What is Days Working Capital?

Days Working Capital is a financial metric that measures the efficiency of a company’s working capital management. It represents the number of days it takes for a company to convert its working capital into revenue.

Definition and Explanation

Working capital refers to the funds a company uses to finance its day-to-day operations, such as inventory, accounts receivable, and accounts payable. It is an essential component of a company’s financial health, as it ensures smooth operations and the ability to meet short-term obligations.

Days Working Capital is calculated by dividing the average working capital by the average daily revenue. It provides insights into how efficiently a company manages its working capital and how quickly it can generate revenue from its current assets.

How to Calculate Days Working Capital

To calculate Days Working Capital, follow these steps:

- Determine the average working capital by adding the beginning and ending working capital and dividing it by 2.

- Determine the average daily revenue by dividing the total revenue by the number of days in the period.

- Divide the average working capital by the average daily revenue to get the Days Working Capital.

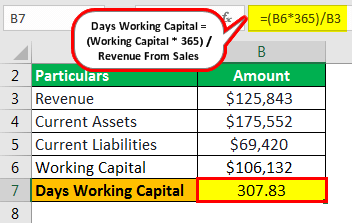

The formula can be represented as:

Days Working Capital = Average Working Capital / Average Daily Revenue

Example Calculation of Days Working Capital

Let’s say a company has an average working capital of $500,000 and an average daily revenue of $10,000. The calculation would be:

Days Working Capital = $500,000 / $10,000 = 50 days

This means that, on average, it takes the company 50 days to convert its working capital into revenue.

Importance of Days Working Capital

Days Working Capital is an important metric for assessing a company’s financial health and efficiency. A lower number of days indicates that a company is able to convert its working capital into revenue quickly, which is generally favorable. It suggests that the company has effective working capital management and can generate revenue from its current assets efficiently.

On the other hand, a higher number of days may indicate that a company is struggling to convert its working capital into revenue, potentially leading to cash flow issues and operational challenges. It may suggest that the company has excessive inventory or slow-paying customers, which can negatively impact its financial performance.

By monitoring and analyzing Days Working Capital, companies can identify areas for improvement in their working capital management and take necessary actions to optimize their cash flow and operational efficiency.

Definition and Explanation

Days Working Capital is a financial metric that measures the efficiency of a company’s working capital management. Working capital refers to the funds a company has available to cover its day-to-day operations, such as paying suppliers, managing inventory, and meeting short-term obligations.

Days Working Capital specifically focuses on the number of days it takes for a company to convert its working capital into revenue. It provides insights into how effectively a company is utilizing its working capital to generate sales and indicates the company’s ability to meet its short-term financial obligations.

The calculation of Days Working Capital involves dividing the average working capital by the average daily sales. The result represents the number of days it takes for the company to convert its working capital into revenue.

A higher number of days working capital indicates that the company takes longer to convert its working capital into revenue, which may suggest inefficiency in managing its working capital. Conversely, a lower number of days working capital indicates that the company is able to convert its working capital into revenue quickly, which may indicate effective working capital management.

Days Working Capital is an important metric for investors, creditors, and management as it provides insights into a company’s liquidity, financial health, and efficiency. It helps identify potential cash flow issues, assesses the company’s ability to meet short-term obligations, and highlights the effectiveness of working capital management strategies.

How to Calculate Days Working Capital

Calculating days working capital is an important step in financial analysis as it helps businesses understand their liquidity and efficiency. It measures the number of days it takes for a company to convert its working capital into revenue.

Step 1: Determine the Components of Working Capital

Working capital is the difference between a company’s current assets and current liabilities. Current assets include cash, accounts receivable, inventory, and other assets that can be easily converted into cash within a year. Current liabilities include accounts payable, short-term loans, and other obligations that are due within a year.

Step 2: Calculate Average Working Capital

To calculate the average working capital, add the working capital at the beginning and end of a specific period (e.g., a month or a year) and divide it by 2. This provides a more accurate representation of the company’s working capital during that period.

Step 3: Determine Revenue

Next, determine the revenue generated by the company during the same period for which you calculated the average working capital. This can be obtained from the company’s financial statements.

Step 4: Calculate Days Working Capital

Finally, divide the average working capital by the revenue and multiply it by the number of days in the period. This will give you the number of days it takes for the company to convert its working capital into revenue.

Days Working Capital = (Average Working Capital / Revenue) x Number of Days

This metric provides insights into the efficiency of a company’s working capital management. A lower number of days working capital indicates that the company is able to convert its working capital into revenue quickly, which is generally considered favorable. On the other hand, a higher number of days working capital may suggest that the company is facing challenges in converting its working capital into revenue efficiently.

By calculating days working capital regularly, businesses can identify trends and make informed decisions to improve their cash flow and overall financial performance.

Step-by-Step Guide to Calculate Days Working Capital

To calculate the days working capital, you need to follow these steps:

Step 1: Determine the Accounts Receivable (AR)

First, you need to find the total value of accounts receivable, which represents the amount of money owed to your company by customers for goods or services provided on credit.

Step 2: Determine the Inventory (INV)

Next, calculate the value of inventory, which includes all the goods or raw materials held by your company for production or sale.

Step 3: Determine the Accounts Payable (AP)

Then, find the total value of accounts payable, which represents the amount of money your company owes to suppliers or vendors for goods or services received on credit.

Step 4: Calculate the Working Capital (WC)

Subtract the value of accounts payable (AP) from the sum of accounts receivable (AR) and inventory (INV) to calculate the working capital.

Step 5: Calculate the Days Working Capital (DWC)

Finally, divide the working capital (WC) by the average daily operating expenses (ADOE) to calculate the days working capital.

