Overview of the Federal Reserve’s Balance Sheet

The balance sheet is divided into two main sections: assets and liabilities. The assets represent what the Federal Reserve owns, while the liabilities represent what it owes to others.

Assets

The Federal Reserve’s assets consist of a variety of financial instruments, including government securities, loans to financial institutions, and foreign currency reserves. These assets are held by the Federal Reserve to support its monetary policy objectives and ensure the stability of the financial system.

One of the largest components of the Federal Reserve’s assets is its holdings of government securities, such as Treasury bonds and mortgage-backed securities. These securities are purchased by the Federal Reserve in open market operations, which are designed to influence interest rates and the availability of credit in the economy.

Another important asset on the Federal Reserve’s balance sheet is its foreign currency reserves. These reserves are held to support the stability of the international financial system and to facilitate foreign exchange transactions.

Liabilities

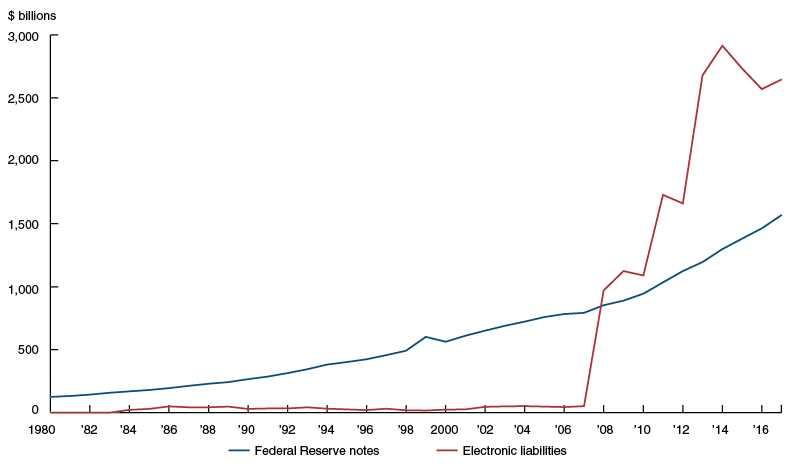

The Federal Reserve’s liabilities represent what it owes to others, primarily in the form of currency in circulation and reserves held by banks. Currency in circulation includes all the physical currency, such as banknotes and coins, that is in the hands of the public.

Reserves held by banks are funds that banks are required to hold at the Federal Reserve to meet reserve requirements. These reserves play a crucial role in the functioning of the banking system and the implementation of monetary policy.

In addition to currency in circulation and reserves held by banks, the Federal Reserve also has other liabilities, such as deposits held by foreign central banks and the U.S. Treasury. These deposits represent funds that are held by the Federal Reserve on behalf of other institutions.

Treasuries

One of the primary assets held by the Federal Reserve is U.S. Treasury securities. These are government-issued debt instruments that are used to finance the federal government’s operations. The Federal Reserve purchases Treasury securities in the open market, which increases the money supply and stimulates economic activity. Conversely, when the Federal Reserve sells Treasury securities, it reduces the money supply, thereby slowing down economic growth.

Mortgage-Backed Securities

Another significant asset on the Federal Reserve’s balance sheet is mortgage-backed securities (MBS). These are securities that represent an ownership interest in a pool of mortgage loans. The Federal Reserve began purchasing MBS during the financial crisis to support the housing market and provide liquidity to the financial system. By holding MBS, the Federal Reserve influences mortgage rates and promotes stability in the housing sector.

Foreign Currency Reserves

The Federal Reserve also holds foreign currency reserves as part of its assets. These reserves consist of foreign currencies, such as euros, yen, and pounds, that the Federal Reserve acquires through various means, including foreign exchange interventions and agreements with other central banks. Foreign currency reserves provide the Federal Reserve with the ability to intervene in foreign exchange markets to stabilize the value of the U.S. dollar and support international trade.

Other Assets

In addition to the aforementioned assets, the Federal Reserve also holds a range of other assets, including loans to financial institutions, gold reserves, and special drawing rights (SDRs) issued by the International Monetary Fund (IMF). These assets serve various purposes, such as providing liquidity to the banking system, preserving the value of the central bank’s balance sheet, and supporting the international monetary system.

| Asset Type | Description |

|---|---|

| Treasuries | Government-issued debt securities used to finance the federal government |

| Mortgage-Backed Securities | Securities representing ownership interest in a pool of mortgage loans |

| Foreign Currency Reserves | Holdings of foreign currencies to stabilize the value of the U.S. dollar |

| Other Assets | Loans to financial institutions, gold reserves, and special drawing rights (SDRs) |

Examining the Federal Reserve’s Liabilities

Types of Liabilities

The Federal Reserve has several types of liabilities, including:

- Reserve Balances: Reserve balances are the deposits held by commercial banks and other depository institutions at the Federal Reserve. These balances are considered liabilities because the Federal Reserve is obligated to redeem them upon demand.

- U.S. Treasury Securities: The Federal Reserve holds U.S. Treasury securities as part of its monetary policy operations. These securities represent the debt obligations of the U.S. government and are considered liabilities of the Federal Reserve.

- Foreign Official Deposits: The Federal Reserve also holds deposits of foreign central banks and international organizations. These deposits are considered liabilities because the Federal Reserve is responsible for redeeming them when requested.

- Other Liabilities: The Federal Reserve may have other liabilities, such as loans or agreements with foreign central banks or financial institutions. These liabilities are typically related to the Federal Reserve’s role in maintaining financial stability and facilitating international monetary cooperation.

Implications of Liabilities

The liabilities of the Federal Reserve have important implications for the economy. For example, changes in reserve balances can affect the liquidity and lending capacity of commercial banks. When the Federal Reserve increases reserve balances, it provides banks with more funds to lend, which can stimulate economic activity. Conversely, when the Federal Reserve decreases reserve balances, it reduces the lending capacity of banks, which can have a contractionary effect on the economy.

The holdings of U.S. Treasury securities by the Federal Reserve also have implications for the government’s borrowing costs. When the Federal Reserve purchases Treasury securities, it increases the demand for these securities, which can lower their yields and borrowing costs for the government. On the other hand, when the Federal Reserve sells Treasury securities, it reduces the demand for these securities, which can increase their yields and borrowing costs for the government.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.