Fundamentals: Types, Analysis Ratios, and Example

Fundamental analysis is a method used by investors to evaluate the intrinsic value of a stock or security. It involves analyzing various factors such as financial statements, industry trends, and management performance to determine the true worth of an investment.

Types of Fundamental Analysis

There are two main types of fundamental analysis: quantitative and qualitative.

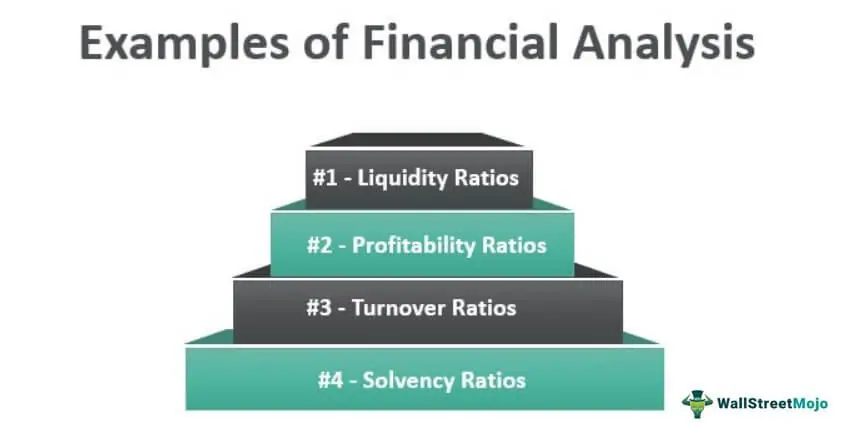

- Quantitative Analysis: This type of analysis involves the use of financial ratios and metrics to assess the financial health and performance of a company. These ratios include profitability ratios, liquidity ratios, and solvency ratios. By analyzing these ratios, investors can gain insights into the company’s profitability, efficiency, and ability to meet its financial obligations.

Analysis Ratios

Analysis ratios are key metrics used in fundamental analysis to evaluate the financial performance and health of a company. Some commonly used analysis ratios include:

- Profitability Ratios: These ratios measure the company’s ability to generate profits and include metrics such as return on equity (ROE), return on assets (ROA), and gross profit margin.

- Liquidity Ratios: Liquidity ratios assess the company’s ability to meet short-term obligations and include metrics such as current ratio and quick ratio.

- Solvency Ratios: Solvency ratios measure the company’s ability to meet long-term debt obligations and include metrics such as debt-to-equity ratio and interest coverage ratio.

By analyzing these ratios, investors can gain insights into the company’s financial performance, stability, and overall health.

Example:

Let’s consider a hypothetical example of a company called XYZ Inc. Through fundamental analysis, an investor analyzes XYZ Inc.’s financial statements, industry trends, and management performance. The investor evaluates XYZ Inc.’s profitability ratios, liquidity ratios, and solvency ratios to determine whether the company is a good investment.

Based on the analysis, the investor finds that XYZ Inc. has a high return on equity, indicating strong profitability. The liquidity ratios show that the company has sufficient short-term assets to meet its obligations. Additionally, the solvency ratios indicate that XYZ Inc. has a low level of debt and is capable of meeting its long-term obligations.

Based on these findings, the investor concludes that XYZ Inc. is a financially healthy company with good prospects for future growth, making it a potentially attractive investment.

Fundamental Analysis Types: Quantitative and Qualitative

Fundamental analysis is a method of evaluating a company’s financial health and performance by examining its financial statements, management team, industry trends, and other factors. It involves analyzing both quantitative and qualitative data to gain insights into the company’s current and future prospects.

Qualitative analysis, on the other hand, focuses on non-financial factors that can impact a company’s performance. This includes evaluating the company’s management team, its competitive position within the industry, its brand reputation, and its ability to innovate. Qualitative analysis also takes into account external factors such as economic conditions, regulatory changes, and market trends that can affect the company’s prospects.

It is important to note that fundamental analysis is not a foolproof method and should be used in conjunction with other forms of analysis, such as technical analysis and market sentiment analysis. Additionally, it is crucial to keep in mind that past performance is not indicative of future results, and that market conditions can change rapidly.

Fundamental Analysis Ratios: Key Metrics for Evaluation

In fundamental analysis, ratios are essential tools for evaluating the financial health and performance of a company. These ratios provide insights into various aspects of a company’s operations, profitability, liquidity, and solvency. By analyzing these ratios, investors can make informed decisions about whether to invest in a particular company.

1. Price-to-Earnings (P/E) Ratio: This ratio compares a company’s stock price to its earnings per share (EPS). It indicates how much investors are willing to pay for each dollar of earnings. A higher P/E ratio suggests that investors have high expectations for future growth.

2. Price-to-Sales (P/S) Ratio: This ratio compares a company’s stock price to its revenue per share. It is used to evaluate a company’s valuation relative to its sales. A lower P/S ratio may indicate that a company is undervalued.

3. Return on Equity (ROE): This ratio measures a company’s profitability by comparing its net income to its shareholders’ equity. It indicates how effectively a company is utilizing its equity to generate profits. A higher ROE suggests better profitability.

4. Debt-to-Equity (D/E) Ratio: This ratio compares a company’s total debt to its shareholders’ equity. It shows the proportion of a company’s financing that comes from debt. A higher D/E ratio indicates higher financial risk and potential difficulties in repaying debt.

5. Current Ratio: This ratio measures a company’s ability to pay its short-term obligations using its short-term assets. It compares a company’s current assets to its current liabilities. A higher current ratio suggests better liquidity and the ability to meet short-term obligations.

6. Gross Margin: This ratio compares a company’s gross profit to its revenue. It indicates the profitability of a company’s core operations. A higher gross margin suggests better efficiency in producing goods or services.

7. Operating Margin: This ratio measures a company’s operating income as a percentage of its revenue. It shows how much profit a company generates from its core operations. A higher operating margin indicates better operational efficiency.

8. Return on Assets (ROA): This ratio measures a company’s profitability by comparing its net income to its total assets. It indicates how effectively a company is utilizing its assets to generate profits. A higher ROA suggests better asset utilization.

9. Dividend Yield: This ratio compares a company’s annual dividend per share to its stock price. It indicates the return on investment from dividends. A higher dividend yield suggests higher returns for investors.

10. Earnings per Share (EPS): This ratio measures a company’s profitability by dividing its net income by the number of outstanding shares. It indicates the amount of earnings attributable to each share. Higher EPS suggests higher profitability.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.