Credit Default Swap Index CDX

A Credit Default Swap Index (CDX) is a financial instrument that allows investors to trade credit risk. It is a type of derivative that provides protection against the default of a specific group of underlying assets, such as corporate bonds or loans.

The CDX is structured as a basket of credit default swaps (CDS), which are contracts that transfer the credit risk of a specific issuer to a counterparty. The index represents a diversified portfolio of credit risks, allowing investors to gain exposure to a broad range of companies or sectors.

CDXs are typically traded over-the-counter (OTC) and are standardized contracts that have specific terms and conditions. They are often used by investors to hedge against credit risk or to speculate on the creditworthiness of a particular group of companies.

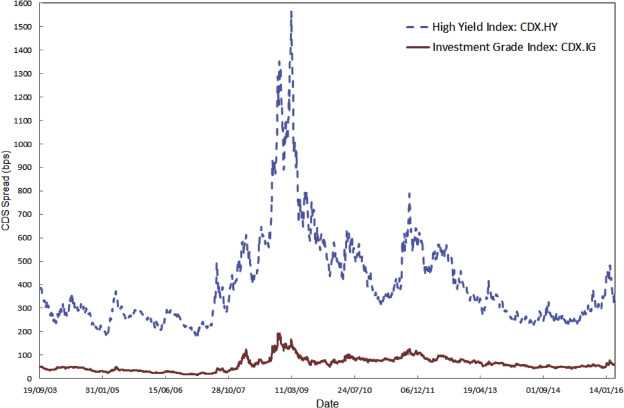

CDXs are calculated and maintained by financial institutions, such as Markit or Bloomberg. The index is typically quoted in basis points, which represent the cost of insuring against default. A higher basis point value indicates higher credit risk.

Investors can buy or sell CDXs to express their views on the creditworthiness of a specific group of companies or sectors. For example, if an investor believes that the technology sector is going to perform well, they can buy a CDX that represents a basket of technology companies. If the creditworthiness of the companies in the index improves, the value of the CDX will increase, allowing the investor to profit.

A Credit Default Swap Index (CDX) is a financial instrument that allows investors to trade credit risk. It is essentially a derivative product that is based on a basket of individual credit default swaps (CDS). A CDS is a contract between two parties, where one party agrees to pay the other party a fixed amount in the event of a credit event, such as a default or bankruptcy, of a specified reference entity.

The CDX is created by a financial institution, such as a bank or a brokerage firm, and is typically traded over-the-counter (OTC). It is designed to provide investors with exposure to a diversified portfolio of credit risks, rather than individual credit risks. The index is composed of a predetermined number of reference entities, which are typically large corporations or sovereign entities.

The value of a CDX is determined by the creditworthiness of the reference entities and the overall market sentiment towards credit risk. If the creditworthiness of the reference entities deteriorates, the value of the CDX will decrease. Conversely, if the creditworthiness improves, the value of the CDX will increase.

Investors can use CDX to hedge against credit risk or to speculate on changes in credit risk. For example, if an investor believes that the creditworthiness of a particular industry or sector will deteriorate, they can buy a CDX that includes reference entities from that industry or sector. If the creditworthiness does indeed deteriorate, the value of the CDX will increase, allowing the investor to profit.

However, investing in CDX also carries risks. The value of the CDX can be volatile and can be affected by a variety of factors, including changes in interest rates, economic conditions, and market sentiment. Additionally, CDX is a leveraged product, meaning that investors can potentially lose more than their initial investment.

How CDX Works

The Credit Default Swap Index (CDX) is a financial instrument that allows investors to trade credit risk. It is essentially a benchmark for credit default swaps (CDS) and provides a way for investors to hedge against the risk of default on a particular debt instrument or a group of debt instruments.

CDX works by creating a standardized index that represents a basket of credit default swaps. These swaps are essentially insurance contracts that pay out in the event of a default on a debt obligation. The index is created by selecting a group of reference entities, typically companies or sovereigns, and determining the cost of insuring their debt against default.

The CDX index is then traded in the market, allowing investors to take positions on the creditworthiness of the reference entities. Investors can buy or sell protection on the index, depending on their view of the credit risk. If an investor believes that the credit risk is low, they can buy protection on the index, essentially paying a premium to insure against default. On the other hand, if an investor believes that the credit risk is high, they can sell protection on the index, receiving a premium for taking on the risk.

CDX is typically traded over-the-counter (OTC) and is settled in cash. The value of the index is determined by the market participants and is influenced by factors such as changes in credit spreads, market sentiment, and economic conditions. The index is also periodically rebalanced to reflect changes in the creditworthiness of the reference entities.

