Double-Declining Balance Depreciation Method: Definition and Formula

The double-declining balance depreciation method is a commonly used accounting technique for calculating the depreciation expense of an asset. It is an accelerated depreciation method that allows for larger deductions in the early years of an asset’s life and smaller deductions in the later years.

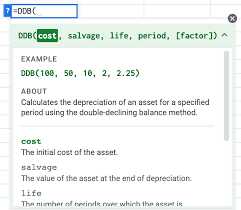

The formula for calculating the depreciation expense using the double-declining balance method is as follows:

| Year | Depreciation Rate | Depreciation Expense | Book Value |

|---|---|---|---|

| 1 | 2 x Straight-line rate | ||

| 2 | 2 x Straight-line rate | ||

| 3 | 2 x Straight-line rate | ||

| … | … | … | … |

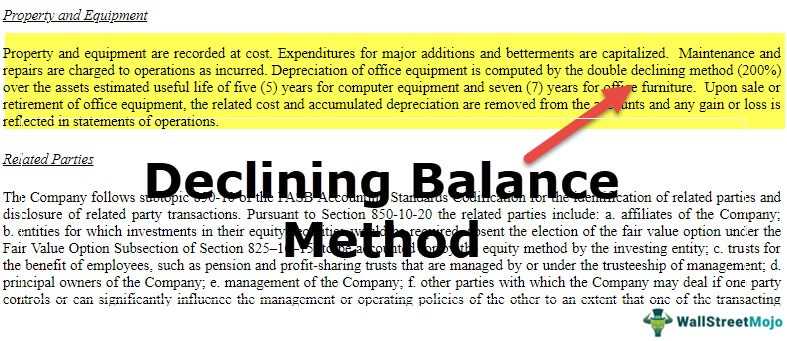

The double-declining balance method is based on the assumption that an asset’s value declines more rapidly in the earlier years of its useful life. This method is often used for assets that are expected to become technologically obsolete or have a higher risk of wear and tear in the early years.

One of the benefits of using the double-declining balance method is that it allows for a faster write-off of an asset’s cost, which can help to reduce taxable income and lower tax liabilities. Additionally, this method can better reflect the actual usage and economic benefit of an asset.

However, there are also limitations to consider when using the double-declining balance method. This method may not be suitable for assets that have a more consistent pattern of depreciation over time. Additionally, the double-declining balance method may result in higher depreciation expenses in the early years, which could impact cash flow and financial ratios.

The double-declining balance depreciation method is a popular accounting technique used to allocate the cost of an asset over its useful life. This method is based on the assumption that an asset loses its value more rapidly in the early years of its life and slows down in later years.

Under this method, the depreciation expense is calculated by applying a fixed rate to the asset’s book value. The rate used is double the straight-line depreciation rate, hence the name “double-declining balance.”

To understand how this method works, let’s consider an example. Suppose a company purchases a machine for $10,000 with a useful life of 5 years and no salvage value. Using the double-declining balance method, the depreciation rate would be 40% (double the straight-line rate of 20%).

This process continues until the book value reaches the salvage value or zero. In our example, the machine would be fully depreciated at the end of the fifth year.

The double-declining balance method is advantageous for businesses that want to reflect the higher depreciation expense in the early years of an asset’s life. This can be beneficial for tax purposes, as it allows for larger deductions in the early years.

Benefits of the Double-Declining Balance Depreciation Method

- Accelerated depreciation: One of the main benefits of the Double-Declining Balance Depreciation Method is that it allows for accelerated depreciation. This means that the asset’s value is depreciated at a faster rate in the early years of its useful life, which can help businesses to recover the cost of the asset more quickly.

- Tax advantages: The accelerated depreciation provided by the Double-Declining Balance Depreciation Method can also offer tax advantages for businesses. By depreciating the asset at a faster rate, businesses can deduct a larger portion of the asset’s cost from their taxable income in the earlier years, which can result in lower tax liabilities.

- Reflects asset obsolescence: The Double-Declining Balance Depreciation Method takes into account the fact that assets may become obsolete or lose value more quickly in certain industries or technological environments. By using this method, businesses can more accurately reflect the decreasing value of their assets over time.

- Simple calculation: The formula for the Double-Declining Balance Depreciation Method is relatively simple and straightforward, making it easier for businesses to calculate and track depreciation expenses. This can save time and resources compared to other more complex depreciation methods.

Limitations of the Double-Declining Balance Depreciation Method

The double-declining balance depreciation method is a widely used accounting technique for allocating the cost of an asset over its useful life. While it offers several advantages, it also has some limitations that should be considered.

1. Overstated Depreciation Expense

One of the main limitations of the double-declining balance depreciation method is that it can result in overstated depreciation expenses in the early years of an asset’s life. This is because the method applies a higher depreciation rate to the asset’s initial book value, which leads to larger depreciation expenses compared to other depreciation methods. As a result, the asset’s carrying value may be lower than its fair market value, which can distort the financial statements.

2. Inaccurate Depreciation Estimates

Another limitation of the double-declining balance depreciation method is that it relies on estimates of an asset’s useful life and salvage value. If these estimates are inaccurate, it can lead to incorrect depreciation calculations. For example, if the estimated useful life is too short or the salvage value is too high, the depreciation expense may be understated, resulting in an overstatement of the asset’s carrying value on the balance sheet.

3. Limited Applicability

The double-declining balance depreciation method may not be suitable for all types of assets. It is most commonly used for assets that experience higher levels of depreciation in the early years of their useful life, such as technology equipment or vehicles. For assets with a more even distribution of depreciation over their useful life, other depreciation methods, such as straight-line depreciation, may be more appropriate.

4. Complex Calculation

The double-declining balance depreciation method requires a more complex calculation compared to other depreciation methods. It involves determining the asset’s initial book value, the depreciation rate, and the remaining useful life. This can be time-consuming and prone to errors, especially for businesses with a large number of assets. Additionally, the calculation may need to be adjusted if there are changes in the asset’s useful life or salvage value, adding further complexity.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.