What is Accumulated Depreciation?

Accumulated Depreciation is a term used in accounting to represent the total depreciation expense that has been charged against an asset since it was acquired. It is a contra-asset account, meaning it is subtracted from the asset’s original cost to determine its net book value.

Depreciation is the systematic allocation of the cost of an asset over its useful life. It is a way to recognize the wear and tear, obsolescence, or decrease in value of an asset over time. Accumulated Depreciation keeps track of the total amount of depreciation that has been recorded for an asset, providing a more accurate representation of its current value.

Accumulated Depreciation is typically shown on the balance sheet as a negative amount, reducing the value of the corresponding asset. For example, if a company has a building with a cost of $1 million and accumulated depreciation of $200,000, the net book value of the building would be $800,000.

Accumulated Depreciation is important for financial reporting purposes as it helps to provide a more accurate picture of the company’s assets and their value. It allows for the recognition of the decrease in value of assets over time, which is important for making informed business decisions.

In the field of accounting, accumulated depreciation refers to the total depreciation expense that has been charged against an asset since its acquisition. It represents the reduction in the value of an asset over time due to wear and tear, obsolescence, or any other factors that cause a decrease in its usefulness or value.

Depreciation and its Importance

Depreciation is a crucial concept in accounting as it helps in accurately reporting the value of assets on the balance sheet. It allows businesses to allocate the cost of an asset over its useful life, reflecting the gradual consumption of its value. By recognizing depreciation, companies can match the expense of using an asset with the revenue it generates, providing a more accurate representation of the financial health of the business.

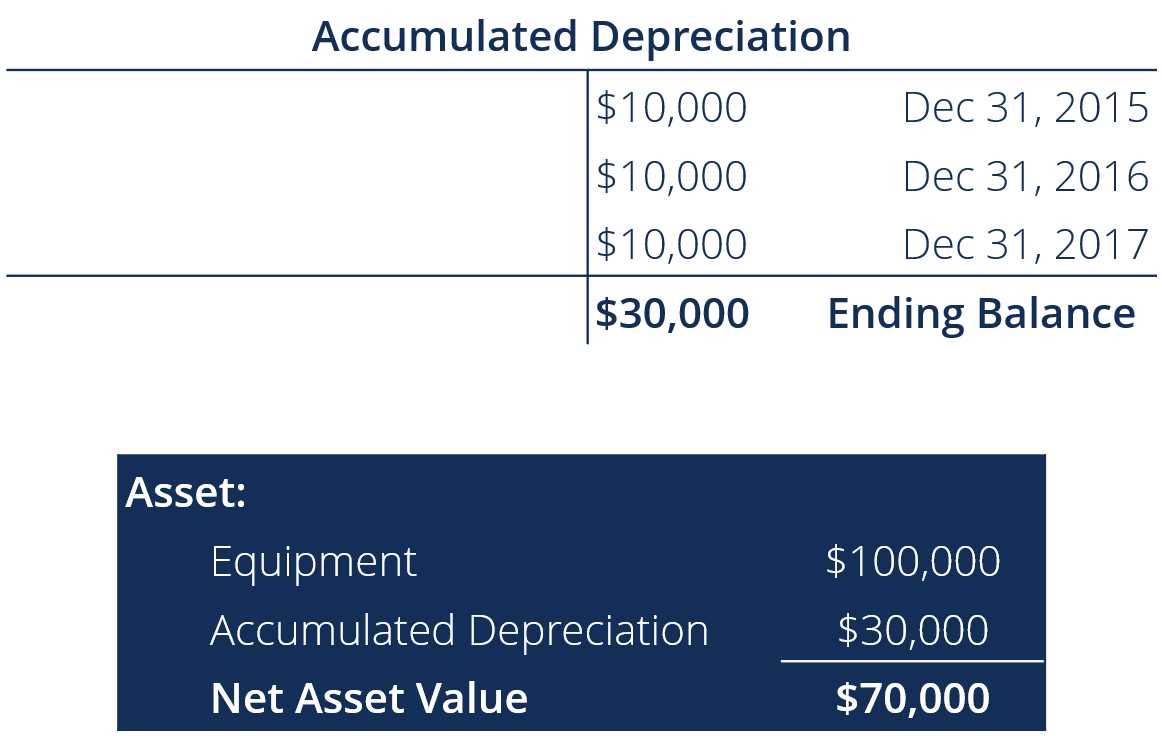

Accumulated depreciation is an essential component in determining the net book value of an asset. The net book value is calculated by subtracting the accumulated depreciation from the original cost of the asset. This value is crucial for decision-making purposes, such as determining the fair market value of an asset or assessing its potential resale value.

Methods of Calculating Accumulated Depreciation

There are several methods used to calculate accumulated depreciation, including:

- Straight-Line Method: This method evenly distributes the depreciation expense over the useful life of the asset.

- Declining Balance Method: This method applies a higher depreciation expense in the early years of an asset’s life and gradually reduces it over time.

- Units of Production Method: This method calculates depreciation based on the actual usage or production output of the asset.

Recording Accumulated Depreciation

Accumulated depreciation is recorded as a contra-asset account on the balance sheet. It is subtracted from the corresponding asset account to reflect the decrease in value over time. For example, if a company has a building with an original cost of $500,000 and accumulated depreciation of $100,000, the net book value of the building would be $400,000.

It is important to note that accumulated depreciation does not represent the actual cash outflow from the business. It is a non-cash expense that is used for accounting purposes to reflect the decrease in the value of an asset.

