How to File Form 1099-DIV for Dividends and Distributions

Filing Form 1099-DIV is an important step in reporting dividends and distributions for tax purposes. This form is used by businesses and individuals who receive dividends, capital gain distributions, or other distributions from investments.

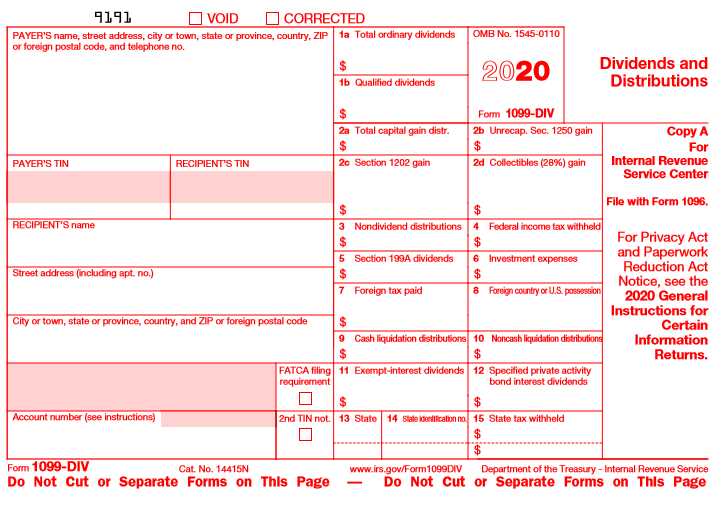

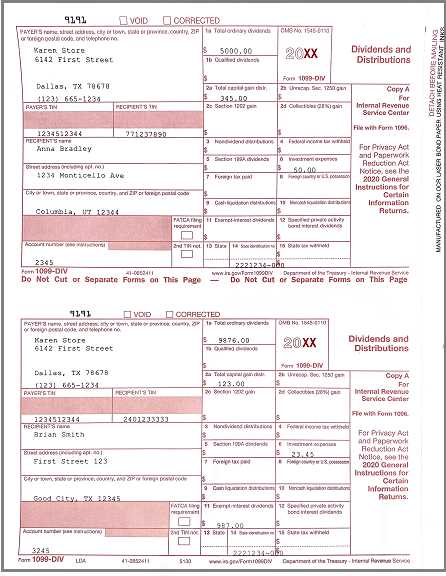

Once you have collected all the required information, you can fill out Form 1099-DIV. This form consists of several parts, including the payer’s information, the recipient’s information, and the details of the dividends and distributions. You will need to enter the amounts in the appropriate boxes and ensure that all the information is accurate and complete.

After completing Form 1099-DIV, you will need to send a copy to the recipient and another copy to the Internal Revenue Service (IRS). The recipient copy should be provided to the individual or business who received the dividends or distributions, while the IRS copy should be sent to the appropriate IRS address by the filing deadline.

It is important to note that the filing deadline for Form 1099-DIV is typically January 31st of the year following the tax year in which the dividends or distributions were received. Failure to file the form on time or to provide accurate information can result in penalties and fines.

Form 1099-DIV is a tax form used to report dividends and distributions received by individuals from various sources, such as stocks, mutual funds, and real estate investment trusts (REITs). It is important to understand this form as it helps in accurately reporting your income and ensuring compliance with tax regulations.

What is Form 1099-DIV?

Form 1099-DIV is issued by financial institutions and companies to individuals who have received dividends and distributions of $10 or more during the tax year. The form provides detailed information about the type and amount of income received, which is necessary for accurate tax reporting.

Information Included in Form 1099-DIV

Form 1099-DIV includes the following information:

- Recipient’s Information: This section includes the recipient’s name, address, and taxpayer identification number (TIN).

- Dividend Income: This section reports the total amount of dividends received from stocks, mutual funds, and REITs.

- Capital Gains Distributions: This section reports any capital gains distributions received from mutual funds or REITs.

- Federal Income Tax Withheld: This section reports the amount of federal income tax withheld from the dividends and distributions.

- Account Number: This section includes the account number associated with the dividends and distributions.

Importance of Form 1099-DIV

Form 1099-DIV is important for both the recipient and the Internal Revenue Service (IRS). For the recipient, it provides a detailed summary of their dividend and distribution income, which is necessary for accurate tax reporting. It helps individuals determine their taxable income and ensures that they report all their earnings correctly.

For the IRS, Form 1099-DIV serves as a tool to track and verify the income reported by individuals. It helps the IRS identify any discrepancies between the income reported on the tax return and the income reported by financial institutions and companies.

Using Form 1099-DIV for Tax Filing

When filing your taxes, you need to include the information from Form 1099-DIV on your tax return. The amounts reported on the form should be entered in the appropriate sections of your tax form, such as Schedule B for reporting dividend income and Schedule D for reporting capital gains distributions.

It is important to review the information on Form 1099-DIV carefully and ensure its accuracy. If you believe there is an error on the form, you should contact the issuer and request a corrected form before filing your taxes.

