Franked Dividend: Definition, Types, Example

A franked dividend is a type of dividend that is paid out by a company to its shareholders. Unlike regular dividends, which are paid out of the company’s after-tax profits, franked dividends are paid out of the company’s pre-tax profits. This means that the company has already paid taxes on the profits before distributing them to shareholders.

There are two types of franked dividends: fully franked dividends and partially franked dividends. Fully franked dividends are dividends that have been paid out of the company’s pre-tax profits and have had the full amount of tax paid on them. Partially franked dividends are dividends that have been paid out of the company’s pre-tax profits but have had only a portion of the tax paid on them.

Fully Franked Dividends

Fully franked dividends are the most common type of franked dividend. They are usually paid out by companies that have already paid the full amount of tax on their profits. When shareholders receive fully franked dividends, they are entitled to a tax credit for the amount of tax that has already been paid by the company. This means that the dividends are essentially tax-free for the shareholders.

Partially Franked Dividends

Partially franked dividends are less common than fully franked dividends. They are usually paid out by companies that have not paid the full amount of tax on their profits. When shareholders receive partially franked dividends, they are entitled to a tax credit for only a portion of the tax that has been paid by the company. This means that the dividends are partially taxable for the shareholders.

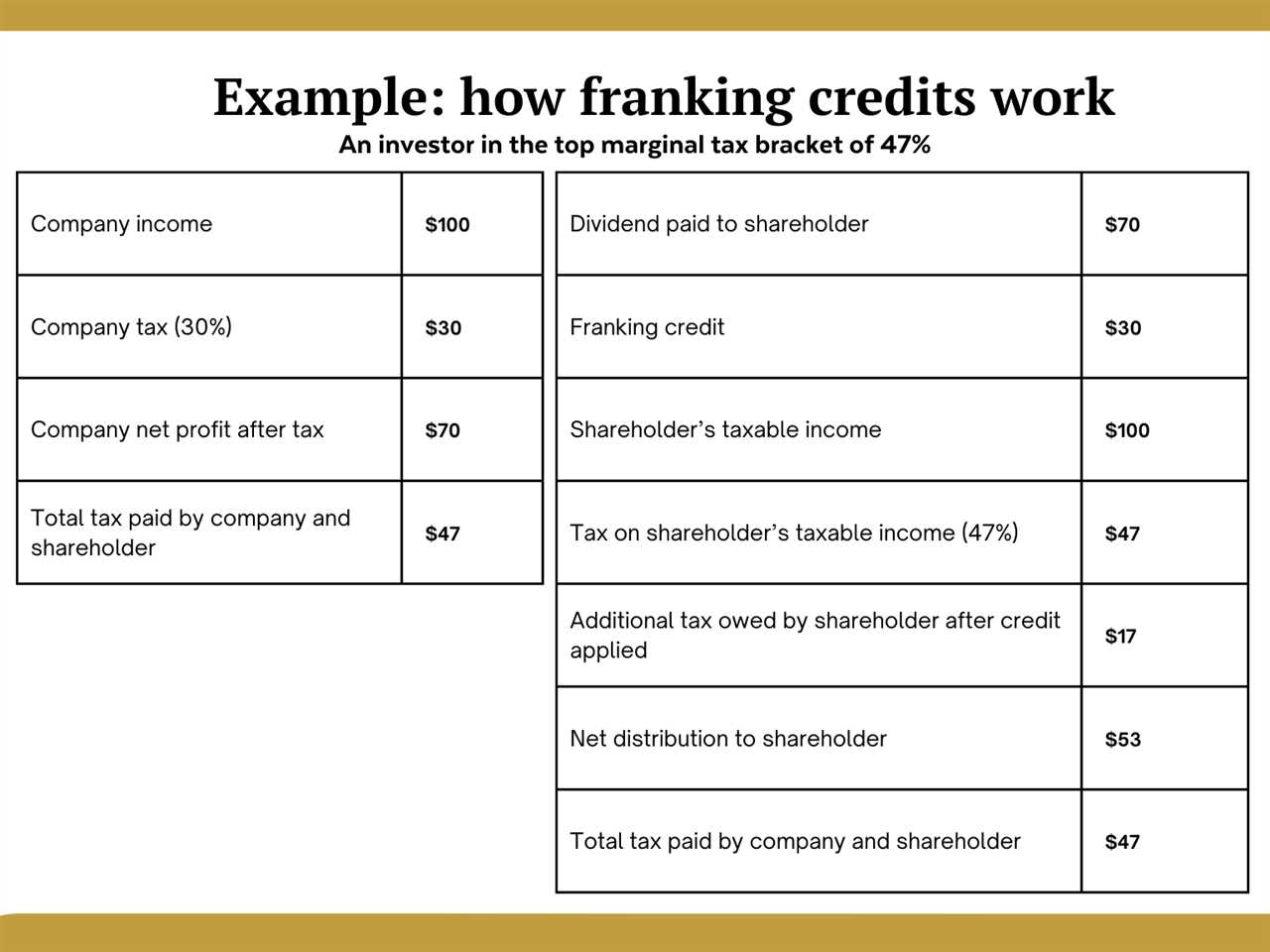

Here is an example to illustrate how franked dividends work:

Example:

Company XYZ earns a profit of $1,000,000 before tax. The company pays a corporate tax rate of 30%, resulting in a tax payment of $300,000. The remaining $700,000 is distributed to shareholders as dividends.

What is a Franked Dividend?

A franked dividend is a type of dividend that is paid out by a company to its shareholders and comes with a tax credit. This tax credit is designed to prevent double taxation on the same income.

A franked dividend is a dividend that has already had the company tax paid on it. This means that when the dividend is received by the shareholder, they also receive a tax credit for the tax that has already been paid by the company. This tax credit can then be used to offset the individual shareholder’s tax liability.

Franked dividends are beneficial for shareholders because they reduce the overall tax burden on the dividend income. Without the tax credit, shareholders would have to pay tax on the dividend income at their individual tax rate, resulting in double taxation. With franked dividends, shareholders only pay tax on the remaining portion of the dividend income after the tax credit has been applied.

It is important to note that not all dividends are franked. Companies have the option to pay either franked or unfranked dividends, depending on their financial situation and tax obligations. Shareholders should carefully consider the tax implications of receiving franked dividends when making investment decisions.

