Gross Margin Definition

Gross margin is a financial ratio that measures the profitability of a company by calculating the percentage of revenue that remains after deducting the cost of goods sold (COGS). It is an important indicator of a company’s ability to generate profit from its core operations.

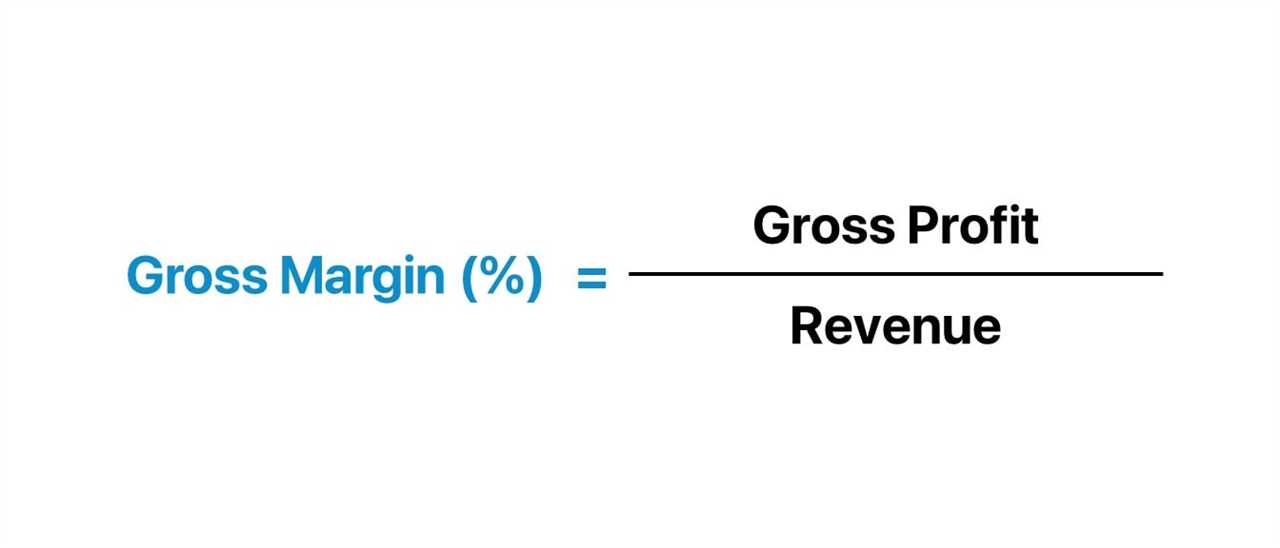

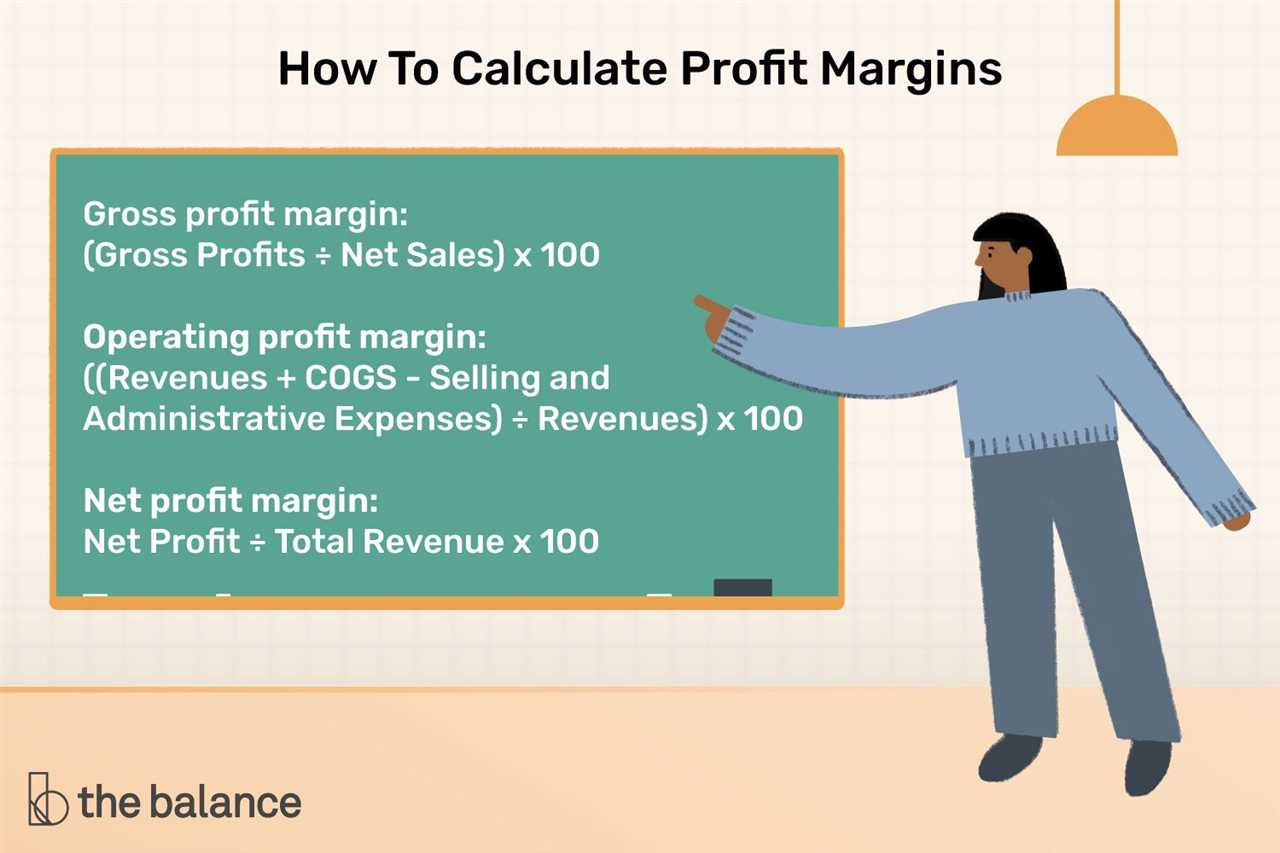