One of the key advantages of CDX is its liquidity. The index is actively traded, allowing investors to enter and exit positions easily. This liquidity makes it an attractive instrument for investors looking to manage their credit risk exposure.

However, CDX also carries risks. The value of the index can be volatile, especially during periods of market stress or economic downturns. Additionally, the creditworthiness of the reference entities can change, leading to losses for investors. It is important for investors to carefully assess the credit risk associated with the index and to implement risk management strategies to mitigate potential losses.

The Role of Credit Default Swaps

Credit Default Swaps (CDS) play a crucial role in the functioning of the Credit Default Swap Index (CDX). These financial instruments are essentially insurance contracts that protect investors against the risk of default on a particular debt obligation, such as a bond or loan. The CDX, on the other hand, is a benchmark index that tracks the performance of a basket of CDS contracts.

Another important role of credit default swaps is to provide liquidity to the market. CDS contracts can be bought and sold in the secondary market, allowing investors to enter or exit positions as needed. This liquidity helps to ensure that investors can easily manage their credit risk exposure and adjust their portfolios accordingly.

Price Discovery

Credit default swaps also play a crucial role in price discovery. The prices of CDS contracts can provide valuable information about the creditworthiness of a particular company or entity. If the price of a CDS contract increases, it indicates that the market perceives an increased risk of default. Conversely, a decrease in the price of a CDS contract suggests a lower perceived risk of default.

Market Speculation

Credit default swaps also attract speculative investors who aim to profit from changes in the credit risk of a particular entity. These investors may take positions in CDS contracts based on their assessment of the creditworthiness of a company or their expectations of market movements. This speculation can contribute to price volatility in the CDS market.

Benefits and Risks of CDX

Investing in Credit Default Swap Index CDX can offer several benefits, but it also carries certain risks that investors should be aware of.

Benefits of CDX

- Diversification: CDX allows investors to gain exposure to a diversified portfolio of credit default swaps. This diversification can help spread the risk and potentially reduce the impact of defaults on individual companies.

- Liquidity: CDX is traded on exchanges, which provides investors with liquidity. They can easily buy or sell their positions without having to find a counterparty.

- Efficiency: CDX offers a cost-effective way to gain exposure to the credit market. Investors can participate in the credit default swap market without having to individually negotiate and manage multiple contracts.

Risks of CDX

- Counterparty Risk: CDX involves entering into contracts with counterparties, and there is a risk that the counterparty may default on their obligations. It is important to carefully assess the creditworthiness of the counterparty before entering into any CDX transactions.

- Market Risk: CDX is subject to market risk, including changes in credit spreads, interest rates, and overall market conditions. These factors can impact the value of the index and the returns on CDX investments.

- Liquidity Risk: While CDX offers liquidity, there can be instances where the market for CDX contracts becomes illiquid, making it difficult to buy or sell positions at desired prices.

Before investing in CDX, it is important to carefully consider these benefits and risks and assess whether they align with your investment goals and risk tolerance. Consulting with a financial advisor or conducting thorough research can help investors make informed decisions.

Advanced Concepts and Strategies

1. Trading CDX Options

One advanced strategy involves trading CDX options. CDX options allow investors to take positions on the future direction of credit spreads. By buying or selling options contracts, investors can profit from changes in credit spreads without taking on the risk of holding the underlying CDX index.

2. Pair Trading

Another advanced strategy is pair trading, which involves taking long and short positions on two different CDX indices. The goal of pair trading is to profit from the relative performance of the two indices. For example, an investor may take a long position on one CDX index and a short position on another CDX index if they believe that one index will outperform the other.

Pair trading can be a useful strategy for investors who want to hedge their exposure to the overall credit market. By taking long and short positions on different indices, investors can potentially profit from the performance of individual sectors or industries within the credit market.

3. Leveraged CDX Trading

Leveraged CDX trading is a high-risk, high-reward strategy that involves using borrowed funds to amplify potential returns. With leveraged trading, investors can take larger positions in the CDX index than they would be able to with their own capital.

4. Spread Trading

Spread trading is a strategy that involves taking long and short positions on different CDX indices with similar credit quality. The goal of spread trading is to profit from the difference in credit spreads between the two indices.

For example, an investor may take a long position on a CDX index with a higher credit spread and a short position on a CDX index with a lower credit spread. If the credit spreads converge, the investor can profit from the narrowing spread. However, if the credit spreads diverge, the investor may incur losses.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.