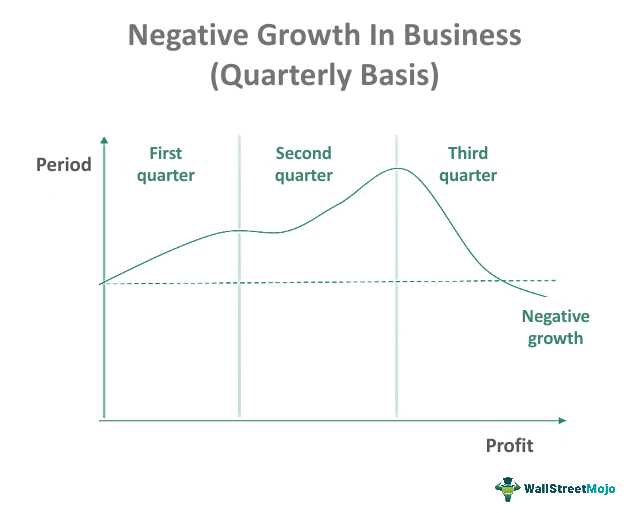

Definition and Causes of Negative Growth

There are several factors that can contribute to negative growth in an economy. One of the main causes is a decrease in consumer spending. When consumers reduce their spending, businesses experience lower demand for their products and services, leading to a decrease in production and ultimately a decline in GDP.

Another factor that can lead to negative growth is a decrease in investment. When businesses and individuals reduce their investment in new projects and capital goods, it can result in a slowdown in economic activity and a decrease in GDP. This can be caused by factors such as uncertainty in the business environment, high interest rates, or a lack of available credit.

Government policies and regulations can also contribute to negative growth. Excessive taxation and regulation can discourage businesses from expanding and investing, leading to a decrease in economic activity. Additionally, political instability or corruption can undermine investor confidence and hinder economic growth.

External factors, such as changes in international trade or natural disasters, can also cause negative growth. For example, a decrease in exports due to trade barriers or a decline in tourism can have a significant impact on an economy’s GDP. Similarly, natural disasters like hurricanes or earthquakes can disrupt production and infrastructure, leading to a decline in economic output.

Economic Impact of Negative Growth

One of the most immediate impacts of negative growth is a decrease in employment opportunities. As businesses struggle to maintain profitability during a period of economic contraction, they may be forced to lay off workers or reduce their working hours. This can result in higher unemployment rates and a decrease in consumer spending, further exacerbating the economic downturn.

Negative growth can also have a detrimental impact on the financial sector. During periods of economic contraction, banks and other financial institutions may face increased risks as borrowers struggle to repay their loans. This can lead to a decrease in lending and credit availability, making it more difficult for businesses and individuals to access the capital they need to invest and grow.

Furthermore, negative growth can have a ripple effect on global markets. As one country experiences economic contraction, it can lead to decreased demand for imports, affecting the economies of its trading partners. This can create a domino effect, causing a slowdown in global trade and further exacerbating the economic downturn.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.