Inverse ETF: Definition, Comparison to Short Selling, and Example

An inverse ETF, or exchange-traded fund, is a type of investment vehicle that allows investors to profit from the decline in the value of an underlying asset or index. Unlike traditional ETFs, which aim to track the performance of an asset or index, inverse ETFs are designed to move in the opposite direction.

Inverse ETFs achieve this inverse movement through the use of derivatives, such as options and futures contracts. These derivatives allow the ETF to generate returns that are inversely correlated to the performance of the underlying asset or index.

Comparison to Short Selling

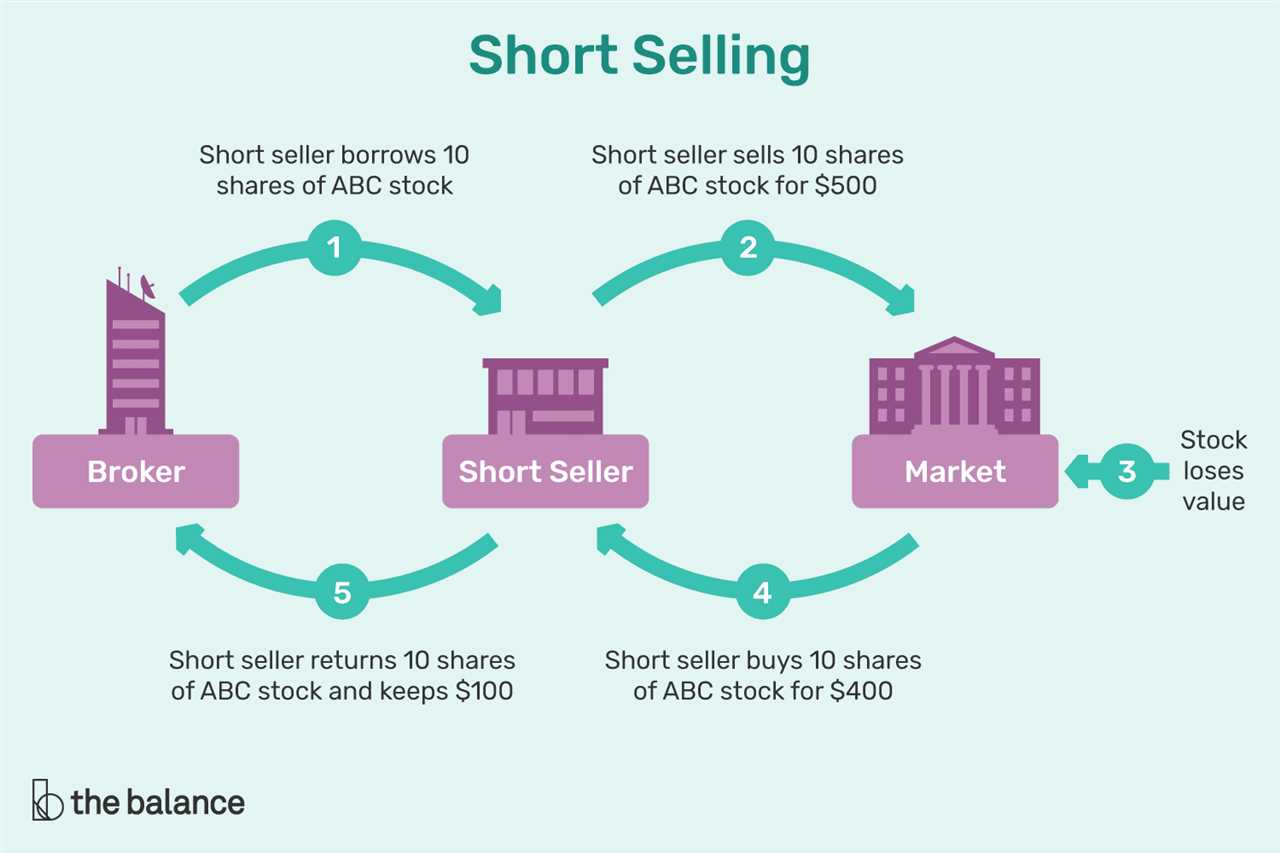

Inverse ETFs offer a similar investment strategy to short selling, but with some key differences. Short selling involves borrowing shares of a stock or other asset and selling them in the hopes of buying them back at a lower price in the future. Inverse ETFs, on the other hand, can be bought and sold like regular stocks on an exchange.

