What is Net Asset Value Per Share (NAVPS)?

Net Asset Value Per Share (NAVPS) is a financial metric used to calculate the value of a company’s assets per outstanding share of its common stock. It is commonly used by investors and analysts to assess the underlying value of a company’s shares.

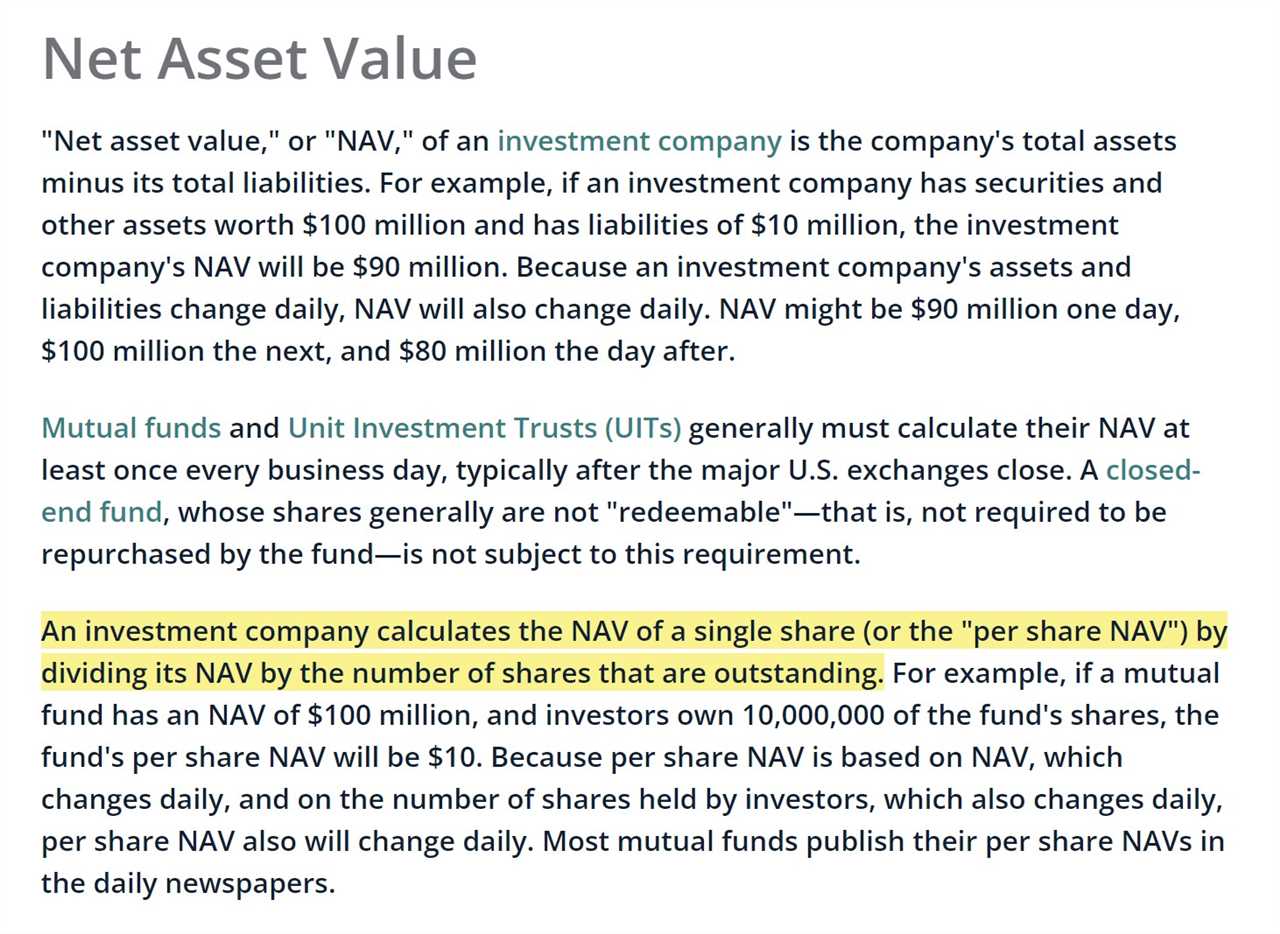

NAVPS is calculated by dividing the total net assets of a company by the number of outstanding shares. Net assets include all of a company’s assets, such as cash, investments, and property, minus its liabilities, such as debt and other obligations.

NAVPS provides investors with a measure of the intrinsic value of a company’s shares. It helps them determine whether a stock is undervalued or overvalued in the market. If the NAVPS is higher than the current market price per share, it suggests that the stock may be undervalued and could be a good investment opportunity. Conversely, if the NAVPS is lower than the market price per share, it may indicate that the stock is overvalued and could be a potential risk.

