Importance of DLOM in Valuation

Discounts for Lack of Marketability (DLOM) play a crucial role in the valuation of assets and businesses. DLOM represents the reduction in the value of an asset or business interest due to its lack of marketability, which refers to the ability to quickly and easily convert the asset into cash at fair market value.

1. Enhances Accuracy of Valuation

Considering DLOM in the valuation process helps to provide a more accurate representation of the true value of an asset or business interest. By factoring in the lack of marketability, the valuation takes into account the potential limitations and risks associated with selling the asset or business interest in the open market.

Without considering DLOM, the valuation may overestimate the value of the asset or business interest, leading to unrealistic expectations and potential financial losses for buyers or investors.

2. Reflects Real-World Market Conditions

Including DLOM in the valuation process reflects the real-world market conditions and the actual challenges faced when selling an illiquid asset or business interest. Illiquid assets or businesses may require a longer time to find a buyer, negotiate a fair price, and complete the transaction.

By incorporating DLOM, the valuation accounts for the time and effort required to sell the asset or business interest, providing a more accurate representation of its value in the current market environment.

3. Mitigates Risk for Buyers and Investors

DLOM helps to mitigate risk for buyers and investors by considering the potential difficulties and uncertainties associated with selling an illiquid asset or business interest. The discount applied due to lack of marketability provides a cushion for these risks, reducing the potential financial loss in case of a future sale.

By factoring in DLOM, buyers and investors can make more informed decisions and assess the risk-reward tradeoff when considering the purchase of an illiquid asset or business interest.

4. Supports Negotiations and Decision-Making

Valuations that incorporate DLOM provide a solid foundation for negotiations and decision-making processes. The discount for lack of marketability serves as a starting point for negotiations, allowing buyers and sellers to reach a fair and mutually beneficial agreement.

Furthermore, DLOM helps buyers and investors evaluate the potential return on investment and make informed decisions based on the risk and reward associated with the illiquid asset or business interest.

Factors Affecting DLOM

1. Company-specific Factors

2. Market Conditions

The overall market conditions and investor sentiment can also affect DLOM. During periods of economic uncertainty or market volatility, investors may demand higher discounts to compensate for the increased risk associated with illiquid investments. Conversely, in favorable market conditions, DLOM may be relatively lower as investors are more willing to take on illiquidity risk.

3. Size of Ownership Interest

4. Transfer Restrictions

Transfer restrictions imposed on the ownership interests can significantly affect DLOM. These restrictions may include lock-up periods, rights of first refusal, or limitations on the transferability of shares. The presence of transfer restrictions reduces the marketability of the ownership interests and, therefore, increases DLOM.

5. Dividend Policy

The dividend policy of the company can also impact DLOM. Companies that have a history of paying regular dividends or have a clear dividend policy in place may be perceived as more attractive to investors, reducing the DLOM. Conversely, companies that do not pay dividends or have an inconsistent dividend policy may face higher DLOM due to the uncertainty surrounding potential cash flows.

| Factors Affecting DLOM | Description |

|---|---|

| Company-specific Factors | Financial performance, growth prospects, industry dynamics, and management quality |

| Market Conditions | Economic conditions and investor sentiment |

| Size of Ownership Interest | Minority vs. controlling ownership interests |

| Transfer Restrictions | Lock-up periods, rights of first refusal, limitations on transferability |

| Dividend Policy | Regular dividends, clear dividend policy |

Methods for Calculating DLOM

1. Restricted Stock Studies

One commonly used method is the analysis of restricted stock studies. This approach involves comparing the prices of restricted stocks, which are stocks that have limitations on their transferability, to the prices of freely tradable stocks. By examining the price differences between these two types of stocks, an estimate of the DLOM can be derived.

2. Pre-IPO Studies

Another method is the analysis of pre-IPO studies. This approach involves studying the prices of shares in companies that are about to go public. By comparing the prices of these shares to the prices of similar publicly traded companies, an estimate of the DLOM can be determined.

Both restricted stock studies and pre-IPO studies provide valuable insights into the market’s perception of the lack of marketability of certain investments. However, it is important to note that these studies are based on historical data and may not always accurately reflect current market conditions.