One advantage of inverse ETFs over short selling is that they are typically easier and more accessible for individual investors. Short selling requires a margin account and can involve additional costs, such as borrowing fees and interest charges. Inverse ETFs, on the other hand, can be purchased through a regular brokerage account and do not require borrowing or margin.

Example of an Inverse ETF

One example of an inverse ETF is the ProShares Short S&P 500 ETF (SH). This ETF aims to provide investors with a return that is inversely correlated to the performance of the S&P 500 index. If the S&P 500 index declines by 1%, the value of the ProShares Short S&P 500 ETF is expected to increase by approximately 1%.

Investors can use inverse ETFs like SH to hedge their portfolios against market downturns or to profit from declining markets. By holding inverse ETFs, investors can potentially offset losses in their other investments when the market is experiencing a downturn.

It is important to note that inverse ETFs are designed for short-term trading strategies and may not be suitable for long-term investors. They are also subject to risks, such as tracking error and compounding effects, which can impact their performance.

What is an Inverse ETF?

An Inverse ETF, or Exchange-Traded Fund, is a type of investment vehicle that allows investors to profit from the decline in the value of an underlying asset or index. Unlike traditional ETFs, which aim to track the performance of an asset or index, inverse ETFs are designed to generate returns that are the opposite of the asset or index they are tracking.

Inverse ETFs achieve this inverse performance by using a variety of financial instruments, such as derivatives and short positions, to replicate the opposite movement of the underlying asset or index. This means that when the underlying asset or index decreases in value, the inverse ETF will increase in value, and vice versa.

Investors should also be aware that inverse ETFs carry a higher level of risk compared to traditional ETFs. The use of derivatives and short positions can amplify losses, and the performance of an inverse ETF can be affected by factors such as market volatility and liquidity.

Comparison of Inverse ETFs to Short Selling

Inverse ETFs, on the other hand, are exchange-traded funds that aim to provide the opposite performance of a specific index or asset class. They achieve this by using various financial instruments such as derivatives and swaps. Inverse ETFs allow investors to profit from a decline in the value of an index or asset class without the need to engage in short selling.

There are several key differences between inverse ETFs and short selling:

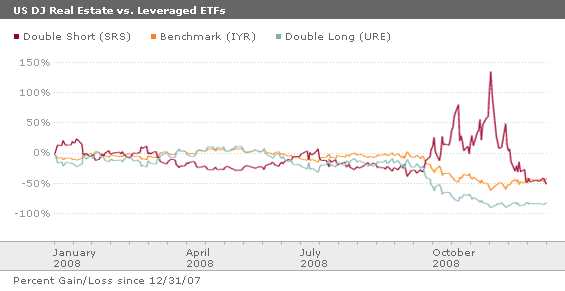

- Leverage: Inverse ETFs often use leverage to amplify the inverse performance of the underlying index or asset class. This means that the returns of an inverse ETF can be magnified compared to the actual decline in the index or asset class. Short selling does not involve leverage.

- Cost: Short selling typically involves borrowing fees and interest expenses, which can eat into the potential profits. Inverse ETFs have expense ratios, which represent the costs associated with managing the fund, but they do not have borrowing fees or interest expenses.

- Accessibility: Short selling requires a margin account and approval from a broker. Inverse ETFs, on the other hand, can be bought and sold like regular stocks on a stock exchange, making them more accessible to individual investors.

It is important for investors to carefully consider their risk tolerance, investment goals, and time horizon before deciding whether to engage in short selling or invest in inverse ETFs. Both strategies have their own advantages and disadvantages, and it is crucial to understand the potential risks and rewards associated with each approach.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.