Negative Volume Index (NVI) Meaning

The Negative Volume Index (NVI) is a technical analysis indicator that is used to identify trends in the stock market. It was developed by Paul Dysart in the 1980s as a way to measure the strength of a trend based on volume. The NVI is designed to be used in conjunction with other technical indicators to confirm or contradict signals.

Overview

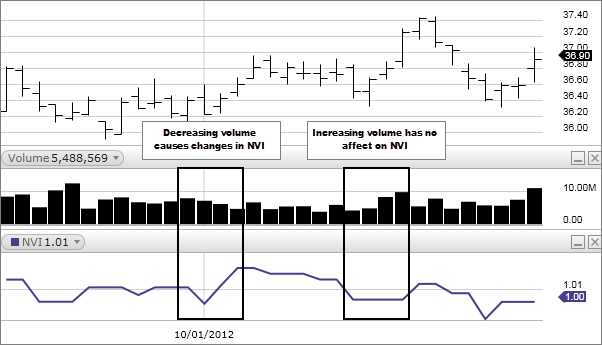

The NVI is based on the premise that when volume increases on days when the price of a stock or index decreases, it indicates selling pressure and a potential reversal in the trend. Conversely, when volume decreases on days when the price increases, it suggests buying pressure and a continuation of the trend.

The NVI is calculated by starting with a base value of 1 and then adding or subtracting a percentage of the previous day’s NVI based on the volume change. If the volume increases, a certain percentage of the previous day’s NVI is added. If the volume decreases, a certain percentage is subtracted. This calculation is repeated for each day in the data set.

Calculations

To calculate the NVI, the following steps are taken:

- Start with a base value of 1.

- If the volume increases, add a certain percentage of the previous day’s NVI to the base value.

- If the volume decreases, subtract a certain percentage of the previous day’s NVI from the base value.

- Repeat this calculation for each day in the data set.

The resulting NVI values can be plotted on a chart to visualize the trend. When the NVI is rising, it suggests a bullish trend, while a declining NVI indicates a bearish trend. Traders and investors can use the NVI to confirm other technical indicators and make more informed decisions about buying or selling stocks.

Technical Analysis Basic Education

The Negative Volume Index is a fundamental concept in technical analysis, which is the study of historical market data to predict future price movements. Technical analysis is based on the belief that market trends and patterns repeat over time, and that these patterns can be used to make profitable trading decisions.

Catname

The term “catname” in the article’s plan is likely a placeholder or a typo. It does not have any specific meaning or relevance to the Negative Volume Index (NVI) topic.

Negative Volume Index (NVI) Overview

The Negative Volume Index (NVI) is a technical analysis indicator that helps traders identify and confirm the strength of a downtrend in a stock or market. It was developed by Paul Dysart and is based on the premise that volume plays a crucial role in determining the direction of a price trend.

How NVI Works

The NVI calculates the cumulative percentage change in price on days when the trading volume decreases compared to the previous day. The indicator assumes that when the volume decreases during a downtrend, it indicates that smart money is not participating in the selling pressure, suggesting a potential reversal or weakening of the downtrend.

The NVI is calculated as follows:

- Start with a base value of 1000.

- If the volume decreases, calculate the percentage change in price and add it to the base value.

- If the volume increases, do not make any changes to the base value.

- Continue this process for each trading day, updating the base value accordingly.

The resulting NVI line can be plotted on a chart to visually represent the strength of the downtrend. When the NVI line is rising, it indicates that the downtrend is losing momentum. Conversely, when the NVI line is falling, it suggests that the downtrend is gaining strength.

Interpreting NVI

Traders can use the NVI in conjunction with other technical indicators and chart patterns to make more informed trading decisions. For example, if the NVI is rising while the price is forming a bullish chart pattern, it could be a signal that the downtrend is likely to reverse and a bullish trend may be emerging.

Conclusion

The Negative Volume Index (NVI) is a valuable tool for traders looking to identify and confirm downtrends in stocks or markets. By analyzing volume changes during a downtrend, the NVI can provide insights into the strength and potential reversals of the trend. However, it should be used in conjunction with other indicators and risk management strategies for more accurate and reliable trading decisions.

Calculations

The Negative Volume Index (NVI) is calculated using the following steps:

- Start with an initial value of 1000 for the NVI.

- For each trading day, compare the current day’s volume with the volume of the previous day.

- If the current day’s volume is lower than the previous day’s volume, subtract the percentage change in price from the NVI.