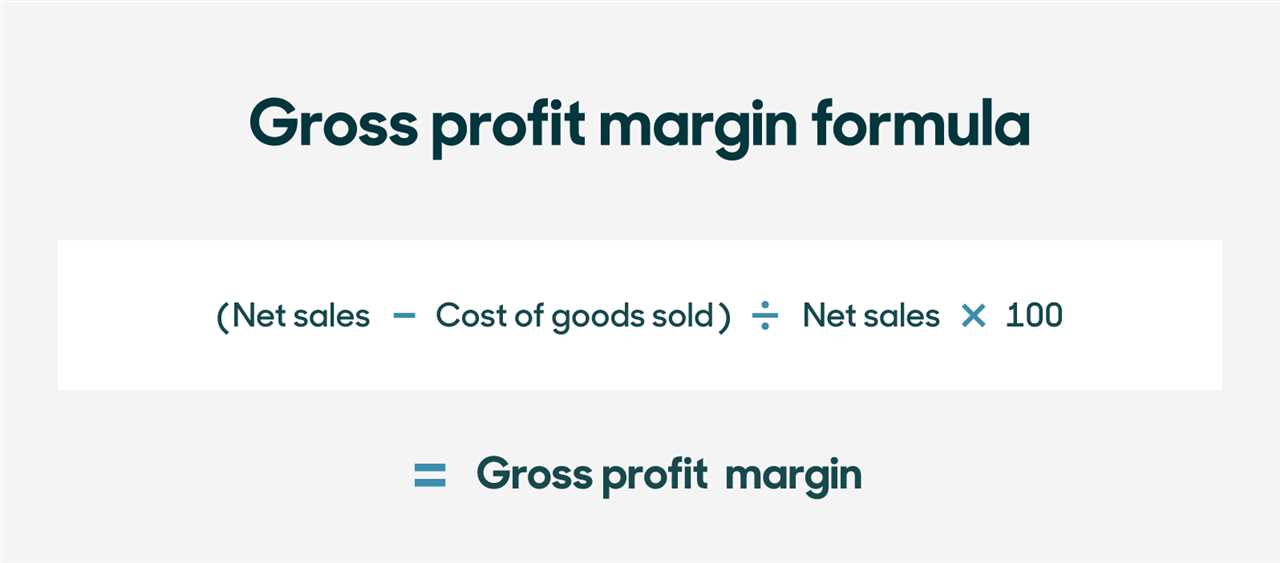

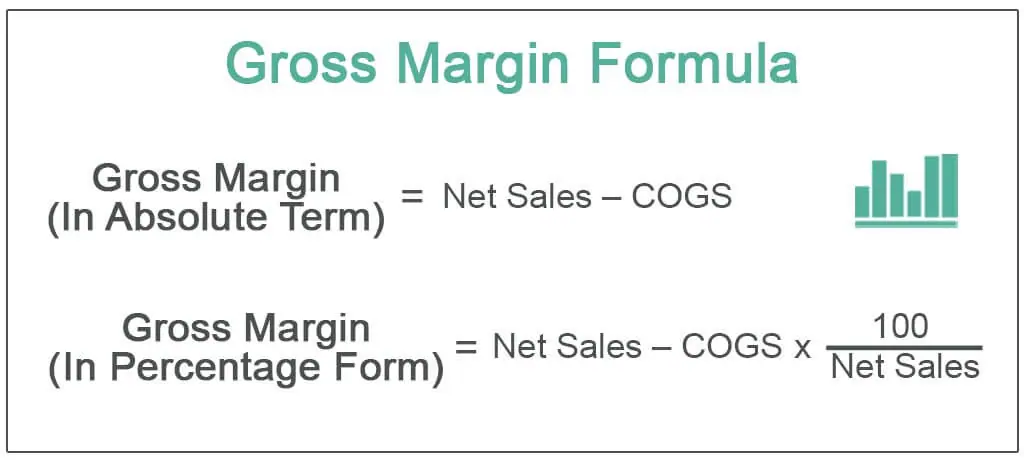

COGS includes the direct costs associated with producing or delivering a product or service, such as raw materials, labor, and manufacturing overhead. Gross margin is calculated by subtracting COGS from revenue and dividing the result by revenue, then multiplying by 100 to get a percentage.

