Depreciation Definition

Depreciation is a term used in accounting to describe the reduction in value of an asset over time. It is a way of allocating the cost of an asset over its useful life. Assets such as buildings, vehicles, machinery, and equipment are subject to depreciation.

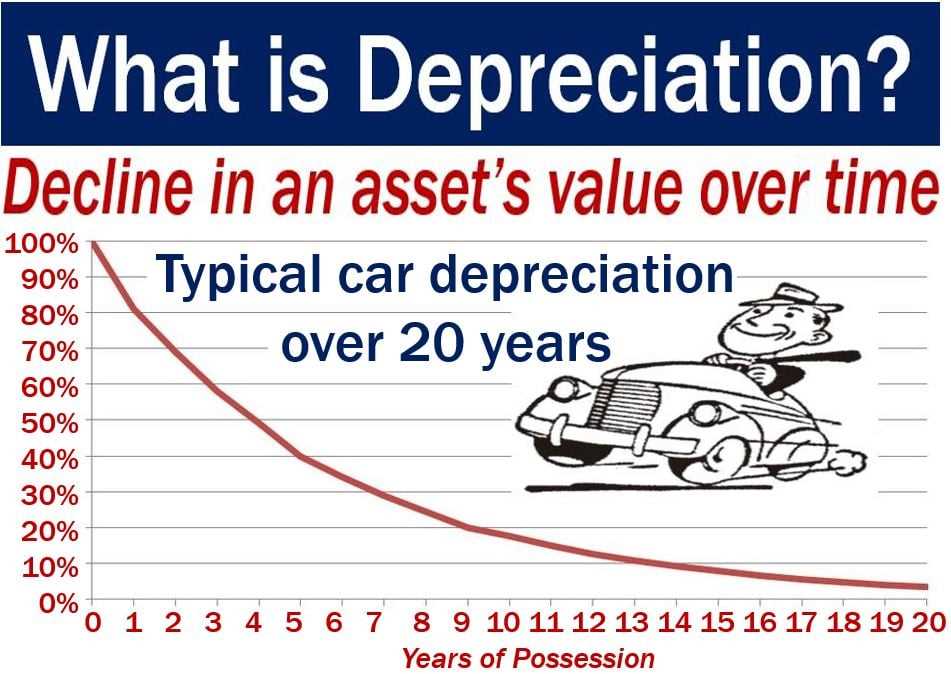

What is Depreciation?

Depreciation is a non-cash expense that reflects the wear and tear, obsolescence, and aging of an asset. It is important for businesses to account for depreciation as it helps in determining the true cost of using an asset and in maintaining accurate financial records.

Types of Depreciation

There are several methods used to calculate depreciation, including:

- Straight-Line Depreciation: This method evenly distributes the cost of an asset over its useful life.

- Declining Balance Depreciation: This method allocates a higher depreciation expense in the early years of an asset’s life and decreases it over time.

Depreciation Calculation

The calculation of depreciation depends on the method used. For straight-line depreciation, the formula is:

Where:

- Cost of Asset is the original cost of the asset.

- Salvage Value is the estimated value of the asset at the end of its useful life.

- Useful Life is the estimated number of years the asset will be useful.

For declining balance depreciation, the formula is more complex and takes into account the asset’s depreciation rate and the remaining book value.

Accurate depreciation calculation is crucial for financial reporting and tax purposes. It helps businesses determine the value of their assets and plan for future replacements or upgrades.

What is Depreciation?

Depreciation is a term used in accounting to describe the gradual decrease in the value of an asset over time. It is a way of allocating the cost of an asset over its useful life. Depreciation is important for businesses because it allows them to account for the wear and tear, obsolescence, and other factors that reduce the value of their assets.

Depreciation is typically calculated for tangible assets, such as buildings, vehicles, and equipment, but it can also be applied to intangible assets, such as patents or copyrights. The purpose of depreciation is to match the expense of using an asset with the revenue it generates.

Depreciation is an important concept in financial reporting, as it affects the balance sheet and income statement of a company. It is also relevant for tax purposes, as it can be used to reduce taxable income and lower the amount of taxes owed.

Types of Depreciation

1. Straight-Line Depreciation

Straight-line depreciation is the most common and simplest method of depreciation. Under this method, the cost of the asset is evenly distributed over its useful life. The formula for calculating straight-line depreciation is:

For example, if a company purchases a machine for $10,000 with a useful life of 5 years and a residual value of $2,000, the annual depreciation expense would be:

2. Declining Balance Depreciation

Declining balance depreciation is a method that allows for a higher depreciation expense in the early years of an asset’s life and lower depreciation expense in the later years. This method is often used for assets that are expected to have a higher rate of obsolescence or wear and tear in the early years. The formula for calculating declining balance depreciation is:

Depreciation Expense = (Book Value at Beginning of Year * Depreciation Rate)

The depreciation rate is usually a percentage that is double the straight-line rate. For example, if the straight-line rate is 20%, the declining balance rate would be 40%. The book value at the beginning of each year is calculated by subtracting the accumulated depreciation from the cost of the asset.

3. Units of Production Depreciation

Units of production depreciation is a method that allocates the cost of an asset based on its usage or production output. This method is commonly used for assets that are directly related to production, such as machinery or vehicles. The formula for calculating units of production depreciation is:

This method allows for a more accurate allocation of the asset’s cost based on its actual usage. The depreciation expense will vary each period depending on the level of production.