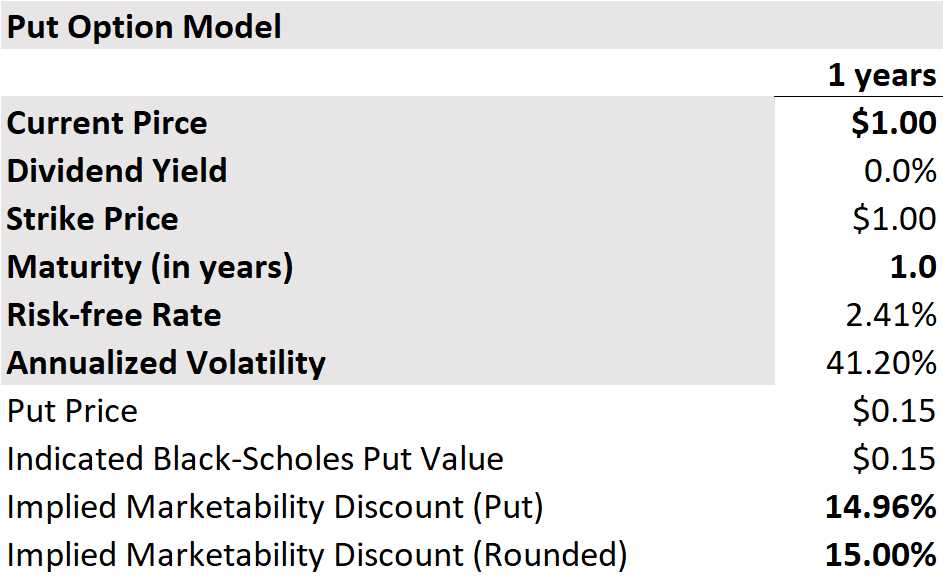

3. Option Pricing Models

4. Cash Flow Models

It is important to note that each method has its own strengths and limitations. The choice of method depends on the specific characteristics of the investment being valued and the availability of relevant data. Additionally, it is often recommended to use multiple methods and compare the results to arrive at a more reliable estimate of the DLOM.

Tools for Assessing DLOM

Quantitative Models

One commonly used quantitative model is the restricted stock studies. These studies analyze the price differences between restricted stock and freely tradable stock to determine the discount. Another quantitative model is the option pricing model, which uses the principles of options pricing to estimate the DLOM.

Qualitative Approaches

It is important to note that both quantitative models and qualitative approaches have their strengths and limitations. Valuation professionals often use a combination of these tools to arrive at a comprehensive assessment of the DLOM.

Quantitative Models

Benefits of Quantitative Models

Quantitative models offer several advantages in assessing DLOM:

- Accuracy: By relying on data-driven calculations, quantitative models provide a more accurate estimation of DLOM compared to subjective methods.

- Consistency: These models ensure consistency in the valuation process by applying consistent formulas and parameters.

- Transparency: Quantitative models make the valuation process transparent by providing clear and explicit calculations, making it easier for stakeholders to understand and evaluate the DLOM.

- Efficiency: With the use of automated calculations, quantitative models save time and effort in determining the DLOM, allowing for faster decision-making.

Types of Quantitative Models

There are various types of quantitative models used to assess DLOM:

- Restricted Stock Studies: These models analyze the trading activity and performance of restricted stocks to determine the discount associated with lack of marketability.

- Pre-IPO Studies: These models examine the price difference between shares sold in private transactions and the expected IPO price to estimate the DLOM.

- Quantitative Marketability Discounts Models: These models incorporate various market-based factors, such as trading volume, bid-ask spread, and market capitalization, to calculate the DLOM.

Each type of quantitative model has its own strengths and limitations, and the choice of model depends on the specific circumstances and characteristics of the asset being valued.

Qualitative Approaches

Qualitative approaches are another method used to assess the discount for lack of marketability (DLOM) in valuation. These approaches involve evaluating various qualitative factors that may impact the marketability of a security or asset.

Another qualitative approach is the assessment of the company’s industry and market conditions. This involves evaluating factors such as competition, market trends, and regulatory environment. A company operating in a highly competitive industry or facing unfavorable market conditions may be considered less marketable and therefore have a higher DLOM.

Furthermore, qualitative approaches may also consider the company’s management team and corporate governance practices. A company with a strong and experienced management team, transparent governance practices, and a good reputation may be seen as more marketable and have a lower DLOM.

Overall, qualitative approaches provide a more subjective assessment of the DLOM by considering various qualitative factors that may impact the marketability of a security or asset. These approaches can be useful in situations where quantitative models may not fully capture the unique characteristics of the security or asset being valued.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.