Gross margin is often expressed as a percentage and is used by investors, analysts, and managers to assess a company’s financial health and compare it to industry peers. A higher gross margin indicates that a company is able to generate more profit from its sales, while a lower gross margin may indicate inefficiencies in production or pricing strategies.

In summary, gross margin is a key financial metric that provides insights into a company’s profitability and operational efficiency. It is an essential tool for evaluating the financial performance of a business and making informed decisions about its future prospects.

Gross margin is a key financial metric that measures the profitability of a company’s core operations. It represents the difference between the revenue generated from sales and the cost of goods sold (COGS). In other words, it shows how much money a company makes from its products or services after deducting the direct costs associated with producing those products or services.

Components of Gross Margin

To calculate the gross margin, you need to know two key components:

- Revenue: This refers to the total amount of money generated from the sales of products or services. It includes both cash sales and credit sales.

- Cost of Goods Sold (COGS): This represents the direct costs associated with producing or delivering the products or services. It includes the cost of raw materials, labor, and any other expenses directly related to the production process.

By subtracting the COGS from the revenue, you can calculate the gross margin.

Interpreting Gross Margin

Gross margin is expressed as a percentage and can vary across industries. A higher gross margin indicates that a company is generating more revenue relative to its production costs, which is generally a positive sign. It suggests that the company has a competitive advantage, efficient operations, or effective pricing strategies.

On the other hand, a lower gross margin may indicate that a company is struggling to cover its production costs or facing pricing pressures. It could be a sign of inefficiency, increased competition, or the need to reevaluate pricing strategies.

Importance of Gross Margin

The gross margin is a crucial financial metric for businesses as it provides valuable insights into the profitability of their operations. It represents the percentage of revenue that remains after deducting the cost of goods sold (COGS). This means that the higher the gross margin, the more money a company retains to cover its operating expenses and generate profits.

The gross margin is an essential indicator for investors and stakeholders as it helps them assess the financial health and efficiency of a business. A high gross margin indicates that a company has a competitive advantage in its industry, as it can charge higher prices for its products or services while maintaining lower production costs.

Furthermore, the gross margin allows businesses to analyze their pricing strategies and cost structures. By comparing the gross margins of different products or services, companies can identify which ones are more profitable and make informed decisions about resource allocation and product development.

In addition, the gross margin is often used by lenders and creditors to evaluate the creditworthiness of a company. A higher gross margin indicates that a business has sufficient cash flow to cover its debts and is less risky to lend money to.

Overall, the gross margin is a key performance indicator that provides valuable insights into a company’s profitability, competitiveness, and financial stability. By monitoring and improving their gross margin, businesses can optimize their operations, enhance their financial performance, and achieve sustainable growth.

Gross Margin Example

Let’s take a look at an example to better understand the concept of gross margin. Suppose a company sells a product for $100 and the cost of producing that product is $60. To calculate the gross margin, we subtract the cost of goods sold from the revenue and divide the result by the revenue.

Gross Margin = $40 / $100

Gross Margin = 0.4 or 40%

This means that the company has a gross margin of 40%. This indicates that for every dollar of revenue generated, the company retains 40 cents as gross profit after covering the cost of producing the product.

The gross margin percentage is a key financial ratio that helps assess a company’s profitability and efficiency in managing its production costs. A higher gross margin indicates that the company is able to generate more profit from its sales, while a lower gross margin may suggest that the company is facing challenges in controlling its production costs.

By analyzing the gross margin, businesses can make informed decisions about pricing strategies, cost management, and overall profitability.

Calculating Gross Margin

Calculating the gross margin is a crucial step in assessing the financial health of a business. It helps determine the profitability of a company by measuring the percentage of revenue that remains after deducting the cost of goods sold (COGS).

To calculate the gross margin, you need to have two key figures: the revenue and the COGS. The revenue represents the total amount of money generated from the sale of goods or services, while the COGS includes all the direct costs associated with producing or delivering those goods or services.

Once you have these figures, you can use the following formula to calculate the gross margin:

The calculated gross margin percentage indicates the amount of each dollar of revenue that is left after covering the direct costs of producing the goods or services. A higher gross margin percentage is generally considered favorable, as it suggests that the company is able to generate more profit from each sale.

By calculating the gross margin regularly, businesses can track their profitability over time, identify trends, and make informed decisions to improve their financial performance.

Interpreting the Results

Once you have calculated the gross margin for your business, it is important to interpret the results to gain insights into your financial performance. The gross margin percentage can provide valuable information about the profitability of your products or services.

A high gross margin indicates that your business is able to generate a significant profit from each sale, which is a positive sign. It means that you have a good pricing strategy and are able to cover your costs while still making a profit.

Comparing your gross margin to industry benchmarks can also provide valuable insights. If your gross margin is significantly lower than the industry average, it may indicate that you are not competitive in terms of pricing or cost management. On the other hand, if your gross margin is higher than the industry average, it could mean that you have a competitive advantage and are able to command higher prices.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.