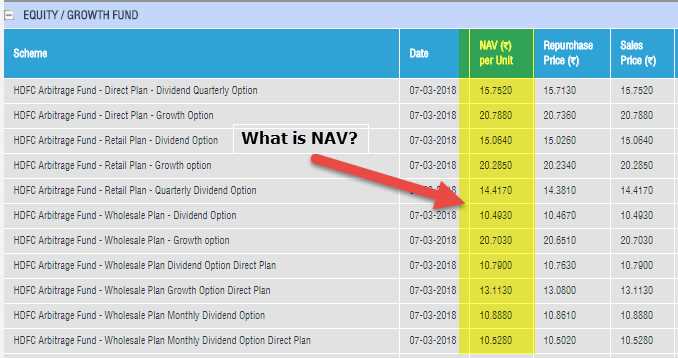

Net Asset Value (NAV): Definition, Formula, Example, and Uses

Net Asset Value (NAV) is a financial metric used to determine the value of a mutual fund or an investment company. It represents the per-share value of the fund’s assets minus its liabilities. NAV is calculated daily and is an important indicator for investors to evaluate the performance of a mutual fund.

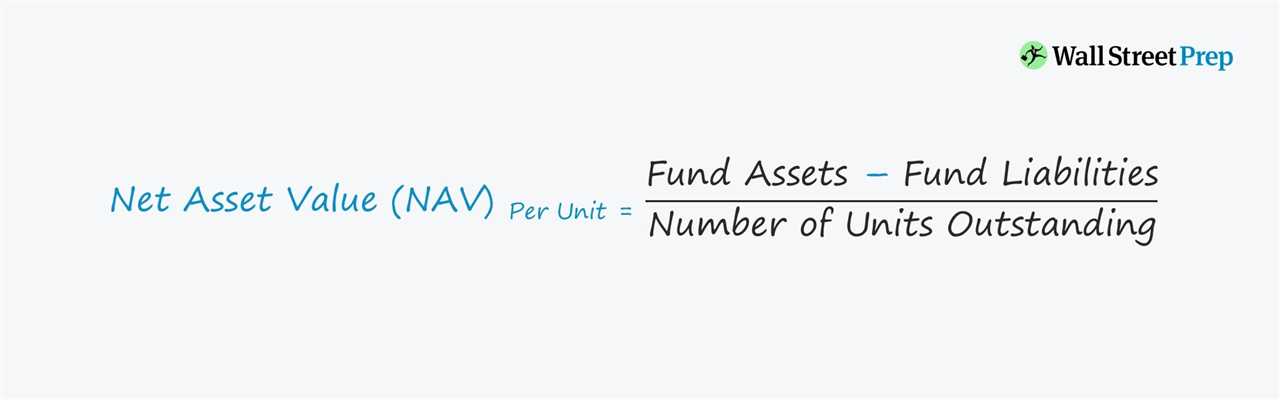

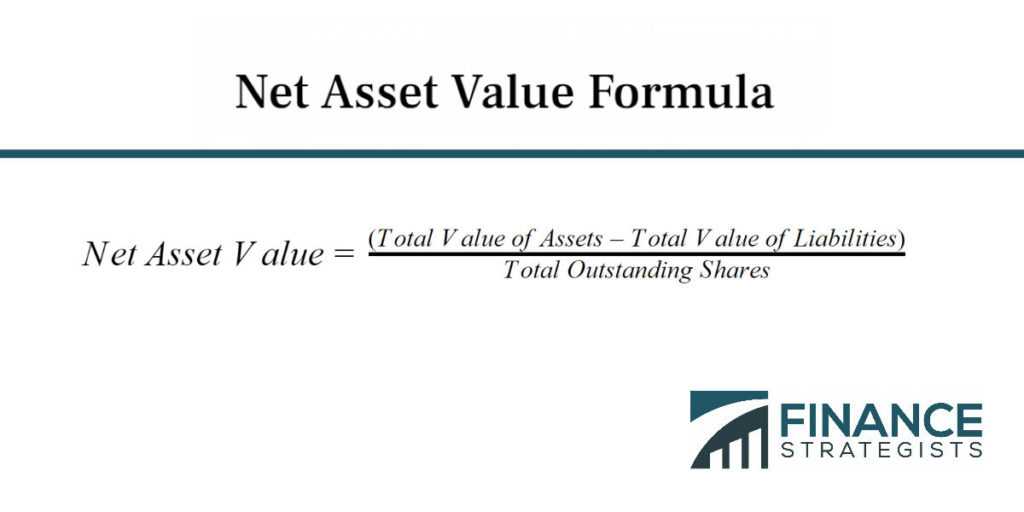

The formula for calculating NAV is simple:

For example, let’s consider a mutual fund with total assets of $10 million and total liabilities of $2 million. If the number of outstanding shares is 1 million, the NAV would be calculated as follows:

| NAV = $8 per share |

Investors can use NAV to determine the value of their investment in the mutual fund. If the NAV increases over time, it indicates that the fund’s assets are growing and the investment is performing well. On the other hand, if the NAV decreases, it may suggest a decline in the fund’s performance.