DWC = WC / ADOE

Note: The average daily operating expenses (ADOE) can be calculated by dividing the total operating expenses by the number of days in the period you are analyzing.

By following these steps, you can calculate the days working capital, which provides insights into how efficiently your company manages its working capital and cash flow. It helps you understand the number of days your company can operate with its current working capital without additional cash inflows.

Example Calculation of Days Working Capital

Days Working Capital is a financial metric that measures the number of days it takes for a company to convert its working capital into revenue. It provides insights into the efficiency of a company’s operations and its ability to manage its short-term assets and liabilities.

To calculate Days Working Capital, you need to know the company’s average daily operating expenses and its average working capital. The formula is as follows:

Days Working Capital = Average Working Capital / Average Daily Operating Expenses

Step 1: Calculate Average Working Capital

To calculate the average working capital, you need to determine the working capital for a specific period, such as a month or a year. Working capital is the difference between a company’s current assets and current liabilities. It represents the funds available for the day-to-day operations of the business.

Current Assets: $100,000

Current Liabilities: $50,000

The working capital would be:

Working Capital = $50,000

Step 2: Calculate Average Daily Operating Expenses

To calculate the average daily operating expenses, you need to determine the total operating expenses for a specific period, such as a month or a year, and divide it by the number of days in that period.

For example, let’s say a company has total operating expenses of $500,000 for the year:

Average Daily Operating Expenses = Total Operating Expenses / Number of Days

Average Daily Operating Expenses = $500,000 / 365

Average Daily Operating Expenses = $1,369.86

Step 3: Calculate Days Working Capital

Now that you have the average working capital and the average daily operating expenses, you can calculate the Days Working Capital:

Days Working Capital = Average Working Capital / Average Daily Operating Expenses

Days Working Capital = $50,000 / $1,369.86

Days Working Capital = 36.47

This means that, on average, it takes the company approximately 36.47 days to convert its working capital into revenue.

By analyzing the Days Working Capital over time, you can identify trends and make informed decisions about the company’s financial health and operational efficiency. A higher number of days may indicate that the company is taking longer to convert its working capital into revenue, which could be a sign of inefficiency or liquidity issues. On the other hand, a lower number of days may indicate that the company is managing its working capital effectively and generating revenue quickly.

Real-Life Scenario

Company XYZ

Company XYZ is a manufacturing company that produces and sells electronic devices. They have a diverse range of products and a large customer base. However, they often face challenges in managing their working capital effectively.

Due to the nature of their business, Company XYZ has to maintain a significant amount of inventory to meet customer demand. They also offer credit terms to their customers, allowing them to pay for the products within a specific period of time. This means that Company XYZ has to wait for the payment from their customers, while still incurring costs to produce and maintain the inventory.

Let’s say Company XYZ has an average inventory of $500,000 and an average account receivable of $300,000. Their cost of goods sold (COGS) is $1,000,000 per year. By using the formula for days working capital, we can calculate the number of days it takes for Company XYZ to convert their working capital into cash.

Days Working Capital = (Average Inventory + Average Accounts Receivable) / COGS * 365

Days Working Capital = ($500,000 + $300,000) / $1,000,000 * 365

Days Working Capital = $800,000 / $1,000,000 * 365

Days Working Capital = 0.8 * 365

Days Working Capital = 292

This means that it takes Company XYZ approximately 292 days to convert their working capital into cash. This indicates that they have a long cash conversion cycle, which can lead to cash flow problems and hinder their ability to meet their financial obligations.

To improve their days working capital, Company XYZ can implement various strategies such as optimizing inventory management, negotiating better credit terms with suppliers, and improving their collection process. By reducing the number of days it takes to convert their working capital into cash, they can enhance their cash flow and overall financial performance.

Importance of Days Working Capital

Days Working Capital is a crucial financial metric that provides valuable insights into a company’s liquidity and operational efficiency. It measures the average number of days it takes for a company to convert its working capital into revenue.

Efficient management of working capital is essential for the smooth functioning and growth of any business. By monitoring and optimizing Days Working Capital, companies can ensure that they have enough cash flow to cover their short-term obligations and invest in growth opportunities.

Liquidity Management

Days Working Capital helps businesses assess their liquidity position. By calculating the number of days it takes to convert working capital into revenue, companies can determine how quickly they can access cash from their current assets.

A lower number of days working capital indicates that a company can quickly convert its assets into cash, which is a positive sign. It means that the company has enough liquidity to meet its short-term obligations and can take advantage of any unexpected opportunities that may arise.

On the other hand, a higher number of days working capital suggests that the company may have difficulties in converting its assets into cash. This could indicate potential cash flow problems and may require the company to seek additional financing or adjust its operational strategies.

Operational Efficiency

Days Working Capital also serves as a measure of a company’s operational efficiency. It reflects how well a company manages its inventory, accounts receivable, and accounts payable.

A lower number of days working capital implies that a company is effectively managing its inventory and can quickly convert it into revenue. It also suggests that the company has efficient credit and collection policies, allowing it to collect payments from customers promptly.

Conversely, a higher number of days working capital indicates that a company may have excess inventory or inefficient credit and collection processes. This can tie up cash flow and hinder the company’s ability to invest in growth initiatives or meet its financial obligations.

Investor and Creditor Confidence

Days Working Capital is an important metric for investors and creditors when assessing a company’s financial health. It provides insights into a company’s ability to generate cash flow and manage its short-term obligations.

A company with a low number of days working capital is seen as financially healthy and well-managed. It demonstrates that the company has strong liquidity and operational efficiency, which can instill confidence in potential investors and creditors.

On the other hand, a high number of days working capital may raise concerns among investors and creditors. It may indicate potential cash flow issues or inefficiencies in the company’s operations, which can be perceived as higher risk.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.