What is Stochastic Modeling?

Stochastic modeling is a mathematical technique used to model and analyze systems that involve random variables. It is a branch of probability theory that allows for the study of uncertainty and randomness in various fields, including finance, economics, engineering, and biology.

At its core, stochastic modeling involves the use of probability distributions to represent the uncertain behavior of variables. These distributions can be used to simulate and predict the outcomes of complex systems, taking into account the randomness and variability inherent in real-world scenarios.

Stochastic modeling is particularly useful in situations where deterministic models, which assume fixed and known values for all variables, are inadequate. By incorporating randomness into the models, stochastic modeling provides a more realistic representation of the inherent uncertainty and variability present in many real-world systems.

Stochastic modeling can be applied to a wide range of problems and situations. In finance, for example, it can be used to model stock prices, interest rates, and other financial variables that are subject to random fluctuations. In engineering, it can be used to analyze the reliability and performance of complex systems. In biology, it can be used to model the spread of diseases or the growth of populations.

Definition and Purpose

Key Concepts

- Random Processes: Stochastic modeling deals with random processes, which are sequences of events or variables that evolve over time. These processes are characterized by their probabilistic nature, where the outcome of each event is uncertain.

- Probability Distributions: Stochastic modeling relies on probability distributions to represent the uncertainty associated with random variables. These distributions provide a mathematical description of the likelihood of different outcomes.

- Simulation: Stochastic modeling often involves the use of simulation techniques to generate random samples from probability distributions. These samples are then used to estimate the behavior of the system being modeled.

Applications

Stochastic modeling has a wide range of applications in various fields, including finance, economics, engineering, and biology. In finance, for example, stochastic modeling is used to analyze and predict the behavior of stock prices, interest rates, and other financial variables. It is also used in risk assessment and portfolio optimization.

Other applications of stochastic modeling include predicting the spread of diseases, analyzing the performance of complex systems, such as transportation networks or manufacturing processes, and optimizing resource allocation in supply chain management.

Benefits

The use of stochastic modeling provides several benefits in decision making and analysis:

- Accounting for Uncertainty: Stochastic modeling allows for the consideration of uncertainty and randomness in decision-making processes. This helps to provide a more realistic and accurate representation of the system being modeled.

- Quantitative Analysis: Stochastic modeling provides a quantitative framework for analyzing and evaluating the behavior of complex systems. It allows for the estimation of probabilities, expected values, and other statistical measures.

- Optimization: Stochastic modeling can be used to optimize decision-making processes by considering the trade-offs between different objectives and constraints. It helps in finding the best possible solution under uncertain conditions.

Applications of Stochastic Modeling

Stochastic modeling is a powerful tool that finds applications in various fields, including finance, economics, engineering, and environmental sciences. It allows for the analysis and prediction of complex systems that involve random variables and uncertainty.

In finance, stochastic modeling is widely used for risk assessment and portfolio optimization. By incorporating randomness and volatility into financial models, it provides a more realistic representation of market behavior. This helps investors and financial institutions make informed decisions and manage their investments more effectively.

Stochastic modeling is also applied in insurance and actuarial science. By considering the uncertainty in events such as accidents or natural disasters, insurance companies can accurately calculate premiums and assess the potential risks. This ensures that the insurance policies are priced appropriately and the companies remain financially stable.