NAV is also used to calculate the purchase and redemption price of mutual fund shares. When investors buy shares, they typically pay the NAV plus any applicable fees. When they sell shares, they receive the NAV minus any applicable fees.

What is Net Asset Value (NAV)?

Net Asset Value (NAV) is a financial metric used to determine the value of a mutual fund, exchange-traded fund (ETF), or other investment vehicle. It represents the per-share value of the fund’s assets minus its liabilities. NAV is calculated by dividing the total value of the fund’s assets by the number of outstanding shares.

NAV is an important measure for investors because it provides insight into the underlying value of their investment. It allows investors to assess the performance of a fund and make informed decisions about buying or selling shares.

The formula for calculating NAV is relatively simple. It is calculated by subtracting the fund’s liabilities from its assets and dividing the result by the number of outstanding shares. The resulting value represents the NAV per share.

| Net Asset Value (NAV) Formula: |

|---|

For example, if a mutual fund has total assets of $100 million, total liabilities of $10 million, and 10 million outstanding shares, the NAV would be calculated as follows:

| Total Assets: | $100,000,000 |

|---|---|

| Total Liabilities: | $10,000,000 |

| Number of Outstanding Shares: | 10,000,000 |

| NAV: |

Therefore, the NAV per share of the mutual fund would be $9.

Investors use NAV to determine the value of their investment and to compare the performance of different funds. A higher NAV indicates a higher value per share, but it does not necessarily mean a better investment. Other factors, such as expense ratios, historical performance, and investment strategy, should also be considered when evaluating a fund.

Formula for Calculating Net Asset Value (NAV)

Net Asset Value (NAV) is a financial metric used to determine the value of a mutual fund or an investment company. It represents the per-share value of the fund’s assets minus its liabilities. The NAV calculation is essential for investors as it helps them understand the worth of their investment and make informed decisions.

The formula for calculating Net Asset Value (NAV) is:

| NAV | = | / | Total Number of Outstanding Shares |

The market value of assets refers to the total value of all the securities, cash, and other assets held by the mutual fund. Liabilities include any debts or obligations that the fund has, such as management fees or expenses.

To calculate the NAV, subtract the total liabilities from the market value of assets and then divide the result by the total number of outstanding shares. The outcome will give you the NAV per share, which represents the value of each share in the mutual fund.

For example, let’s assume a mutual fund has a market value of assets of $10 million and liabilities of $1 million. The total number of outstanding shares is 1 million. Using the formula, we can calculate the NAV as follows:

| NAV | = | / | 1,000,000 |

| NAV | = | $9 |

Therefore, the NAV per share for this mutual fund is $9.

The NAV calculation is crucial for investors as it provides them with a benchmark to evaluate the performance of their investment. If the NAV increases over time, it indicates that the fund’s assets are growing, and the investment is performing well. Conversely, a decreasing NAV may suggest a decline in the fund’s performance.

Investors can also use the NAV to compare different mutual funds and make informed investment decisions. They can analyze the NAV per share of various funds and choose the one that aligns with their investment goals and risk tolerance.

Example and Uses of Net Asset Value (NAV)

Net Asset Value (NAV) is a crucial metric used in the financial industry, particularly in the evaluation of mutual funds. It represents the per-share value of a mutual fund’s assets minus its liabilities. The NAV is calculated daily and provides investors with an accurate measure of the fund’s worth.

One of the primary uses of NAV is to determine the purchase and redemption price of mutual fund shares. When an investor wants to buy or sell shares of a mutual fund, the NAV is used to calculate the price at which the transaction will occur. The NAV allows investors to know the exact value of their investment at any given time.

Additionally, NAV is used by investors to assess the performance of a mutual fund. By comparing the NAV of a fund over different time periods, investors can analyze the fund’s growth or decline in value. This information helps investors make informed decisions about whether to buy, hold, or sell their mutual fund shares.

NAV is also used by fund managers to determine the fees and expenses associated with a mutual fund. Management fees are often calculated as a percentage of the fund’s NAV. By using the NAV as a reference point, fund managers can accurately calculate the fees and expenses that will be charged to investors.

Furthermore, NAV is used by financial analysts and researchers to evaluate the overall health and performance of the mutual fund industry. By analyzing the NAV of different funds, researchers can identify trends, assess market conditions, and make predictions about the future direction of the industry.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.