Remember, failing to report dividend and distribution income accurately can result in penalties and interest charges from the IRS. Therefore, it is crucial to understand Form 1099-DIV and use it correctly when filing your taxes.

Reporting Dividends and Distributions

When filing Form 1099-DIV for dividends and distributions, it is important to accurately report the information to the Internal Revenue Service (IRS). This form is used to report income received from dividends, capital gains, and other distributions from investments.

Next, you will need to determine the type of income being reported. Dividends are typically classified as either qualified or non-qualified. Qualified dividends are subject to lower tax rates, while non-qualified dividends are taxed at the recipient’s ordinary income tax rate. It is important to accurately categorize the dividends to ensure proper tax treatment.

Once you have gathered the necessary information and determined the type of income, you can proceed to fill out the Form 1099-DIV. This form consists of several sections, including the recipient’s information, the payer’s information, and the breakdown of the dividends and distributions. It is essential to accurately report the amounts in the appropriate boxes to avoid any discrepancies.

In addition to reporting the dividends and distributions, you may also need to report any federal income tax withheld. If the payer withheld any taxes from the payments, this amount should be included on the Form 1099-DIV. It is important to double-check this information to ensure its accuracy.

Finally, once the Form 1099-DIV is completed, it should be sent to the recipient and filed with the IRS. The recipient will use this form to report the income on their tax return, while the IRS uses it to verify the accuracy of the reported income. It is crucial to keep a copy of the form for your records.

Overall, accurately reporting dividends and distributions on Form 1099-DIV is essential for both the recipient and the IRS. By following the proper procedures and ensuring the accuracy of the information, you can avoid any potential issues or penalties related to incorrect reporting.

Filing Requirements for Form 1099-DIV

Form 1099-DIV is a tax form used to report dividends and distributions received by individuals, partnerships, corporations, and other entities. If you receive dividends or distributions from stocks, mutual funds, or other investments, you may need to file Form 1099-DIV with the Internal Revenue Service (IRS).

Who needs to file Form 1099-DIV?

Not everyone who receives dividends or distributions needs to file Form 1099-DIV. The filing requirements depend on the amount of dividends or distributions received and the type of recipient.

Individuals who receive $10 or more in dividends or distributions during the tax year must file Form 1099-DIV. This includes both cash dividends and dividends reinvested to purchase additional shares of stock or mutual funds.

Partnerships, corporations, and other entities must file Form 1099-DIV if they pay dividends or distributions of $600 or more to any recipient during the tax year.

How to file Form 1099-DIV

To file Form 1099-DIV, you will need to obtain the form from the IRS website or through an authorized tax software provider. The form must be completed with accurate information about the dividends or distributions received and the recipient’s information.

Once the form is completed, you must provide copies to the recipients by January 31st of the following year. You will also need to file a copy of the form with the IRS by the last day of February, if filing by mail, or by March 31st, if filing electronically.

If you are filing more than 250 forms, you must file electronically with the IRS.

Consequences of not filing Form 1099-DIV

Failing to file Form 1099-DIV or filing an incorrect form can result in penalties from the IRS. The penalties vary depending on the size of the entity and the length of time the failure continues.

For individuals, the penalty can range from $50 to $280 per form, with a maximum penalty of $1,130,500 per year. For corporations, the penalty can range from $100 to $530 per form, with a maximum penalty of $3,392,000 per year.

It is important to ensure that you file Form 1099-DIV accurately and on time to avoid these penalties.

Tips for Filing Form 1099-DIV

1. Understand the requirements:

Before filing Form 1099-DIV, it is important to familiarize yourself with the requirements set by the Internal Revenue Service (IRS). Make sure you understand which types of payments qualify as dividends and distributions, and ensure that you have all the necessary information from the payees.

2. Gather all the relevant information:

Collect all the necessary information from the payees, including their names, addresses, and tax identification numbers (TINs). This information is crucial for accurately reporting dividends and distributions on Form 1099-DIV.

3. Double-check the numbers:

Accuracy is key when filing Form 1099-DIV. Double-check all the numbers, including the total amount of dividends and distributions, and ensure that they match the information provided by the payees. Any discrepancies could lead to issues with the IRS.

4. File on time:

Make sure to file Form 1099-DIV by the deadline set by the IRS. Failure to file on time can result in penalties and interest charges. It is recommended to file electronically, as it is faster and more efficient.

5. Keep copies for your records:

After filing Form 1099-DIV, make sure to keep copies of all the forms for your records. This will come in handy in case of any future inquiries or audits by the IRS.

6. Seek professional help if needed:

If you are unsure about any aspect of filing Form 1099-DIV, it is always a good idea to seek professional help. Tax professionals can provide guidance and ensure that you are filing the form correctly.

By following these tips, you can navigate the process of filing Form 1099-DIV for dividends and distributions with confidence and accuracy.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.