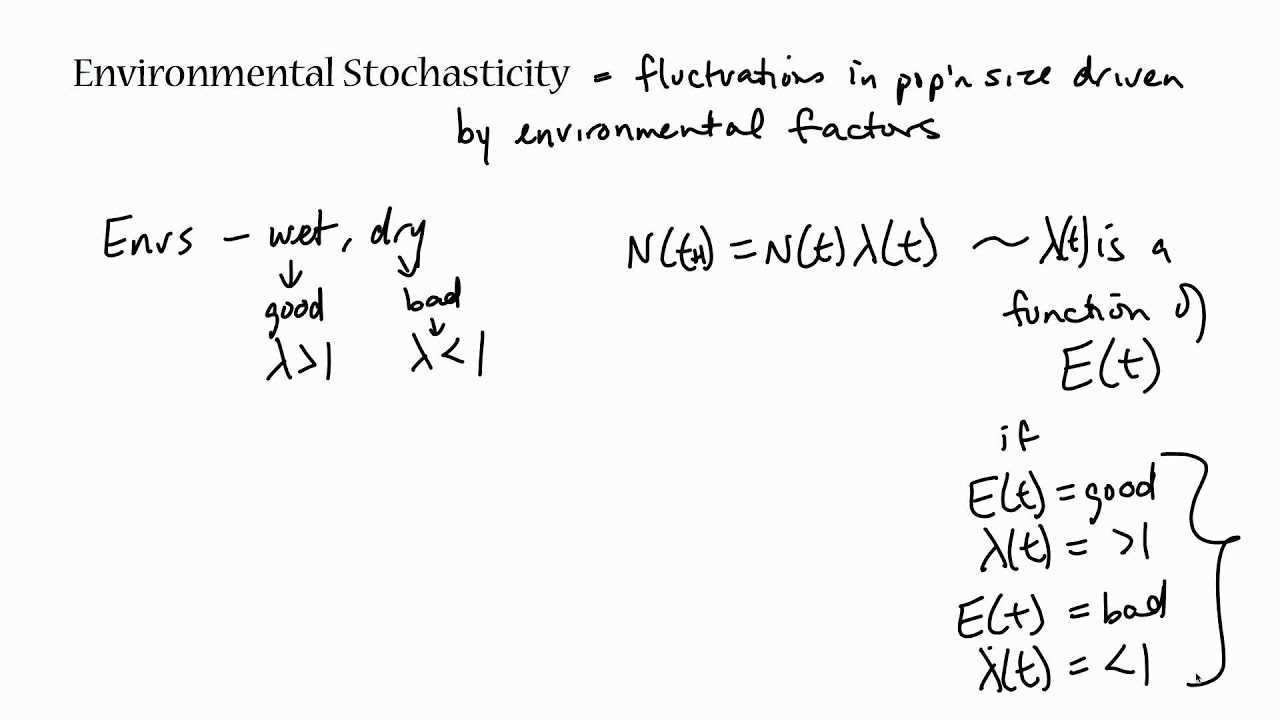

Environmental sciences also benefit from stochastic modeling. It is used to study the impacts of climate change, population dynamics, and natural resource management. By incorporating randomness into these models, scientists can simulate different scenarios and assess the potential risks and uncertainties associated with environmental changes.

Financial Analysis

Financial analysis is a crucial component of decision-making in business and investment. It involves assessing the financial health and performance of a company or investment opportunity. Stochastic modeling is a powerful tool that can be used in financial analysis to make more accurate predictions and improve decision-making.

Stochastic modeling involves using mathematical techniques to model and analyze random variables and their behavior over time. It takes into account the uncertainty and randomness inherent in financial markets and allows for the simulation of various scenarios. By incorporating stochastic modeling into financial analysis, analysts can better understand the potential risks and rewards associated with different investment strategies.

One of the main applications of stochastic modeling in financial analysis is in portfolio optimization. By using stochastic models to simulate different market conditions, analysts can determine the optimal allocation of assets in a portfolio to maximize returns while minimizing risk. This helps investors make informed decisions about which assets to include in their portfolios and how much to invest in each.

Stochastic modeling can also be used in risk management. By simulating different scenarios, analysts can assess the potential impact of various risks on a company’s financial performance. This allows for the development of risk mitigation strategies and the identification of potential vulnerabilities.

Furthermore, stochastic modeling can be used in financial forecasting. By incorporating stochastic models into forecasting models, analysts can obtain more accurate predictions of future financial performance. This can be particularly useful for companies and investors who need to make long-term financial plans and projections.

Benefits of Stochastic Modeling

Stochastic modeling is a powerful tool that offers several benefits in various fields, including financial analysis. By incorporating randomness and uncertainty into mathematical models, stochastic modeling provides a more realistic representation of complex systems and processes.

1. Improved Accuracy

2. Risk Assessment and Management

Stochastic modeling enables the assessment and management of risks associated with various scenarios. By incorporating random variables and their associated probabilities, analysts can simulate different outcomes and evaluate the likelihood of specific events occurring. This information can then be used to make informed decisions and develop effective risk management strategies.

3. Decision Making under Uncertainty

Stochastic modeling provides a framework for making decisions in situations where there is uncertainty or incomplete information. By considering multiple possible outcomes and their associated probabilities, decision-makers can evaluate the expected value and potential risks of different options. This allows for more informed decision-making and can help mitigate the negative impact of uncertain events.

4. Sensitivity Analysis

5. Scenario Planning

Stochastic modeling enables scenario planning, which involves creating and analyzing multiple possible future scenarios. By incorporating random variables and their associated probabilities, analysts can simulate different scenarios and evaluate their potential outcomes. This can help organizations anticipate and prepare for a range of possible future events, improving their resilience and adaptability.

Improved Decision Making

Stochastic modeling plays a crucial role in improving decision making in various fields, including financial analysis. By incorporating uncertainty and randomness into the modeling process, stochastic modeling provides a more realistic representation of complex systems and helps decision-makers make informed choices.

One of the key benefits of stochastic modeling is its ability to capture the inherent variability and uncertainty in real-world scenarios. Traditional models often assume that variables are deterministic and follow a specific pattern, which may not accurately reflect the complexity of the system being modeled. Stochastic modeling, on the other hand, allows for the inclusion of random variables and probabilistic outcomes, providing a more accurate representation of the real world.

Furthermore, stochastic modeling allows decision-makers to quantify and analyze the uncertainty associated with different variables. By using statistical techniques and probability distributions, decision-makers can estimate the likelihood of different outcomes and assess the impact of uncertainty on their decisions. This information can be invaluable in risk management and resource allocation, as it helps decision-makers identify potential vulnerabilities and develop contingency plans.

Stochastic modeling also enables decision-makers to optimize their strategies by considering the trade-offs between different objectives. By incorporating probabilistic outcomes and constraints into the modeling process, decision-makers can identify the best course of action that maximizes their objectives while minimizing the associated risks. This optimization approach allows decision-makers to make more efficient use of resources and improve overall performance.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.