NAVPS is particularly useful in the analysis of mutual funds and other investment vehicles. It allows investors to compare the performance of different funds and assess their relative value. By comparing the NAVPS of different funds, investors can determine which fund is generating the highest returns relative to its underlying assets.

In addition to its use in investment analysis, NAVPS is also important for financial reporting purposes. Companies are required to calculate and disclose their NAVPS in their financial statements. This provides transparency and allows investors to make informed decisions based on the company’s financial health.

Overall, Net Asset Value Per Share (NAVPS) is a key metric that helps investors and analysts assess the value of a company’s shares. It provides a measure of the intrinsic value of a stock and is used to determine whether a stock is undervalued or overvalued in the market.

Formula for Calculating Net Asset Value Per Share (NAVPS)

Net Asset Value Per Share (NAVPS) is a financial ratio that is used to measure the value of a company’s assets per share of its outstanding common stock. It is calculated by dividing the net asset value of the company by the number of outstanding shares.

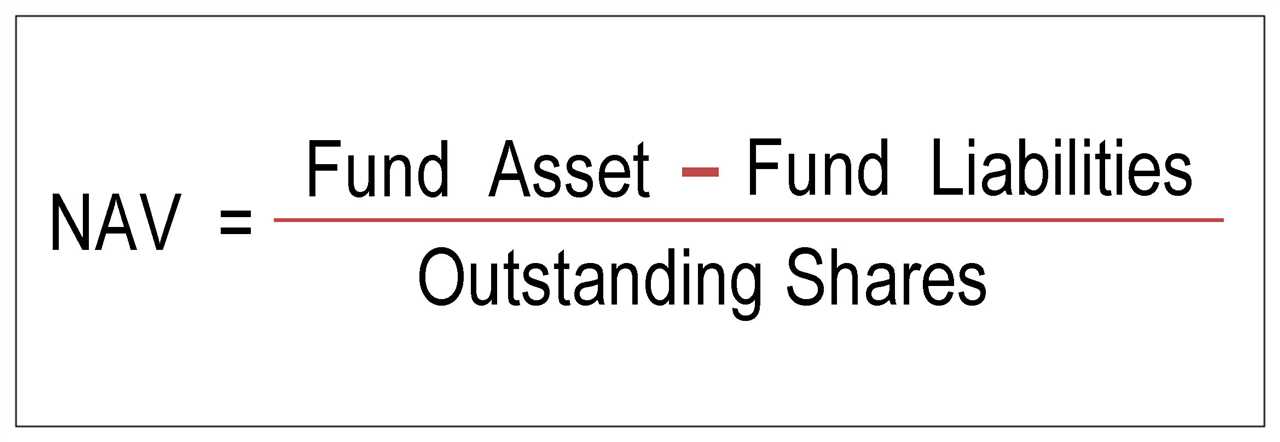

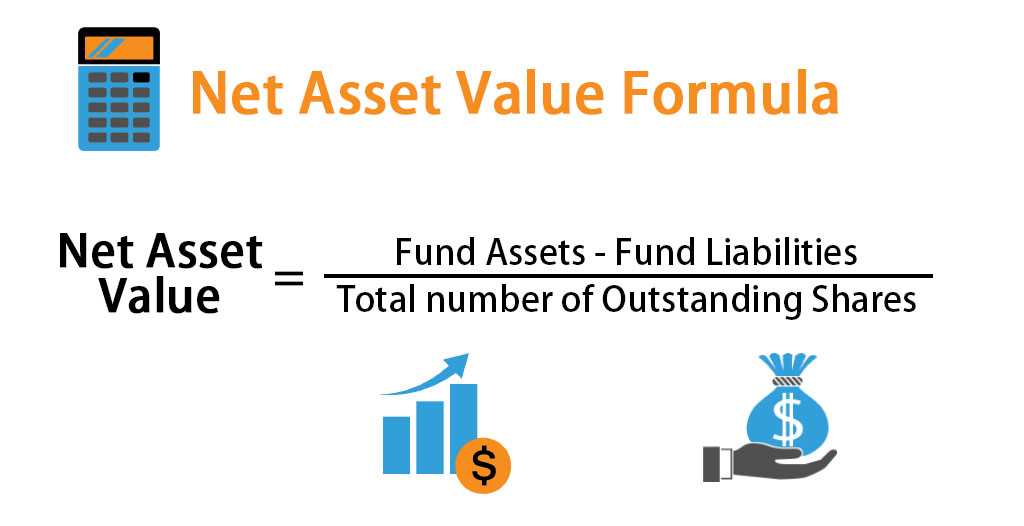

The formula for calculating Net Asset Value Per Share (NAVPS) is:

Where:

- Total Assets refers to the total value of all the assets owned by the company, including cash, investments, property, and equipment.

