Low Volume Pullback Indicator: Definition and How It Works

The low volume pullback indicator is a technical analysis tool that helps traders identify potential buying opportunities in the stock market. It is based on the concept that when a stock experiences a pullback in price on low trading volume, it may be a sign of temporary weakness and a potential opportunity to buy at a lower price.

The indicator works by analyzing the relationship between price and volume. When a stock pulls back in price, but the trading volume is low, it suggests that there is not much selling pressure and that the pullback may be temporary. This can be a signal for traders to enter a long position, expecting the stock to bounce back and continue its upward trend.

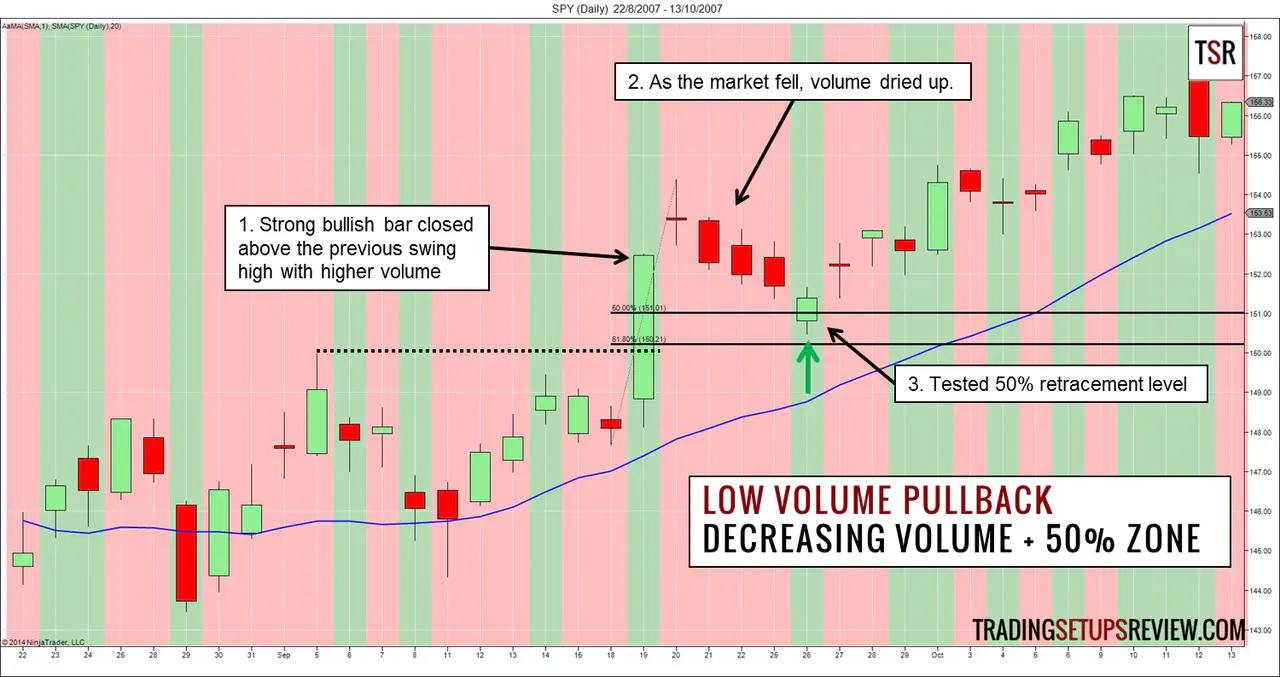

To use the low volume pullback indicator, traders typically look for a stock that has been in an uptrend and then experiences a pullback in price. They then analyze the volume during the pullback period to determine if it is low compared to the volume during the uptrend. If the volume is significantly lower, it may indicate a low volume pullback and a potential buying opportunity.

Traders can use additional technical analysis tools, such as trend lines or moving averages, to confirm the low volume pullback and increase the probability of a successful trade. It is important to note that the low volume pullback indicator is not foolproof and should be used in conjunction with other indicators and analysis techniques.

There are several benefits to using the low volume pullback indicator. Firstly, it can help traders identify potential buying opportunities at lower prices, allowing them to enter trades with a favorable risk-reward ratio. Secondly, it can help traders avoid entering trades during periods of high selling pressure, which could result in losses. Lastly, it can provide traders with a clear entry point and help them manage their trades more effectively.

| Benefits of the Low Volume Pullback Indicator |

|---|

| Identifies potential buying opportunities |

| Avoids entering trades during periods of high selling pressure |

| Provides clear entry points |

| Helps manage trades more effectively |

What is the Low Volume Pullback Indicator?