These are just a few examples of the types of depreciation methods that can be used. The choice of method depends on various factors and should be made based on the specific circumstances of the company and the asset in question.

Straight-Line Depreciation

Straight-line depreciation is a method used to allocate the cost of an asset evenly over its useful life. It is the simplest and most commonly used depreciation method in accounting. Under this method, the asset’s cost is divided by its useful life to determine the annual depreciation expense.

The formula for calculating straight-line depreciation is:

The cost of the asset refers to the initial cost of acquiring or producing the asset. The salvage value is the estimated residual value of the asset at the end of its useful life. The useful life is the estimated period over which the asset is expected to generate economic benefits.

For example, let’s say a company purchases a machine for $10,000 with a useful life of 5 years and a salvage value of $2,000. Using the straight-line depreciation method, the annual depreciation expense would be:

Each year, the company would record a depreciation expense of $1,600 until the machine’s useful life is exhausted.

Straight-line depreciation is often preferred for its simplicity and ease of calculation. It provides a consistent and predictable depreciation expense over the asset’s useful life, making it easier for financial reporting and budgeting purposes.

Declining Balance Depreciation

How Does Declining Balance Depreciation Work?

Under the declining balance method, the asset is depreciated at a higher rate in the early years and at a lower rate in the later years. This means that the depreciation expense is higher in the beginning and gradually decreases over time.

For example, let’s say a company purchases a machine for $10,000 with an estimated useful life of 5 years. The straight-line depreciation rate would be 20% per year ($10,000 / 5 years). However, if the company decides to use the declining balance method with a depreciation rate of 40%, the depreciation expense for the first year would be $4,000 ($10,000 * 40%).

Advantages and Disadvantages of Declining Balance Depreciation

One advantage of the declining balance method is that it allows companies to allocate a higher depreciation expense in the early years when the asset is more productive. This can help to reflect the asset’s actual usage and value over time.

However, there are also some disadvantages to using the declining balance method. One disadvantage is that it can result in a higher depreciation expense in the early years, which may not accurately reflect the asset’s actual decline in value. Additionally, this method may not be suitable for assets that have a longer useful life or a more consistent decline in value.

Overall, the declining balance method is a useful tool for calculating depreciation expenses, but it should be used in conjunction with other methods and considerations to ensure accurate financial reporting.

Depreciation Calculation

Depreciation calculation is an essential process in accounting that helps businesses determine the decrease in value of their assets over time. It is crucial for financial reporting and tax purposes. There are various methods of depreciation calculation, each with its own advantages and considerations.

Straight-Line Depreciation

Straight-line depreciation is the simplest and most commonly used method of calculating depreciation. It assumes that the asset depreciates evenly over its useful life. The formula for straight-line depreciation is:

| Depreciation Expense | = |

|---|

Where:

- Depreciation Expense is the amount of depreciation recognized in a specific accounting period.

- Cost of Asset is the original cost of the asset.

- Salvage Value is the estimated residual value of the asset at the end of its useful life.

- Useful Life is the estimated number of years or units of production the asset will be used.

Declining Balance Depreciation

Declining balance depreciation is a method that allows for a higher depreciation expense in the earlier years of an asset’s life and lower expenses in later years. This method is often used for assets that lose their value more rapidly in the early years. The formula for declining balance depreciation is:

| Depreciation Expense | = | Book Value * Depreciation Rate |

|---|

Where:

- Depreciation Expense is the amount of depreciation recognized in a specific accounting period.

- Book Value is the original cost of the asset minus accumulated depreciation.

- Depreciation Rate is the percentage rate at which the asset depreciates each year.

It is important to note that the depreciation rate for declining balance depreciation is typically higher than the straight-line depreciation rate.

Overall, depreciation calculation is a crucial aspect of accounting that helps businesses accurately reflect the decrease in value of their assets over time. By using the appropriate depreciation method, businesses can ensure accurate financial reporting and make informed decisions regarding asset management.

How to Calculate Depreciation

Depreciation is an important concept in accounting that allows businesses to allocate the cost of an asset over its useful life. By calculating depreciation, businesses can accurately reflect the decrease in value of their assets over time.

Straight-Line Depreciation

One common method of calculating depreciation is the straight-line method. This method evenly distributes the cost of an asset over its useful life. To calculate straight-line depreciation, you need to know the initial cost of the asset, its salvage value (the estimated value at the end of its useful life), and the number of years it will be used.

The formula for straight-line depreciation is:

For example, let’s say a company purchases a piece of equipment for $10,000 with a salvage value of $2,000 and a useful life of 5 years. The depreciation expense would be:

Declining Balance Depreciation

Another method of calculating depreciation is the declining balance method. This method allows for a higher depreciation expense in the earlier years of an asset’s life and gradually decreases the depreciation expense over time.

To calculate declining balance depreciation, you need to know the initial cost of the asset, its salvage value, the useful life, and the depreciation rate (usually a percentage).

The formula for declining balance depreciation is:

For example, let’s say a company purchases a vehicle for $20,000 with a salvage value of $5,000, a useful life of 5 years, and a depreciation rate of 20%. The depreciation expense for the first year would be:

In the second year, the accumulated depreciation would be $4,000, so the depreciation expense would be:

This process continues until the accumulated depreciation equals the initial cost minus the salvage value.

Calculating depreciation is essential for businesses to accurately reflect the decrease in value of their assets over time. By using methods like straight-line depreciation or declining balance depreciation, businesses can allocate the cost of an asset over its useful life and make informed financial decisions.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.