000,000, and the expected cash flows over the next five years are as follows:

- Year 1: $300,000

- Year 2: $400,000

- Year 3: $500,000

- Year 4: $600,000

- Year 5: $700,000

The company decides to use a discount rate of 10% to reflect the risk and opportunity cost of the investment. By applying the discount rate to each cash flow and summing up the present values, the net present value of the investment is calculated to be $379,080. Since the net present value is positive, the investment is considered profitable.

Overall, the net present value rule is a valuable tool for businesses to assess the profitability of investments and make informed financial decisions. By considering the time value of money, businesses can determine whether an investment will generate positive returns and contribute to their overall financial success.

Applying the Net Present Value Rule in Business

What is the Net Present Value Rule?

The Net Present Value (NPV) rule is a financial concept that calculates the present value of future cash flows generated by an investment, taking into account the time value of money. It compares the present value of cash inflows to the present value of cash outflows, allowing businesses to assess the profitability of an investment.

The NPV rule states that an investment is considered worthwhile if the NPV is positive, meaning that the present value of cash inflows exceeds the present value of cash outflows. Conversely, if the NPV is negative, the investment is deemed unprofitable.

How to Calculate the Net Present Value?

To calculate the NPV, businesses need to consider the initial investment cost, the expected cash inflows, and the discount rate. The discount rate represents the minimum acceptable rate of return for the investment.

The formula for calculating the NPV is as follows:

- Estimate the expected cash inflows for each period of the investment.

- Discount each cash inflow to its present value using the discount rate.

- Sum up the present values of all cash inflows.

- Subtract the initial investment cost from the sum of present values.

If the resulting NPV is positive, the investment is considered profitable. If it is negative, the investment is not expected to generate sufficient returns to cover the initial investment cost.

Benefits of Using the Net Present Value Rule

The NPV rule offers several benefits for businesses when making investment decisions:

- It accounts for the time value of money, recognizing that a dollar received in the future is worth less than a dollar received today.

- It considers all cash flows associated with an investment, including both inflows and outflows.

- It provides a clear and quantitative measure of the potential profitability of an investment.

- It helps businesses prioritize and compare different investment opportunities.

By using the NPV rule, businesses can make informed decisions about whether to pursue an investment, helping them allocate their resources effectively and maximize their returns.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.