The Low Volume Pullback Indicator is a technical analysis tool used by traders to identify potential buying opportunities in a stock or other financial instrument. It is based on the concept that when a stock experiences a pullback in price on low trading volume, it may indicate a temporary pause in the overall trend and a potential opportunity to buy at a lower price.

The indicator works by comparing the current trading volume to a specified threshold or average volume level. If the current volume is significantly lower than the threshold or average, and the price is experiencing a pullback, it may suggest that there is a lack of selling pressure and a potential opportunity for buyers to step in.

Traders often use the Low Volume Pullback Indicator in conjunction with other technical analysis tools to confirm potential buying opportunities. For example, they may look for other indicators such as trend lines, moving averages, or support levels to validate the potential trade.

It is important to note that the Low Volume Pullback Indicator is not a foolproof strategy and should be used in conjunction with other analysis techniques and risk management strategies. It is also important to consider other factors such as market conditions, news events, and overall market sentiment when making trading decisions.

How Does the Low Volume Pullback Indicator Work?

The Low Volume Pullback Indicator is a technical analysis tool that helps traders identify potential buying opportunities in the market. It works by analyzing the volume of a security during a pullback or correction phase.

During a pullback, the price of a security retraces or moves against the prevailing trend. This can be a temporary pause in an uptrend or a temporary bounce in a downtrend. The Low Volume Pullback Indicator focuses on identifying pullbacks with low trading volume, which suggests a lack of selling pressure.

When the indicator detects a low volume pullback, it generates a signal indicating a potential buying opportunity. Traders can use this signal to enter a long position, expecting the price to resume its upward movement. The indicator helps traders avoid buying during periods of high volume, which could indicate a strong selling pressure and a potential trend reversal.

Traders can use the Low Volume Pullback Indicator in conjunction with other technical analysis tools to increase the probability of successful trades. For example, they can look for confirmation signals from trend lines, moving averages, or other indicators before entering a trade.

It is important to note that the Low Volume Pullback Indicator is not a standalone tool and should be used as part of a comprehensive trading strategy. Traders should consider other factors such as market conditions, fundamental analysis, and risk management before making any trading decisions.

Benefits of Using the Low Volume Pullback Indicator

The Low Volume Pullback Indicator is a powerful tool that can provide traders with several benefits when used effectively. Here are some of the key advantages of using this indicator:

1. Identifying Potential Reversals

One of the main benefits of the Low Volume Pullback Indicator is its ability to identify potential reversals in the market. By analyzing the volume levels during a pullback, traders can determine whether the market is likely to reverse its direction or continue in the same trend. This information can be invaluable in making informed trading decisions and maximizing profits.

2. Confirming Trend Strength

Another advantage of using the Low Volume Pullback Indicator is its ability to confirm the strength of a trend. When the indicator shows low volume during a pullback, it suggests that the trend is strong and likely to continue. On the other hand, high volume during a pullback may indicate a weakening trend or potential trend reversal. By using this indicator, traders can gain confidence in their analysis and make more accurate predictions about the future direction of the market.

3. Enhancing Entry and Exit Points

The Low Volume Pullback Indicator can also help traders enhance their entry and exit points. By identifying low volume pullbacks within a trend, traders can look for opportunities to enter the market at favorable prices. Additionally, when the indicator shows high volume during a pullback, it may signal a good time to exit a trade and secure profits. By using this indicator in combination with other technical analysis tools, traders can improve their timing and increase their chances of success.

4. Minimizing Risk

Using the Low Volume Pullback Indicator can also help traders minimize risk. By identifying potential reversals and confirming trend strength, traders can avoid entering trades that have a higher likelihood of failure. This can help protect their capital and reduce losses. Additionally, by using the indicator to determine exit points, traders can secure profits and limit potential losses. By effectively managing risk, traders can increase their overall profitability and success in the market.

5. Versatility

The Low Volume Pullback Indicator is a versatile tool that can be used in various markets and timeframes. Whether you are a day trader, swing trader, or long-term investor, this indicator can provide valuable insights into market dynamics. It can be used in conjunction with other technical indicators and trading strategies to enhance your analysis and decision-making process.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.