EBITDA: All You Need to Know About Definition, Calculation Formulas, History, and Criticisms

EBITDA, which stands for Earnings Before Interest, Taxes, Depreciation, and Amortization, is a financial metric used to evaluate the profitability and operational performance of a company. It provides a clearer picture of a company’s financial health by excluding non-operating expenses and non-cash items.

Definition:

EBITDA represents a company’s earnings before deducting interest expenses, taxes, depreciation, and amortization. It is often used by investors, analysts, and financial institutions to assess a company’s ability to generate cash flow from its core operations.

Calculation Formulas:

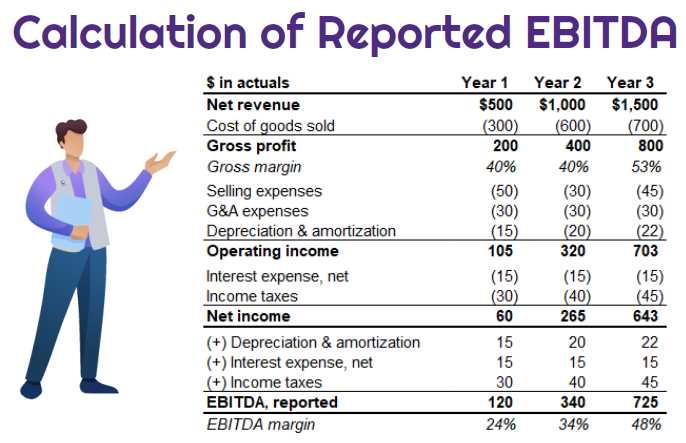

There are two common formulas used to calculate EBITDA:

EBITDA = Net Income + Interest + Taxes + Depreciation + Amortization

EBITDA = Operating Profit + Depreciation + Amortization

History:

The concept of EBITDA originated in the 1980s when it was used by private equity firms to evaluate the financial performance of potential acquisition targets. It gained popularity in the 1990s during the dot-com boom and has since become a widely used financial metric.

Criticisms:

What is EBITDA?

EBITDA stands for Earnings Before Interest, Taxes, Depreciation, and Amortization. It is a financial metric used to assess the profitability and financial health of a company. EBITDA is often used by investors, analysts, and financial institutions to evaluate a company’s operating performance and compare it to other companies in the same industry.

Definition

EBITDA is a measure of a company’s operating performance, excluding the effects of interest, taxes, depreciation, and amortization. It provides a clearer picture of a company’s profitability by focusing on its core operations. EBITDA is calculated by adding back interest, taxes, depreciation, and amortization to a company’s net income.

Calculation Formulas for EBITDA

There are two common formulas used to calculate EBITDA:

- EBITDA = Net Income + Interest + Taxes + Depreciation + Amortization

- EBITDA = Operating Income + Depreciation + Amortization

The first formula includes interest and taxes, while the second formula focuses only on operating income. The choice of formula may vary depending on the specific needs and preferences of the user.

History of EBITDA

EBITDA was first introduced in the 1980s by the investment banking community as a way to evaluate leveraged buyouts (LBOs). It gained popularity due to its simplicity and ability to provide a quick snapshot of a company’s financial performance. Over the years, EBITDA has become widely used in various industries and is now considered a standard financial metric.

Criticisms of EBITDA

While EBITDA is a useful metric for evaluating a company’s operating performance, it has its limitations and has been subject to criticism. Some of the main criticisms include:

- Exclusion of interest, taxes, depreciation, and amortization can distort the true financial picture of a company.

- EBITDA can be manipulated by companies to make their financial performance appear better than it actually is.

Despite these criticisms, EBITDA remains a widely used metric in the financial industry and provides valuable insights into a company’s profitability and financial health.

Calculation Formulas for EBITDA

EBITDA, which stands for Earnings Before Interest, Taxes, Depreciation, and Amortization, is a financial metric used to evaluate a company’s operating performance. It is often used by investors, analysts, and lenders to assess a company’s profitability and cash flow.

There are several formulas used to calculate EBITDA, depending on the level of detail and information available. The most common formula is:

EBITDA = Net Income + Interest + Taxes + Depreciation + Amortization

This formula starts with the company’s net income, which is the total revenue minus expenses, including taxes and interest. Then, it adds back interest, taxes, depreciation, and amortization to arrive at the EBITDA figure.

Let’s break down each component of the formula:

- Net Income: This is the company’s total revenue minus all expenses, including taxes and interest. It represents the profit generated by the company.

- Interest: This includes the interest paid on loans and other forms of debt. It is added back to the net income because it is considered a financing cost and not directly related to the company’s operating performance.

- Taxes: This includes all taxes paid by the company, such as income tax. Taxes are added back to the net income because they are not considered an operating expense.

- Depreciation: This represents the decrease in value of an asset over time. It is added back to the net income because it is a non-cash expense and does not affect the company’s cash flow.

- Amortization: This represents the gradual reduction of an intangible asset’s value over time. It is added back to the net income because it is a non-cash expense and does not affect the company’s cash flow.

History of EBITDA

EBITDA, which stands for Earnings Before Interest, Taxes, Depreciation, and Amortization, has a long history in the world of finance and accounting. It was first introduced in the 1980s by the investment banking community as a way to measure a company’s operating performance without the influence of non-operating factors.

The concept of EBITDA gained popularity in the 1990s, particularly during the dot-com boom, when many technology companies were experiencing rapid growth but had yet to turn a profit. EBITDA provided a way to evaluate these companies based on their ability to generate cash flow from their core operations, rather than focusing solely on their net income.

During this time, EBITDA became a commonly used metric in the valuation of companies, especially in the technology and telecommunications sectors. It was seen as a more accurate measure of a company’s profitability and financial health, as it excluded non-cash expenses like depreciation and amortization, which can vary significantly between companies.

Despite these criticisms, EBITDA continues to be used by many investors, analysts, and financial professionals as a tool for evaluating the financial performance of companies. It is particularly useful in industries where non-cash expenses are significant, such as real estate and manufacturing.

Criticisms of EBITDA

While EBITDA is a widely used financial metric, it has faced its fair share of criticisms from various stakeholders. Critics argue that EBITDA can be misleading and does not provide a complete picture of a company’s financial health. Here are some of the main criticisms of EBITDA:

2. Ignores changes in working capital: EBITDA does not consider changes in working capital, such as accounts receivable and accounts payable. These changes can have a significant impact on a company’s cash flow and overall financial performance. Ignoring working capital can lead to an inaccurate assessment of a company’s ability to generate cash and manage its short-term obligations.

3. Masks high levels of debt: EBITDA can mask a company’s high levels of debt. By focusing solely on earnings before interest, taxes, depreciation, and amortization, EBITDA does not account for the interest expense associated with a company’s debt. This can give the impression that a company is more financially stable than it actually is.

4. Lacks comparability: EBITDA can vary significantly between companies, making it difficult to compare their financial performance. Different companies may have different levels of depreciation, amortization, and interest expenses, which can skew the EBITDA figures. This lack of comparability can make it challenging for investors and analysts to make informed decisions.

6. Overemphasis on revenue growth: EBITDA is often used as a measure of a company’s profitability and is sometimes used to evaluate executive performance. This can create a focus on revenue growth at the expense of other important factors, such as cash flow, return on investment, and long-term sustainability. By solely relying on EBITDA, companies may prioritize short-term gains over long-term value creation.

Overall, while EBITDA can be a useful metric for certain purposes, it is important to consider its limitations and use it in conjunction with other financial measures to get a more comprehensive view of a company’s financial health.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.