The Importance of Investing in the Transportation Sector

1. Economic Growth and Stability

The transportation sector is closely linked to economic growth and stability. As economies grow, the demand for transportation services increases, driving the need for infrastructure development, logistics, and supply chain management. By investing in the transportation sector, investors can benefit from the overall economic growth and stability of the industry.

2. Essential Industry

Transportation is an essential industry that is vital for the functioning of other sectors. It enables the movement of raw materials, finished goods, and people, supporting various industries such as manufacturing, retail, and tourism. Investing in the transportation sector allows investors to participate in an industry that is fundamental to the global economy.

3. Diversification

Investing in the transportation sector can provide diversification benefits to an investment portfolio. By including transportation industry investments, investors can reduce the risk associated with having a concentrated portfolio and increase the potential for long-term returns. The transportation sector offers different sub-sectors, including airlines, shipping, railroads, and logistics, allowing investors to diversify their investments across various segments.

4. Technological Advancements

The transportation sector is constantly evolving, driven by technological advancements. Investments in transportation can provide exposure to innovative technologies such as electric vehicles, autonomous vehicles, and advanced logistics systems. These technological advancements have the potential to disrupt traditional transportation models and create new investment opportunities.

5. Sustainable and ESG Investing

The transportation sector is increasingly focusing on sustainability and environmental, social, and governance (ESG) factors. Investors interested in sustainable and responsible investing can find opportunities in the transportation sector, such as investing in companies that are developing clean energy solutions, reducing carbon emissions, and promoting sustainable transportation practices.

| Benefits of Investing in the Transportation Sector |

|---|

| Economic growth and stability |

| Essential industry |

| Diversification |

| Technological advancements |

| Sustainable and ESG investing |

Overall, investing in the transportation sector offers a range of benefits, including exposure to economic growth, diversification, technological advancements, and opportunities for sustainable investing. By considering the importance of the transportation sector and its potential for long-term growth, investors can make informed investment decisions and potentially achieve significant returns.

Benefits of Transportation Industry Investments

Investing in the transportation sector can offer numerous benefits for investors. Here are some key advantages of investing in the transportation industry:

| 1. Stable Returns: | Transportation companies often provide stable returns due to the constant demand for their services. People and businesses rely on transportation for various needs, such as commuting, shipping goods, and traveling. This consistent demand can result in steady revenue streams and potential profits for investors. |

| 2. Diversification: | Investing in the transportation sector can help diversify an investment portfolio. By adding transportation industry investments to a portfolio that includes stocks, bonds, and other assets, investors can potentially reduce risk and improve overall returns. This diversification can be particularly beneficial during economic downturns when certain sectors may underperform. |

| 3. Infrastructure Development: | Investing in the transportation sector can contribute to the development of infrastructure. Governments and private companies often invest in transportation infrastructure projects, such as building roads, bridges, airports, and railways. These investments not only create job opportunities but also stimulate economic growth and improve overall transportation efficiency. |

| 4. Technological Advancements: | The transportation industry is constantly evolving and embracing new technologies. Investments in transportation companies can provide exposure to innovative technologies, such as electric vehicles, autonomous vehicles, and advanced logistics systems. These technological advancements can lead to improved efficiency, reduced costs, and increased profitability for transportation companies. |

| 5. Global Connectivity: |

Overall, investing in the transportation sector offers various benefits, including stable returns, diversification, infrastructure development, technological advancements, and global connectivity. These advantages make transportation industry investments an attractive option for investors looking to diversify their portfolios and potentially achieve long-term growth.

Growth Potential in the Transportation Sector

1. Increasing Global Trade

With the rise of globalization, the volume of international trade has been steadily increasing. This has led to a surge in demand for transportation services, including shipping, air freight, and logistics. As more goods need to be transported across borders, companies in the transportation sector are well-positioned to capitalize on this trend.

2. Technological Advancements

The transportation industry is constantly evolving with technological advancements. From autonomous vehicles to electric cars, these innovations are driving growth and efficiency in the sector. Investors who recognize and invest in companies at the forefront of these advancements can benefit from their potential for long-term growth and profitability.

3. Infrastructure Development

Many countries are investing heavily in infrastructure development, including transportation networks. This includes the construction of new roads, railways, airports, and ports. As infrastructure improves, transportation companies can expand their operations and cater to a larger customer base. Investors can take advantage of this growth by investing in companies involved in infrastructure development projects.

4. E-commerce Boom

Diversification of Investment Portfolio

Investing in the transportation sector can provide a valuable opportunity for diversification of your investment portfolio. By allocating a portion of your investments to the transportation industry, you can reduce the overall risk of your portfolio by spreading it across different sectors.