Types of Franked Dividends

Franked dividends are a type of dividend that is paid out by a company and comes with a tax credit for the shareholders. There are several types of franked dividends that investors should be aware of:

| Type | Description |

|---|---|

| Fully Franked Dividend | A fully franked dividend is a dividend that has been fully taxed at the corporate tax rate, and the company has attached a franking credit to the dividend to pass on the tax paid to the shareholders. This means that the shareholders receive a tax credit for the tax already paid by the company. |

| Partially Franked Dividend | A partially franked dividend is a dividend that has been partially taxed at the corporate tax rate. The company attaches a franking credit to the dividend, but the tax paid by the company is less than the maximum corporate tax rate. This means that the shareholders receive a partial tax credit for the tax paid by the company. |

| Unfranked Dividend | An unfranked dividend is a dividend that has not been taxed at the corporate tax rate. The company does not attach a franking credit to the dividend, and the shareholders do not receive any tax credit for the dividend. This type of dividend is usually paid out by companies that have not paid any corporate tax. |

It is important for investors to understand the type of franked dividend they are receiving, as it can have implications for their tax obligations. Fully franked dividends provide the most tax benefits, as shareholders receive a tax credit for the full amount of tax paid by the company. Partially franked dividends provide some tax benefits, but the tax credit is limited to the amount of tax paid by the company. Unfranked dividends do not provide any tax benefits, as shareholders do not receive a tax credit.

Example of Franked Dividend

Let’s consider an example to understand how a franked dividend works.

Suppose you are an investor who owns shares in a company that has declared a dividend of $1 per share. The company has already paid taxes on its profits at the corporate tax rate, which is, let’s say, 20%. This means that for every $1 of profit, the company has paid $0.20 in taxes.

Now, let’s assume that the company has a franking credit of $0.20 per share. This credit represents the taxes already paid by the company. When the company distributes the dividend, it can attach the franking credit to the dividend payment.

Let’s assume that your personal tax rate is 30%. When you include the franking credit in your taxable income, you will need to pay taxes on the total dividend received, which is $1.20. However, you can offset the tax liability by claiming a tax credit of $0.20, which is the franking credit attached to the dividend.

In summary, a franked dividend is a dividend payment that includes a franking credit representing the taxes already paid by the company. This allows investors to offset their tax liability and avoid double taxation on the company’s profits.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.