Methods of Calculating Accumulated Depreciation

Accumulated depreciation is a crucial concept in accounting that helps businesses accurately reflect the decrease in value of their assets over time. There are several methods available to calculate accumulated depreciation, each with its own advantages and considerations.

Straight-Line Method

The straight-line method is the most commonly used method for calculating accumulated depreciation. It involves spreading the cost of an asset evenly over its useful life. To calculate accumulated depreciation using this method, you need to know the initial cost of the asset, its estimated salvage value, and its useful life.

Accumulated depreciation can be calculated using the formula:

Declining Balance Method

The declining balance method is another commonly used method for calculating accumulated depreciation. This method allows for a higher depreciation expense in the early years of an asset’s life and gradually decreases the depreciation expense over time. The declining balance method is often used for assets that are expected to generate higher revenues in their early years.

Accumulated depreciation can be calculated using the formula:

Units of Production Method

The units of production method is used to calculate accumulated depreciation based on the actual usage or production of an asset. This method is particularly useful for assets that are expected to have varying levels of usage or production over their useful lives. To calculate accumulated depreciation using this method, you need to know the initial cost of the asset, its estimated salvage value, and the total number of units the asset is expected to produce.

Accumulated depreciation can be calculated using the formula:

It is important for businesses to carefully consider which method of calculating accumulated depreciation is most appropriate for their specific assets and financial reporting needs. The chosen method can have a significant impact on the value of the asset and the overall financial statements of the business.

Exploring Different Approaches to Calculate Accumulated Depreciation

Accumulated depreciation is an important concept in accounting that reflects the decrease in value of an asset over time. It is essential for businesses to accurately calculate accumulated depreciation to properly report their financial position.

There are several methods that can be used to calculate accumulated depreciation, each with its own advantages and disadvantages. Let’s explore some of the different approaches:

| Method | Description |

|---|---|

| Straight-Line Method | |

| Declining Balance Method | This method assumes that an asset will lose more value in the earlier years of its useful life and less value in the later years. It applies a fixed rate to the asset’s book value each year. The formula for calculating accumulated depreciation using the declining balance method is: Book Value * Depreciation Rate. |

| Units of Production Method |

It is important for businesses to choose the most appropriate method for calculating accumulated depreciation based on the nature of their assets and the industry they operate in. Each method has its own advantages and disadvantages, and the choice of method can impact the financial statements and profitability of a business.

Accurate calculation of accumulated depreciation is crucial for financial reporting as it provides a true and fair view of the value of an asset and the overall financial health of a business. It allows businesses to properly allocate costs and determine the remaining value of their assets.

Importance of Accumulated Depreciation

1. Asset Valuation

Accumulated depreciation allows businesses to accurately determine the current value of their assets. As assets age and wear out, their value decreases. By calculating and recording accumulated depreciation, businesses can reflect the true value of their assets on their balance sheets. This information is vital for making informed financial decisions, such as selling or replacing assets.

2. Income Statement Accuracy

Accumulated depreciation also plays a crucial role in ensuring the accuracy of the income statement. The depreciation expense, which is the portion of an asset’s value that is expensed each year, is deducted from the revenue to calculate the net income. By accurately calculating and recording accumulated depreciation, businesses can ensure that the depreciation expense is correctly reflected in the income statement, providing a more accurate representation of the company’s financial performance.

3. Tax Deductions

Accumulated depreciation is also important for tax purposes. In many countries, businesses can claim tax deductions for the depreciation of their assets. By accurately calculating and recording accumulated depreciation, businesses can claim the appropriate tax deductions, reducing their taxable income and potentially lowering their tax liability.

4. Asset Replacement Planning

Recognizing the Significance of Accumulated Depreciation in Financial Reporting

Accumulated depreciation plays a crucial role in financial reporting, providing valuable information about the true value of a company’s assets. It is an essential component in determining the net book value of an asset, which is the difference between its original cost and the accumulated depreciation.

Accumulated depreciation also helps in assessing the useful life of an asset. By tracking the depreciation over time, companies can estimate the remaining useful life of an asset and plan for its replacement or refurbishment. This information is crucial for making informed decisions regarding capital expenditures and budgeting.

Additionally, accumulated depreciation provides insights into the overall financial health of a company. It allows investors, creditors, and other stakeholders to evaluate the extent to which assets have been used and the potential need for future investments in replacement or upgrades. It also helps in assessing the company’s ability to generate cash flows and its overall profitability.

Moreover, accumulated depreciation is essential for complying with accounting standards and regulations. Generally Accepted Accounting Principles (GAAP) and International Financial Reporting Standards (IFRS) require the inclusion of accumulated depreciation in financial statements to ensure transparency and comparability across different companies.

Impact of Accumulated Depreciation on Assets

Accumulated depreciation plays a crucial role in determining the true value of assets in financial reporting. It is an accounting method used to allocate the cost of an asset over its useful life. As assets age and wear out, their value decreases, and accumulated depreciation reflects this decrease.

When calculating the value of an asset, the accumulated depreciation is subtracted from the original cost. This adjusted value provides a more accurate representation of the asset’s current worth. It helps organizations make informed decisions regarding asset replacement, repairs, or upgrades.

Accumulated depreciation affects the balance sheet by reducing the carrying value of assets. It is listed as a contra-asset account, which means it is subtracted from the asset’s value. This reduction in value reflects the decrease in the asset’s usefulness and market value over time.

Furthermore, accumulated depreciation also impacts the income statement through depreciation expense. Depreciation expense is recognized as an operating expense and is deducted from revenues to determine net income. By allocating the cost of an asset over its useful life, accumulated depreciation helps organizations accurately report their financial performance.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.