The transportation sector encompasses various industries such as airlines, shipping, logistics, and railroads, each with its own unique characteristics and risk factors. By investing in multiple transportation industries, you can benefit from the growth potential of different sectors while mitigating the impact of any negative events that may affect a specific industry.

Furthermore, the transportation sector is often considered a defensive sector, meaning that it tends to perform well even during economic downturns. This can provide stability to your investment portfolio during times of market volatility.

In addition to diversifying your portfolio across different industries, investing in the transportation sector can also help diversify your investment across different asset classes. For example, you can invest in transportation stocks, bonds, or even infrastructure projects. This diversification across asset classes can further reduce the risk of your portfolio and potentially enhance your overall returns.

Overall, diversifying your investment portfolio by including transportation industry investments can provide you with a well-rounded and balanced portfolio that is better equipped to withstand market fluctuations and generate long-term returns.

Factors to Consider when Investing in the Transportation Sector

Investing in the transportation sector can be a lucrative opportunity, but it is important to consider several factors before making any investment decisions. These factors can help you make informed choices and maximize your returns. Here are some key factors to consider:

- Market Conditions: Evaluate the current market conditions and trends in the transportation sector. Look for growth potential, demand for transportation services, and any regulatory changes that may impact the industry.

- Competition: Research the competitive landscape of the transportation sector. Identify the major players, their market share, and their strategies. Consider how your investment will fit into the market and how you can differentiate yourself from competitors.

- Technological Advancements: Stay updated on the latest technological advancements in the transportation industry. Innovations such as autonomous vehicles, electric vehicles, and logistics software can significantly impact the sector. Assess how these advancements can affect your investment and whether you need to adapt or incorporate them into your strategy.

- Risk Management: Understand the risks associated with investing in the transportation sector. Consider factors such as fuel price volatility, regulatory changes, geopolitical risks, and natural disasters. Develop a risk management strategy to mitigate these risks and protect your investment.

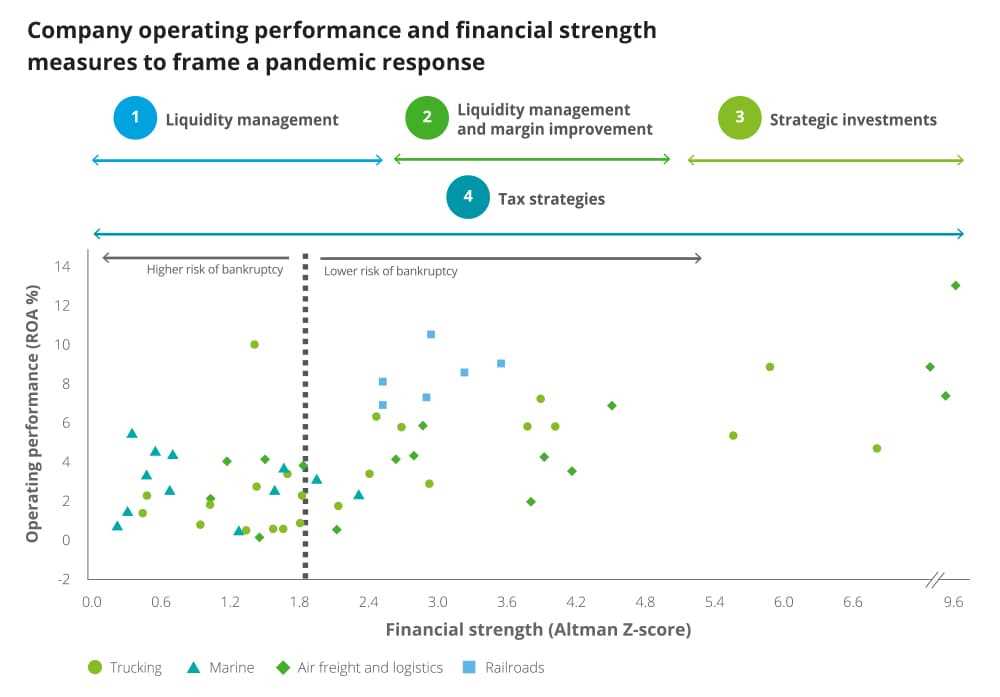

- Financial Performance: Analyze the financial performance of transportation companies. Look at key financial metrics such as revenue growth, profitability, and debt levels. Assess the company’s ability to generate consistent cash flows and its financial stability.

- Expert Advice: Seek advice from industry experts, financial advisors, or investment professionals. They can provide valuable insights and help you make informed investment decisions in the transportation sector.

By considering these factors, you can make well-informed investment decisions in the transportation sector and potentially benefit from its growth and profitability.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.