- Total Liabilities refers to the total value of all the debts and obligations owed by the company, including loans, accounts payable, and accrued expenses.

- Number of Outstanding Shares refers to the total number of shares of common stock that are owned by shareholders and are available for trading on the stock market.

The Net Asset Value Per Share (NAVPS) ratio is commonly used by investors to assess the value of a company’s stock. A higher NAVPS indicates that the company has more assets per share, which can be seen as a positive sign for investors. On the other hand, a lower NAVPS may indicate that the company has more liabilities or fewer assets per share, which can be seen as a negative sign.

It is important to note that the NAVPS is just one of many financial ratios that investors use to evaluate a company’s financial health and performance. It should be used in conjunction with other ratios and factors to make informed investment decisions.

Uses of Net Asset Value Per Share (NAVPS)

Net Asset Value Per Share (NAVPS) is a key metric used by investors and analysts to evaluate the performance and value of a mutual fund or investment company. It provides important insights into the financial health and profitability of the company. Here are some of the main uses of NAVPS:

1. Investment Decision Making

NAVPS is often used by investors to make informed investment decisions. By comparing the NAVPS of different mutual funds or investment companies, investors can assess the relative value and potential return of each option. A higher NAVPS may indicate a more profitable and well-managed investment, while a lower NAVPS may suggest potential risks or underperformance.

2. Performance Evaluation

NAVPS is a useful tool for evaluating the performance of a mutual fund or investment company over time. By tracking the changes in NAVPS, investors can assess the growth or decline in the value of their investment. This information can help investors determine whether the fund or company is meeting their financial goals and expectations.

3. Benchmarking

NAVPS can also be used for benchmarking purposes. Investors can compare the NAVPS of a mutual fund or investment company to a relevant market index or industry average to gauge its performance relative to the broader market. This allows investors to assess whether the fund or company is outperforming or underperforming its peers.

4. Portfolio Management

NAVPS is an important factor in portfolio management. By considering the NAVPS of different investments, portfolio managers can make informed decisions about asset allocation and diversification. They can also use NAVPS to monitor the performance of individual investments within the portfolio and make adjustments as needed.

5. Financial Reporting

NAVPS is a key component of financial reporting for mutual funds and investment companies. It is typically included in financial statements and reports to provide shareholders and stakeholders with an accurate measure of the company’s net asset value per share. This information is important for transparency and accountability.

| Uses of NAVPS | Description |

|---|---|

| Investment Decision Making | Helps investors assess the value and potential return of different investment options. |

| Performance Evaluation | Allows investors to track the growth or decline in the value of their investment. |

| Benchmarking | Enables investors to compare the performance of a fund or company to market indices or industry averages. |

| Portfolio Management | Aids in asset allocation, diversification, and monitoring of individual investments. |

| Financial Reporting | Provides shareholders and stakeholders with an accurate measure of the company’s net asset value per share. |

Overall, Net Asset Value Per Share (NAVPS) is a versatile metric that serves multiple purposes in the evaluation and management of mutual funds and investment companies. It provides valuable insights into the financial performance and value of these entities, helping investors make informed decisions and assess the overall health of their investments.

Importance of Net Asset Value Per Share (NAVPS) in Financial Ratios

The Net Asset Value Per Share (NAVPS) is a crucial financial ratio that provides investors with valuable information about the value of a company’s assets per share of its outstanding stock. It is an important indicator of a company’s financial health and can be used to assess the performance and value of an investment.

One of the main uses of NAVPS is in the valuation of mutual funds and exchange-traded funds (ETFs). NAVPS is calculated by dividing the total value of a fund’s assets by the number of shares outstanding. This allows investors to determine the price at which they can buy or sell shares of the fund. It also provides a benchmark for comparing the performance of different funds.

NAVPS is also used in the valuation of real estate investment trusts (REITs). REITs are companies that own and manage income-generating properties, such as office buildings, shopping centers, and apartment complexes. By calculating the NAVPS of a REIT, investors can determine the value of the company’s underlying real estate assets.

Additionally, NAVPS is used in the valuation of closed-end funds and private equity funds. Closed-end funds are investment funds that issue a fixed number of shares and trade on an exchange, while private equity funds are investment funds that invest in privately held companies. In both cases, NAVPS provides investors with a measure of the fund’s underlying asset value.

Furthermore, NAVPS is an important metric for individual investors who are looking to assess the value of their investment portfolios. By calculating the NAVPS of their holdings, investors can determine the value of their investments on a per-share basis. This can be useful for making investment decisions, such as buying or selling shares, and for tracking the performance of their investments over time.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.