- If the current day’s volume is higher than the previous day’s volume, do not make any changes to the NVI.

- Continue this process for each trading day, updating the NVI accordingly.

The NVI is typically displayed as a line chart, with the x-axis representing the trading days and the y-axis representing the NVI values. Traders and investors use the NVI to identify trends and reversals in the market. When the NVI is rising, it indicates that volume is decreasing on down days, suggesting a potential bullish trend. Conversely, when the NVI is falling, it suggests that volume is increasing on down days, indicating a potential bearish trend.

By analyzing the NVI, traders can gain insights into the market’s strength and weakness, helping them make more informed trading decisions. It is important to note that the NVI is just one tool among many in technical analysis and should be used in conjunction with other indicators and analysis techniques.

| Day | Volume | Price Change | NVI |

|---|---|---|---|

| 1 | 100,000 | +2% | 1,000 |

| 2 | 80,000 | -1% | 990 |

| 3 | 120,000 | +3% | 990 |

| 4 | 70,000 | -2% | 980 |

| 5 | 90,000 | +1% | 980 |

Technical Analysis Basic Education

Technical analysis is a method used by traders and investors to analyze market data and make predictions about future price movements. It is based on the belief that historical price and volume data can provide insights into market trends and patterns.

What is Technical Analysis?

Technical analysis involves the use of various tools and techniques to analyze price charts and other market data. These tools can include indicators, patterns, and trend lines. Traders and investors use technical analysis to identify potential entry and exit points for trades, as well as to determine the strength of a trend.

One of the key concepts in technical analysis is the idea that price and volume are closely related. The Negative Volume Index (NVI) is a technical indicator that takes this relationship into account.

What is the Negative Volume Index (NVI)?

The Negative Volume Index (NVI) is a technical indicator that was developed by Paul Dysart in the 1930s. It is based on the idea that when volume decreases during a price decline, it indicates that smart money is not participating in the market. The NVI calculates a cumulative value based on the volume and price movements, and it can be used to identify potential reversals in the market.

Calculations

The NVI is calculated by starting with a base value of 1000 and then adding or subtracting a percentage of the previous day’s NVI based on the volume and price movements. If the volume decreases and the price declines, the NVI is increased. If the volume increases and the price declines, the NVI is decreased. This calculation is repeated for each trading day, resulting in a cumulative value that can be plotted on a chart.

The NVI is typically used in conjunction with other technical indicators to confirm or validate trading signals. It can be used to identify potential buying or selling opportunities, as well as to determine the overall trend of the market.

| Advantages | Disadvantages |

|---|---|

| Can help identify potential reversals in the market | May generate false signals |

| Can be used in conjunction with other technical indicators | |

| Provides insights into the relationship between price and volume | Not suitable for all types of markets |

Overall, technical analysis is a valuable tool for traders and investors to make informed decisions in the market. The Negative Volume Index (NVI) is just one of many technical indicators that can be used to analyze market data and identify potential trading opportunities.

Technical Analysis Basic Education

Technical analysis is a method used by traders and investors to forecast future price movements of financial assets based on historical price and volume data. It involves the study of charts, patterns, and indicators to identify trends and make informed trading decisions.

What is the Negative Volume Index (NVI)?

The Negative Volume Index (NVI) is a technical indicator developed by Paul Dysart in the 1930s. It is designed to track the performance of a stock or market index during periods of low trading volume. The NVI assumes that smart money, or professional investors, tends to be more active during periods of low volume, while retail investors are more active during periods of high volume.

The NVI calculates a cumulative index value based on the percentage change in price on days with declining volume. It is used to identify potential bearish trends and reversals in the market.

Overview of the Negative Volume Index (NVI)

The NVI is based on the premise that when volume decreases and prices decline, it indicates that smart money is selling and taking profits. Conversely, when volume decreases and prices increase, it suggests that smart money is accumulating positions.

The NVI is plotted as a cumulative line on a chart, with the line rising when prices increase on low volume and falling when prices decline on low volume. Traders use the NVI to confirm the strength of a trend and identify potential trend reversals.

Calculations of the Negative Volume Index (NVI)

The NVI is calculated using the following formula:

Where:

- NVI(previous day) is the NVI value of the previous day

- Price is the closing price of the current day

- Price(previous day) is the closing price of the previous day

- NV(previous day) is the negative volume of the previous day

The NVI is typically plotted alongside a price chart to provide additional insights into market trends and potential reversals.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.